Current status and trends of pulp and paper industry in Indonesia

According to statistics, Indonesia's pulp and paper production capacity has a compound annual growth rate of 1.83% from 2014 to 2021, and currently has 115 operating bases. While these numbers are not necessarily comparable to those in China, the United States or India, they still play an important role in the interconnected global structure of the pulp and paper industry. As a dynamic market, it is important to understand the current state of the pulp and paper industry in Indonesia and the factors influencing its future.

Looking back at the capacity trends in Indonesia over the past few years, it is interesting to note that there was a significant increase in capacity between 2014 and 2016, followed by a gradual decline from 2017 to date. In fact, Indonesia is expected to reach its lowest capacity since 2015 by the end of 2022. However, according to data from FisherSolve, capacity is expected to realign its growth direction in 2023, with a projected increase of 8%.

When we break it down by major grade, when analyzing the major grade capacity of the various regions, we usually do not see a trend: the commodity pulp produced in Indonesia is the clear leading grade compared to other regions. In the past few years, we have been used to thinking of cardboard as a leading grade. However, by the end of 2022, there is expected to be an 86% difference between market pulp capacity and box board capacity in Indonesia.

Similar to 2022, the region's top three leading grades in 2023 and 2024 will include commodity pulp, box board paper, and printed writing paper. Nevertheless, the production of carton board is expected to increase significantly in 2023, approaching the above three grades - a trend that will be crucial to watch. Most other grades are not expected to change much over the next two years.

The chart below shows the cost breakdown of the pulp and paper industry in Indonesia and we can see that raw material fiber (35%), pulp (28%) and energy (17%) make up the top three cost components, as in many other countries.

Cost breakdown of pulp and paper industry in Indonesia

There are many factors affecting the pulp and paper industry in Indonesia, but some of the most notable include: Indonesia's position as one of the largest exporters of paper and commodity pulp has created tremendous growth potential, driving its pulp and paper market on an upward trend. At the same time, the high level of consolidation among paper producers in Indonesia means that the production economy will outperform peer countries such as India where producers are dispersed.

In addition, energy costs in Indonesia are one of the largest contributors to the total cost due to the high prices of coal and natural gas in the country. Its future fuel price movements will have a significant impact on the overall competitiveness of its pulp and paper industry. As the government becomes more aware of the importance of protecting the natural environment, there is less room for expansion of local pulp and paper production facilities. Demand for household paper in Indonesia is relatively strong as migrant labor complements slow population growth, and consumer income growth will support further tissue demand.

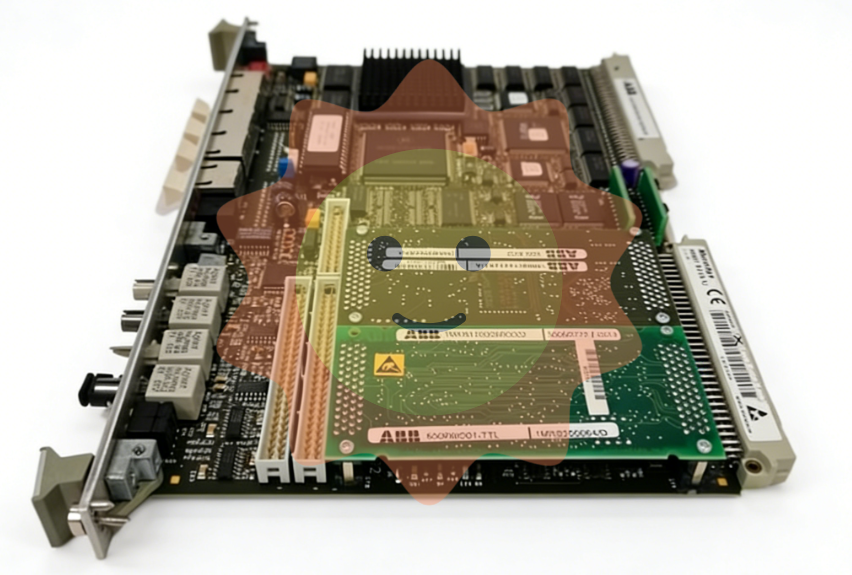

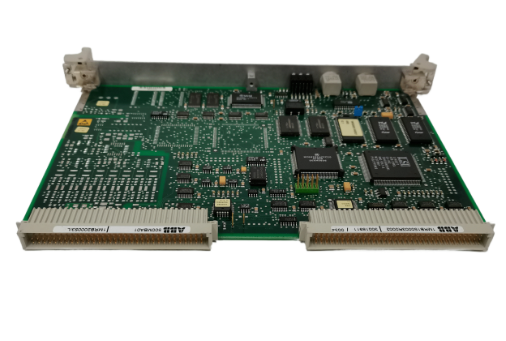

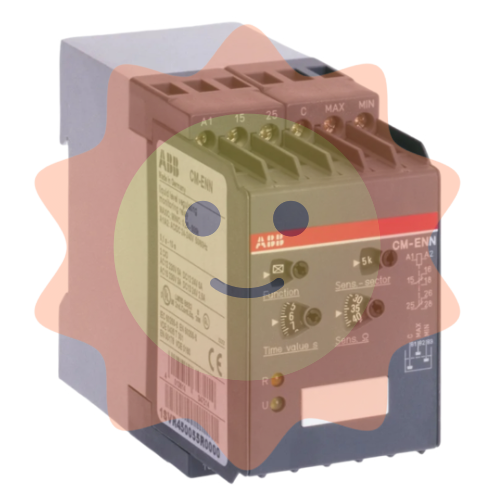

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA