Uncertain 2023, how should food and beverage firmly move forward?

What food and drink will we need in 2023?

COVID-19, the Russia-Ukraine war, the Fed's interest rate hike, the stock market's decline... 2022, full of uncertainty, is an exceptionally difficult year for all walks of life.

If the time dimension is enlarged and viewed from a more macro perspective, 2022 is only the next insignificant downward cycle in the ongoing economic fluctuations in the development of human society.

However, the small pains in this historical flood are projected to the present, enough to make the industry dig the heart, let alone fall on everyone's head, and what a heavy mountain it will be.

Into 2023, the three-year suspension of social life has been restarted, and the "recovery" of economic and social has become the keyword of this year. Among them, consumption is not only the main driving force of economic growth, but also an important force point to promote the current economic operation to return to the right track.

However, 2022 has passed, but uncertainty continues and will gradually become the new normal.

What will happen to the consumer market in this turbulent and unknown environment?

Among them, is the food and beverage track still available?

And how to push forward, explore new life?

The food and beverage industry will unleash more consumer demand

Walter, American scholar. In his book The Unequal Society, Scheidel argues that mass mobilization for war, transformative revolutions, state failure, and deadly infectious diseases can ameliorate socioeconomic inequality, called the four Horsemen of corrective power.

On January 10, 2023, according to data released by the Central bank, RMB deposits increased by 26.26 trillion yuan in 2022, an increase of 6.59 trillion yuan year-on-year, hitting a record high. Among them, household deposits increased by 17.84 trillion yuan, a substantial increase of 7.94 trillion yuan compared with household savings deposits in 2021.

In this regard, many experts in the industry are optimistic that this excess savings, which is significantly higher than in previous years, is likely to become a "excess consumption" to stimulate domestic demand and promote economic revitalization.

But in fact, most of the current savings come from high-income groups, and the middle and low-income groups that can really achieve a big rebound in consumption not only have no excess income, but a large part of the population is even constantly consuming the excess savings before the epidemic.

As we all know, high-income groups have a strong ability to resist risks, their consumption behavior is little affected by the environment, and their marginal propensity to consume is low, and their support for the entire consumption market is limited.

As for low - and middle-income people, after 22 years of salary cuts, layoffs, epidemics and other magical encounters, 23 years is likely to spend more money on risk defense, rather than consumption.

In addition, real estate investment confidence is declining, financial products ushered in a wave of redemption, all signs show that even if the epidemic zero policy is waved away, the economic development situation is still unpredictable.

In 2023, when the economy is waiting to explode, perhaps the pandemic will not bring us the fairness described in the Unequal Society, but instead deepen the existing economic divide. In the future, we may not be greeted by the long-awaited "V" recovery, but the crueler "K" recovery.

Perhaps the overall environment may not be as optimistic as some people expect, but "food for the people", as a major existence of the food industry, with its "fundamental nature of human survival", is expected to remain strong in 2023.

In addition, although the New Year has come, the health threat of the epidemic has not really disappeared, and the high-intensity life continues, and the long-term accumulation of mental internal friction makes people need to find an emotional outlet, and consumption is a perfect carrier.

At present, people may be more cautious about high consumption, but products such as food and beverages that are approachable but can give high emotional value through the five senses are expected to form a strong rebound in the market.

In addition, at the end of 2022, with the release of policies such as the Notice on Further Optimizing the Implementation of the Novel Coronavirus Prevention and Control Measures and the overall Plan for the Implementation of the "Class B and B Tube" for the novel coronavirus infection, the epidemic prevention and control measures will be gradually optimized, the fundamentals of the food and beverage industry will be gradually bottomed, and the consumption scene will be gradually repaired, which will drive the food and beverage industry to recover. Superposition industry upstream raw material prices fall, will drive 2023 industry profit release, valuation increase.

At the same time, at the national and government level, in order to stimulate domestic demand for the food and beverage industry has also given considerable support policies. In the Outline of the Strategic Plan for Expanding Domestic Demand (2022-2035) issued by The State Council, the content of food and beverage is mainly reflected in: continue to improve traditional consumption and improve the basic consumption quality such as food and clothing. We will increase the supply of high-quality basic consumer goods, and promote the same line, same standard and same quality of domestic and export products. Promote healthy diet structure, increase the supply of healthy and nutritious agricultural products and food, and promote the healthy development of the catering industry.

It can be seen that although there are still many variables in the consumer market in 2023, the food and beverage industry is expected to release more consumer demand, and the growth of the overall market is expected.

The dilemma of the new normal

We are optimistic about the overall development of the food and beverage industry in 2023, but we also have to admit that the suspended three years have already brought multiple pressures to the survival and development of many food companies, consumer behavior changes, capital is cold... The brand is facing one predicament after another.

However, "good luck and bad luck coexist with crisis", many times the secret of success depends not only on the environment, but also on the judgment of the environment and the insight behind the essence.

(1) The pursuit of cost performance = consumption downgrade?

In the food circle in 2022, the front foot of the upcoming food is just hot, and the back foot of the leftover food is rising one after another; Among the major e-commerce platforms, Pinjoduo, once at the bottom of the "despise chain", saw its revenue in the third quarter of 2022 increase by 65% over the same period last year to 35.5 billion yuan, much higher than Alibaba's 3% and Jingdong's 11.4%, achieving a perfect counterattack.

Whether it is imminent and scraps of food, or pinduoduo, there seems to be a common label, that is, "low price", which also prompted many people to clamor for "consumption downgrade".

But is this really the case?

Simply equating the pursuit of low prices with lower consumption, as well as packaging products as a symbol of "consumption upgrade" by many new consumer brands in recent years, relying only on gorgeous appearance, high prices and eye-catching stunts, is too simple and rude.

With the increasing maturity of the consumption mind of a new generation of consumers, they increasingly understand what they really need, rather than the purchase impulse advocated by brand education, and their consumption behavior begins to be rationalized, thus completing the cognitive leap from "want" to "need".

As a result, consumer demand for products has also evolved from one stimulus point to a systematic consumption experience connected by quality, price, service, emotion, etc., to achieve the true sense of the past many new consumer brands repeatedly emphasized the "self", that is, from the real needs to provide and meet the real emotional value.

It can be seen that the current situation is not only a consumption downgrade, but in a sense more like a consumption upgrade.

McKinsey's latest McKinsey China Consumer Report 2023 also expressed a similar view: The Chinese consumer market shows a consumption trend of "smarter choices, consumption is not downgraded", consumers do not compromise in the choice of brands and products, but more careful to make trade-offs, and more actively seek discounts and promotions.

After all, no one is willing to be a sucker, to be cut chives again and again, and those who are used to lazy in product and brand construction, do not respect and Revere consumers' brands will eventually rise quickly with the fleeting air outlet and quickly dissipate.

Therefore, in 2023, please give up the appearance, rough, rough products and brand management model, abandon the arrogance in the bone, cherish the heart of humility and reverence, truly "user-centered" fully land, and think about brand upgrading based on the real emotional needs of users.

(2) Capital departure = consumption cold?

Another big event in 2022 will be the departure of capital.

According to the "Annual Inventory of Consumption and Investment in 2022" jointly released by Li Jin and Niu data, the number of investment and financing events in the consumer industry in 2022 fell sharply, with only 982 cases throughout the year, a year-on-year decline of 43%. While food and beverage remained a popular investment track in the consumer sector, there were 240 fewer investments overall than last year, and 102 fewer investments in the catering sector.

When the hot money receded, many people panicked and worried that the winter of new consumption was coming.

In fact, consumption has always been there, and before the influx of capital, the track was alive and well, and it has been steadily accelerating.

Only in the past period of time, many investors who fled the TMT field poured into new consumption with a large amount of money, and they reused the logic of investing in TMT, which brought subversive impact to the industry but also distorted and drastic changes in the mentality of many industry insiders.

However, there are essential differences between consumption and the Internet in business logic.

As a long slope and thick snow track, the mind of consumers can not easily seize in the day and night, and ultimately need to return to the product itself, the brand needs to rely on the real products, in the interactive time of constant communication and dialogue with consumers to moisten their hearts bit by bit, forming a unique brand imprint.

The crude money-burning logic of the Internet and the obsession with digital myths have proved untenable in the consumer business.

With the departure of hot money and the dissipation of the capital bubble, new consumption will eventually return to the right track. Perhaps, when the fickleness and noise subside, the brand players can be more practical and more focused on the cultivation of internal skills.

On the other hand, only after a big reshuffle can the market enter a real virtuous circle.

What food and drink will we need in 2023?

In any case, in 2023, the food and beverage industry will eventually usher in the rotation of the old and the new, the subversion and reshaping of the rules and the establishment of a new order.

At the same time, as a always vibrant evergreen track, 2023 is bound to usher in more and more brands, and the game between various categories will become more subdivided and intense.

So, in this year of uncertainty, what kind of food and drink do we really need? How can brands find their own definite direction?

(1) The eternal theme of health

This year and even in the future for a long time, there is no doubt that "health" will become the main theme of food and beverage innovation.

With the continuous development of social economy and civilization, people's consciousness has been continuously improved and expanded, and new demands have also emerged, among which the demand for food and beverage has gradually derived from the bottom of the survival of food and clothing to the pursuit of physical and mental health.

Therefore, health is an inevitable choice in the process of continuous innovation and development of food and beverage, but the outbreak of the "new crown" black swan event has made consumers realize the rapid improvement of health awareness in a short period of time, thus greatly accelerating the pace of food and beverage innovation towards health.

The major consumer trend insights and analyses released in recent years also confirm that the current trend of food and beverage health is unstoppable.

However, under the major theme of "health", what kind of functional demands can make consumers willing to pay is largely affected by the environment and cognition.

I still remember that for a long time in the past, people's cognition that fat is the culprit that affects health and leads to obesity, so a variety of products under the banner of "low fat" have been popular among consumers.

Later, as the concept of sugar control gradually penetrated from the field of daily chemical to the food circle, in addition, a large number of studies have shown that excessive intake of added sugar can lead to obesity, diabetes, cancer and other diseases, the original beloved sugar instead of fat has become the target of public criticism, from the government, institutions to enterprises, individuals are competing to join the "anti-sugar" team.

In this context, products such as Genki Forest, which focus on zero sugar/low sugar, have become a new fashion that leads the trend.

It can be seen that the health of the product should be based on the trend, and it needs to be built on the premise of the broad cognition of consumers, and make deep insight based on consumer demand.

For example, in the past two years, many foreign authorities released the trend insight can always see the "enhance immunity" related trend prediction. However, returning to the Chinese market, both consumers and brands actually lack a sense of body in this direction.

This is largely due to the difference in epidemic prevention and control policies between China and foreign countries in the past, resulting in the vast majority of Chinese people have not had a personal health threat due to the epidemic.

However, with the opening of epidemic control at the end of 22 years, infection cases across the country continued to rise, and people began to have an urgent demand for enhancing their own immunity. In addition, products that protect or repair organs vulnerable to the attack of the new coronavirus, such as protecting the heart, clearing heat and resolving the lungs, were also sought after by consumers.

Now on January 12, due to rumors of helping to prevent "Yangkang myocarditis", Coenzyme Q10 climbed the Weibo hot search list with search volume skyrocketing 2500%, triggering 100 million + readings and 10,000 + discussions, and many well-known brands related products were out of stock several times.

All these will release a good signal for product innovation in China's health food market in 2023.

At the same time, as everyone said, "COVID-19 is like opening a blind box, but it is particularly unfriendly to the elderly."

On January 17, 2023, at the press conference on the Operation of the National Economy in 2022 held by The State Council Information Office, China's population decreased by 850,000 compared with the end of the previous year, which is the first negative growth in nearly 61 years.

It can be seen that after the baptism of the first wave of the epidemic, coupled with the worsening aging problem in China, healthy food focusing on the elderly in 2023 is also expected to enter a new stage of high-speed take-off.

(2) Hoarding under the one-person scenario

It has to be said that the impact of the epidemic on food and beverage and even the entire consumer industry is far more extensive and profound than imagined.

Life goes on, and China's fight against COVID-19 has entered a new phase, but the psychological impact of the last three years of COVID-19 and the projected consumer behavior are still lingering.

"The family has surplus food, the heart does not panic."

The older generation loves to stock up, because they have experienced a shortage of materials, and the subconscious has always been imprinted with the fear of hunger. Therefore, even if the economic level is improved later and the living conditions are comfortable, they still use stockpiling to obtain a sense of security.

In the era of material development and convenient logistics, the emerging generation has also deeply appreciated the taste of "one ration" because of the epidemic.

Many young people from the past disdain to hoard goods to today's habit of hoarding goods, as if the sense of security can only come from full refrigerators and lockers, and this psychological fear in the short term is difficult to be easily erased due to the relaxation of epidemic prevention and control.

Bain & Company and Kantar Consumer Index jointly released the "2022 China Shopper Report Series II" pointed out that the sales volume of China's fast-moving consumer goods market increased by 5.9% over the same period last year, becoming the main engine of sales growth, among which the consumer hoarding behavior spawned by the epidemic is one of the reasons for sales growth. Mintel data also show that the epidemic will lead to a significant increase in hoarding behavior.

Based on this hoarding heat, convenience food and prepared dishes take off and usher in a golden period of rapid development.

It is also worth noting that according to relevant data such as the China Statistical Yearbook, the number of people living alone in China will reach 92 million in 2021, resulting in a lonely economy with huge consumption potential.

When "hoarding" meets "lonely economy", the hoarding demand of a one-person scene may become an effective way for brands to seek differentiation.

Behind the one-person scene is the consumer's need to be independent and take better care of themselves, but also contains a huge emotional gap.

Therefore, the good goods built around this kind of people must have higher standards and requirements, not only to be convenient, but also need to be healthy, rich choices, and have a sense of ritual.

For example, compared with the traditional family clothing with large weight and single taste, the combination of small specifications for one person and a variety of flavors or a more balanced collocation of nutritional components is more friendly to the people living alone and more relevant to their real needs.

In addition, the brand can also skip the inherent limitations of thinking, starting from the consumer's use scenario, in the product form (liquid, solid, concentrated state...) Storage mode (frozen, refrigerated, room temperature...) Food program (ready-to-eat, pre-preparation, DIY...) Other dimensions of innovation consideration, to achieve the combined effect of 1+1>2.

(3) Sustainable "sustainability"

The hot word in the food industry in 2022 must be "sustainable".

Yili, Unilever, Danone, Gengenforest, Mengniu, Budweiser, Danone, Panpan and other enterprises have landed renewable energy carbon neutral factories.

At the same time, on June 5, 2022, Unilever and more than 20 global authorities and leading enterprises such as Vision Technology Group, China Energy Conservation Association, China Quality Certification Center, Shanghai Energy Efficiency Center jointly issued the "Zero carbon factory Evaluation Method" group standard, becoming the world's first complete and quantifiable "zero carbon factory" construction standards and evaluation rules.

With the operation of green factories, coffee, yogurt, ice cream, camellia oil, vegetable meat slices and other zero-carbon (low-carbon) foods have also entered the tables of consumers. In addition, such as Master Kong, Pepsi, Coca-Cola, Nestle, etc., have also launched non-bottle label low-carbon environmental protection packaging products.

If 21 years of the food circle, "sustainable" or just emerging branches of the new shoots, then 22 years is low-carbon products everywhere, "carbon neutral" in the food industry has been fully practiced in the year.

It is predictable that as climate and food crises become more severe, people will eventually begin to extend their health concerns to the whole ecology, exploring how to build a dynamic balance between people and the planet, and more and more people will intentionally apply sustainability to everyday life.

However, if food companies want to walk out of a sustainable road is not overnight, the process is bound to be full of challenges and difficulties, need to do a "protracted war" consciousness. Achieving "carbon neutrality" requires years of investment and accumulation for food and beverage companies, which is bound to require huge time and capital costs.

Therefore, from the perspective of economic benefits, in order to make the products meet the sustainable requirements, the participating enterprises may need to invest more costs in different links to optimize and improve the technology, and eventually these expensive production costs will also be transferred to the consumer side of the market.

However, research data from global consulting agencies such as Innova and Mintel show that nearly half of consumers are willing to pay a higher premium for "sustainability."

However, this conclusion at the current stage is more to release a consumer preference signal, that is, consumers prefer one of the two similar products with sustainable properties, but are not really willing to pay a higher amount.

As far as the overall sustainable development behavior of Chinese consumers is concerned, the foundation of environmental protection, sustainable and low-carbon consumer education is not yet solid, and the decision-making weight value is not high. From the perspective of product design and positioning, "low-carbon" usually serves as an additional attribute after the product or brand itself has a certain selling point or influence. It is more suitable as an addition option without reducing the original sensory experience and cost of the product.

In the same way, there are always "stir-fried" plant meat in China, and the green concept of carbon reduction no matter how well it is blown, as long as the taste is not passed for a day, it is difficult to really seize the hearts of consumers.

Healthy, stocked, sustainable... Whether it is seeking a healthy placebo, obtaining a sense of security, or demonstrating their own values, the essence of these trends means that consumers return to their own world, and do not only value the cosmetic functions and selling points of products, but the pursuit of emotional satisfaction and comfort brought by the most real needs.

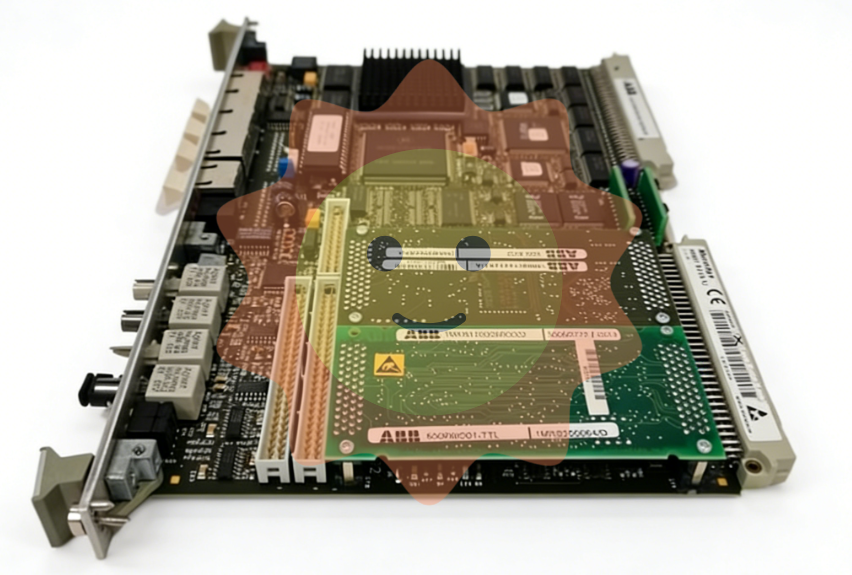

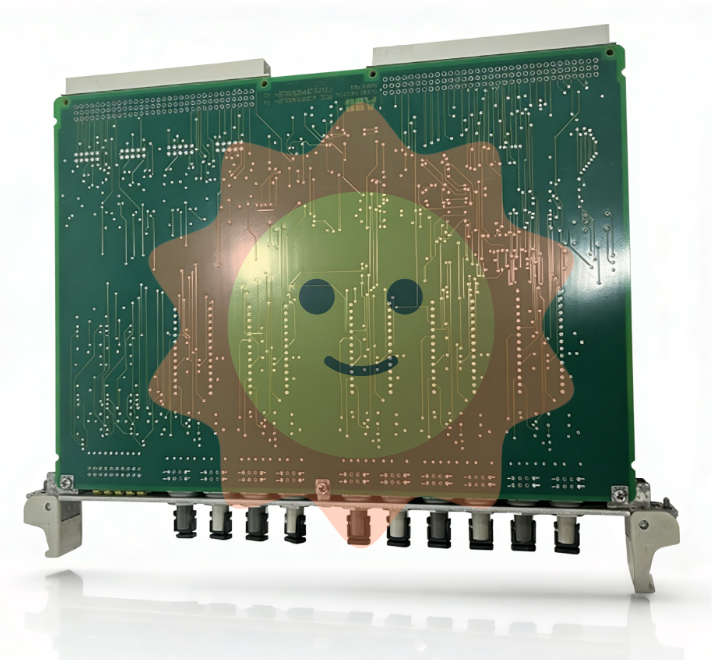

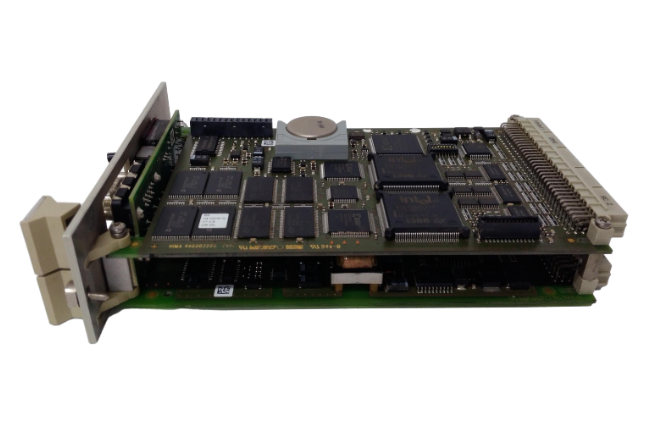

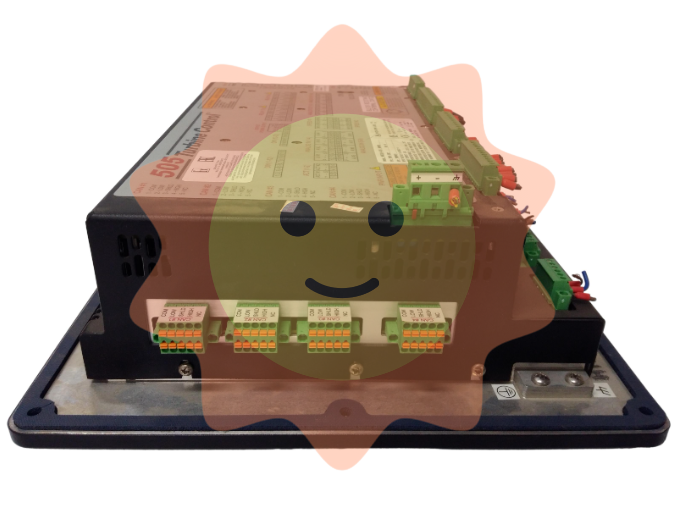

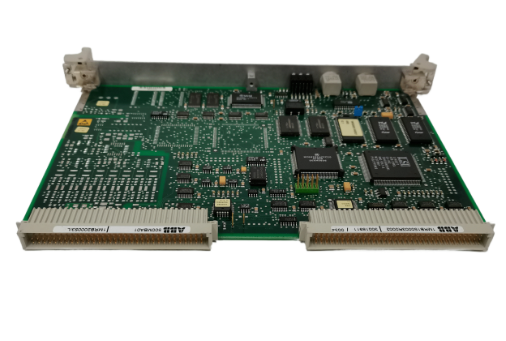

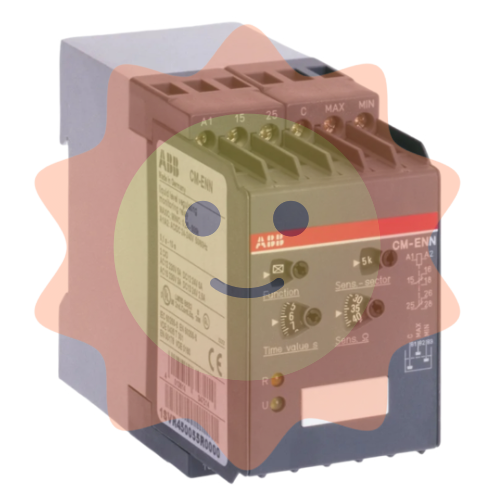

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

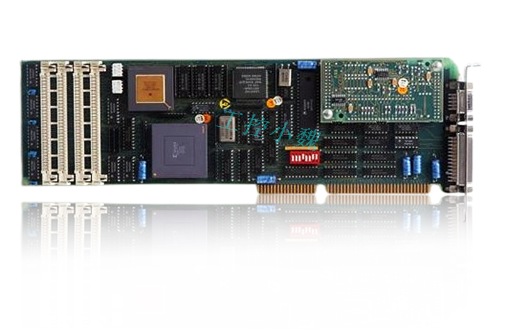

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA