Omni-channel deconstruction of snack food

1, Duplicate: forty years of channel changes, snack brands competing

Leisure snacks trillion market, rich categories, brands, in order to better understand the current status of the channel we will be 40 years of leisure food industry development is roughly divided into the following four stages. From the perspective of supply and demand, the rise of each round of new channel dividends will create new investment opportunities, and companies that can cross the cycle, maintain the lead, and form a brand are the only omni-channel cultivation and continuous iterative innovation.

Snack 1.0- The era of Great Circulation (1980-2000) : From the perspective of macro environment, this stage coincides with the dividend period of reform and opening up, with per capita GDP rising from less than 200 US dollars to 960 US dollars, CAGR reaching 8.3%, and foreign and Taiwanese brands with mature single products and distribution systems under the blank category of budding demand have entered the era of running the race. International snack giants such as Wrigley (1989), Dove (1993), Haojia (1993) and Heiliyou (1994) have set up factories in China, followed by Daliyuan (1989), Xizhilang (1992), Pan Pan (1996), Qiqiha Food (1999). With the "big single product + big production + big channel + big retail" model, win a place in the subdivision category and form the cognition of the finished product category and brand in the relatively concentrated period of traffic.

Snacks 2.0- The rise of brand chains (2000-2012) : From the perspective of macro environment, this stage was accompanied by the rapid increase of World Trade dividend and urbanization rate, and the rapid development of commercial real estate, including chain supermarkets and shopping centers. In 1992, the "Reply on the Utilization of Foreign Capital in the field of commercial retail" was released, and in 1995, it was opened to the food and chain operation field. In 1995, Carrefour entered China and expanded rapidly at an average rate of 16 stores per year from 2003 to 2006. Walmart entered China in 1996 and has opened 426 stores in 25 provinces across the country by 2016. At the time of the acceleration of the foreign super racing land, Lianhua, Yonghui, RT-Mart, etc. are also in a period of vigorous development, and the supermarket stores CAGR of nearly 20% from 2002 to 2010. With the rise of offline chains, snack brands have derived two development paths. At this stage, consumers gradually grasp the pricing power to enter the buyer's market after experiencing domestic and foreign brand category education, and brands with supermarket endorsement or increased frequency of contact are more likely to stand out.

Snacks 3.0- e-commerce channel outbreak (2012-2018) : From the perspective of the macro environment, in 2012, as the economy bid farewell to the era of high growth, the Internet ushered in a new round of channel reform. According to CNNIC statistics, in 2012, the number of Internet users in China was 560 million, and the penetration rate was 42.1%. By 2018, the number of Internet users reached 830 million, and the penetration rate was nearly 60%. From the perspective of monthly activity, the year-on-year growth rate of mobile user monthly activity from 2012 to 2018 continued to rise, at the same time, Baicao Wei (2010), good Food shop (2012) and three squirrels (2012) have embraced online dividends, of which three squirrels' operating income from 2014 to 2019 climbed from 900 million to 10.2 billion. CAGR exceeded 62%, and from the profit margin point of view, because the online platform is mainly dominated by low-cost explosive funds, the net interest rate is still maintained at a low single digit level, the net profit of squirrel to the mother in 2019 is only 240 million yuan, and the same period is still offline Qiqiao2019 revenue of 4.8 billion yuan, and the net profit of mother exceeds 600 million.

Snacks 4.0- Omni-channel Cultivation (2018 to date) : From the perspective of macro environment, as the bottom driving force of leisure snacks, the proportion of the population aged 15-44 years old has entered a downward channel since the peak in 2012. From 2012 to 2018, the impact of the industry under the booming development of the Internet is not obvious. After 2018, with the combination of multiple macro factors such as economic slowdown, housing and housing speculation, and the impact of the epidemic, Leisure snacks market growth into the marginal decline channel, online traffic decentralization, offline traffic fragmentation under the enterprise customer cost increase, the former circulation era leading Wangwang 2012-2021 snack food revenue is in place, the omni-channel transformation has become an industry consensus. Product side, the industry after 40 years of development and consumer popularity, health, functionality, price performance and other multiple personalized demands coexist, since 2020, capital intervention under the net red products emerge in an endless stream, more than 1 billion single products are rare, with a large single product breakthrough Qiqiha, Gan Yuan have to find the second growth curve, product iteration innovation has become the necessary competitiveness through the industry cycle.

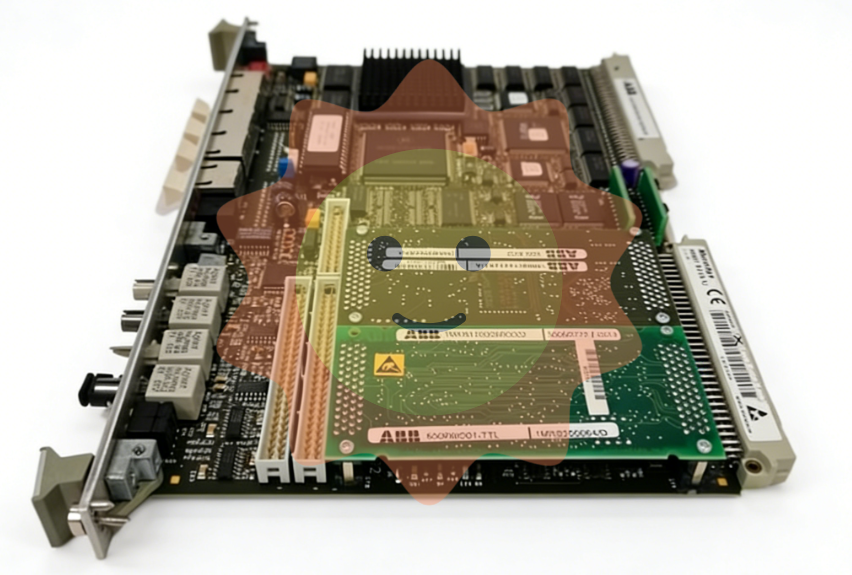

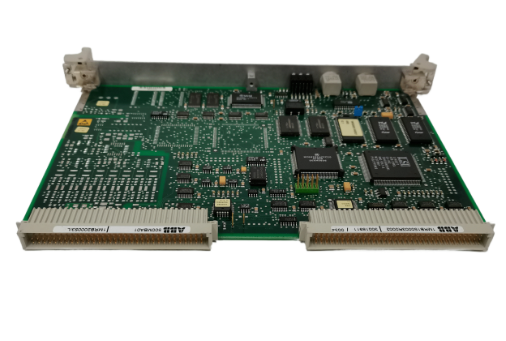

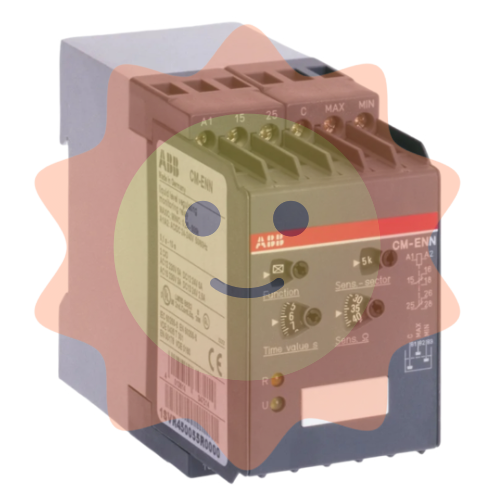

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA