Growing demand for pulp and paper products

Both in terms of output and demand, China's pulp and paper industry is the largest in the world. However, for China, some raw materials and specialty products are still dependent on imports. As domestic industries such as e-commerce and food delivery services continue to grow, so will the demand for pulp and paper products, which presents a huge opportunity for market entry and investment.

China is the world's largest producer and consumer of pulp and paper products. In 2022, China's combined pulp and paper product production exceeded 280 million tons and consumption exceeded 230 million tons.

Paper and paperboard products are critical to many industries in China, and demand is likely to continue to grow as incomes rise and consumers' disposable income increases. The rise of industries such as e-commerce and food delivery services has increased the demand for paper and cardboard packaging. In addition, China still relies on imports for certain domestically produced products and raw materials, such as wood pulp.

In this article, we examine the latest data on the Chinese pulp and paper market, including production, consumption and trade, and discuss the key market segments and opportunities for foreign investors.

Overview of pulp and paper industry in China

According to the "China Pulp and Paper Annual Report 2022" compiled by the China Paper Association, the total output of the pulp, paper and paper products industry in 2022 reached 283.91 million tons, a slight increase of 1.32% over 2021.

In 2022, the industry's total operating revenue was 1.52 trillion yuan ($210.32 billion), up 0.44 percent year on year, but profit fell 29.79 percent year on year to 62.1 billion yuan ($8.59 billion).

Supply and demand of paper and paper products

In 2022, China's paper and cardboard production reached 124.25 million tons, an increase of 2.64%. However, the output of paper products fell 4.65% year-on-year, with a total of 73.79 million tons produced.

A survey by the China Paper Association shows that in 2022, there will be about 2,500 paper and board producers and 4,727 paper products manufacturers in China, with annual revenue of more than 20 million yuan ($2.77 million).

From the perspective of demand for pulp and paper products, the total consumption of paper and cardboard was 124.03 million tons, down 1.94% from the previous year. The per capita annual consumption of paper and cardboard in 2022 will be 87.84 kg.

Despite the decline in the consumption of paper and paperboard in 2022, the growth in demand from 2013 to 2022 actually outpaced the growth in production, which grew at an average annual rate of 2.32% while consumption grew at an average annual rate of 2.67%. In fact, both production and consumption have remained relatively stable over the past decade, with consumption continuing to grow between 2018 and 2021.

A similar trend has been seen in the paper products industry. In 2022, the industry's total output fell 4.65% to 73.79 million tons, and consumption also fell 5.89% to 68.97 million tons. However, the industry's output is growing at an average annual rate of 3.69% and 3.45% between 2013 and 2022.

Supply and demand for pulp

According to the statistics of the China Paper Association, the total output of pulp in China in 2022 reached 85.87 million tons, an increase of 5.01% over the previous year. The largest segment of the pulp industry is waste pulp, with China's output of about 59.14 million tons in 2022, an increase of 1.72% over the previous year. Among them, the output of wood pulp was 21.15 million tons, an increase of 16.92%; The output of non-wood pulp was 5.58 million tons, an increase of 0.72%.

From the perspective of demand, China's pulp consumption in 2022 is about 112.95 million tons, an increase of 2.59% from the previous year. Among them, 43.28 million tons of wood pulp, accounting for 38% of the total pulp consumption, of which more than half (52%) rely on imports.

About 64.3 million tonnes of waste pulp were consumed in 2022, accounting for 57% of total pulp consumption, of which the vast majority (about 95%) was domestically produced.

Finally, non-wood pulp production will reach 5.37 million tons in 2022, accounting for 5% of total pulp consumption.

Mainly paper and pulp products

Cardboard and corrugated paper are the most commonly used packaging materials, accounting for the largest proportion in the production and consumption of paper products in China. This is followed by uncoated printing and writing paper, white cardboard and household paper.

Waste paper: In 2022, the total amount of domestic waste paper recycled in China was 65.85 million tons, an increase of 1.45% over 2021, the recycling rate of waste paper reached 53.1%, and the utilization rate reached 53.5%. The amount of waste paper recycled has gradually increased in the past decade, with an average annual growth rate of 4.64% from 2013 to 2022.

Newspapers and wrapping paper: Not surprisingly, with the rise of digital media, newspaper paper production and consumption have steadily declined over the past decade. Between 2013 and 2022, the compound annual growth rate of the industry's production is -14.28 percent and that of consumption is -10.38 percent. At the same time, the output of packaging paper in 2022 was 7.3 million tons, an increase of 2.1% over the previous year. Consumption was about the same at 7.31 million tonnes, up 1.25% from 2021. Between 2013 and 2022, the average annual growth rate of production is 1.56%, while consumption is 1.31%.

Pulp molding: China has a large and growing pulp molding industry, accounting for about 40.5% of the global capacity. Pulp molding is a lightweight material made from recycled plant fibers. It is most commonly used as a protective packaging in industrial and medical Settings, but is probably most recognized for its application in the food industry, where it is used as disposable tableware (e.g. food trays and beverage holders), egg trays, and more.

In the food industry in particular, the material is gaining popularity due to its use as a more sustainable alternative to plastics. This usage will continue to rise as companies and governments seek to reduce their environmental impact. At the same time, the rise of food delivery services and takeaways has also increased demand for the material due to its lightweight, protective, disposable nature and low cost.

According to prospective Industry Research Institute estimates, in 2022, China's pulp molding capacity is about 1.79 million tons, accounting for about 40.5% of the global capacity of 4.42 million tons. At the same time, China's molded pulp production reached 1.57 million tons in 2022. The largest segment of pulp molding products is general protective packaging, accounting for about 64% of China's pulp molding production in 2022, or about 1.01 million tons.

The most common product is disposable tableware. In 2022, the total output of this product in China is 440,000 tons, accounting for about 28% of the total output of pulp molding in China. Finally, China's pulp molding high-quality industrial packaging production is relatively small, about 120,000 tons, accounting for 8% of the total.

Import and export of paper and pulp

China is a major importer and exporter of pulp and paper. Imports of almost all types of pulp and paper products declined in 2022, corresponding to an overall decline in imports that year due to the severe epidemic and subsequent restrictions. In 2022, the total import of paper, cardboard, pulp, waste paper and paper products reached 38.73 million tons, down 8.31% from the previous year. Those imports, however, edged up 0.82 percent to $29.89 billion.

A total of 8.36 million tons of paper and cardboard were imported in 2022, down 23.3% from the previous year. At the same time, 29.64 million tons of pulp (excluding non-paper and non-wood pulp 22.37 million tons) were imported, down 2.88% from the previous year.

Waste paper was one of the few industries that saw an increase in imports, up 5.56% year-on-year to 570,000 tons. At the same time, imports of paper products fell 42.86% to 160,000 tons.

The average price of paper and paperboard imports in 2022 was $732.69 per ton, an increase of 5.35% over the previous year, and the average price of pulp imports was $766.35 per ton, an increase of 13.45%.

The average cost of waste paper was $237.82 per ton, down 3.43% from the previous year.

On the other hand, most of the exports saw substantial growth in 2022, with total exports of paper, cardboard, pulp, waste paper and paper products increasing by 38.2% year-on-year to 13.827,100 tons. Those exports also rose 30.6 percent to a total of $34.65 billion.

In 2022, China's pulp and paper exports: paper and cardboard exports reached 8.58 million tons, an increase of 56.86%; Pulp exports reached 266,800 tons, an increase of 73.02%; Waste paper exports reached 300 tons, 75% less than the previous year; The export of paper products was 4.98 million tons, an increase of 13.7% over the previous year. The average export price of paper and paperboard was US $1,567.03 per ton, down 4.86% from the previous year; The average export price of pulp was $1,563.66 per ton, up 27.7%.

China pulp and paper industry policy

China does not impose any additional restrictions on foreign investment in the pulp and paper industry, and even encourages investment in certain industries. The China Catalogue of Industries to Encourage Foreign Investment (2022 Edition), effective January 1, 2023, Outlines several sub-industries to encourage foreign investment, including (but not limited to) : heavy corrugated cardboard and carton equipment manufacturing; Light corrugated cardboard and carton equipment manufacturing with corrugated height below 0.75mm; Papermaking chemicals; New paper machinery (including pulping) and other complete equipment manufacturing and waste paper recycling.

Companies engaged in these encouraging industries may be eligible for certain government support policies and incentives. These include:

Import equipment exemption: for encouraged foreign investment projects, the import of self-use equipment within the total investment can be exempted from tariffs, but there are special circumstances; Enjoy preferential land prices and relax land regulation: encouraged foreign projects can give priority to land supply and intensive use. The reserve price of land transfer can be determined according to 70% of the lowest price of industrial land transfer in the country.

Reduction of enterprise income tax: Foreign-invested enterprises engaged in encouraged industries in some areas such as western China and Hainan Province, which meet certain conditions, can be taxed at a reduced tax rate of 15%.

Reduce import taxes on some paper products: At the end of December 2022, the Customs Tariff Commission of The State Council announced a series of adjustments to import taxes on a series of products from 2023. This includes temporarily lowering import duties on dozens of pulp and paper products to below the most Favored Nation (MFN) level.

Prospects and opportunities of pulp and paper industry in China

Although the use of paper and pulp has decreased in traditional Settings, especially in the digitalized areas of communications, media, and literature, other recent phenomena have helped offset this decline. For example, the rapid rise of e-commerce and delivery services has increased the demand for corrugated paper and cardboard. Food delivery is a booming industry in China, and demand for plastic alternatives will continue to grow as consumers and businesses become increasingly concerned about the environmental impact.

By the same token, recycling and waste management also present great potential as the country seeks to develop a circular economy. For example, the 14th Five-Year Plan for the development of circular economy aims to increase the utilization rate of waste paper to 60 million tons by 2025.

Companies can also tap into the premium specialty paper market, which continues to show great potential as consumption of mid-to-high-end products grows. High-quality packaging, especially for high-end luxury goods, is highly valued by Chinese consumers, while the cultural tendency to give gifts has further expanded the demand for specialty paper production.

Although China dominates the production of some types of pulp and paper products, certain products are still dependent on imports, especially raw materials such as wood pulp. As a result, foreign producers who have not yet sold in China may want to explore trade opportunities.

Finally, China is also an ideal location to source suppliers of pulp and paper products, given its dominance in certain sub-industries, particularly finished paper products such as coated paper, tissue paper, white board, specialty paper and cardboard.

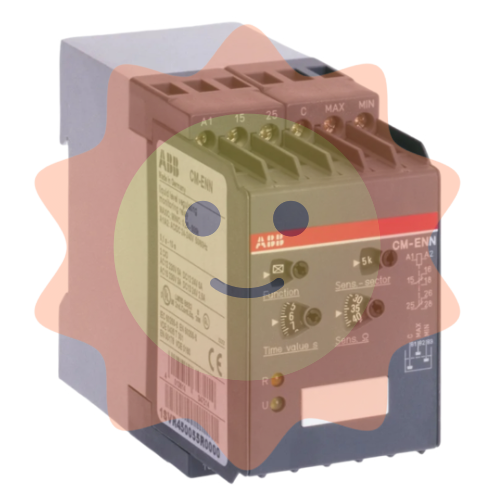

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

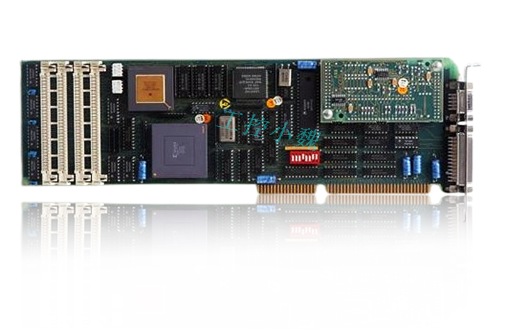

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA