Darkest moment: Jingdong's dilemma and broken game

2) Goods: private brands, reconstructing retail links from the top of the supply chain

Private brand building is an operational strategy at the commodity level and an important source of differentiated content. Compared with the design of the front-end membership mechanism, the more important thing is whether it can provide more targeted services and more appropriate goods for the users selected by the paying membership mechanism. The simple member discount still stays in the price level of competition, differentiation is rooted in the content level. Members promote consumption "1→N" quantitative change (members buy more and get more within the cycle), commodity power determines the qualitative change of "0→1" (reflected in the renewal rate). At the same time, paying members provide stable sales expectations for the private brand supply chain, and ideally the two will eventually form a circular driving mechanism.

Jd.com began experimenting with its own brands in 2015. Among the first five brands, two brands in luggage and cosmetics have been suspended. Men's INTERIGHT and digital dostyle are doing well, and the annual sales volume is at the level of 100 million yuan. This reflects that Jingdong better understands the consumer needs of its main user group (young men); For fashion and personalized categories, JD's design and development capabilities and user base are not enough to cultivate its own brands.

3) Supply chain: Home business and Wal-Mart close cooperation, will compete for FMCG high-frequency entry

The short-distance delivery corresponding to home business is another area of exploration in the supply chain dimension of Jingdong. Business super house matching is still in the cultivation period, user habits have not yet developed; The FMCG category carried by Jingdong Home is the entrance of high-frequency consumption, which has strategic significance and growth prospects. Jd Home business with strategic partners such as Walmart and New Dada as the core is still a strategic area worth looking forward to.

Cooperation with Walmart or Jingdong home corner overtaking opportunity. In July 2018, Jingdong and Walmart announced that they would open up the entire line of inventory and cooperate with 10 cloud warehouses to improve O2O selection efficiency; In August, the two sides jointly raised capital to a new $500 million. We believe that Walmart is an ally of Jingdong with special significance, or an opportunity for Jingdong Home business to overtake a corner: ① Walmart's supply chain efficiency is beyond doubt, which helps Jingdong improve its cost control ability. Walmart's core "everyday low price" comes from cost control, and its efficient back office and replicable supply chain management capabilities built in more than 50 years of operation have been tested by history. ② Supplement Jingdong offline traffic entry. Jingdong has not yet established its own physical store system. Compared with its own store operation, Walmart's original mature store body and warehousing and logistics system in the Chinese market are undoubtedly beneficial supplements to Jingdong's offline network. 3. Jd is Walmart's core e-commerce partner in the Chinese market. Walmart is seeking e-commerce breakthrough in the world. After injecting the No. 1 store package into Jingdong (Walmart is the second largest institutional shareholder of Jingdong except Tencent) and jointly injecting Dada, Jingdong is the core e-commerce partner of Walmart in the Chinese market, and shoulders the operation exploration of e-commerce stores, and the investment is worth looking forward to.

Profit forecast and investment advice: Go to the bottom of the water and wait for the clouds to rise

We split JD's listed company business into three parts: self-operated e-commerce, third-party platform and logistics services. It is expected that the company's revenue in the next three years will be 4610.7/5509.6/638.19 billion yuan, with a year-on-year growth of 27.3%, 19.5%, 15.8%; Net profit returned to the mother 15.2/35.6/5.81 billion yuan; non-GAAP operating profit was 28.1/837/12.12 billion yuan respectively, corresponding to non-GAAP operating profit margin of 0.6%, 1.5% and 1.9% respectively.

Combined with segment valuation and DCF valuation, we believe that the fair market value of JD is about $37.5-42.9 billion (corresponding to $25.92-29.65 /ADS). As of the close of December 14, 2018, JD's market capitalization was $32.1 billion ($22.17 /ADS), down 46.5% year-to-date. We believe that the continued decline in the company's market value this year reflects the secondary market's excessive concerns about the deterioration of the domestic macroeconomic and industry competitive landscape. Over the past years, Jingdong has accumulated more than one trillion GMV scale relying on experience advantages, so that it has a strong advantage in the supply chain side, and there is still a large space for the multi-category consumption mining and platform traffic realization of 300 million quality users. Give the company an "overweight" rating.

- EMERSON

- Honeywell

- CTI

- Rolls-Royce

- General Electric

- Woodward

- Yaskawa

- xYCOM

- Motorola

- Siemens

- Rockwell

- ABB

- B&R

- HIMA

- Construction site

- electricity

- Automobile market

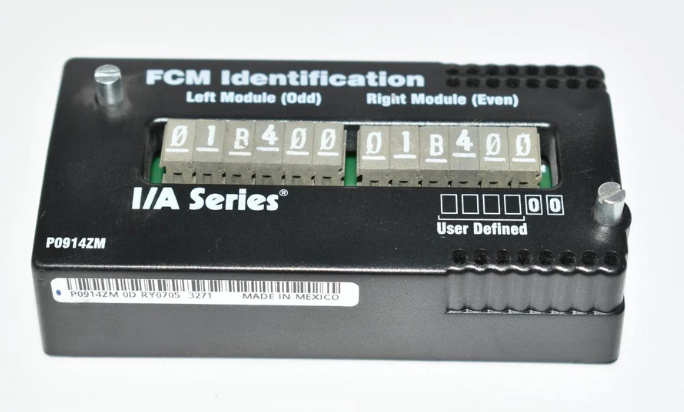

- PLC

- DCS

- Motor drivers

- VSD

- Implications

- cement

- CO2

- CEM

- methane

- Artificial intelligence

- Titanic

- Solar energy

- Hydrogen fuel cell

- Hydrogen and fuel cells

- Hydrogen and oxygen fuel cells

- tyre

- Chemical fiber

- dynamo

- corpuscle

- Pulp and paper

- printing

- fossil

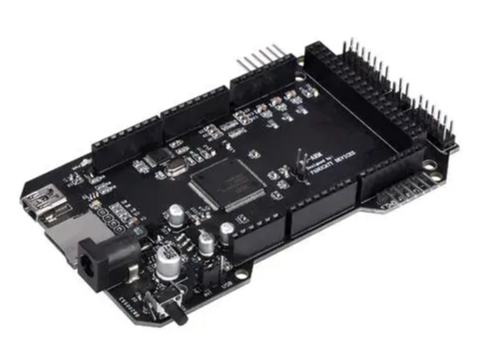

- FANUC

- Food and beverage

- Life science

- Sewage treatment

- Personal care

- electricity

- boats

- infrastructure

- Automobile industry

- metallurgy

- Nuclear power generation

- Geothermal power generation

- Water and wastewater

- Infrastructure construction

- Mine hazard

- steel

- papermaking

- Natural gas industry

- Infrastructure construction

- Power and energy

- Rubber and plastic

- Renewable energy

- pharmacy

- mining

- Plastic industry

- Schneider

- Kongsberg

- NI

- Wind energy

- International petroleum

- International new energy network

- gas

- WATLOW

- ProSoft

- SEW

- wind

- ADVANCED

- Reliance

- YOKOGAWA

- TRICONEX

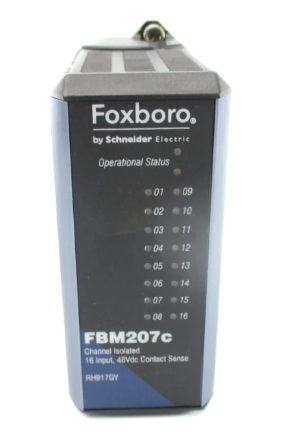

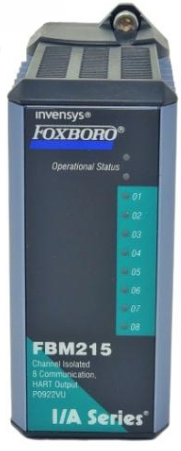

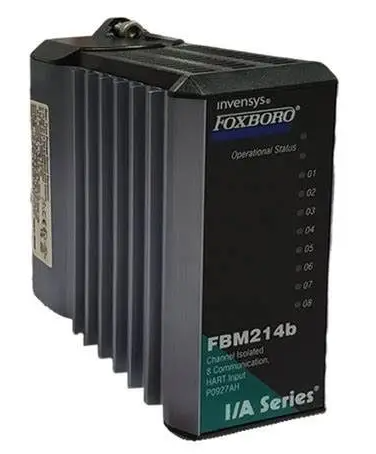

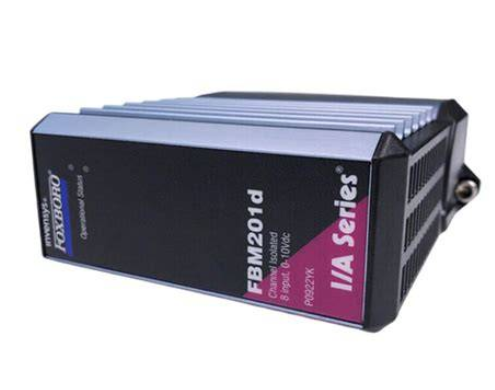

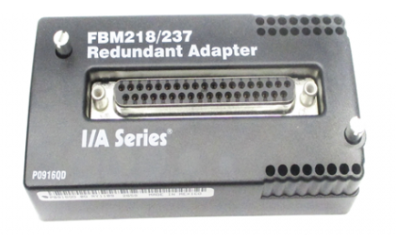

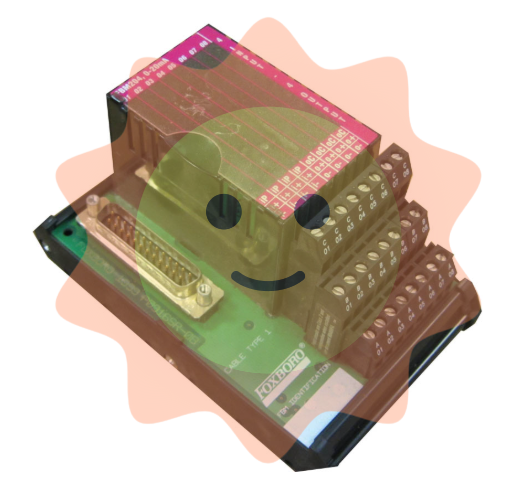

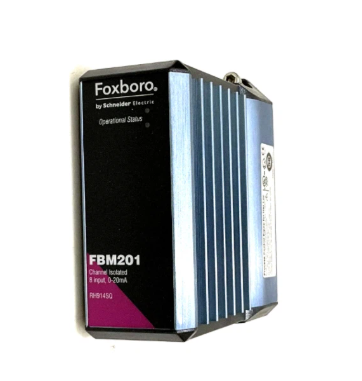

- FOXBORO

- METSO

- MAN

- Advantest

- ADVANCED

- ALSTOM

- Control Wave

- AB

- AMAT

- STUDER

- KONGSBERG

- MOTOROLA

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- Triconex

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- KOLLMORGEN

- Beijer

- Endress+Hauser

- MOOG

- KB

- Moxa

- Rexroth

- YAMAHA

- Johnson

- Westinghouse

- WAGO

- TOSHIBA

- TEKTRONIX

- BENDER

Email:wang@kongjiangauto.com