Going faster and further – additional fuel switching options in the power sector

1. No new gas supply contracts with Russia

Gas import contracts with Gazprom covering more than 15 bcm per year are set to expire by the end of 2022, equating to around 12% of the company’s gas supplies to the EU in 2021. Overall, contracts with Gazprom covering close to 40 bcm per year are due to expire by the end of this decade.

This provides the EU with a clear near-term window of opportunity to significantly diversify its gas supplies and contracts towards other sources, leveraging the options for imports provided by its large LNG and pipeline infrastructure.

Impact: Taking advantage of expiring long-term contracts with Russia will reduce the contractual minimum take-or-pay levels for Russian imports and enable greater diversity of supply.

2. Replace Russian supplies with gas from alternative sources

Complementing the point above, our analysis indicates that production inside the EU and non-Russian pipeline imports (including from Azerbaijan and Norway) could increase over the next year by up to 10 bcm from 2021. This is based on the assumptions of a higher utilisation of import capacity, a less heavy summer maintenance schedule, and production quotas/caps being revised upwards.

The EU has greater near-term potential to ramp up its LNG imports, considering its ample access to spare regasification capacity. LNG trade is inherently flexible, so the crucial variables for the near-term are the availability of additional cargoes, especially those that have some contractual leeway over the destination, and competition for this supply with other importers, notably in Asia.

The EU could theoretically increase near-term LNG inflows by some 60 bcm, compared with the average levels in 2021. However, all importers are fishing in the same pool for supply, so (in the absence of weather-related or other factors that limit import demand in other regions) this would mean exceptionally tight LNG markets and very high prices.

Considering current forward prices and the LNG supply-demand balance, we have factored into our 10-Point Plan a 20 bcm increase in the EU’s LNG imports over the next year. The timely procurement of LNG can be facilitated by enhanced dialogue with LNG exporters and other importers, increased transparency, and efficient use of capacities at LNG regasification terminals.

The increases in non-Russian pipeline and LNG deliveries assume a concerted effort to tackle methane leaks, both across Europe, where leaks are estimated at 2.5 bcm a year from oil and gas operations, and among other non-European suppliers - especially those that flare significant quantities of gas today.

There is limited potential to scale up biogas and biomethane supply in the short term because of the lead times for new projects. But this promising low-carbon sector offers important medium-term upside for the EU’s domestic gas output. The same consideration applies to production of low-carbon hydrogen via electrolysis, which is contingent on new electrolyser projects and new low-carbon generation coming online. Increased output of low-carbon gases is vital to meet the EU’s 2030 and 2050 emissions reduction targets.

Impact: Around 30 bcm in additional gas supply from non-Russian sources.

3. Introduce minimum gas storage obligations to enhance market resilience

Gas storage plays a key role in meeting seasonal demand swings and providing insurance against unexpected events, such as surges in demand or shortfalls in supply, that cause price spikes. The value of the security provided by gas storage is even greater at a time of geopolitical tensions.

The current tight seasonal price spreads in European gas markets do not provide sufficient incentive for storage injections ahead of the 2022-23 heating season, as demonstrated by the results of the recent gas storage capacity auctions in the EU. A harmonised approach to minimum storage obligations for commercial operators in the EU’s single gas market, together with robust market-based capacity allocation mechanisms, would ensure the optimal use of all available storage capacity in the EU.

Our analysis, based on the experience of recent years, suggests that fill levels of at least 90% of working storage capacity by 1 October are necessary to provide an adequate buffer for the European gas market through the heating season. Given the depleted levels of storage today, gas injection in 2022 needs to be around 18 bcm higher than in 2021.

Regional coordination of gas storage levels and access can provide an important element of solidarity among EU member states and reinforce their gas supply security ahead of the next winter season.

Impact: Enhances the resilience of the gas system, although higher injection requirements to refill storage in 2022 will add to gas demand and prop up gas prices.

4. Accelerate the deployment of new wind and solar projects

In 2022, record additions of solar PV and wind power capacity and a return to average weather conditions are already expected to increase the EU’s output from these renewable sources by over 100 terawatt-hours (TWh), a rise of more than 15% compared with 2021.

A concerted policy effort to fast-track further renewable capacity additions could deliver another 20 TWh over the next year. Most of this would be utility-scale wind and solar PV projects for which completion dates could be brought forward by tackling delays with permitting. This includes clarifying and simplifying responsibilities among various permitting bodies, building up administrative capacity, setting clear deadlines for the permitting process, and digitalising applications.

Faster deployment of rooftop solar PV systems can reduce consumer bills. A short-term grant programme covering 20% of installation costs could double the pace of investment (compared with the IEA’s base case forecast) at a cost of around EUR 3 billion. This would increase annual output from rooftop solar PV systems by up to 15 TWh.

Impact: An additional 35 TWh of generation from new renewable projects over the next year, over and above the already anticipated growth from these sources, bringing down gas use by 6 bcm.

5. Maximise generation from existing dispatchable low-emissions sources: bioenergy and nuclear

Nuclear power is the largest source of low emissions electricity in the EU, but several reactors were taken offline for maintenance and safety checks in 2021. Returning these reactors to safe operations in 2022, alongside the start of commercial operations for the completed reactor in Finland, can lead to EU nuclear power generation increasing by up to 20 TWh in 2022.

A new round of reactor closures, however, would dent this recovery in output: four nuclear reactors are scheduled to shut down by the end of 2022, and another one in 2023. A temporary delay of these closures, conducted in a way that assures the plants’ safe operation, could cut EU gas demand by almost 1 bcm per month.

The large fleet of bioenergy power plants in the EU operated at about 50% of its total capacity in 2021. These plants could generate up to 50 TWh more electricity in 2022 if appropriate incentives and sustainable supplies of bioenergy are put in place.

Impact: An additional 70 TWh of power generation from existing dispatchable low emissions sources, reducing gas use for electricity by 13 bcm.

6. Enact short-term measures to shelter vulnerable electricity consumers from high prices

With today’s market design, high gas prices in the EU feed through into high wholesale electricity prices in ways that can lead to windfall profits for companies. This has significant implications for the affordability of electricity, as well as for the economic incentives for the broader electrification of end-uses, which is a key element of clean energy transitions.

We estimate that spending by EU member states to cushion the impact of the energy price crisis on vulnerable consumers already amounts to a commitment of around EUR 55 billion.

Increases in electricity costs are unavoidable to a certain extent when gas (and CO2) prices are high. But current wholesale markets create the potential for profits for many electricity generators and their parent companies that are well in excess of the costs related to operations or capital recovery. Current market conditions could lead to excess profits of up to EUR 200 billion in the EU for gas, coal, nuclear, hydropower and other renewables in 2022.

Temporary tax measures to raise rates on electricity companies’ windfall profits could be considered. These tax receipts should then be redistributed to electricity consumers to partially offset higher energy bills. Measures to tax windfall profits have already been adopted in Italy and Romania in 2022.

Impact: Brings down energy bills for consumers even when natural gas prices remain high, making available up to EUR 200 billion to cushion impacts on vulnerable groups.

7. Speed up the replacement of gas boilers with heat pumps

Heat pumps offer a very efficient and cost-effective way to heat homes, replacing boilers that use gas or other fossil fuels. Speeding up anticipated deployment by doubling current EU installation rates of heat pumps would save an additional 2 bcm of gas use within the first year, requiring a total additional investment of EUR 15 billion.

Alongside existing policy frameworks, targeted support for investment can drive the scaling up of heat pump installations. Ideally, this is best combined with upgrades of the homes themselves to maximise energy efficiency gains and reduce overall costs.

Replacing gas boilers or furnaces with heat pumps is also an attractive option for industry, although deployment may take longer to scale up.

A shift from gas to electricity for heating buildings could have the corresponding effect of pushing up gas demand for power generation, depending on the situation. However, any increase would be much lower than the overall amount of gas saved. Such a shift would also transfer seasonal swings in demand from the gas market to the power market.

Impact: Reduces gas use for heating by an additional 2 bcm in one year.

8. Accelerate energy efficiency improvements in buildings and industry

Energy efficiency is a powerful instrument for secure clean energy transitions, but it often takes time to deliver major results. In this plan, we consider how to pick up the rate of progress, focusing on measures that can make a difference quickly.

At present, only about 1% of the EU’s building stock is renovated each year. A rapid extension to an additional 0.7%, targeting the least efficient homes and non-residential buildings, would be possible through standardised upgrades, mainly via improved insulation. This would save more than 1 bcm of gas use in the space of a year and would also bring benefits for employment, though it would require parallel efforts to improve supply chains for materials and workforce development.

This boost to the near-term rate of building retrofits and heat pump deployment accelerates changes that are part of EU policy frameworks. By 2030, the European Union’s Energy Efficiency Directive and Energy Performance of Buildings Directive, within the Fit for 55 framework, are projected to reduce gas demand in buildings by 45 bcm per year compared with today.

Many households are installing smart heating controls (smart thermostats) to reduce energy bills and improve home comfort, and this is a simple process that can be scaled up quickly. Tripling the current installation rate of about one million homes per year would reduce gas demand for heating homes by an extra 200 mcm a year at a total cost of EUR 1 billion. These devices can be incentivised through existing programmes such as subsidies to households or utility obligation schemes.

Annual maintenance checks of gas boilers can be used to ensure hot water boilers in homes are set at a temperature that optimises efficiency, no higher than 60 °C.

Helping small businesses (SMEs) become more efficient will save energy and also help protect those businesses from price volatility. Many EU states have effective programmes to offer energy efficiency audits and advice to SMEs that can save energy quickly and effectively. Scaling these up to offer them to 5% of SMEs would deliver immediate annual energy savings of 250 mcm.

Impact: Reduces gas consumption for heat by close to an additional 2 bcm within a year, lowering energy bills, enhancing comfort and boosting industrial competitiveness.

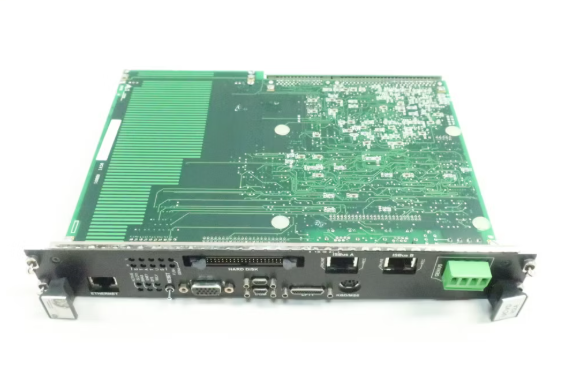

- EMERSON

- Honeywell

- CTI

- Rolls-Royce

- General Electric

- Woodward

- Yaskawa

- xYCOM

- Motorola

- Siemens

- Rockwell

- ABB

- B&R

- HIMA

- Construction site

- electricity

- Automobile market

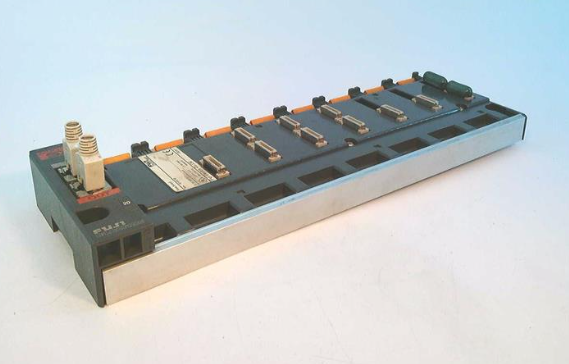

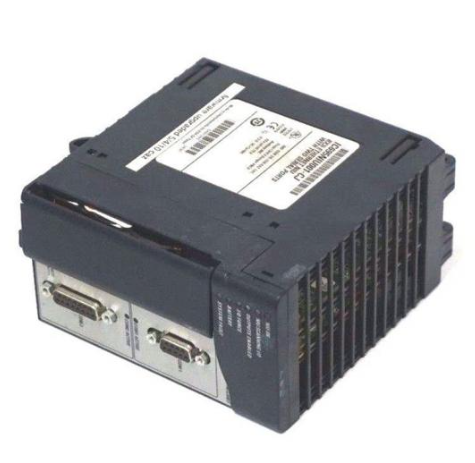

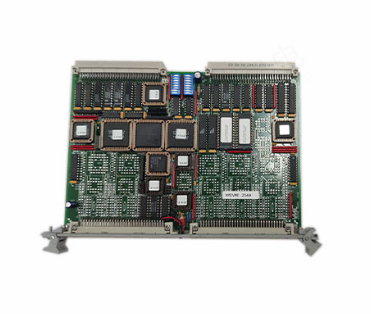

- PLC

- DCS

- Motor drivers

- VSD

- Implications

- cement

- CO2

- CEM

- methane

- Artificial intelligence

- Titanic

- Solar energy

- Hydrogen fuel cell

- Hydrogen and fuel cells

- Hydrogen and oxygen fuel cells

- tyre

- Chemical fiber

- dynamo

- corpuscle

- Pulp and paper

- printing

- fossil

- FANUC

- Food and beverage

- Life science

- Sewage treatment

- Personal care

- electricity

- boats

- infrastructure

- Automobile industry

- metallurgy

- Nuclear power generation

- Geothermal power generation

- Water and wastewater

- Infrastructure construction

- Mine hazard

- steel

- papermaking

- Natural gas industry

- Infrastructure construction

- Power and energy

- Rubber and plastic

- Renewable energy

- pharmacy

- mining

- Plastic industry

- Schneider

- Kongsberg

- NI

- Wind energy

- International petroleum

- International new energy network

- gas

- WATLOW

- ProSoft

- SEW

- wind

- ADVANCED

- Reliance

- YOKOGAWA

- TRICONEX

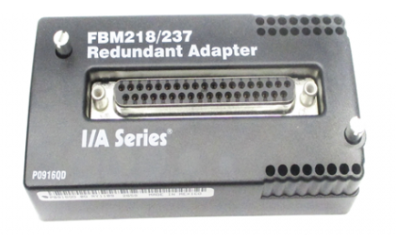

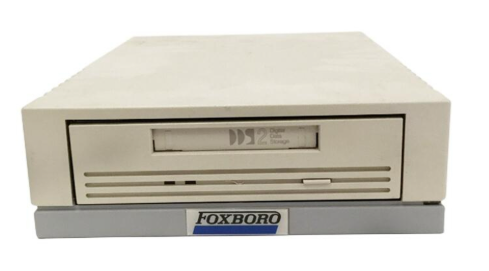

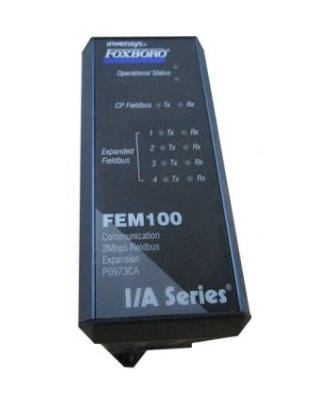

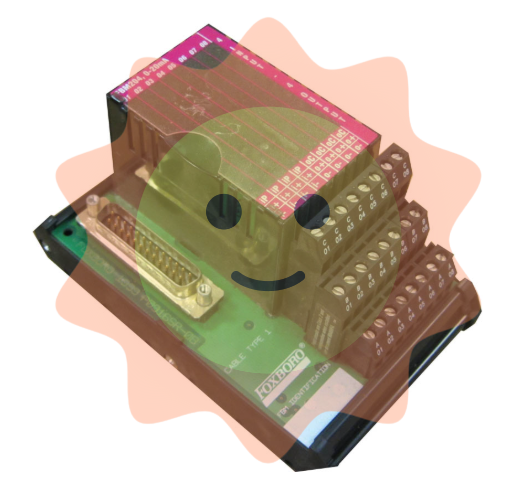

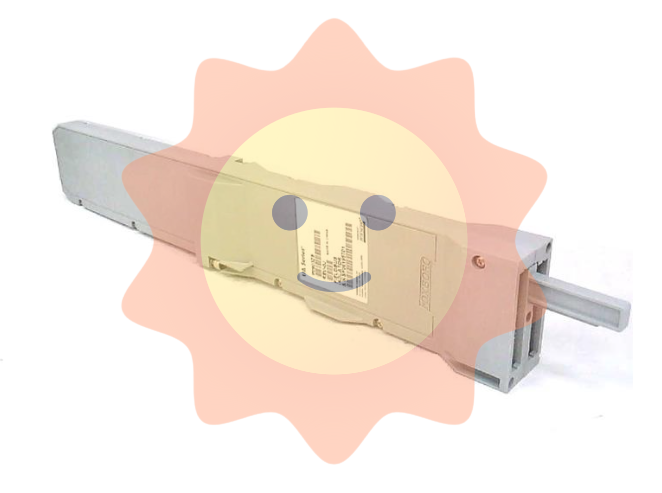

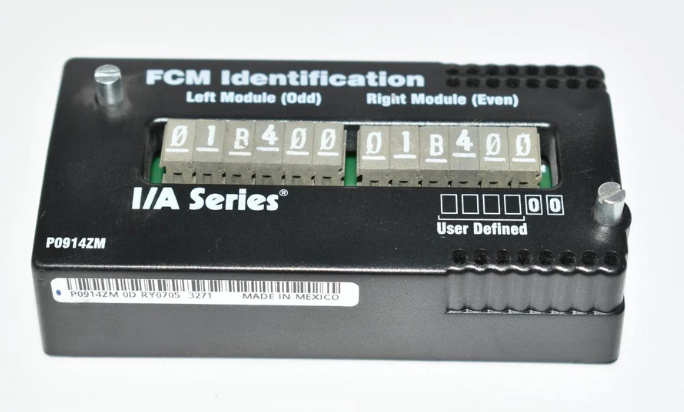

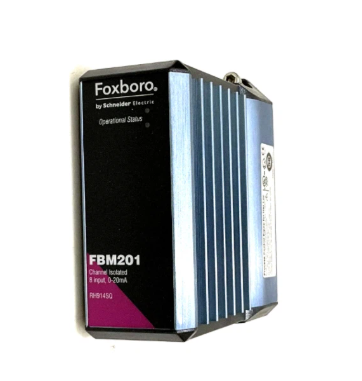

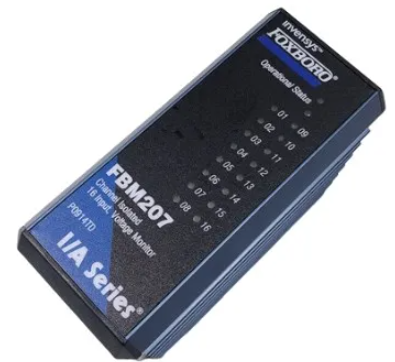

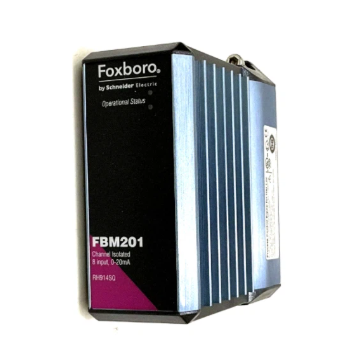

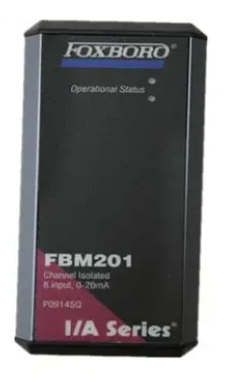

- FOXBORO

- METSO

- MAN

- Advantest

- ADVANCED

- ALSTOM

- Control Wave

- AB

- AMAT

- STUDER

- KONGSBERG

- MOTOROLA

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- Triconex

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- KOLLMORGEN

- Beijer

- Endress+Hauser

- MOOG

- KB

- Moxa

- Rexroth

- YAMAHA

- Johnson

- Westinghouse

- WAGO

- TOSHIBA

- TEKTRONIX

Email:wang@kongjiangauto.com