India Energy Outlook 2021

An expanding economy, population, urbanisation and industrialisation mean that India sees the largest increase in energy demand of any country, across all of our scenarios to 2040. India’s economic growth has historically been driven mainly by the services sector rather than the more energy-intensive industrial sector, and the rate at which India has urbanised has also been slower than in other comparable countries. But even at a relatively modest assumed urbanisation rate, India’s sheer size means that 270 million people are still set to be added to India’s urban population over the next two decades. This leads to rapid growth in the building stock and other infrastructure. The resulting surge in demand for a range of construction materials, notably steel and cement, highlights the pivot in global manufacturing towards India. In the STEPS, as India develops and modernises, its rate of energy demand growth is three times the global average.

The Indian electricity sector is on the cusp of a solar-powered revolution…

Solar power is set for explosive growth in India, matching coal’s share in the Indian power generation mix within two decades in the STEPS – or even sooner in the Sustainable Development Scenario.

As things stand, solar accounts for less than 4% of India’s electricity generation, and coal close to 70%. By 2040, they converge in the low 30%s in the STEPS, and this switch is even more rapid in other scenarios. This dramatic turnaround is driven by India’s policy ambitions, notably the target to reach 450 GW of renewable capacity by 2030, and the extraordinary cost-competitiveness of solar, which out-competes existing coal-fired power by 2030 even when paired with battery storage. The rise of utility-scale renewable projects is underpinned by some innovative regulatory approaches that encourage pairing solar with other generation technologies, and with storage, to offer “round the clock” supply. Keeping up momentum behind investments in renewables also means tackling risks relating to delayed payments to generators, land acquisition, and regulatory and contract uncertainty. However, the projections in the STEPS do not come close to exhausting the scope for solar to meet India’s energy needs, especially for other applications such as rooftop solar, solar thermal heating, and water pumps.

India requires a massive increase in power system flexibility

The pace of change in the electricity sector puts a huge premium on robust grids and other sources of flexibility, with India becoming a global leader in battery storage. India has a higher requirement for flexibility in its power system operation than almost any other country in the world. In the near term, India’s large grid and its coal-fired power fleet meet the bulk of India’s flexibility needs, supported by hydropower and gas-fired capacity. Going forward, new power lines and demand-side options – such as improving the efficiency of air conditioners or shifting the operation of agricultural pumps to different parts of the day – will need to play a much greater role. But battery storage is particularly well suited to the short-run flexibility that India needs to align its solar-led generation peak in the middle of the day with the country’s early evening peak in demand. By 2040, India has 140 GW of battery capacity in the STEPS, the largest of any country, and close to 200 GW in the Sustainable Development Scenario.

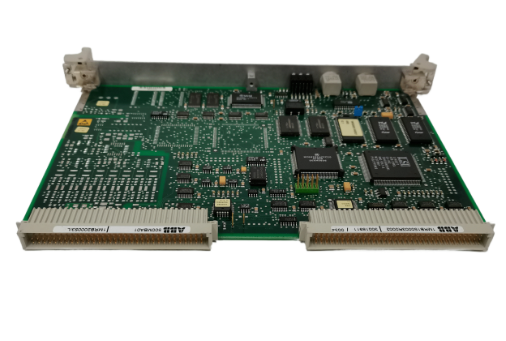

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

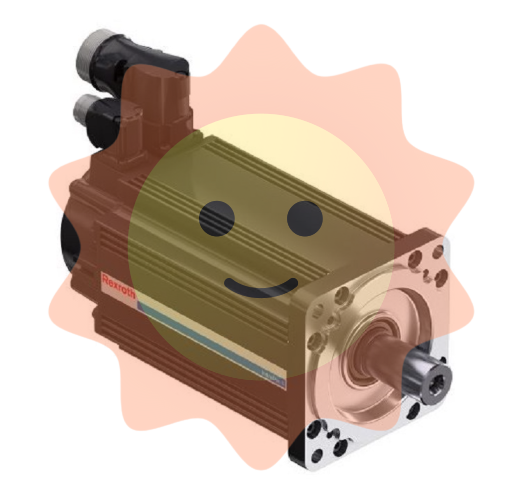

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA

- Other Brands