Food and drink consumption toughness, long-term layout value is high

1. The resilience of food and drink consumption cannot be ignored, and the foundation for sustainable development is solid

1) In the recent food and drink consumption environment, although there are short-term fluctuations, we can see that the potential energy of gradual recovery is accumulating, and the strong resilience of China's consumer market cannot be ignored. 2) The food and beverage industry, as a must choose consumption, as a FMCG, its anti-inflation, anti-risk, the first to benefit from scientific and technological progress of the attributes can not be ignored. 3) Liquor, beer, leisure snacks, etc., as hobby products, their consumption stickiness can not be ignored. 4) Dairy, family food, fresh food, etc., as a daily must, its healthy and delicious properties can not be ignored.

1.1 Economic level: The food and beverage club has a leading growth rate

In the first three quarters of 2023, China's GDP (current price) increased by 4.91%. In 2022, China's GDP (current price) will be 121.02 trillion yuan, a year-on-year growth of 5.82%, and a year-on-year growth of 2.99% based on GDP constant price. In the first three quarters of 2023, China's GDP (current price) was 91.30 trillion yuan, a year-on-year growth of 4.91%, and a year-on-year growth of 5.20% in GDP constant price.

At the end of September 2023, China's M2 increased by 10.30%. At the end of 2022, China's M2 was 266.43 trillion yuan, an increase of 11.80% year-on-year, and the CAGR from 2017 to 2022 was 9.53%. At the end of September 2023, China's M2 was 289.67 trillion yuan, an increase of 10.30%.

Food and drink products grow steadily, through the cycle. In 2022, China's total social zero will be 43.97 trillion yuan, and the CAGR from 2017 to 2022 will be 4.90%, of which the retail sales of grain and oil, food, beverage, tobacco and alcohol will be 1.87, 0.30 and 0.50 trillion yuan, respectively. The CAGR from 2017 to 2022 is 9.96%, 11.70% and 8.56%, respectively, and the growth of food and beverage products is steady, which will continue to grow steadily through the cycle in 2020-2022, which is better than the zero growth rate of the whole society. In the first nine months of 2023, China's total retail sales increased by 6.80%, among which, the retail sales of grain and oil, food, beverage, tobacco and alcohol increased by 5.30%, 2.00% and 9.80% respectively, and the retail sales of tobacco and alcohol still maintained a rapid growth rate.

1.2 Fundamentals of the food and beverage industry: strong growth resilience

In the first three quarters of 2023, the revenue and performance of food and beverage listed companies increased by 9% and 15%. We use the SW Food and Beverage Index as a sample (the same below) to study the situation of various sectors of the food and beverage industry in the first three quarters of 2023. In the first three quarters of 2023, the total revenue of listed companies in the food and beverage sector was +8.61% year-on-year, and the net profit returned to the mother was +15.27% year-on-year. By quarter, the total revenue growth of listed companies in the food and beverage sector slowed down quarter by quarter (2023Q1-Q3 was +10.68%, +8.30%, +6.73%); The growth rate of net profit was higher than that of revenue (+18.23%, +9.94%, +16.06% in 2023Q1-Q3, respectively), and the reduction of raw material costs contributed greatly.

The profitability of the food and beverage industry has increased. In the first three quarters of 2023, the gross profit margin (overall method) of listed companies in the food and beverage sector was 49.56%, +1.45pct year-on-year, and the net profit margin was 21.21%, +1.00pct year-on-year. In the first three quarters of 2023, gross profit margin and net profit margin of listed companies in the food and beverage sector showed an overall trend of improvement (2023Q1-Q3, gross profit margin was +1.39, +2.01, +2.05pct year-on-year, and net profit margin was +1.33, -0.14, +1.59pct year-on-year, respectively).

1.3 Valuation level: Food and beverage PE (TTM) is 26 times, which is the lowest valuation in nearly three years

Food and beverage PE (TTM) is valued at 26 times, at the lowest valuation in nearly three years. As of October 31, 2023, the overall market value of the food and beverage industry was 5.495.2 billion yuan, and the PE (TTM, holistic method, excluding negative values) valuation was 26.39 times, which was 2% of the valuation range in the past 3 years.

Liquor, beer, dairy products, flavoring fermented products are at a low valuation. The valuation of PE (TTM) in the liquor sector is 26.53 times, which is 2% of the valuation range in the past 3 years. The PE (TTM)/nearly 3-year quartile level of beer plate was 28.66 times /2%, the PE (TTM)/nearly 3-year quartile level of dairy plate was 19.56 times /0%, and the PE (TTM)/nearly 3-year quartile level of seasoning and fermentation plate was 33.98 times /3%, respectively.

1.4 Fund heavy position: Layout of food and drink left opportunities, fund allocation ratio increased

Food and beverage industry fund heavy position accounted for 14.00%. As of the end of 23Q3, the total market value of the food and beverage industry fund heavy position was 415.386 billion yuan, accounting for 14.00% of the total fund heavy position, year-on-year -2.46pct, month-on-month +1.09pct; The overallocation ratio of the food and beverage industry fund was 7.48pct, which was -1.44pct year-on-year and +0.78pct month-on-month.

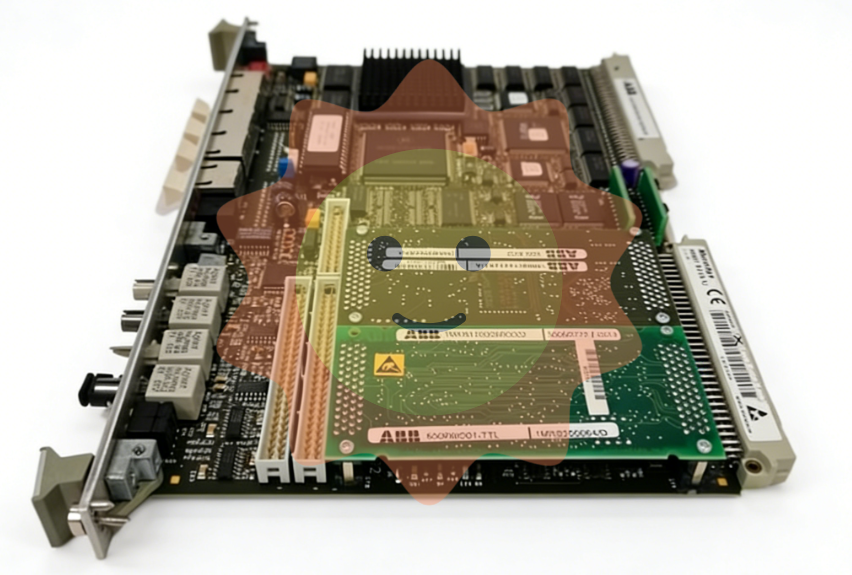

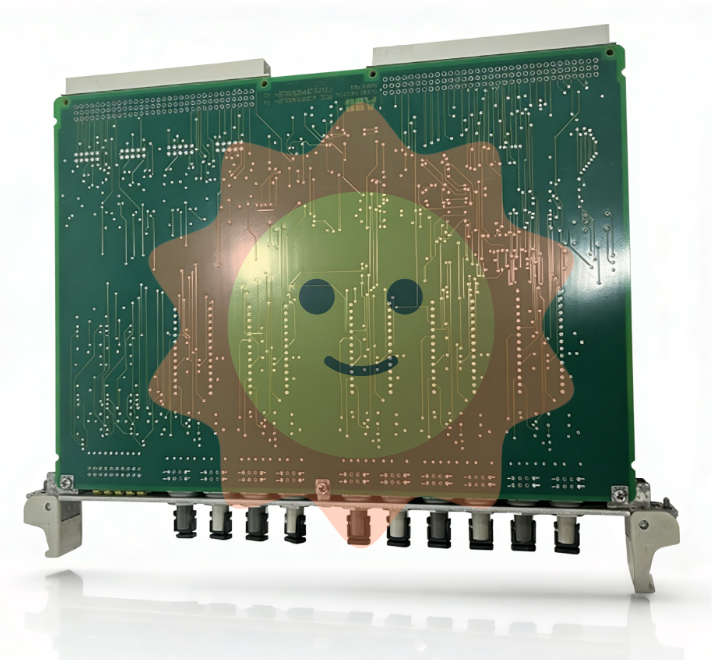

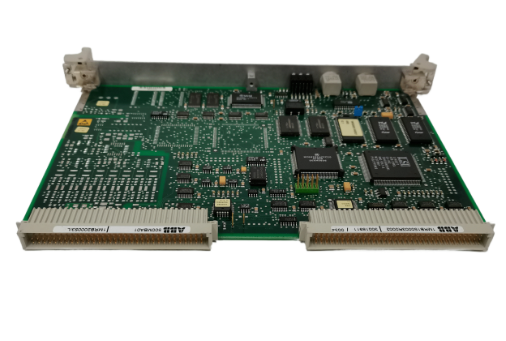

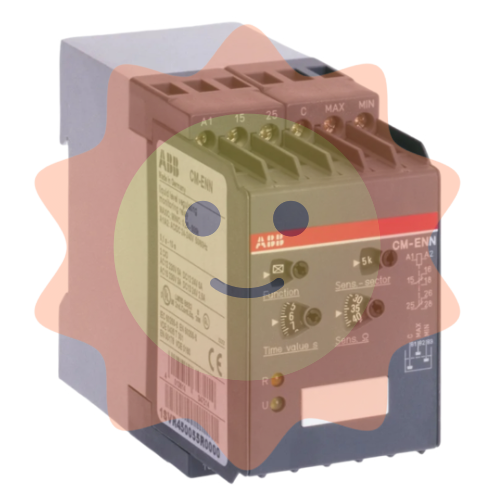

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

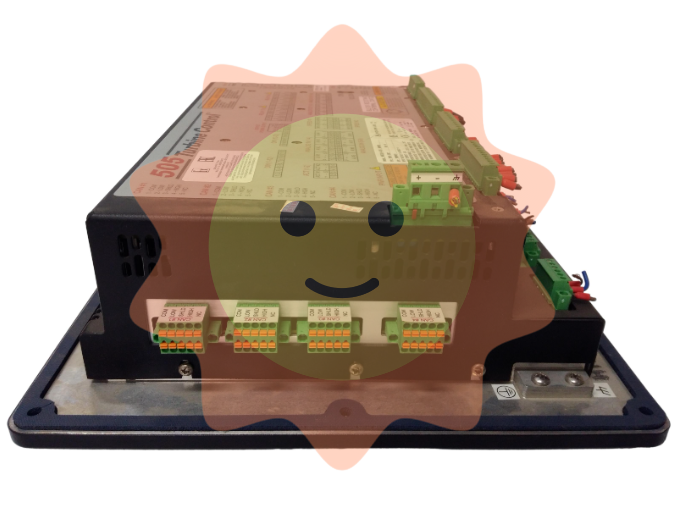

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA