Digital transformation of oil and gas market size

The Asia-Pacific region will account for a large share

The region has a significant market share in the oil and gas industry. In addition, according to the IBEF, India is expected to be one of the most significant contributors to global non-OECD oil consumption growth. India's consumption of petrol products in FY22 was 204.23 MMT. High-speed diesel is the largest petroleum product consumed in India, accounting for 38.84% of petroleum product consumption in FY22. In addition, in January 2022, Indian Oil Corporation Limited (IOCL) announced plans to expand its City Gas distribution (CGD) business, looking to invest INR 70 billion ($918.6 million). Countries such as China, India, Japan and South Korea are among the most active oil and gas sectors in the region, collectively accounting for more than 78% of Asia-Pacific's refining capacity, with important refineries deeply integrated with petrochemical production units. In addition, according to the IBEF, India aims to commercialize 50 percent of its SPR (Strategic Petroleum Reserve) to raise funds and build additional storage tanks to offset high oil prices. In addition, countries like Singapore get more than 10 percent of their refinery throughput in a single year. This provides room for the expansion of existing refineries, and new projects are expected to likely drive demand for digital transformation. Given the long lead times and heavy capital expenditures involved in oil and gas production, key players in the industry are looking to gain a competitive advantage through transformational technologies such as artificial intelligence. For example, Woodside, Australia's foremost natural gas producer, deployed IBM Watson to run AI algorithm operations that search more than 25 million documents, retrieve content, benchmark against historical performance, and suggest relevant information to anyone in the business. In addition, Asia's leading petrochina announced that its Daqing oilfield, which aims to achieve stable production of 50 million tons in 20 years, will undergo digital transformation through technologies such as cloud computing, big data and the Internet of Things. However, the oil and gas sector recovered significantly in 2021, pushing the sector to pre-COVID-19 levels. In its latest report in October 2021, the International Energy Agency (IEA) predicted that India's oil demand is expected to grow by 50 percent by 2030, compared to 7 percent worldwide. Therefore, the growth of the industry is expected to drive the market studied.

Overview of digital transformation in the oil and gas industry

The global digital transformation market in the oil and gas industry is highly competitive and comprised of several major players. Players with a significant share in the market are focusing on expanding their customer base abroad. These companies use strategic partnership programs and acquisitions to increase their market share and profitability. October 2021 - Emerson and Aspen Technology, Inc. Entered into a definitive agreement to combine Emerson's two separate industrial software businesses, Open Systems International, Inc. The company is also investing $6 billion in cash to AspenTech shareholders to create the new AspenTech, a diversified, high-performance industrial software segment with enhanced functionality, scale and technology. May 2021 - Emerson Electric upgraded automation technology to improve reliability at the Malampaya gas production and processing facility operated by Shell Exploration Philippines, completing work ahead of schedule to help the company restore gas supplies as planned; As a result, the Philippines will benefit from continuing to use cleaner natural gas to power its economy.

- EMERSON

- Honeywell

- CTI

- Rolls-Royce

- General Electric

- Woodward

- Yaskawa

- xYCOM

- Motorola

- Siemens

- Rockwell

- ABB

- B&R

- HIMA

- Construction site

- electricity

- Automobile market

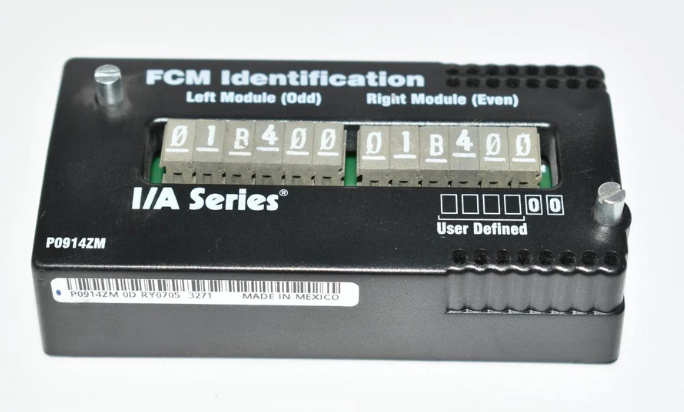

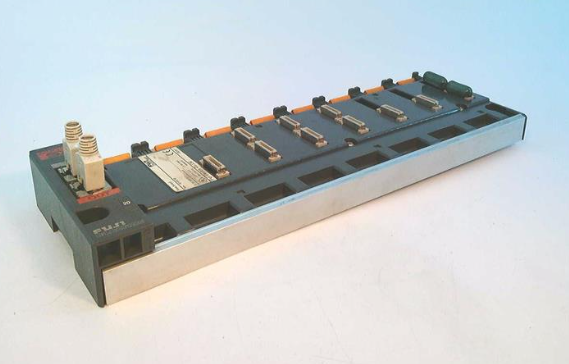

- PLC

- DCS

- Motor drivers

- VSD

- Implications

- cement

- CO2

- CEM

- methane

- Artificial intelligence

- Titanic

- Solar energy

- Hydrogen fuel cell

- Hydrogen and fuel cells

- Hydrogen and oxygen fuel cells

- tyre

- Chemical fiber

- dynamo

- corpuscle

- Pulp and paper

- printing

- fossil

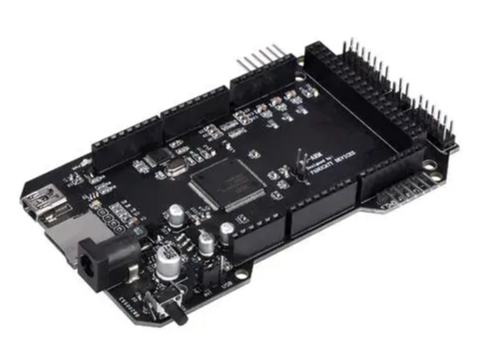

- FANUC

- Food and beverage

- Life science

- Sewage treatment

- Personal care

- electricity

- boats

- infrastructure

- Automobile industry

- metallurgy

- Nuclear power generation

- Geothermal power generation

- Water and wastewater

- Infrastructure construction

- Mine hazard

- steel

- papermaking

- Natural gas industry

- Infrastructure construction

- Power and energy

- Rubber and plastic

- Renewable energy

- pharmacy

- mining

- Plastic industry

- Schneider

- Kongsberg

- NI

- Wind energy

- International petroleum

- International new energy network

- gas

- WATLOW

- ProSoft

- SEW

- wind

- ADVANCED

- Reliance

- YOKOGAWA

- TRICONEX

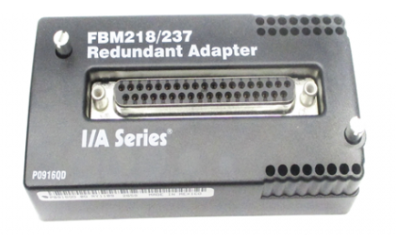

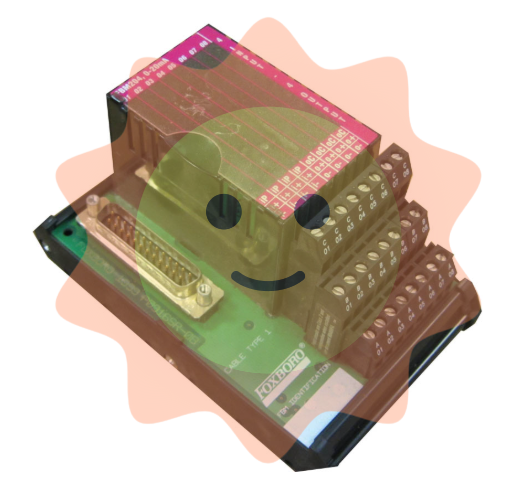

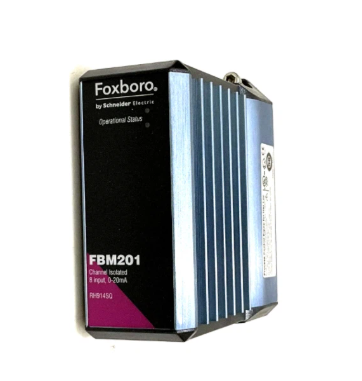

- FOXBORO

- METSO

- MAN

- Advantest

- ADVANCED

- ALSTOM

- Control Wave

- AB

- AMAT

- STUDER

- KONGSBERG

- MOTOROLA

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- Triconex

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- KOLLMORGEN

- Beijer

- Endress+Hauser

- MOOG

- KB

- Moxa

- Rexroth

- YAMAHA

- Johnson

- Westinghouse

- WAGO

- TOSHIBA

- TEKTRONIX

Email:wang@kongjiangauto.com