"China Accelerates towards Carbon Neutrality" Cement: A path to carbon reduction in the cement industry

In the opening article of our series "China Accelerating towards Carbon Neutrality", we imagined a carbon-neutral world in 2050 dominated by new energy elements such as electric vehicles, hydrogen steelmaking, photovoltaic power generation, and green energy storage. Achieving this vision also means that the world needs to reduce net man-made carbon dioxide emissions by about 45% by 2030 compared with 2010. To achieve "net zero emissions" by 2050. In the face of the dual challenges of target and time, the road to carbon neutral transition needs to be started. While countries are competing to carry out specific research and implementation work, China also took the lead in proposing the goal of "carbon peak and carbon neutrality" in the general debate of the seventy-fifth session of the United Nations General Assembly. The United Nations Sustainable Development Goal 13 "Climate action" is also one of McKinsey's social responsibility priorities in China. At this key juncture, McKinsey officially launched China's large-scale carbon neutral transition research project in China. With the help of McKinsey's rich experience in global sustainable development research, combined with comprehensive understanding and profound insight into Chinese society, industries and enterprises, Mobilize the knowledge of more than 100 people around the world to carry out research on carbon neutral transition trends, countermeasures and technologies across major industrial sectors, hoping to make a small contribution to China's early achievement of carbon neutrality goals.

As the third article in this series, this paper will continue to study the carbon neutral transition using the cement industry as a sample. In the future, we will publish a series of articles covering high-carbon emission industries such as coal chemical industry, oil and gas industry and power industry, covering many topics such as carbon emission reduction path analysis, emerging technology discussion, investment cost forecast, international practice sharing, etc. We will also explore traditional carbon emission reduction process innovation, and carbon capture utilization and storage (CCUS), hydrogen energy and other emerging carbon emission reduction trends. In the process of promoting this research, we are very welcome experts from all walks of life colleagues, you can give valuable comments in the message area, you can also directly contact the team. We look forward to working with all sectors of society to advance the path of carbon neutral transition in a green China.

The necessity of carbon neutral transition in China's cement industry

Cement industry is an important basic industry of our national economy, and also constitutes the trunk of modern urban architecture. Globally, the cement industry contributes 7% of total carbon emissions. If the global cement industry were a country, it would be the third largest carbon emitter after China and the United States. China produces nearly 60% of the world's cement, and the carbon emissions of the cement industry are more than half of the total carbon emissions of the global cement industry.

Carbon dioxide emissions in cement production mainly come from the clinker production process (see Figure 1), in which the carbon dioxide emissions in the process of calcination of limestone to produce quick lime account for about 55-70% of the total carbon emissions in the whole production process. The high-temperature calcination process requires the burning of fuel, so the carbon dioxide produced accounts for about 25-40% of the total carbon emissions of the entire production process.

Currently, China's cement industry accounts for about 9% of the country's total carbon emissions and is a major source of carbon dioxide emissions in manufacturing. China is the world's largest cement manufacturer, accounting for about 60% of the world's 3.7 billion tons of cement production capacity in 2019. According to McKinsey estimates, in order to achieve a global warming scenario of no more than 1.5 ° C, by 2050, China's cement industry needs to reduce carbon emissions by more than 70%.

China cement industry carbon emission reduction path

Taking into account the cost, technical feasibility and resource availability of carbon emission reduction, we believe that declining demand, improving energy efficiency, alternative fuels and accelerating carbon capture technology are important starting points for carbon emission reduction in China's cement industry. Based on this, we mapped the carbon emission reduction path of China's cement industry from 2020 to 2030 and 2050.

With input from the Integrated Energy Transition Committee (ETC), the International Energy Agency (IEA), McKinsey's Global Cement Demand Forecast Model, and China's cement industry experts, we estimate that the decline in conventional demand will contribute about 27% of the carbon reduction in China's cement sector by 2050, driven primarily by urbanization and slower growth in the construction industry. As China's urbanization rate stabilizes, GDP-driven cement demand is expected to decline further, and maintenance and renewal of existing buildings will gradually dominate cement demand in the future. In addition, alternative building materials for concrete (e.g., steel, prefabricated materials, cross-laminated wood, etc.) will further reduce cement demand. However, the accuracy of demand forecasts is affected by the reality of urbanization and construction, and if demand does not fall as expected, other drivers will need to be relied on to drive carbon reduction, especially carbon capture and storage (CCS).

Energy efficiency improvements are a no-regret step for technology maturity and could contribute about 5% of the carbon reduction in the cement sector by 2050. The energy efficiency reform of the cement industry includes two aspects: first, the emission reduction contribution of power saving (including raw material grinding, precalciner, cement workshop electricity, etc.), in order to avoid double calculation, we will put this part of the potential in the power industry carbon emission reduction analysis; The second is the emission reduction contribution of fuel savings, which is expected to save 5% of fuel consumption by 2030 and 14% by 2050.

Alternative fuels are a higher priority and more cost-effective means to drive about 10% of the industry's carbon reduction by 2050. If we take a case-by-case look at the main fuels that can heat cement production, we find that renewable waste is the most viable alternative to coal:

1. Coal: Currently more than 95% of the cement production heating, is the main fuel source used for limestone calcination at this stage. Due to the low price of coal, coal fuel is unlikely to be completely replaced, but it will continue to reduce its share in the process of fuel mix improvement, and coal is expected to account for 20-30% of the fuel used in cement production in 2050.

2. Biomass: Currently heating less than 1% of cement production, it is considered a clean resource with no emissions, and combined with carbon capture technology may produce net negative emissions. However, China's biomass resources are overall tight, and many industries have the possibility of significant growth in demand, and there are still no companies in the industry to use biomass to heat the cement workshop. Given the uncertainties on the biomass supply side, it is expected that biomass will comprise 5-10% of the fuel used in cement production in 2050.

3. Waste: Currently, waste provides less than 5% of the heat for cement production, and we believe waste is a better potential carbon reduction resource. On the one hand, organic waste can be used as fuel, and on the other hand, solid waste can replace clinker, reducing the use of limestone, thus further reducing carbon emissions in the production process. At the same time, waste utilization in China has three aspects of favorable policies, relatively sustainable supply, and continuous improvement of garbage classification. It is estimated that by 2050 waste will constitute 55-75% of the fuel used in cement production.

Electric heating: For cement production, the use of electric heating is not very feasible in terms of technical requirements (requiring higher temperature and power), equipment transformation or operational economics, and may not become an important means of emission reduction in the future.

4. Natural gas: Although natural gas cannot help the cement industry achieve zero carbon emissions of fuel, it can significantly reduce the carbon emission intensity of fuel, so it may play an important transitional technical role in future carbon emission reduction; At the same time, natural gas as an alternative fuel is also facing challenges such as rising costs and equipment technological innovation. This paper does not quantitatively analyze the role of natural gas in the future carbon emission reduction roadmap of the cement industry.

In the case of declining demand, improved energy efficiency, and alternative fuels, there is still a large gap between the expected carbon reduction results and the carbon reduction target under the 1.5 ° C scenario, and the support of emerging technologies is needed. Given the characteristics of clinker process emissions in cement production, in the absence of mass replacement of clinker by emerging technologies, carbon capture and storage (CCS) will be the only option for the cement industry to achieve carbon neutrality and is expected to contribute approximately 50% of the industry's carbon reduction by 2050. CCS requires matching geological conditions, such as proximity to declining oil fields, saltwater formations, etc. Moreover, due to the small scale and scattered locations of cement plants, it is difficult for a single enterprise to undertake large-scale CCS infrastructure construction, so it can be considered to participate in the "CCS industrial park" model, and carry out pilot projects with other industries that rely on CCS technology to reduce emissions (such as steel, coal power, etc.). For example, trials can start from Hebei or Shandong, where the industry concentration is high.

A leading domestic cement production company launched China's first cement CCS demonstration project in the second half of 2018, and is currently the only cement company CCS project in China. With an investment of more than 50 million yuan, the CCS project will capture about 50,000 tons of carbon dioxide per year with a capture rate of about 1/30, making it a small-scale pilot project. The future CCS pilot in the cement industry will focus on innovative breakthroughs in capture technology, a substantial increase in the scale of capture, and the gradual construction of the CCS industry chain.

The cement industry has also been promoting the development of emerging cement alternative technologies such as CO2-cured concrete. Carbon curing concrete technology is through the mineralization reaction between carbon dioxide and calcium and magnesium components in concrete, while achieving the storage of greenhouse gases and improving the strength and durability of concrete, thereby reducing the use of cement. However, the technology is still in the pilot stage and needs to be further scaled up. In addition, alternative clinker technology based on non-calcium carbonate is also the focus of future technological innovation in the industry.

At present, China's cement clinker ratio is 0.67, lower than the global average of 0.74. A noteworthy policy trend is that according to the National Standard No. 3 Amendment of GB175-2007 "Portland General Purpose Cement", which has been implemented since October 1, 2019, the 32.5 strength grade (PC32.5R) of composite Portland cement will be cancelled. After modification, four strength grades of 42.5, 42.5R, 52.5 and 52.5R will be retained. This is aimed at improving capacity utilization and product quality in the cement industry, but it will also increase the proportion of clinker used in the cement industry, thereby increasing the unit CO2 emission intensity. To meet this challenge, it is necessary to comprehensively consider the balance between carbon emission intensity and total clinker consumption under the premise of meeting the technical requirements of building construction, and solve it through technological innovation and breakthrough.

We are well aware that the cement industry is one of the major industrial industries with high hard-to-abate emission reduction, not only because cement has fixed process emissions, but also because the overall volume of the cement industry is large but the individual scale is small, and it is difficult to bear the high emission reduction cost due to the low absolute price. All of these have made it difficult for the cement industry to scale CCS and make significant breakthroughs in emerging cement alternative technologies. However, at the same time, due to the remarkable results of the current supply-side reform, the overall profit level of cement enterprises is good, the industry integration degree is improved, and it is in a period of healthy development, and it has the ability to plan ahead and vigorously promote technological innovation and grasp the opportunity period of low-carbon transformation.

Enlightenment to cement enterprises

Capture the business model change opportunities brought about by the low-carbon trend, and actively adapt to downstream trends: cement companies should rethink their product structure, partnerships and their value in the entire construction industry, assess the changes in demand of major downstream customers such as construction developers in a low-carbon environment, and layout new growth opportunities as soon as possible. For example, cement companies can consider promoting technology research and development and enterprise acquisition in the field of alternative building materials, and advance layout of new building materials, building information models, and prefabricated and modular building solutions that may appear in the downstream builders, combining production and building information models to expand more business possibilities downstream. For the future access to sustainable fuel sources (such as biomass), cement companies should be positioned as early as possible according to the characteristics of the region, because other industries will also participate in the carbon neutral race and also want to achieve carbon reduction targets through sustainable fuels.

Under the theme of high-quality development in the "14th Five-Year Plan", vigorously promote the operational transformation of "low-carbon + digital", and improve efficiency to the extreme: deeply understand the impact of the national carbon emission reduction target on the cement industry chain during the "14th Five-Year Plan", and actively carry out end-to-end carbon footprint assessment and emission reduction cost curve assessment; Combine digital operations with low-carbon transformation, using artificial intelligence and machine learning to reduce volatility and improve energy efficiency in the production process, and reduce energy consumption and carbon emissions while continuously improving operational efficiency. For example, a European cement producer achieved fuel savings of 6% by creating a self-learning model of the kiln heat curve to optimize the shape and intensity of the kiln flame. The leading cement companies of the future can outperform their competitors through "low-carbon + digital" operations.

Pay attention to the medium - and long-term impact of low-carbon trends on the ecology of the cement industry, and explore possible new opportunities for green growth: keep track of new materials, new processes and new emission reduction technologies and other fields, carry out pilot projects under the premise of conditions, and obtain the advantage of the first mover in the development of the industry. For the possible "green premium" of emerging green products in the industrial chain, by developing corresponding "low carbon and zero carbon product lines", we will win reputation from environmentally conscious customers. In the future, the ecology of the cement industry may be reshaped by the trend of carbon neutrality, and the way to turn crisis into opportunity is to lay out innovative technologies in advance.

Advice for policymakers

Given the few carbon reduction technology options in the cement sector and the difficulty of transitioning between established technologies (such as alternative fuels) and emerging technologies (such as CCS), strong policy support is needed for the sector's carbon reduction path. In general, the first is to have a clear direction and goals; The second is to introduce and implement the policy of incorporating cement into the carbon price system as soon as possible; The third is to strengthen targeted research and development and financial incentives for emerging technologies. In this way, it can attract more capital attention and support, promote the formation of green cement industry alliance, help cement this traditional industry to revitalize new vitality, and support China's carbon neutral journey.

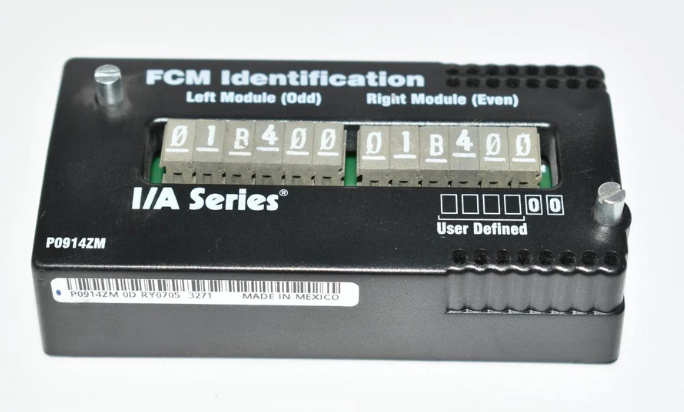

- EMERSON

- Honeywell

- CTI

- Rolls-Royce

- General Electric

- Woodward

- Yaskawa

- xYCOM

- Motorola

- Siemens

- Rockwell

- ABB

- B&R

- HIMA

- Construction site

- electricity

- Automobile market

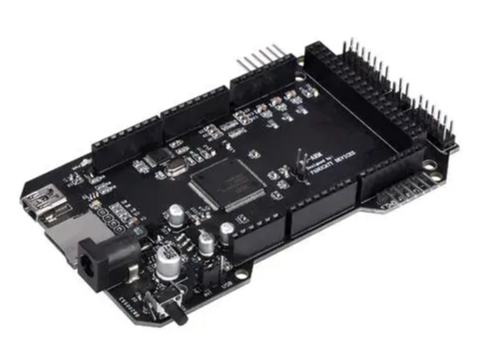

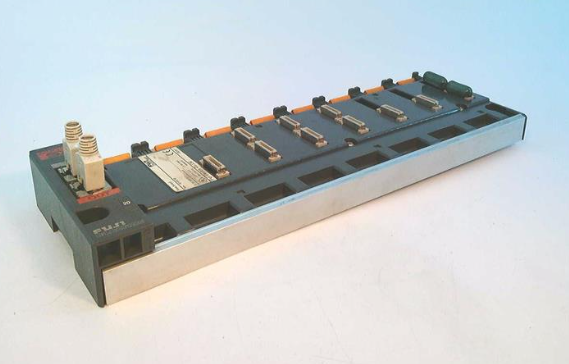

- PLC

- DCS

- Motor drivers

- VSD

- Implications

- cement

- CO2

- CEM

- methane

- Artificial intelligence

- Titanic

- Solar energy

- Hydrogen fuel cell

- Hydrogen and fuel cells

- Hydrogen and oxygen fuel cells

- tyre

- Chemical fiber

- dynamo

- corpuscle

- Pulp and paper

- printing

- fossil

- FANUC

- Food and beverage

- Life science

- Sewage treatment

- Personal care

- electricity

- boats

- infrastructure

- Automobile industry

- metallurgy

- Nuclear power generation

- Geothermal power generation

- Water and wastewater

- Infrastructure construction

- Mine hazard

- steel

- papermaking

- Natural gas industry

- Infrastructure construction

- Power and energy

- Rubber and plastic

- Renewable energy

- pharmacy

- mining

- Plastic industry

- Schneider

- Kongsberg

- NI

- Wind energy

- International petroleum

- International new energy network

- gas

- WATLOW

- ProSoft

- SEW

- wind

- ADVANCED

- Reliance

- YOKOGAWA

- TRICONEX

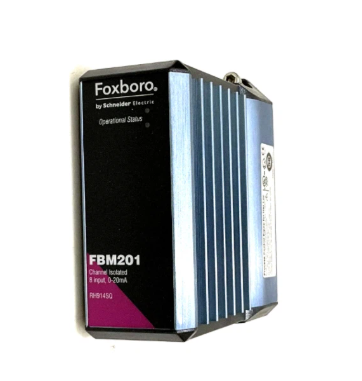

- FOXBORO

- METSO

- MAN

- Advantest

- ADVANCED

- ALSTOM

- Control Wave

- AB

- AMAT

- STUDER

- KONGSBERG

- MOTOROLA

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- Triconex

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- KOLLMORGEN

- Beijer

- Endress+Hauser

- MOOG

- KB

- Moxa

- Rexroth

- YAMAHA

- Johnson

- Westinghouse

- WAGO

- TOSHIBA

- TEKTRONIX

Email:wang@kongjiangauto.com