Digitalisation will come to the fore

Low investment levels are projected not only with respect to the requirements of the Sustainable Development Scenario, but also in Stated Policy Scenario pathways. While this has not led immediately to serious power supply incidents, longer-term risks need to be addressed now. Further acceleration can be expected in the deployment of VRE sources like wind and solar PV, due to continuing cost declines and government support schemes. Incentives for flexibility from other parts of the electricity system, including grids, demand response and batteries, receive less focus or only indirect attention in policies and regulatory frameworks worldwide, but are, nevertheless, essential.

The case of European and US electricity markets is very illustrative in this sense. In the past decade following the financial crisis, advanced market economies have seen weaker-than-expected growth in electricity demand in general. Due to a combination of a weak economic recovery, stronger policies on energy efficiency and a rapid spread of efficient technologies like LED lights, electricity demand has stagnated or even declined across all advanced economy systems. By 2015 electricity demand in Europe and the United States was 435 TWh (6.2%) lower than initial expectations for recovery after the financial crisis. This had important and positive implications for electricity security: there was a major wave of investment into combined-cycle gas turbine capacity just before the acceleration of wind and solar PV capacity additions. These gas turbine plants were envisaged as running at a reasonably high load factor to supply robust demand growth. Despite this not materialising, they still have the technical capacity for low and flexible utilisation, primarily providing grid services, which they have done as the share of variable renewables increased. Many jurisdictions have implemented changes to their market design, such as Capacity Remuneration Mechanisms or scarcity pricing, as means to recognise the contribution of these resources to security of supply and attract investments to them.

This example is relevant to the electricity security discussion. System operators and markets succeeded in maintaining robust electricity security while the share of variable renewables grew faster than expected. However, this task was greatly facilitated by the large excess capacity of predominantly flexible units. It should be emphasised, however, that this capacity balance was not the result of a conscious design; rather, it was the result of an unexpected structural break. It also led to massive-scale value destruction as utilities wrote down assets and their equity capitalisation depreciated. The combination of weak demand and value destruction of flexible assets shaped investor expectations, creating a reluctance to invest in these assets.

Future policy and technology changes can also trigger structural breaks. However, there is no guarantee that these will similarly lead to lower-than-expected demand. On the contrary, the coming decades of the electricity transition might well lead to a re‑acceleration of electricity demand growth and a substantially higher generation capacity need, in particular due to a trend of increased electrification.

Technological progress has been highly asymmetrical: low-carbon generating technologies like wind and solar PV, and the technologies enabling electrification such as electric car batteries, have progressed more swiftly and witnessed larger-scale deployment than non-electrical low-carbon options like biofuels. In the previous decade, energy efficiency progress compounded the effect of weaker-than-expected economic growth, leading to surprisingly low power demand.

In the next decade, while the macroeconomic downside risk is unfortunately real, electrification might well outweigh efficiency gains; a household buying an electric car on average adds as much electricity demand as dozens of families replacing refrigerators with ultra-efficient models. The impact of direct electrification would be reinforced by an increasing strategic interest in electrolytic hydrogen, which could replace fossil-fuelled end uses such as heavy trucks or industrial heat. The recently announced EU hydrogen strategy targeting 10 million tonnes of green hydrogen by 2030 would require over 10% of the region’s present electricity generation, which equals the total growth in electrical output during 2000-2010 in a context of stagnation in electricity demand in the recent decade.

In addition to electrification and reaccelerating demand growth, renewables deployment will also have to cover accelerating and nearly unavoidable coal and nuclear capacity decommissioning in many advanced economies. After the value destruction of the past decade, there is little investment appetite for new conventional flexible assets in most mature energy systems. In any case, these may not always be aligned with a credible low-carbon strategy, as is the case for coal. New flexibility enablers from batteries, wider demand response, deeper interconnection of regional systems, new business models and market designs need to fill the gap.

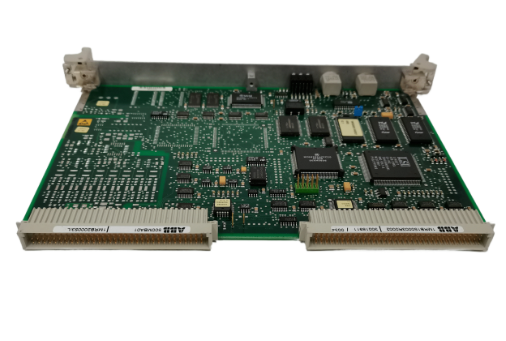

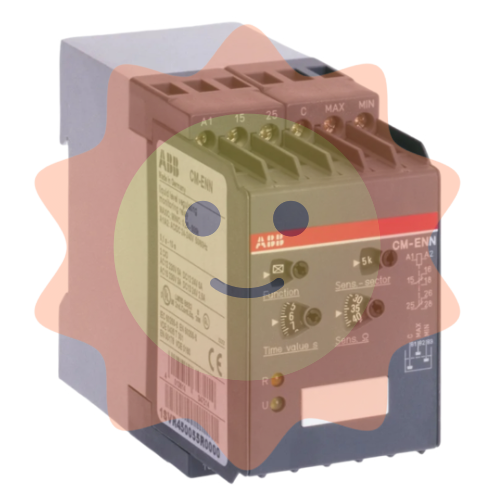

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA