Food and drink consumption toughness, long-term layout value is high

The performance of the second high-end wine enterprises is differentiated, and the profitability of the leading enterprises of Hui wine has improved significantly. According to the data of the Wine Association, the market performance of products in the price segment below 300 yuan is better, and this price segment is the focus of the layout of high-end and strong real estate wine enterprises. The channel pressure is transmitted to the production enterprises, some wine enterprises have a decline in contract liabilities, and the performance of listed liquor companies, especially the high-end and real estate wine enterprises, is further differentiated. Taking Gujing Gong Wine, Yingjia Gong wine as an example, benefiting from the economic vitality of Anhui Province and the company's own continuous promotion of high-end products, the company's profitability improved significantly, 23Q3-3, the growth rate of net profit of the mother reached 45.37%/37.57%, and the net profit rate of sales increased by 3.29/3.48pct compared with the same period last year. Moutai raised the price ceiling for high-end wine and second-high-end wine. On the evening of October 31, Kweichow Moutai issued a major announcement and decided to raise the factory price of vol Feitian and five-star Moutai by 53% from November 1, with an average increase of about 20%, which does not involve the market guidance price. Calculated by 20% price increase, the factory price of Feitian Moutai will reach about 1169 yuan/bottle. Moutai as a representative of high-end wine, its ex-factory price is also a major vane of the industry, before the price increase, Feitian Moutai, Pufive (eight generations), national cellar 1573 ex-factory price gap is not large, the price increase in addition to Maotai fourth quarter and next year to improve the performance of the uncertainty, but also for high-end and high-end wine prices to open the price ceiling.

The importance of "accelerating the construction of an efficient and smooth alcohol circulation system" has been enhanced. In July 23, Wang Xinguo, president of the China Wine Circulation Association, made a study and judgment on the industry, believing that the wine industry has entered a period of transformation and adjustment, with insufficient market consumption power, maladjustment of manufacturer structure, extensive pressure on channels, and widespread price inversion. The concentration of upstream production enterprises continues to increase, and the advantages of national famous wine are obvious, but the concentration of alcohol distribution industry is still low, and the anti-risk ability of small and medium-sized dealers is weak. Comrade An Baojun, deputy director of the Department of Market Operation and Consumption Promotion of the Ministry of Commerce, proposed at the 19th China International Wine Expo that "accelerate the construction of an efficient and smooth wine circulation system, promote the docking of production and consumption, and expand domestic demand." Liquor online channel layout accelerated. According to the data of the wine industry, the scale of alcohol e-commerce is about 80-100 billion yuan, accounting for less than 10% of the overall scale of the liquor market, according to the data of the China Wine Association, the compound growth rate of online liquor turnover in 18-22 years is more than 25%. A number of listed wine companies have gradually increased their online channel layout, and the amount and proportion of online channel revenue have grown rapidly.

3. Dairy industry: Profit margin up period, low temperature fresh milk performance beautiful

1) With the decline of raw milk price (raw milk price 3.7 yuan /kg at the beginning of November, down nearly 10% from the beginning of the year), dairy profit margin can be increased quarter by quarter; Under the background of low milk prices, dairy enterprises increase discounts to benefit consumers, which is expected to promote the growth of terminal mobile sales. 2) Dairy sector, total revenue/performance in the first three quarters of 2023 +2.7%/+20.2%, 23Q3 +0.7%/+52.5%.

3.1 Dairy sector: Profit margin increased quarter by quarter

Profitability is improving quarter by quarter. In the first three quarters of 2023, the total revenue/performance of the dairy sector was +2.65%/+20.17%. By quarter, the revenue of 23Q1/Q2/Q3 was +5.74%/+1.52%/+0.74%, and the performance was +1.98%/+20.95%/+52.47%. The growth rate of revenue slowed down, but the profitability showed an increasing trend. In the first three quarters of 2023, the gross profit margin/net profit margin of the dairy sector was 29.28%/7.34%, +0.29/+1.04pct compared with the same period last year, and the decline of raw milk price contributed significantly to the improvement of gross profit margin. The increase in net profit margin was related to the increase in gross profit margin and the decrease in selling expense ratio (22Q1-3 and 23Q1-3 selling expense ratio of 16.92%/16.26%, respectively). By quarter, the dairy sector 23Q1/Q2/Q3 gross profit ratio is the same ratio of -0.45/+0.20/+1.10pct, and the net profit ratio is the same ratio of -0.28 /+1.03/+2.25pct.

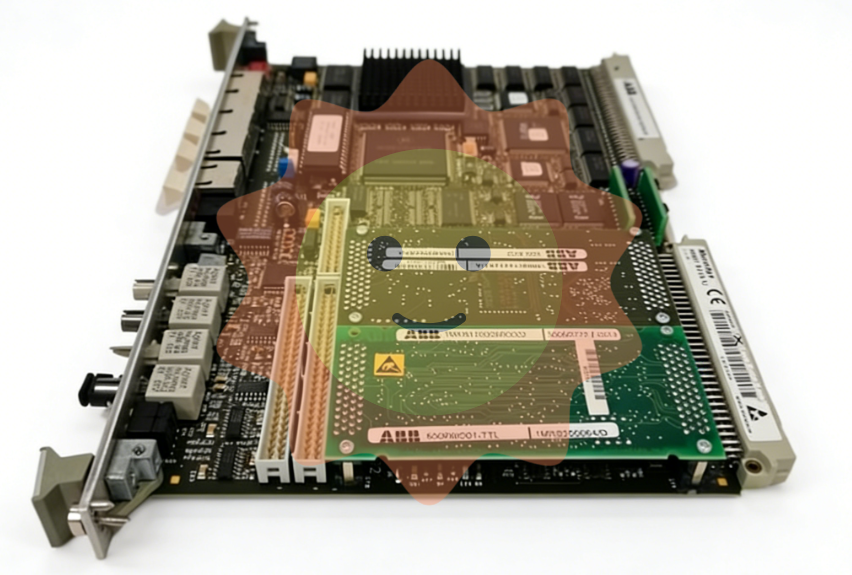

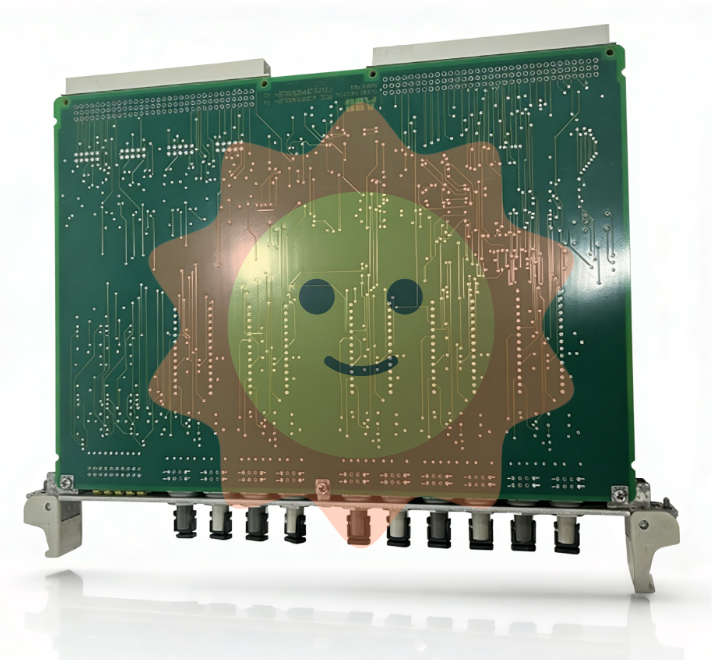

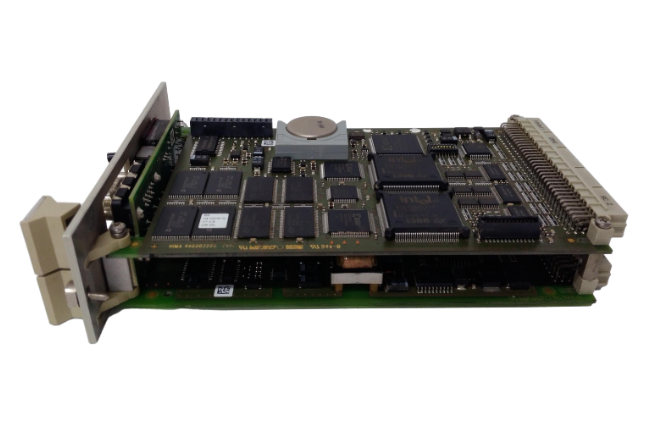

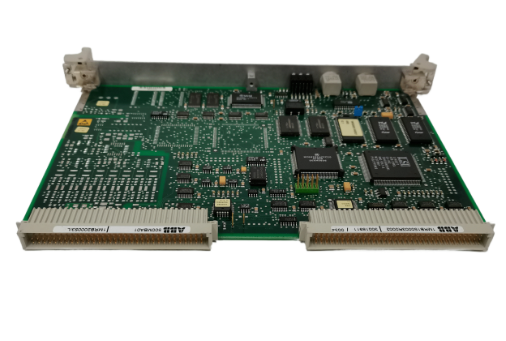

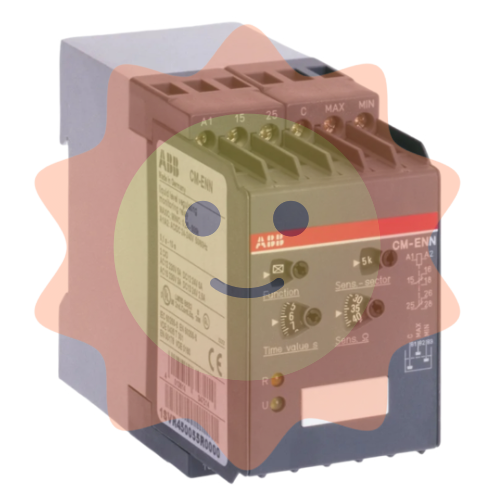

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

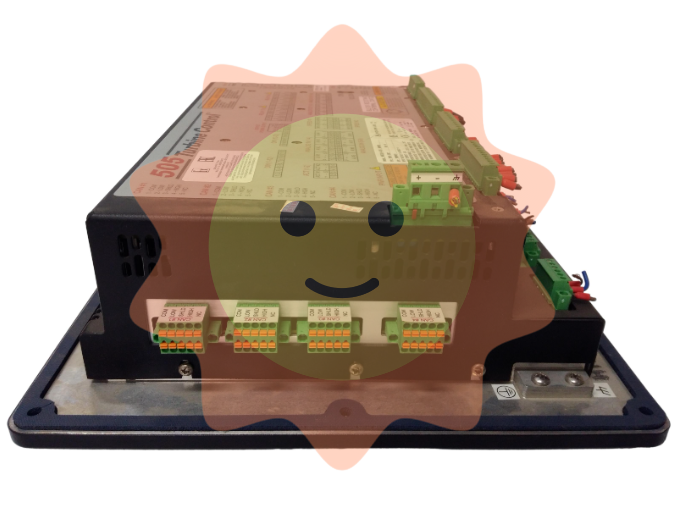

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA