Digital transformation of oil and gas market size

Digital transformation of oil and gas market analytics

The digital transformation market in the oil and gas industry is expected to achieve a CAGR of 9.5% over the forecast period. Digital transformation has been one of the major trends driving the global oil and gas industry since the last decade. This shift enables operations to leverage advanced digital technologies such as artificial intelligence, iot, and big data to improve efficiency, opening up new opportunities as it may involve digital twins, which clearly improve the efficiency of predictive maintenance of critical assets, thereby limiting the exposure of dangerous tasks to workers in the facility. Extended Reality is the latest and emerging solution for the oil and gas industry. Companies such as Shell, ExxonMobil and BP are among the first to adopt immersive technologies in this area. The offshore oil and gas business uses AI in data science to make complex data used in oil and gas exploration and production more accessible, which allows companies to discover new exploration prospects or make more use of existing infrastructure. Recently, for example, BP invested in Houston-based startup Belmont Technology to strengthen the company's artificial intelligence capabilities and develop a cloud-based earth science platform called Sandy. Among all enabling technologies, artificial intelligence is expected to play an important role over the forecast period. Ai is also being used to improve the security of gas stations for preventive maintenance. However, fire incidents at gas stations are increasing. For example, a gas station at McCarran Airport in Las Vegas had an accidental fire in September 2021. Such incidents can prove fatal and devastate the gas station and the surrounding area. However, AI-based smart cameras can enter risk areas and reduce the extent of potential damage. In November 2021, ElectrifAi announced the delivery of computer Vision (CV) and Machine Learning as a Service (MLaaS) to the oil, gas and energy industry at ADIPEC in ABU Dhabi. With ElectrifAI's MLaaS, companies need little experience to realize the maximum business and operational benefits of AI and ML. MLaaS can be quickly deployed in any cloud environment or on-premises. In addition, the adoption of monitoring devices such as iot will enable companies to further digitize the industry by automating and optimizing processes and eliminating associated risks, including security and regulatory issues, as well as by continuously monitoring equipment. In addition, the sharp drop in oil prices in 2020 in the wake of COVID-19 and the price war between Saudi Arabia and Russia are emerging as major constraints to the deployment of automation by oil production companies. In addition, Texas-based Occidental Petroleum Corporation (Oxy) has the biggest 2020 capex cuts of any global oil and gas producer in the world, according to the International Energy Agency (IEA). COVID-19 led Oxy to reduce its 2020 capital expenditure by 48.1%, to $2.7 billion from $5.2 billion planned at the beginning of the year. However, the pandemic has greatly highlighted the need for digitalization in the oil and gas industry. As a result, companies are planning to invest in such transformations; Therefore, the market is expected to grow during the forecast period.

Downstream industries are expected to hold the main market share

Digital transformation is considered one of the core innovations leading downstream operations in the oil and gas industry. The two companies are working to improve asset utilization by improving manufacturing efficiency at their plants. Oil and gas companies' downstream businesses, which include petrochemicals and refining, have always adopted technology to improve their operations. These companies have developed and adopted innovative approaches to managing complex processes and interpreting data to improve performance. Given the strategic push by many companies to expand downstream operations in their oil and gas value chains, particularly petrochemicals, the ongoing digital transformation is expected to bring even greater potential. The main area of concern for suppliers is how to predict and prevent or reduce maintenance costs. Automated solutions for maintenance and turnaround planning tools use application performance management and AI-based simulation and can be easily added to existing operating systems. In addition, upgrading sensor systems for better predictive and prescriptive maintenance can lead to long-term operational efficiencies. Several oil and gas companies rely on technologies such as artificial intelligence, the Internet of Things and big data to improve their operations. For example, Shell's downstream commercial business, which supplies oil and gas to end consumers, uses AI technology to predict consumer demand for petroleum products, measure supply shortages, and recommend a blend of oil for refining processes. Furthermore, the continuous expansion of the industry will also increase the market growth rate during the forecast period. For example, in May 2022, Saudi Arabian Oil Company (Saudi Aramco) announced a partnership with Thai government oil company PTT as it expands its downstream operations in Asia. These organizations aim to improve partnerships in procuring crude oil and marketing refining, petrochemicals and liquefied natural gas (LNG). Blue and green hydrogen and numerous clean energy initiatives are other possible areas of participation. In addition, global crude oil demand falls to 91 million barrels per day in 2020. The decline in 2020 is due to the economic and mobility impacts of the coronavirus pandemic, including widespread shutdowns worldwide. According to the U.S. Energy Information Administration (EIA), crude oil production is expected to be 101.2 million barrels per day in 2023. Growth in crude oil production is also expected to further drive the market growth.

- EMERSON

- Honeywell

- CTI

- Rolls-Royce

- General Electric

- Woodward

- Yaskawa

- xYCOM

- Motorola

- Siemens

- Rockwell

- ABB

- B&R

- HIMA

- Construction site

- electricity

- Automobile market

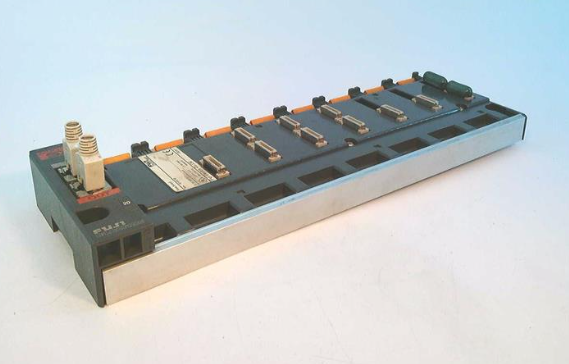

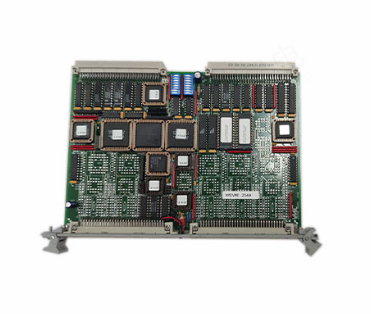

- PLC

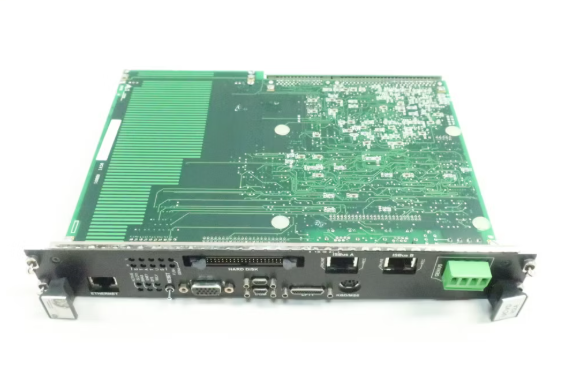

- DCS

- Motor drivers

- VSD

- Implications

- cement

- CO2

- CEM

- methane

- Artificial intelligence

- Titanic

- Solar energy

- Hydrogen fuel cell

- Hydrogen and fuel cells

- Hydrogen and oxygen fuel cells

- tyre

- Chemical fiber

- dynamo

- corpuscle

- Pulp and paper

- printing

- fossil

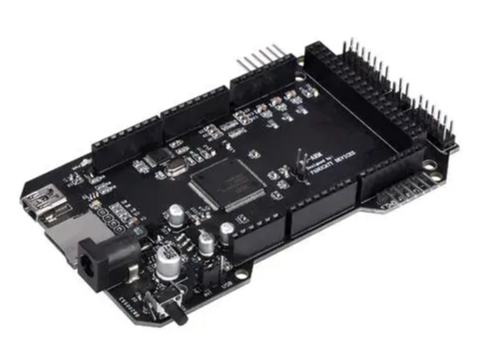

- FANUC

- Food and beverage

- Life science

- Sewage treatment

- Personal care

- electricity

- boats

- infrastructure

- Automobile industry

- metallurgy

- Nuclear power generation

- Geothermal power generation

- Water and wastewater

- Infrastructure construction

- Mine hazard

- steel

- papermaking

- Natural gas industry

- Infrastructure construction

- Power and energy

- Rubber and plastic

- Renewable energy

- pharmacy

- mining

- Plastic industry

- Schneider

- Kongsberg

- NI

- Wind energy

- International petroleum

- International new energy network

- gas

- WATLOW

- ProSoft

- SEW

- wind

- ADVANCED

- Reliance

- YOKOGAWA

- TRICONEX

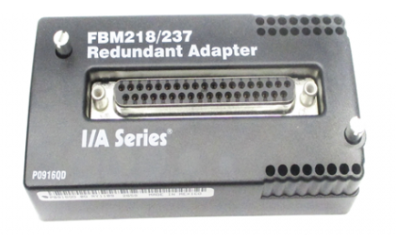

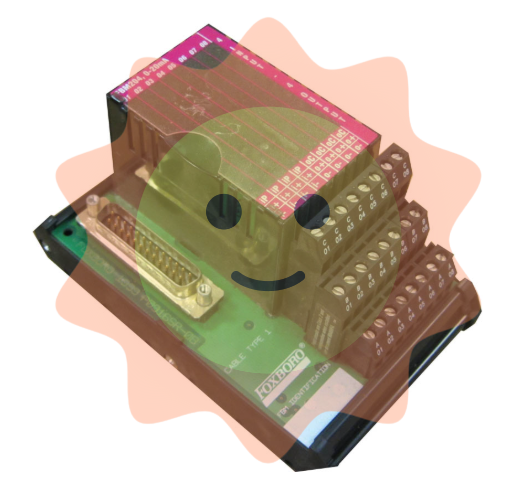

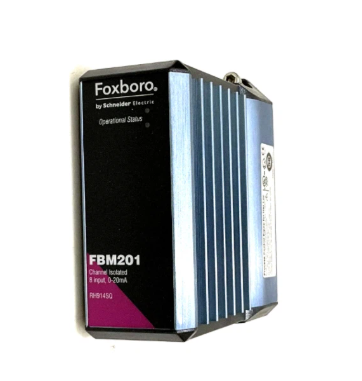

- FOXBORO

- METSO

- MAN

- Advantest

- ADVANCED

- ALSTOM

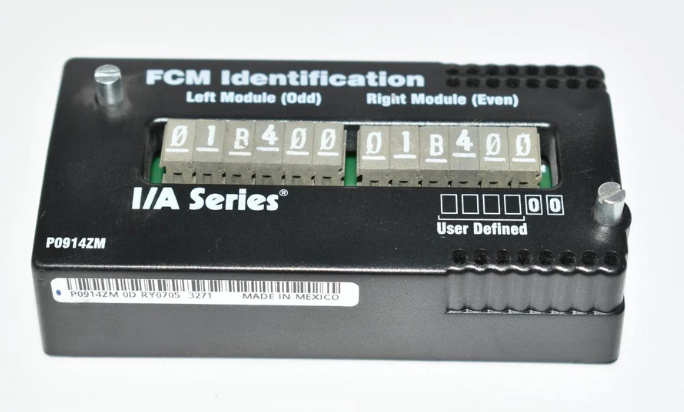

- Control Wave

- AB

- AMAT

- STUDER

- KONGSBERG

- MOTOROLA

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- Triconex

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- KOLLMORGEN

- Beijer

- Endress+Hauser

- MOOG

- KB

- Moxa

- Rexroth

- YAMAHA

- Johnson

- Westinghouse

- WAGO

- TOSHIBA

- TEKTRONIX

Email:wang@kongjiangauto.com