Growing demand for pulp and paper products

Pulp molding: China has a large and growing pulp molding industry, accounting for about 40.5% of the global capacity. Pulp molding is a lightweight material made from recycled plant fibers. It is most commonly used as a protective packaging in industrial and medical Settings, but is probably most recognized for its application in the food industry, where it is used as disposable tableware (e.g. food trays and beverage holders), egg trays, and more.

In the food industry in particular, the material is gaining popularity due to its use as a more sustainable alternative to plastics. This usage will continue to rise as companies and governments seek to reduce their environmental impact. At the same time, the rise of food delivery services and takeaways has also increased demand for the material due to its lightweight, protective, disposable nature and low cost.

According to prospective Industry Research Institute estimates, in 2022, China's pulp molding capacity is about 1.79 million tons, accounting for about 40.5% of the global capacity of 4.42 million tons. At the same time, China's molded pulp production reached 1.57 million tons in 2022. The largest segment of pulp molding products is general protective packaging, accounting for about 64% of China's pulp molding production in 2022, or about 1.01 million tons.

The most common product is disposable tableware. In 2022, the total output of this product in China is 440,000 tons, accounting for about 28% of the total output of pulp molding in China. Finally, China's pulp molding high-quality industrial packaging production is relatively small, about 120,000 tons, accounting for 8% of the total.

Import and export of paper and pulp

China is a major importer and exporter of pulp and paper. Imports of almost all types of pulp and paper products declined in 2022, corresponding to an overall decline in imports that year due to the severe epidemic and subsequent restrictions. In 2022, the total import of paper, cardboard, pulp, waste paper and paper products reached 38.73 million tons, down 8.31% from the previous year. Those imports, however, edged up 0.82 percent to $29.89 billion.

A total of 8.36 million tons of paper and cardboard were imported in 2022, down 23.3% from the previous year. At the same time, 29.64 million tons of pulp (excluding non-paper and non-wood pulp 22.37 million tons) were imported, down 2.88% from the previous year.

Waste paper was one of the few industries that saw an increase in imports, up 5.56% year-on-year to 570,000 tons. At the same time, imports of paper products fell 42.86% to 160,000 tons.

The average price of paper and paperboard imports in 2022 was $732.69 per ton, an increase of 5.35% over the previous year, and the average price of pulp imports was $766.35 per ton, an increase of 13.45%.

The average cost of waste paper was $237.82 per ton, down 3.43% from the previous year.

On the other hand, most of the exports saw substantial growth in 2022, with total exports of paper, cardboard, pulp, waste paper and paper products increasing by 38.2% year-on-year to 13.827,100 tons. Those exports also rose 30.6 percent to a total of $34.65 billion.

In 2022, China's pulp and paper exports: paper and cardboard exports reached 8.58 million tons, an increase of 56.86%; Pulp exports reached 266,800 tons, an increase of 73.02%; Waste paper exports reached 300 tons, 75% less than the previous year; The export of paper products was 4.98 million tons, an increase of 13.7% over the previous year. The average export price of paper and paperboard was US $1,567.03 per ton, down 4.86% from the previous year; The average export price of pulp was $1,563.66 per ton, up 27.7%.

China pulp and paper industry policy

China does not impose any additional restrictions on foreign investment in the pulp and paper industry, and even encourages investment in certain industries. The China Catalogue of Industries to Encourage Foreign Investment (2022 Edition), effective January 1, 2023, Outlines several sub-industries to encourage foreign investment, including (but not limited to) : heavy corrugated cardboard and carton equipment manufacturing; Light corrugated cardboard and carton equipment manufacturing with corrugated height below 0.75mm; Papermaking chemicals; New paper machinery (including pulping) and other complete equipment manufacturing and waste paper recycling.

Companies engaged in these encouraging industries may be eligible for certain government support policies and incentives. These include:

Import equipment exemption: for encouraged foreign investment projects, the import of self-use equipment within the total investment can be exempted from tariffs, but there are special circumstances; Enjoy preferential land prices and relax land regulation: encouraged foreign projects can give priority to land supply and intensive use. The reserve price of land transfer can be determined according to 70% of the lowest price of industrial land transfer in the country.

Reduction of enterprise income tax: Foreign-invested enterprises engaged in encouraged industries in some areas such as western China and Hainan Province, which meet certain conditions, can be taxed at a reduced tax rate of 15%.

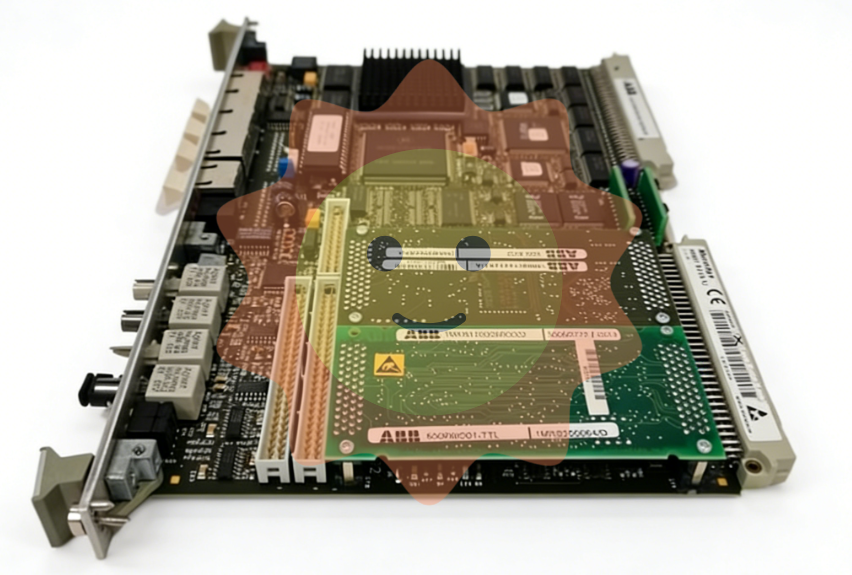

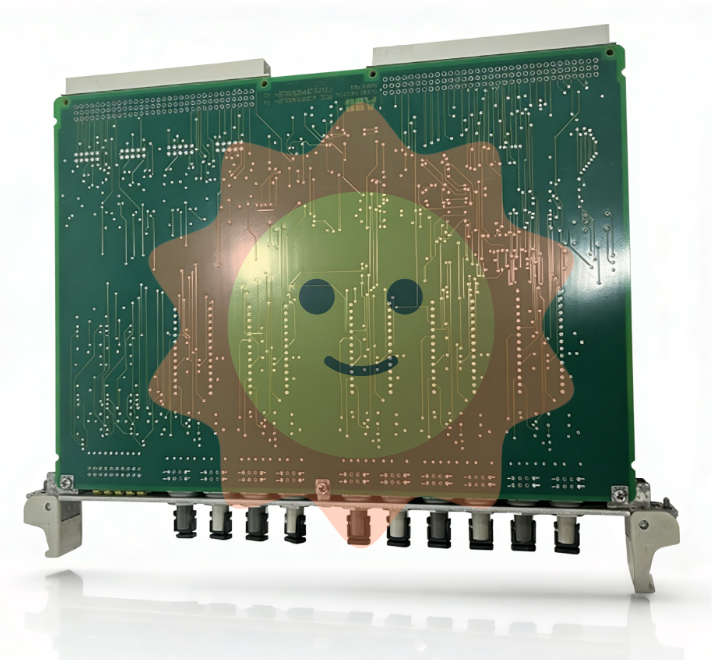

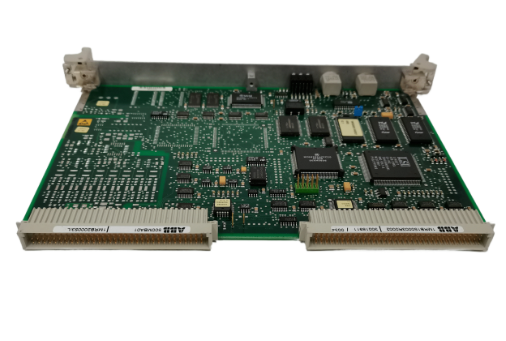

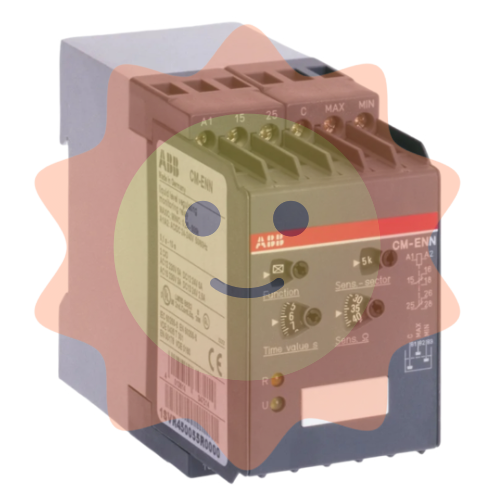

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA