Pharmaceutical equipment industry research in pharmaceutical industry: domestic substitution space is broad

1 Industry: Domestic equipment import substitution, the industry ushered in rapid development

1.1 Pharmaceutical enterprises opened a new round of fixed asset investment, and the pharmaceutical equipment industry ushered in an inflection point

All kinds of machinery and equipment used in the production of pharmaceutical enterprises are collectively referred to as pharmaceutical equipment, pharmaceutical equipment includes eight categories, respectively, raw material medicine machinery and equipment, preparation machinery, pharmaceutical crushing machinery, decoction machinery, pharmaceutical water equipment, pharmaceutical packaging equipment, pharmaceutical testing equipment and other equipment. From the perspective of market share, pharmaceutical packaging equipment accounted for more than 50%, followed by raw material pharmaceutical machinery equipment, preparation equipment, tablet equipment, etc., pharmaceutical crushing machinery and pharmaceutical water equipment accounted for a relatively low proportion.

In recent years, the growth rate of China's pharmaceutical manufacturing assets began to rise. Since 2000, China's pharmaceutical manufacturing industry has experienced two rounds of GMP certification, of which the second round of GMP began in 2011, to promote pharmaceutical companies to increase investment in fixed assets, 2011-2015, the total asset growth rate of pharmaceutical manufacturing industry remained at about 15%. In 2016, the growth rate gradually declined, and by the end of 2019, it has dropped from the previous 15% to the lowest 7.2%. After 2020, the overall growth rate of assets continued to rise, gradually rising from the lowest 7.2% in 2019 to 14.7% in June 2021, and the upward trend is expected to continue.

From the perspective of the overall sales of the industry, since 2010, benefiting from the new GMP certification, downstream pharmaceutical companies have increased investment in fixed assets, driving the rapid development of the upstream pharmaceutical equipment industry, and the industry growth rate has exceeded 20%. With the fixed asset investment of pharmaceutical companies gradually coming to an end, the sales of the pharmaceutical equipment industry have peaked and fallen since 2016, and the industry growth rate is about 15% from 2016 to 2019, and the industry growth rate will rise to about 20% in 2020.

China's pharmaceutical equipment industry started in the 1990s, the first round of GMP certification in 2004 has greatly promoted the development of the industry, and the second round of GMP certification began in 2011 to promote the rapid development of the industry again. In recent years, the rapid development of China's biopharmaceutical industry has accelerated the investment in fixed assets of biopharmaceutical enterprises. At the same time, domestic pharmaceutical equipment enterprises have made breakthroughs in the research and development and production of biological drug equipment, and the new coronavirus epidemic in 2020 has accelerated the import substitution of domestic pharmaceutical equipment, and the industry has ushered in the third rapid development.

1.2 The pattern of China's pharmaceutical equipment industry is scattered, and the concentration degree needs to be improved

The number of pharmaceutical special equipment manufacturing enterprises in China has increased year by year, from 27 in 2000 to 147 in 2020. From the trend point of view, since 2016, the industry has entered a downward cycle, and the number of enterprises has also declined year by year, and by the end of 2019, the number of enterprises has begun to increase again, reaching the current 147. At present, the competitive pattern of China's pharmaceutical special equipment manufacturing industry is relatively scattered. We estimate that the market share of leading enterprises Dongfulong (13.770, -0.48, -3.37%) and Chutian Technology (8.140, -0.50, -5.79%) in 2020 will not exceed 5%. The competitive pattern of China's pharmaceutical special equipment manufacturing industry is still relatively scattered, and the concentration still has room for improvement.

1.3 The outbreak of biological drugs, the demand for biological macromolecule production equipment continues to accelerate

The gross profit margin of biological drugs is about 90%, and the cost accounts for about 10%, of which direct materials account for about 25%, direct labor accounts for about 15%, and manufacturing expenses account for about 60%. In 2020, the global biopharmaceutical market size is 313.1 billion US dollars, assuming that the gross profit margin is 90%, and equipment and consumables are counted in manufacturing expenses, the global equipment and consumables market size is 18.7 billion US dollars in 2020, and Frost and Sullivan is expected to maintain an 8%-10% growth in the next five years.

In 2020, the market size of China's biological drugs is 387 billion yuan, assuming that the proportion of domestic biological drugs reaches 75%, the gross margin is 90%, and the equipment and consumables are counted in the manufacturing expenses, then the market size of China's biological drug equipment and consumables will be 17.5 billion yuan in 2020, considering that China's biosimilar drugs are currently in the outbreak stage. It is expected that the market size of China's biological drug equipment and consumables is expected to maintain more than 20% growth. From the perspective of some biological drug enterprises, their fixed asset investment has been growing rapidly in recent years. The production difficulty of biological drugs is relatively high, and from the international situation, biological drug companies generally prefer to build their own production capacity. At present, the domestic biopharmaceutical industry is in the explosive stage, the number of small biopharmaceutical enterprises is increasing rapidly, the listing speed of biopharmaceutical continues to accelerate, and the investment demand for fixed assets of enterprises is increasing rapidly, which will bring the development of China's pharmaceutical equipment industry.

1.4 The localization rate of core biological drug equipment is low, and the import substitution space is large

At present, the localization rate of China's biological drug equipment is still very low, and the future import substitution space is huge. In 2020, the biological drug equipment revenue of Aoxing Life Technology, Morimatsu International, Dongfulong and other enterprises is still small, of which Aoxing Life Technology is 900 million (including overseas income), Morimatsu International is 770 million, followed by Dongfulong is 200 million. From the perspective of proportion, the biological drug equipment income of Aoxing Life Technology, Morimatsu International, Dongfulong and other enterprises accounted for the total scale of China's biological drug production equipment and consumables market is still very low, and most of the equipment and consumables have the monopoly of overseas enterprises, and the import substitution space of Chinese enterprises is large in the future.

2 Equipment: Domestic enterprises made breakthroughs in biological medicine equipment

2.1.1 Traditional biological drug pharmaceutical process

The development process of biological products production process generally needs to go through the construction of engineering cell bank, shaker process development, pilot process development, pilot scale up, production purification and preparation steps.

2.1.2 China's biologic drug production equipment and consumables market summary

Overall, the market size of China's biological drug equipment and consumables in 2020 is about 17.5 billion yuan, of which reactor systems, disposable reaction bags, chromatography equipment and consumables account for the main share.

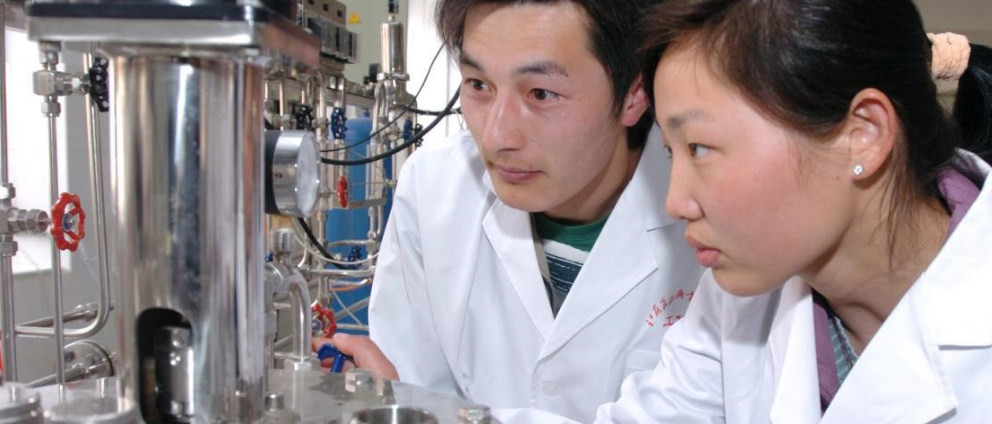

2.2.1 Stainless steel reactor: Low barriers to R & D and production, becoming a breakthrough point for domestic enterprises

Stainless steel reactor has a long history of development, in the 19th century stainless steel reactor development history in the 1950s has come out, the development of now, technology has been very mature, research and development and production barriers are relatively low, China's pharmaceutical equipment enterprises in recent years in this field is also step by step progress, is expected to take the lead in achieving domestic substitution. At present, the main development direction of stainless steel reactor is multi-function, large-scale and intelligent.

2.2.2 One-time reaction system: achieve a substantial reduction in cost and more flexible production

Compared with the traditional stainless steel reaction tank, the cost of the one-time reaction system has been greatly reduced, and the cost has been reduced from the early capital investment to the installation, disinfection, operation manpower, etc., the total cost has been reduced by nearly 50%, and the pre-construction period of the one-time reactor is relatively short. From the specific use scenario, for pre-clinical, clinical stage and relatively small volume of commercial projects, the advantage of disposable reactors is very prominent, enterprises can be more flexible arrangement of production, reduce costs at the same time, production capacity utilization can be improved to a certain extent.

Disposable bioreactor mainly includes shaking type, wave mixing type and stirring type, of which shaking type and wave mixing type have relatively small volume, stirring type reaction volume is larger, and the largest disposable reactor is developed by ABEC with a volume of 6000L. The disposable reaction system is mainly composed of disposable reactors (including reaction bags), disposable liquid storage bags and disposable filter components, etc. From the cost ratio, the proportion of disposable reactors is about 50%, and the proportion of disposable liquid storage bags and reaction bags is about 40%, which is the two items with the highest proportion of one-time reaction system costs. Overall, the technical barrier of the one-time reaction system lies in the design of reaction bags and liquid storage bags.

3 Consumables: Domestic consumables gradually breakthrough, import substitution trend

3.1 Multi-layer co-extruded film and disposable bags: raw materials and processes are the core barriers, and domestic enterprises have gradually broken through

Multi-layer co-extruded film, that is, multi-layer co-extruded composite film, is the resin raw materials with different functions, such as PA/PE/PP/EVOH, respectively melted and extruded, and then combined through their respective flow channels in the same die head after further processing (blow molding cooling method) made of multi-layer composite film. The multi-layer co-extruded film is generally composed of a base layer, a functional layer and a bonding layer. The base layer is used to provide protection and support on the internal and external surfaces, the functional layer plays a barrier role, and the bonding layer is in the middle of the base layer and the functional layer, thus forming an integrated composite film. The larger the volume of disposable bags, the higher the film and process requirements, and the reaction volume of the current disposable reaction system is mainly limited by the performance of disposable bags.

The core barrier of multi-layer co-extruded film lies in the development, selection and composite process of raw materials, while the barrier of disposable reaction bag lies in the welding process. In addition to raw materials and processes, a stable upstream and downstream supply chain is also crucial. Sartorius, for example, involves many links from the supply of raw materials to the production of final products, and a stable production supply chain is crucial to providing stable quality products. Disposable reaction bag price is higher, according to our grassroots research results, 2000L disposable reaction bag is about 150,000 yuan, 1000L is 70,000 to 80,000 yuan, 500L is 40,000 yuan, 200L is 30,000 yuan, 50L is 10,000 to 20,000 yuan.

3.2 Chromatographic fillers and chromatographic columns: The research and development and production barriers are relatively low, and domestic enterprises are expected to break through quickly

Overseas chromatographic column manufacturers mainly include GE, Millipore, Pall and Repligen and a few other enterprises, and the products can be used in the test stage and mass production stage. In contrast, GE has a wide range of products, a leading position in the world, and the largest market share. The most important qualities of chromatographic columns are reproducibility, life and selectivity, which involves the raw material selection of the column itself, bonding technology, column loading process and factory quality testing and other links, on the whole, the development and production barriers of chromatographic columns are relatively low. Domestic enterprises such as Yuexu Technology, Nano technology (19.200, -0.32, -1.64%) and other enterprises have achieved breakthroughs.

Chromatographic technology is the basic principle of the company's product production, there are two main application areas, respectively, preparative chromatography for industrial separation and purification and analytical chromatography for laboratory analysis and detection. The main application field of preparative chromatography is biomedicine, and the customers are relatively concentrated, and the single production is large. Analytical chromatography has a wide range of applications, so the number of customers is large but the single harvest is small.

It is difficult to develop chromatographic fillers as chromatographic "core". In the downstream production process in the field of biomedicine, because the structure of biomolecules is different, complex and has high requirements for the external environment, so for the R & D capability of enterprises, the requirements are extremely high. At present, the main evaluation indicators for the performance of chromatographic fillers are morphology, structure, particle size and distribution, pore size and distribution, material composition and surface functional groups.

4 Stones from Other mountains: From the growth path of Sartorius to see the core competitiveness of pharmaceutical machinery enterprises

4.1 Sartorius

Century-old pharmaceutical machinery supplier: Sartoris is the world's famous pharmaceutical machinery supplier, the company was founded in 1870, the earliest production and sales of short-arm analytical balance, the 20th century 70 years, gradually into the pharmaceutical machinery industry, through the continuous extension of the acquisition, has now become a biopharmaceutical whole process equipment supplies supplier.

Operating income and net profit entered the accelerated growth channel: Sartorius operating income increased from 6 billion yuan in 2011 to 18.74 billion yuan in 2020, with a compound growth rate of 15.5%; Net profit increased from 340 million yuan in 2011 to 1.82 billion yuan in 2020, with a compound growth rate of 20.5%. Beginning in 2018, with the gradual acceleration of the global biologics market, as well as the gradual advancement of the company's globalization strategy, coupled with the accelerated promotion of one-time reaction system applications, the company's revenue and profits have entered an accelerated growth state, 2020 revenue growth rate of more than 30%, profit growth rate of more than 45%, is expected to maintain rapid growth in the next 2-3 years.

The company's products cover the whole process of pharmaceutical process: the company's business mainly includes biological process solutions and laboratory products and services. The biological process solutions segment mainly includes filtration, fermentation, cell culture, purification, storage and other products. The laboratory products and services mainly include instruments and consumables for laboratories in the pharmaceutical industry, and provide related services.

The two business segments are moving in tandem, with significant growth in bioprocess solutions: The company's two main businesses are carried out by two subsidiaries, Sartorius Stedim Biotech S.A, which is mainly engaged in biological process solutions, and Sartorius Lab Holding GmbH, which is mainly engaged in laboratory products and services. From the revenue side, the company's two major businesses show a parallel trend, including biological process solutions segment from 550 million euros in 2013 to 1.78 billion euros in 2020, with a compound growth rate of 18.3%, laboratory products and services segment from 270 million euros in 2013 to 550 million euros in 2020. The compound growth rate was 10.7%.

4.2 Following the development of the pharmaceutical industry, becoming an integrated service provider is the core competitiveness of pharmaceutical machinery enterprises

Closely follow the trend of drug development, and constantly provide new equipment. Overall, the current drug research and development continues to accelerate, the emergence of new drug types, the pharmaceutical machinery industry also put forward higher requirements, pharmaceutical equipment companies need to catch up with the research and development trend, continue to provide new equipment, in order to achieve long-term development.

Rich product range, pharmaceutical equipment integration provider. Pharmaceutical equipment companies need to be able to provide equipment and consumables for the whole process from research and development to production to better meet the diversified needs of pharmaceutical companies and increase customer stickiness. (Report source: Future Think Tank)

Realize the international layout and enjoy the vast global market. International layout can reduce costs at the same time, more convenient service customers, faster corresponding needs, enhance customer stickiness, the global pharmaceutical equipment market space is broad, North America, Asia market development space is huge.

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA

- Other Brands