Innovate pension products, improve the consumption environment, and stimulate consumption potential

"I also bought serious illness insurance and annuity insurance to provide additional protection." "By the time I retire, if I want to have a better quality of life, I need to do more preparation and consider making some long-term, stable investments while I have surplus funds at home," Ms. Li said.

"We should plan as soon as possible according to our own pension needs, enhance the awareness of saving pension funds in exclusive accounts, and reserve pension funds in advance." Pension investment as long as ten years or even decades, we need to control risks through rich pension products and scientific asset allocation, achieve stable preservation and appreciation, enhance their own security capabilities, savings pension into investment pension." The person in charge of the relevant department of China Merchants Bank said.

In order to enrich the people's financial products, the industry started pilot pension financial products. According to the statistics of the financial registration Center, as of the end of May this year, 11 financial companies have issued 51 pension financial products through 10 banks in 10 pilot areas, and the cumulative purchase amount of investors is about 100,555 billion yuan, and a total of 466,500 investors have purchased them.

With the opening of personal pension accounts, on February 10 this year, the first batch of personal pension financial products were sold, according to the data released by China Wealth Management network, four financial companies issued a total of 18 personal pension financial products, with a cumulative sales scale of 763 million yuan. As of June 27, 109,000 people had bought wealth management products through their personal pensions, with each investor buying an average of 7,000 yuan, accounting for 58 percent of the amount that can be purchased throughout the year.

Boc Wealth Management is the first financial management company to sell personal pension financial products. At present, BOC personal pension account has been put on the shelf to sell five financial products issued by BOC Wealth Management. In addition to financial products, customers can also invest in personal pension insurance products, personal pension public fund products and specific pension savings products in the bank.

The person in charge of the relevant department of the Bank of China said that you can integrate your retirement years, investment goals, risk tolerance, etc., actively participate in the asset allocation of personal pensions, and make reserves for retirement life in advance through the long-term investment and decentralized allocation of personal pension products.

Innovate the supply of age-appropriate products, create a safe and assured consumption environment, and better serve elderly consumers

"We hope to introduce more products and services that adapt to the consumption needs of the elderly." Chen Jie, a resident of Qinjiagang Street in Shapingba district, Chongqing, said she has a stable pension, but there are not many products suitable for the elderly, and some products are too heavy, which is easy to waste for elderly people living alone. At present, there are consumption places suitable for young people and children in the shopping mall, but there are few consumption areas for the elderly, not only the types of goods are scattered, but also the lack of some aging facilities and special considerations. For example, in the supermarket, sometimes the position of the elderly goods is too high or too low, so that the elderly can not take it. For example, sometimes online shopping goods are not delivered to the door, to the storage point to pick up their own goods, is not a small difficulty for the elderly. Although it is a detail, it affects the consumption feelings of the elderly and needs to be gradually improved.

Elderly consumers are more looking forward to a safe and assured consumption environment. The reporter learned in the interview that many elderly people like to shop online, but when buying jewelry, home appliances, furniture and other expensive goods, they are still more cautious, and are more willing to buy from physical stores. They are worried about being cheated and difficult to defend their rights later. The elderly hope that the relevant departments will further strengthen law enforcement, severely crack down on the fraud of elderly consumers such as fake and shoddy products and exaggerated product effects, and improve the rights protection mechanism for the elderly, smooth channels, optimize after-sales service for the elderly, so that the elderly dare to consume and are willing to consume.

Recently, the "2023 Silver population consumption Trend Insight Report - Home Appliances" released by Billion Think Tank shows that from the Tmall supply and demand index, the demand side of the "elderly" home appliances industry has far exceeded the supply side. In 2022, the search volume of "home electricity" products on Tmall increased by 200% year-on-year, and the demand is mainly concentrated in the categories of integrated home appliances, refrigerators, washing and care, and environmental health, home life, personal care and other categories. Consumers are more pursuing the convenience, safety, functionality and health of products.

- EMERSON

- Honeywell

- CTI

- Rolls-Royce

- General Electric

- Woodward

- Yaskawa

- xYCOM

- Motorola

- Siemens

- Rockwell

- ABB

- B&R

- HIMA

- Construction site

- electricity

- Automobile market

- PLC

- DCS

- Motor drivers

- VSD

- Implications

- cement

- CO2

- CEM

- methane

- Artificial intelligence

- Titanic

- Solar energy

- Hydrogen fuel cell

- Hydrogen and fuel cells

- Hydrogen and oxygen fuel cells

- tyre

- Chemical fiber

- dynamo

- corpuscle

- Pulp and paper

- printing

- fossil

- FANUC

- Food and beverage

- Life science

- Sewage treatment

- Personal care

- electricity

- boats

- infrastructure

- Automobile industry

- metallurgy

- Nuclear power generation

- Geothermal power generation

- Water and wastewater

- Infrastructure construction

- Mine hazard

- steel

- papermaking

- Natural gas industry

- Infrastructure construction

- Power and energy

- Rubber and plastic

- Renewable energy

- pharmacy

- mining

- Plastic industry

- Schneider

- Kongsberg

- NI

- Wind energy

- International petroleum

- International new energy network

- gas

- WATLOW

- ProSoft

- SEW

- wind

- ADVANCED

- Reliance

- YOKOGAWA

- TRICONEX

- FOXBORO

- METSO

- MAN

- Advantest

- ADVANCED

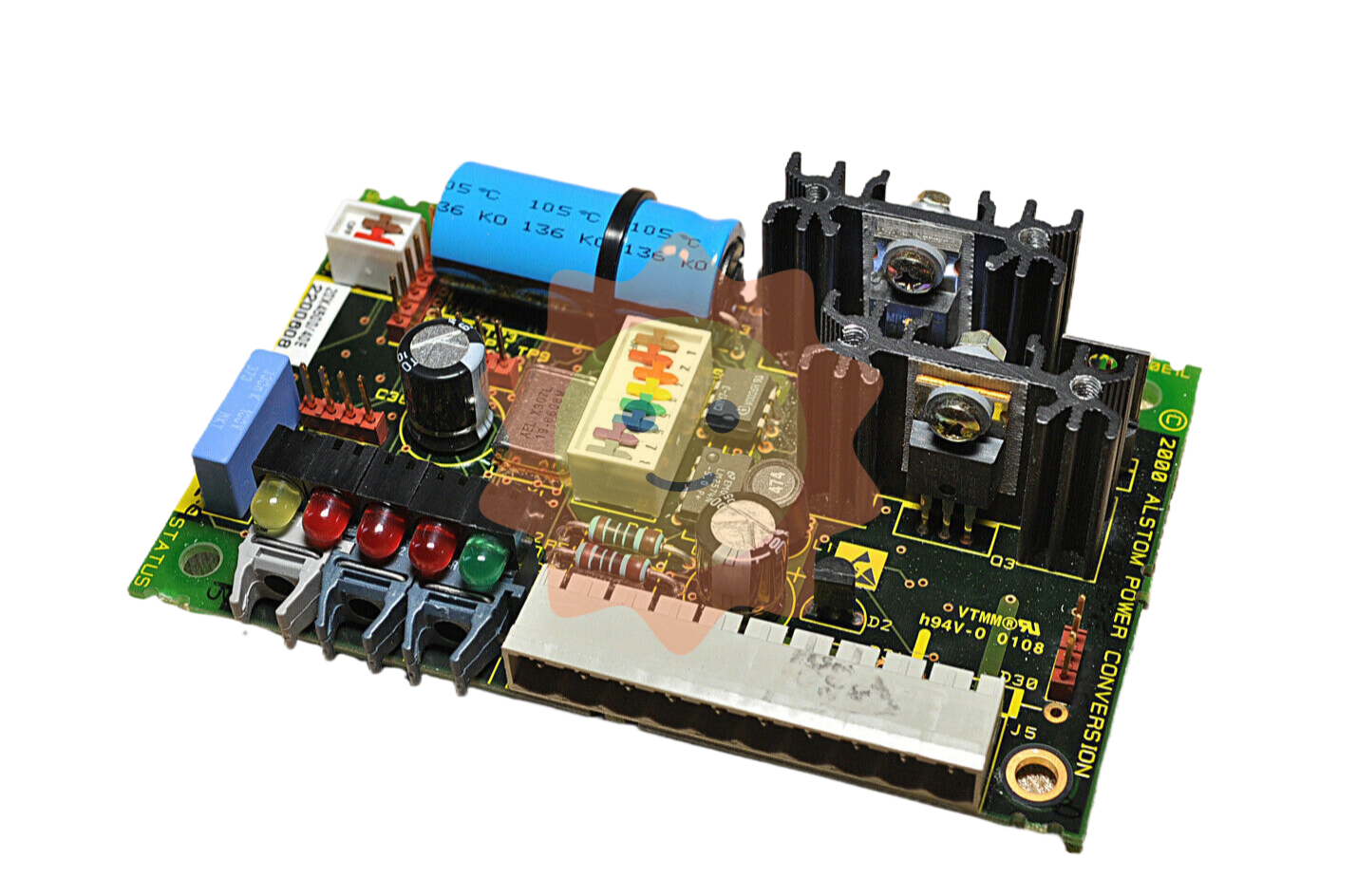

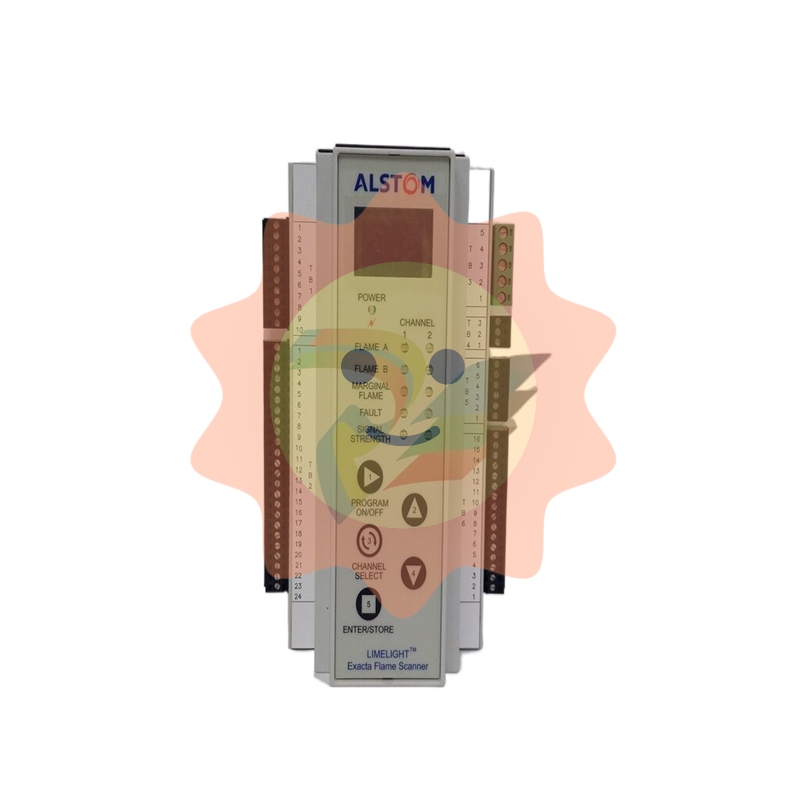

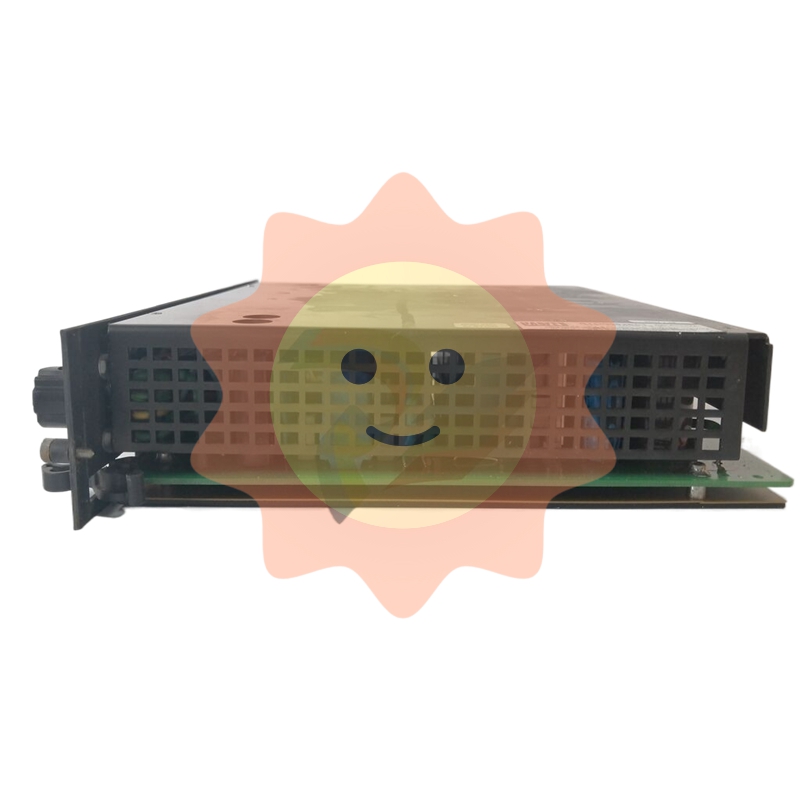

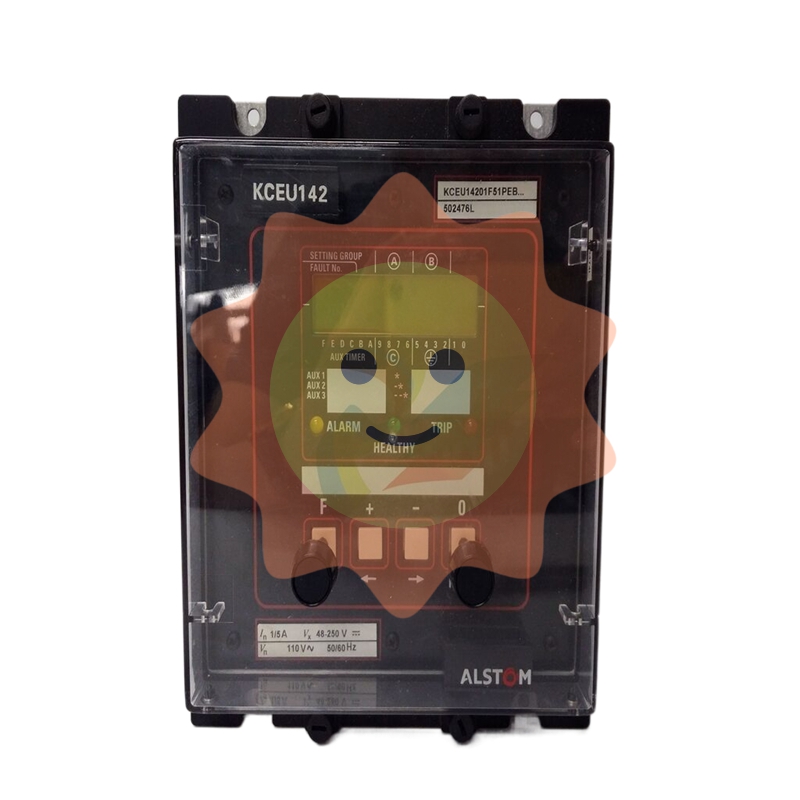

- ALSTOM

- Control Wave

- AB

- AMAT

- STUDER

- KONGSBERG

- MOTOROLA

- DANAHER MOTION

- Bentley

- Galil

- EATON

- MOLEX

- Triconex

- DEIF

- B&W

email:1583694102@qq.com

wang@kongjiangauto.com