Going faster and further – additional fuel switching options in the power sector

1. No new gas supply contracts with Russia

Gas import contracts with Gazprom covering more than 15 bcm per year are set to expire by the end of 2022, equating to around 12% of the company’s gas supplies to the EU in 2021. Overall, contracts with Gazprom covering close to 40 bcm per year are due to expire by the end of this decade.

This provides the EU with a clear near-term window of opportunity to significantly diversify its gas supplies and contracts towards other sources, leveraging the options for imports provided by its large LNG and pipeline infrastructure.

Impact: Taking advantage of expiring long-term contracts with Russia will reduce the contractual minimum take-or-pay levels for Russian imports and enable greater diversity of supply.

2. Replace Russian supplies with gas from alternative sources

Complementing the point above, our analysis indicates that production inside the EU and non-Russian pipeline imports (including from Azerbaijan and Norway) could increase over the next year by up to 10 bcm from 2021. This is based on the assumptions of a higher utilisation of import capacity, a less heavy summer maintenance schedule, and production quotas/caps being revised upwards.

The EU has greater near-term potential to ramp up its LNG imports, considering its ample access to spare regasification capacity. LNG trade is inherently flexible, so the crucial variables for the near-term are the availability of additional cargoes, especially those that have some contractual leeway over the destination, and competition for this supply with other importers, notably in Asia.

The EU could theoretically increase near-term LNG inflows by some 60 bcm, compared with the average levels in 2021. However, all importers are fishing in the same pool for supply, so (in the absence of weather-related or other factors that limit import demand in other regions) this would mean exceptionally tight LNG markets and very high prices.

Considering current forward prices and the LNG supply-demand balance, we have factored into our 10-Point Plan a 20 bcm increase in the EU’s LNG imports over the next year. The timely procurement of LNG can be facilitated by enhanced dialogue with LNG exporters and other importers, increased transparency, and efficient use of capacities at LNG regasification terminals.

The increases in non-Russian pipeline and LNG deliveries assume a concerted effort to tackle methane leaks, both across Europe, where leaks are estimated at 2.5 bcm a year from oil and gas operations, and among other non-European suppliers - especially those that flare significant quantities of gas today.

There is limited potential to scale up biogas and biomethane supply in the short term because of the lead times for new projects. But this promising low-carbon sector offers important medium-term upside for the EU’s domestic gas output. The same consideration applies to production of low-carbon hydrogen via electrolysis, which is contingent on new electrolyser projects and new low-carbon generation coming online. Increased output of low-carbon gases is vital to meet the EU’s 2030 and 2050 emissions reduction targets.

Impact: Around 30 bcm in additional gas supply from non-Russian sources.

3. Introduce minimum gas storage obligations to enhance market resilience

Gas storage plays a key role in meeting seasonal demand swings and providing insurance against unexpected events, such as surges in demand or shortfalls in supply, that cause price spikes. The value of the security provided by gas storage is even greater at a time of geopolitical tensions.

The current tight seasonal price spreads in European gas markets do not provide sufficient incentive for storage injections ahead of the 2022-23 heating season, as demonstrated by the results of the recent gas storage capacity auctions in the EU. A harmonised approach to minimum storage obligations for commercial operators in the EU’s single gas market, together with robust market-based capacity allocation mechanisms, would ensure the optimal use of all available storage capacity in the EU.

Our analysis, based on the experience of recent years, suggests that fill levels of at least 90% of working storage capacity by 1 October are necessary to provide an adequate buffer for the European gas market through the heating season. Given the depleted levels of storage today, gas injection in 2022 needs to be around 18 bcm higher than in 2021.

Regional coordination of gas storage levels and access can provide an important element of solidarity among EU member states and reinforce their gas supply security ahead of the next winter season.

Impact: Enhances the resilience of the gas system, although higher injection requirements to refill storage in 2022 will add to gas demand and prop up gas prices.

4. Accelerate the deployment of new wind and solar projects

In 2022, record additions of solar PV and wind power capacity and a return to average weather conditions are already expected to increase the EU’s output from these renewable sources by over 100 terawatt-hours (TWh), a rise of more than 15% compared with 2021.

A concerted policy effort to fast-track further renewable capacity additions could deliver another 20 TWh over the next year. Most of this would be utility-scale wind and solar PV projects for which completion dates could be brought forward by tackling delays with permitting. This includes clarifying and simplifying responsibilities among various permitting bodies, building up administrative capacity, setting clear deadlines for the permitting process, and digitalising applications.

- EMERSON

- Honeywell

- CTI

- Rolls-Royce

- General Electric

- Woodward

- Yaskawa

- xYCOM

- Motorola

- Siemens

- Rockwell

- ABB

- B&R

- HIMA

- Construction site

- electricity

- Automobile market

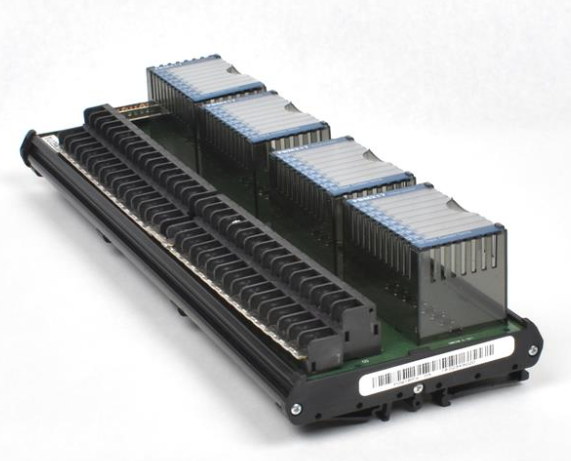

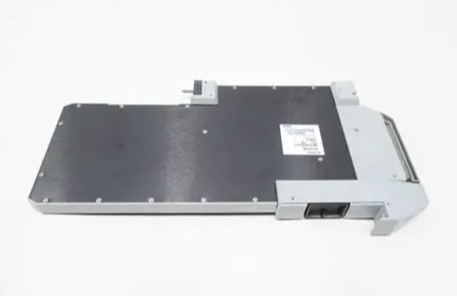

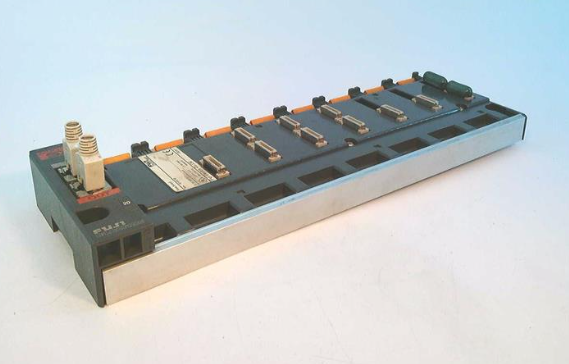

- PLC

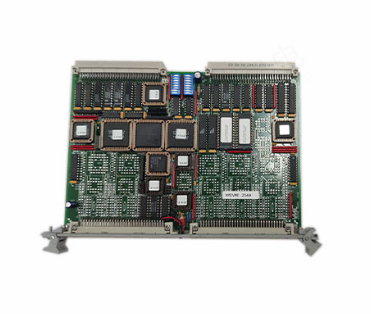

- DCS

- Motor drivers

- VSD

- Implications

- cement

- CO2

- CEM

- methane

- Artificial intelligence

- Titanic

- Solar energy

- Hydrogen fuel cell

- Hydrogen and fuel cells

- Hydrogen and oxygen fuel cells

- tyre

- Chemical fiber

- dynamo

- corpuscle

- Pulp and paper

- printing

- fossil

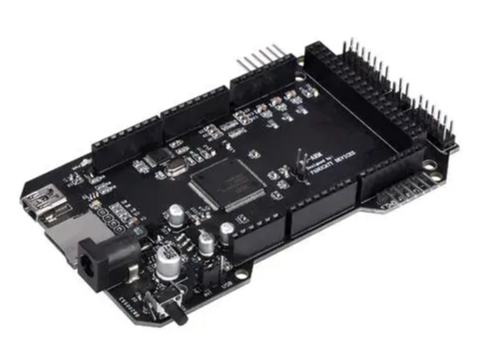

- FANUC

- Food and beverage

- Life science

- Sewage treatment

- Personal care

- electricity

- boats

- infrastructure

- Automobile industry

- metallurgy

- Nuclear power generation

- Geothermal power generation

- Water and wastewater

- Infrastructure construction

- Mine hazard

- steel

- papermaking

- Natural gas industry

- Infrastructure construction

- Power and energy

- Rubber and plastic

- Renewable energy

- pharmacy

- mining

- Plastic industry

- Schneider

- Kongsberg

- NI

- Wind energy

- International petroleum

- International new energy network

- gas

- WATLOW

- ProSoft

- SEW

- wind

- ADVANCED

- Reliance

- YOKOGAWA

- TRICONEX

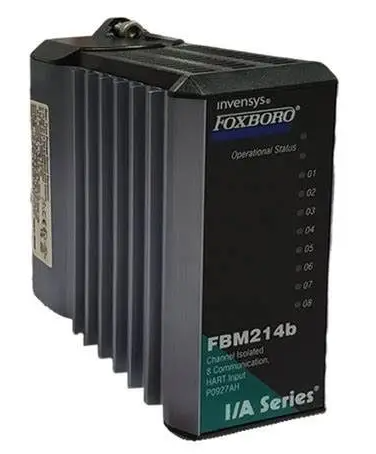

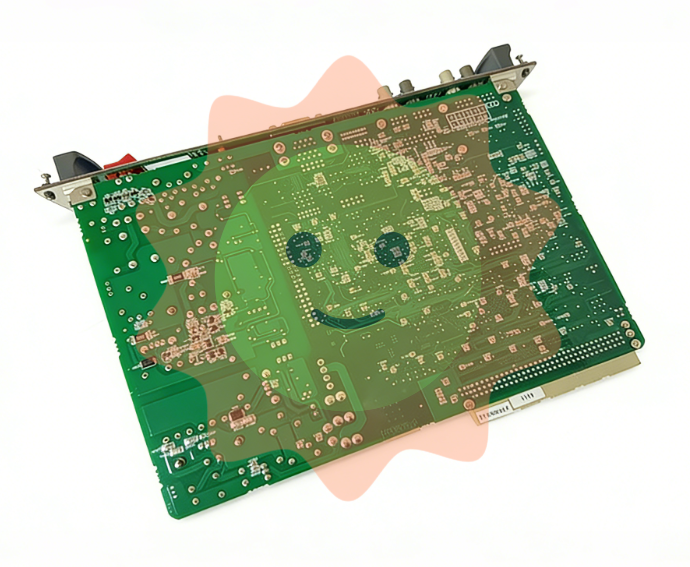

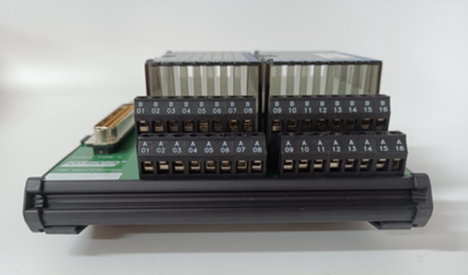

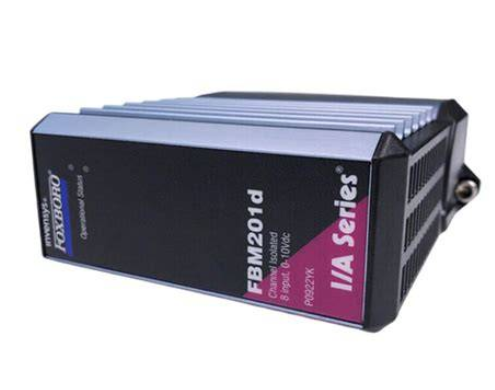

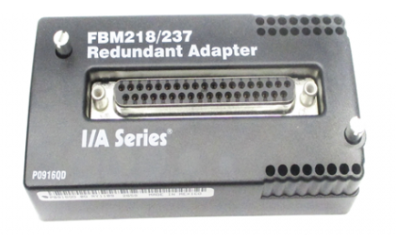

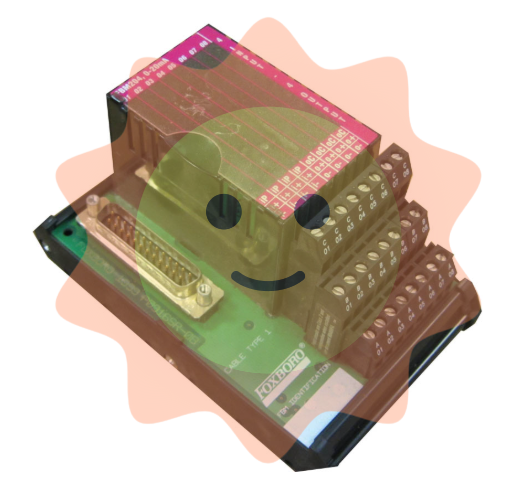

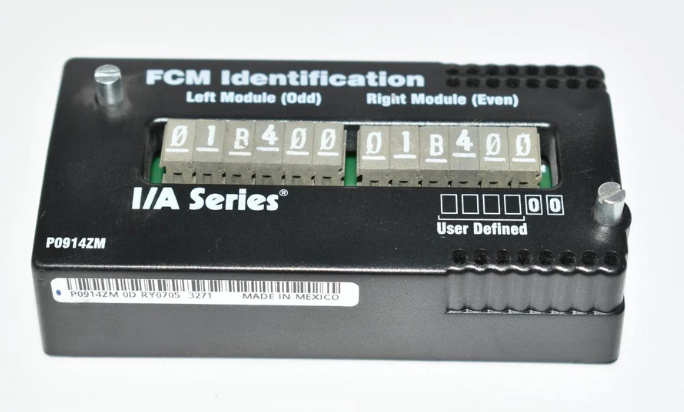

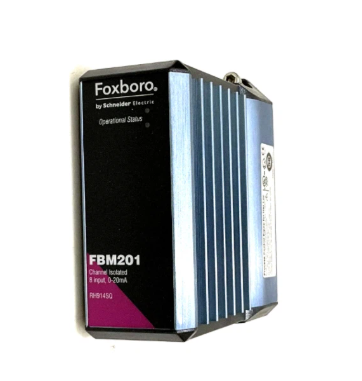

- FOXBORO

- METSO

- MAN

- Advantest

- ADVANCED

- ALSTOM

- Control Wave

- AB

- AMAT

- STUDER

- KONGSBERG

- MOTOROLA

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- Triconex

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- KOLLMORGEN

- Beijer

- Endress+Hauser

- MOOG

- KB

- Moxa

- Rexroth

- YAMAHA

- Johnson

- Westinghouse

- WAGO

- TOSHIBA

- TEKTRONIX

Email:wang@kongjiangauto.com