Pioneer continues, four beams and eight columns write a new chapter of infrastructure

Strengthen the awareness of cash flow security and focus on the improvement of sustainable investment capacity.

The new assessment system replaces the operating income ratio with the operating cash ratio, combined with the return on net assets, reflecting the regulatory requirements of SASAC "to have profit income and cash profit", and the central enterprises need to pay attention to the safety level of cash flow on the basis of book profits. In 2022, the company's revenue to cash ratio is 0.88, and there is a lot of room for improvement in the future. With the further landing of the assessment indicators, the company is expected to achieve a pattern of equal emphasis on safety and development.

The asset-liability ratio continued to improve, and R&D investment increased steadily.

In the context of the central enterprise control leverage target, the company's asset-liability ratio has continued to optimize since 2016, falling from 78.0% to about 72.0%, in line with the latest requirements of the SASAC for the asset-liability ratio to "maintain basic stability".

At the same time, the company continues to increase investment in research and development, promote electric arc furnace and hydrogen metallurgy and other processes, and constantly improve the level of research and development rates, reflecting the company's long-term goal of pursuing high-quality sustainable development.

2. The main industry of metallurgical engineering is based on the emerging industry to create the growth pole

2.1 Metallurgical engineering: Benefit from the two-carbon policy, green production line transformation rise

2.1.1 Industry policy end: The dual-carbon policy promotes industry rectification, and the electric arc furnace method has huge room for improvement

The central government has issued a heavy carbon emission reduction policy to optimize the industrial structure, increase the use of clean energy and reduce energy consumption per unit product for high-energy-consuming industries such as steel, non-ferrous metals and building materials.

In October 2021, The State Council issued the "Action Plan for Carbon Peak before 2030", requiring the industrial sector to speed up green low-carbon transformation and high-quality development, steel, non-ferrous metals and other industries to strictly implement capacity replacement, and strive to take the lead in carbon peak.

In November of the same year, the state issued the "14th Five-Year Plan" national clean production implementation plan key industries clean low-carbon transformation plan, requiring high energy consumption industries to complete the relevant production transformation, taking the steel industry as an example, during the "14th Five-Year Plan" period to complete 530 million tons of steel production capacity ultra-low emission transformation, 460 million tons of coking production capacity clean production transformation.

According to the national promulgation of the "double carbon" target, high-emission industries have successively promulgated the carbon peak target.

Take the steel industry as an example, by 2025, the steel industry needs to achieve carbon emissions peak; By 2030, the steel industry's carbon emissions are 30% lower than their peak, and 420 million tons of carbon emissions are expected to be reduced. At the same time, the steel industry should improve smelting technology, and vigorously promote the whole scrap electric furnace process, promote the joint regeneration and reuse of steel industry wastewater, and promote the electromagnetic strong oxidation of coking wastewater. With the deepening of the "double carbon" process, new processes and technologies in the industry are expected to be popularized.

In 2022, the carbon emissions of China's steel industry accounted for about 15% of the total carbon emissions of the country, and it is the industry with the highest carbon emissions in 31 categories of manufacturing, and its clean and intelligent transformation is crucial to the completion of the dual-carbon goal.

In 2022, China's steel production will be 1.018 billion tons, and the output of converter and electric furnace methods will account for 90%/10%. China's steel production capacity demand, high demand for raw materials, due to less scrap resources, it is difficult to support the supply of raw materials, so iron ore, limestone and coking coal as raw materials of the long process of steel making method occupies a dominant position, and the long process method of steel carbon displacement in 2-3 tons, much higher than the short process method of 0.8 tons of the level, resulting in the steel industry carbon emissions remain high for a long time.

From the short term perspective, to achieve the goal of double carbon needs to be carried out by the way of reduction replacement. From 2017 to 2025, China's steel industry plans to withdraw a total of 324.89 million tons of iron-making capacity, new iron-making capacity of 284.57 million tons, net withdrawal of 40.32 million tons, cumulative withdrawal of steel production capacity of 359.74 million tons, new steel production capacity of 320.7 million tons, net withdrawal of 39.67 million tons.

- EMERSON

- Honeywell

- CTI

- Rolls-Royce

- General Electric

- Woodward

- Yaskawa

- xYCOM

- Motorola

- Siemens

- Rockwell

- ABB

- B&R

- HIMA

- Construction site

- electricity

- Automobile market

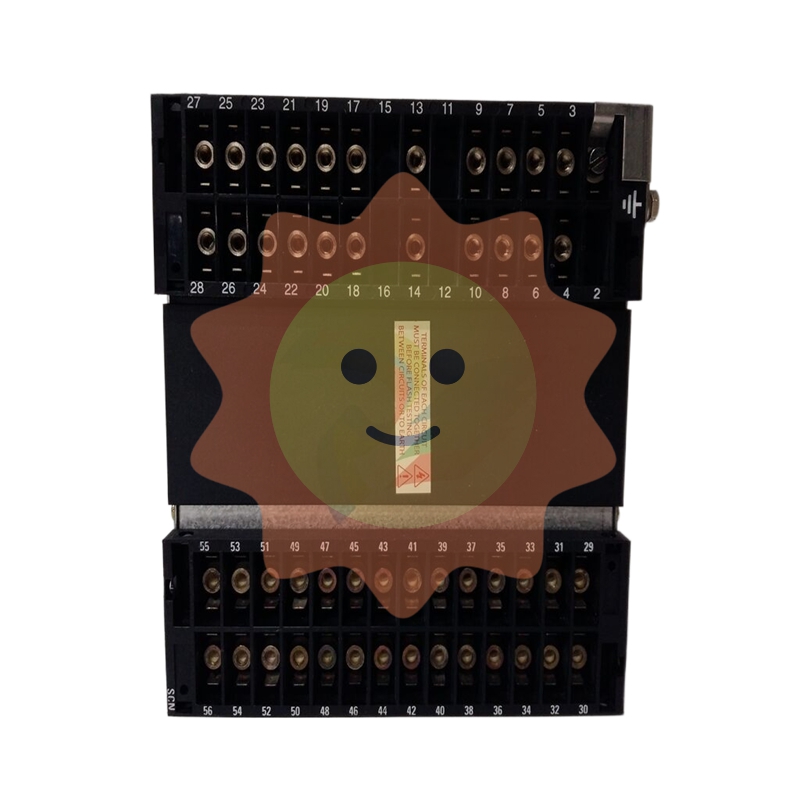

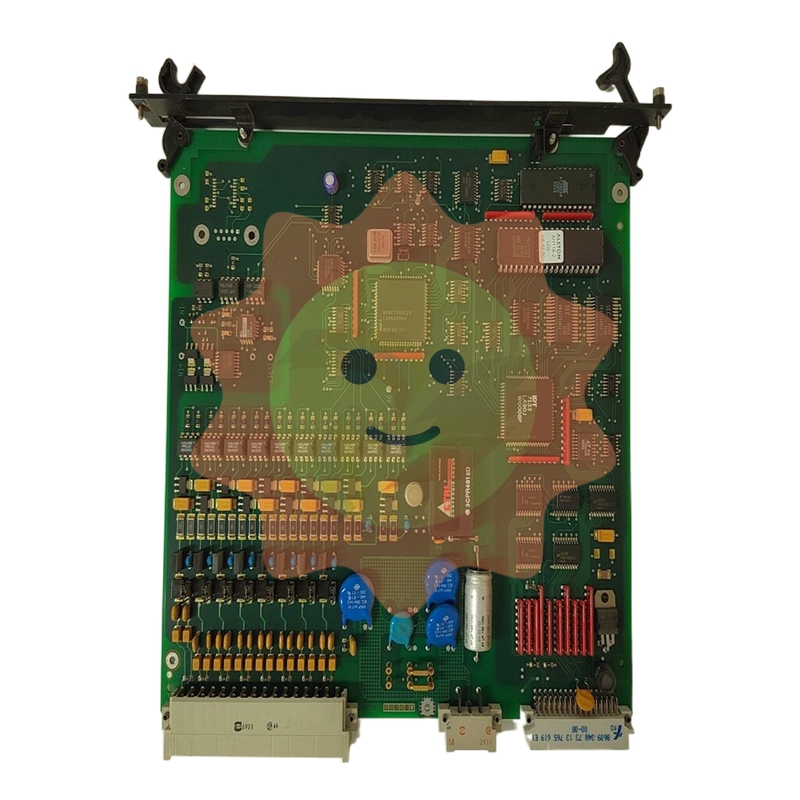

- PLC

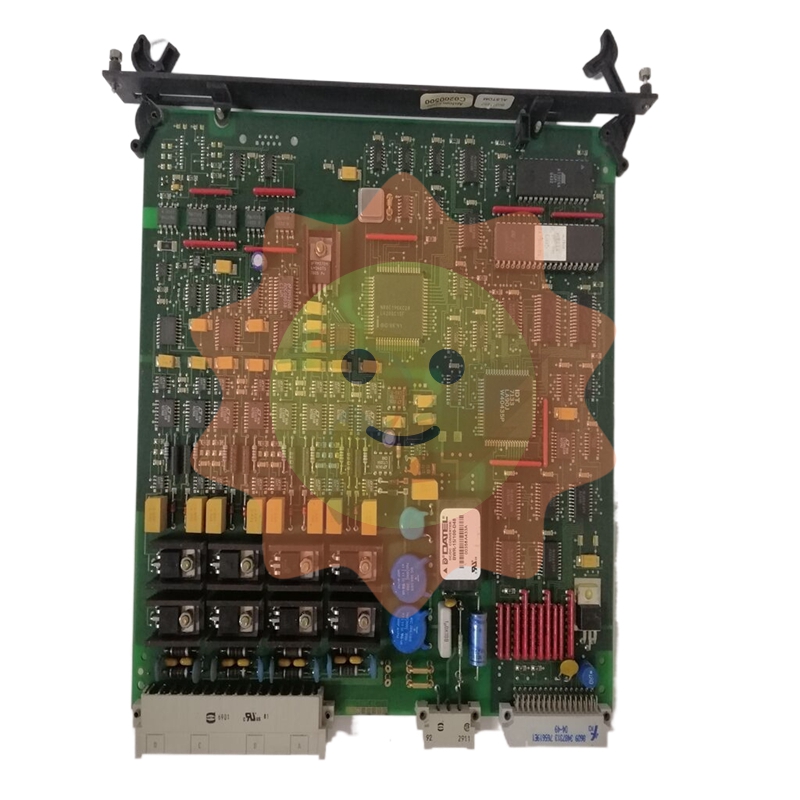

- DCS

- Motor drivers

- VSD

- Implications

- cement

- CO2

- CEM

- methane

- Artificial intelligence

- Titanic

- Solar energy

- Hydrogen fuel cell

- Hydrogen and fuel cells

- Hydrogen and oxygen fuel cells

- tyre

- Chemical fiber

- dynamo

- corpuscle

- Pulp and paper

- printing

- fossil

- FANUC

- Food and beverage

- Life science

- Sewage treatment

- Personal care

- electricity

- boats

- infrastructure

- Automobile industry

- metallurgy

- Nuclear power generation

- Geothermal power generation

- Water and wastewater

- Infrastructure construction

- Mine hazard

- steel

- papermaking

- Natural gas industry

- Infrastructure construction

- Power and energy

- Rubber and plastic

- Renewable energy

- pharmacy

- mining

- Plastic industry

- Schneider

- Kongsberg

- NI

- Wind energy

- International petroleum

- International new energy network

- gas

- WATLOW

- ProSoft

- SEW

- wind

- ADVANCED

- Reliance

- YOKOGAWA

- TRICONEX

- FOXBORO

- METSO

- MAN

- Advantest

- ADVANCED

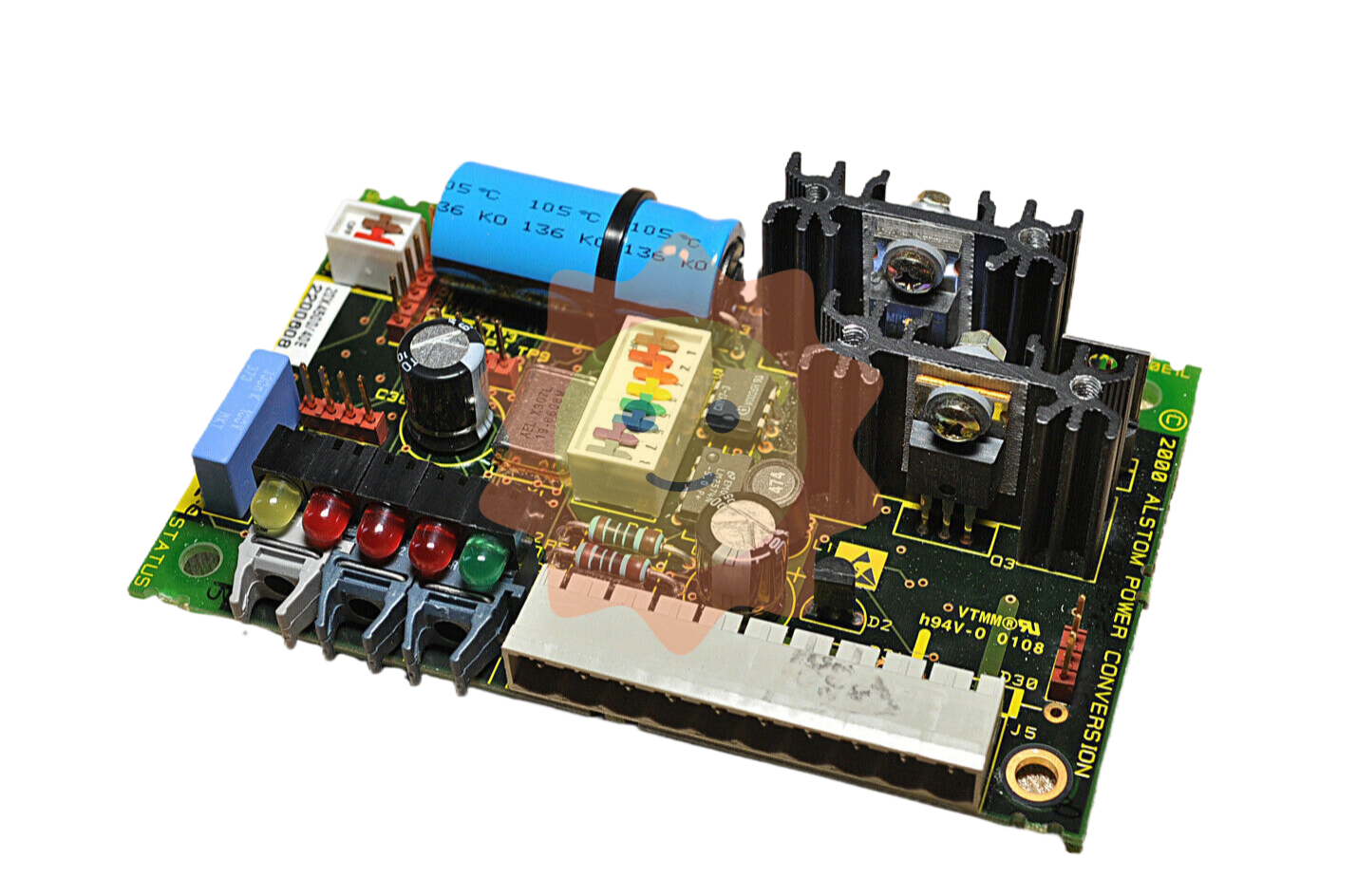

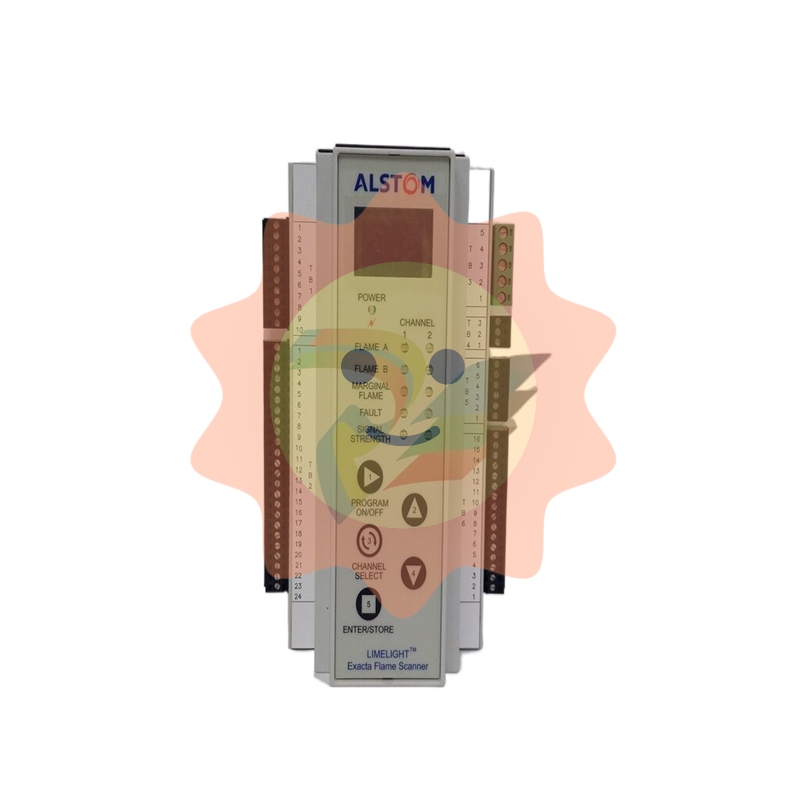

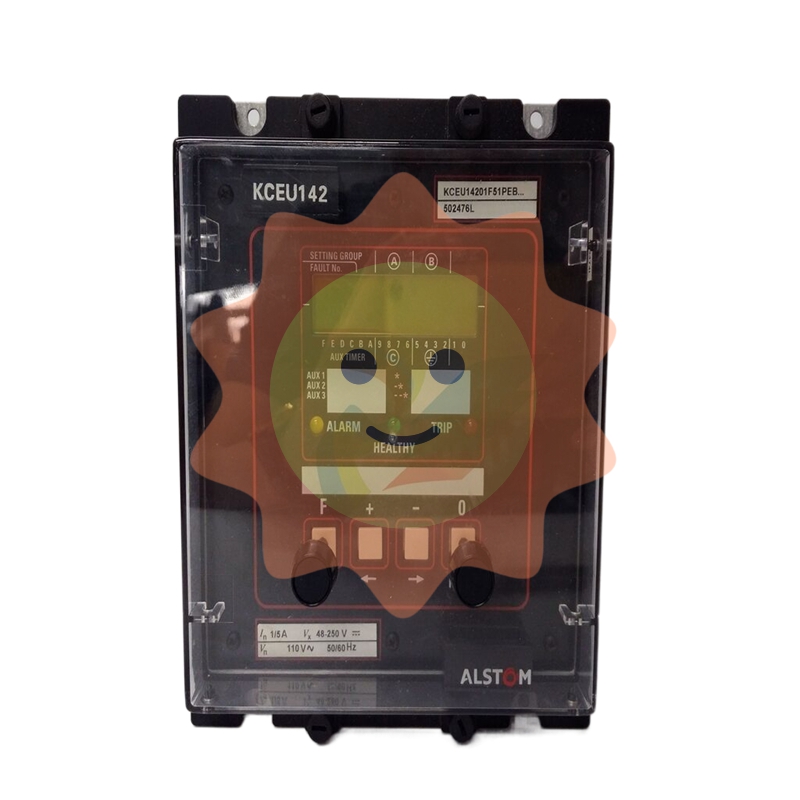

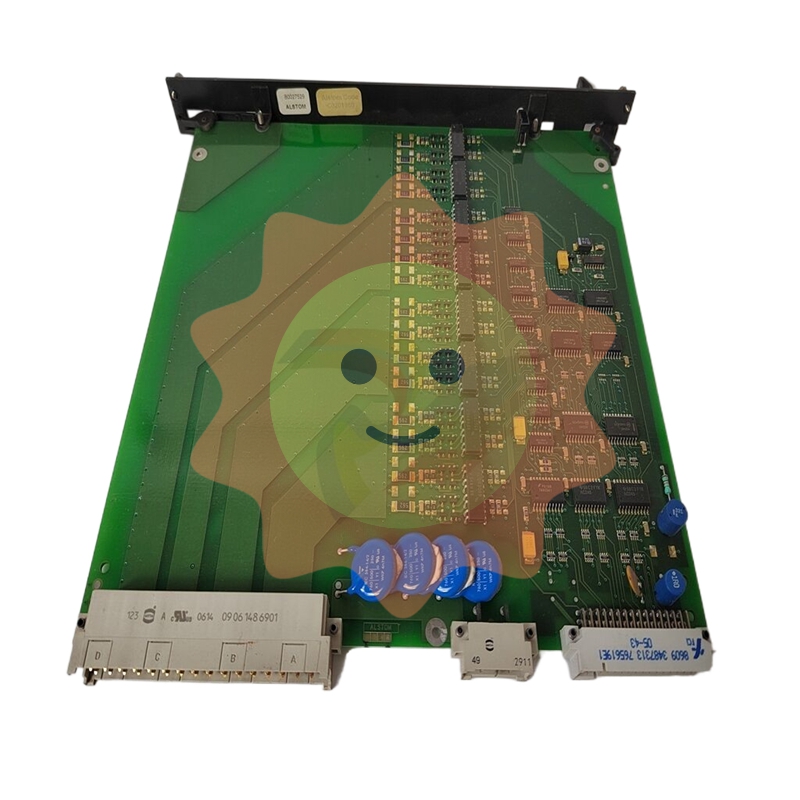

- ALSTOM

- Control Wave

- AB

- AMAT

- STUDER

- KONGSBERG

- MOTOROLA

- DANAHER MOTION

- Bentley

- Galil

- EATON

- MOLEX

- Triconex

- DEIF

- B&W

- ZYGO

- Aerotech

email:1583694102@qq.com

wang@kongjiangauto.com