Omni-channel deconstruction of snack food

1, Duplicate: forty years of channel changes, snack brands competing

Leisure snacks trillion market, rich categories, brands, in order to better understand the current status of the channel we will be 40 years of leisure food industry development is roughly divided into the following four stages. From the perspective of supply and demand, the rise of each round of new channel dividends will create new investment opportunities, and companies that can cross the cycle, maintain the lead, and form a brand are the only omni-channel cultivation and continuous iterative innovation.

Snack 1.0- The era of Great Circulation (1980-2000) : From the perspective of macro environment, this stage coincides with the dividend period of reform and opening up, with per capita GDP rising from less than 200 US dollars to 960 US dollars, CAGR reaching 8.3%, and foreign and Taiwanese brands with mature single products and distribution systems under the blank category of budding demand have entered the era of running the race. International snack giants such as Wrigley (1989), Dove (1993), Haojia (1993) and Heiliyou (1994) have set up factories in China, followed by Daliyuan (1989), Xizhilang (1992), Pan Pan (1996), Qiqiha Food (1999). With the "big single product + big production + big channel + big retail" model, win a place in the subdivision category and form the cognition of the finished product category and brand in the relatively concentrated period of traffic.

Snacks 2.0- The rise of brand chains (2000-2012) : From the perspective of macro environment, this stage was accompanied by the rapid increase of World Trade dividend and urbanization rate, and the rapid development of commercial real estate, including chain supermarkets and shopping centers. In 1992, the "Reply on the Utilization of Foreign Capital in the field of commercial retail" was released, and in 1995, it was opened to the food and chain operation field. In 1995, Carrefour entered China and expanded rapidly at an average rate of 16 stores per year from 2003 to 2006. Walmart entered China in 1996 and has opened 426 stores in 25 provinces across the country by 2016. At the time of the acceleration of the foreign super racing land, Lianhua, Yonghui, RT-Mart, etc. are also in a period of vigorous development, and the supermarket stores CAGR of nearly 20% from 2002 to 2010. With the rise of offline chains, snack brands have derived two development paths. At this stage, consumers gradually grasp the pricing power to enter the buyer's market after experiencing domestic and foreign brand category education, and brands with supermarket endorsement or increased frequency of contact are more likely to stand out.

Snacks 3.0- e-commerce channel outbreak (2012-2018) : From the perspective of the macro environment, in 2012, as the economy bid farewell to the era of high growth, the Internet ushered in a new round of channel reform. According to CNNIC statistics, in 2012, the number of Internet users in China was 560 million, and the penetration rate was 42.1%. By 2018, the number of Internet users reached 830 million, and the penetration rate was nearly 60%. From the perspective of monthly activity, the year-on-year growth rate of mobile user monthly activity from 2012 to 2018 continued to rise, at the same time, Baicao Wei (2010), good Food shop (2012) and three squirrels (2012) have embraced online dividends, of which three squirrels' operating income from 2014 to 2019 climbed from 900 million to 10.2 billion. CAGR exceeded 62%, and from the profit margin point of view, because the online platform is mainly dominated by low-cost explosive funds, the net interest rate is still maintained at a low single digit level, the net profit of squirrel to the mother in 2019 is only 240 million yuan, and the same period is still offline Qiqiao2019 revenue of 4.8 billion yuan, and the net profit of mother exceeds 600 million.

Snacks 4.0- Omni-channel Cultivation (2018 to date) : From the perspective of macro environment, as the bottom driving force of leisure snacks, the proportion of the population aged 15-44 years old has entered a downward channel since the peak in 2012. From 2012 to 2018, the impact of the industry under the booming development of the Internet is not obvious. After 2018, with the combination of multiple macro factors such as economic slowdown, housing and housing speculation, and the impact of the epidemic, Leisure snacks market growth into the marginal decline channel, online traffic decentralization, offline traffic fragmentation under the enterprise customer cost increase, the former circulation era leading Wangwang 2012-2021 snack food revenue is in place, the omni-channel transformation has become an industry consensus. Product side, the industry after 40 years of development and consumer popularity, health, functionality, price performance and other multiple personalized demands coexist, since 2020, capital intervention under the net red products emerge in an endless stream, more than 1 billion single products are rare, with a large single product breakthrough Qiqiha, Gan Yuan have to find the second growth curve, product iteration innovation has become the necessary competitiveness through the industry cycle.

Different types of snack food companies, channel focus and investment return drivers vary. According to the different aspects of the industry chain, snack companies are divided into three categories: manufacturing, brand retail and chain. From the perspective of ROE disassembly, the manufacturing type is mainly driven by the net profit ratio, and there is a significant positive correlation with the scale effect. Such companies to product polishing as the core, in the creation of multiple growth curves at the same time, through the procurement bargaining power to improve, supply chain system optimization and brand premium increase to promote profit margins, channel side mostly offline as the basic plate, all-channel refined development. Brand retail is mainly driven by equity multiplier and turnover rate, efficiency is supreme and the rest is king, and it is necessary to rely on brand and supply chain to achieve profit margin improvement in the later period.

Such companies operate in multi-category, multi-SKUs and multi-channels, relying on OEM OEM in the upstream, optimizing operational efficiency in the midstream, and relying on their own channels or third-party channels for sales in the downstream, showing the overall characteristics of small profits and high sales, and the net interest rate is mostly in the low single digits due to the two-sided squeeze. The chain driving factors are relatively balanced, due to independent production + own channels, the theoretical profit margin space is higher, but due to the constraints of the management side path, the income ceiling is lower than the retail type. Because the channel of such companies is single-store model, management mechanism and category positioning, this report focuses more on the first two types of companies.

2. Current situation: Under the stratification of consumption, the channel customer base scene is differentiated

The proportion of middle income people increased, but the marginal consumption tendency was differentiated, and the offline market was a new engine for the growth of mass goods and K-shaped growth among categories. According to McKinsey's statistics, 45% of urban consumption in 2020 is mainly contributed by well-off families, and it is expected that by 2030, high-income consumers will drive nearly 60% of urban consumption, becoming the backbone of the future consumer market. From the perspective of consumer products, the marginal consumption tendency of the middle income group has a certain differentiation, the proportion and growth rate of mass consumer goods are weaker than the domestic overall level, and high-end consumption still continues to grow rapidly.

By city, according to Accenture's 2021 China Consumer research data, consumers in high-line markets are more inclined to increase investment in savings, education, healthcare and other fields, while consumers in low-line markets are more willing to spend on consumer entertainment. According to the study on the consumption trend of young and middle-aged people in the county market in 2022, the young and middle-aged people in the offline market have a longer disposable time and spend more than they need, spending an average of 879 yuan on food, tobacco and alcohol per month, which is the main expenditure on daily consumer goods. From the perspective of consumption decision-making, after clarifying the demand, 60% of the respondents surveyed by Accenture said that they would still verify the research through multiple channels and multiple information sources, and consume more rationally and restrained. According to the statistics of Kantar's China Shoppers Report in 2020, taking instant noodles, personal cleaning supplies, clothing washing and infant formula categories as examples, there is a clear phenomenon that the growth rate of low-end and high-end categories is as fast, and the performance of the mid-end category is lagging behind, which again reflects the K-type differentiation of consumption from the micro level.

The retail channel structure is scattered, offline channels are still the main market, and e-commerce and vertical chain maintain positive growth. Disassembling the existing retail channels can be divided into three categories: modern, traditional and online. With the stratification of consumption and the elaboration of the scene, various emerging formats such as member stores, discount stores, category franchises and O2O are derived. From the perspective of target customer groups, member stores, boutique supermarkets, etc. meet the needs of middle and high income groups, discount stores, community group buying and traditional channels meet the needs of customers who pay attention to cost performance. From the perspective of the scene, according to Nielsen survey statistics, member stores can cover an area of more than 5 kilometers; KA stores, BC supermarkets and discount stores improve the coverage radius of about 2 kilometers; convenience stores, CVS, franchise stores and mom-and-wife stores are mostly community stores, completing the last kilometer of contact. Online and O2O supplement the consumption scene from time and space. From the perspective of channel development, e-commerce and franchise stores have maintained positive growth in the past five years, and the remaining channels have been adjusted. Focusing on the casual snacks category, offline channels are still the core and due to the impulse consumption attributes of snacks, the online proportion is about 13% lower than the overall FMCG.

Considering the complexity of retail channels, this paper disintegrates the characteristics of offline and online channels and combines the cases of snack companies to resume business, so as to better capture the investment opportunities of sub-sectors when the next round of new channel reform dividends rises.

3. Offline channels: member stores + discount stores, new highlights of structure

3.1, high-end member store: focus on the high line, brand endorsement

3.1.1 billion market scale, with its own brands to form differentiated competition

High-end member stores target middle and high income groups, select cost-effective products around the world, reduce costs through mass procurement, operating their own brands, and achieve profits through membership fee income and product price differences. Membership supermarket took shape in China in 1996, 2014-2018 due to the restriction of consumption concept development is relatively blocked, Sam and Metro have resilience, in 2019 Costco settled in Shanghai superimposed small red book and other content e-commerce grass, the local supermarket began to transform to membership supermarket under the network red effect. According to the statistics of the First Leopard Research Institute, from 2016 to 2021, the size of China's membership supermarket market increased from 1.3 billion to 2.7 billion US dollars, with a compound growth rate of nearly 16%.

From the perspective of target customer groups, according to business school research statistics, Sam's Club paying members are mainly in first and second-tier cities, accounting for nearly 60%, mainly 25-45 years old women, mostly white-collar occupations, from the educational distribution of university and postgraduate education accounts for a relatively high proportion. Considering the higher time cost of the middle and high income groups and the higher requirements for quality of life, the membership store selected by SKU becomes the better choice. According to the first leopard research statistics, more than 70% of consumers will go at least once in a month, "goods to find someone" mode channel through cost-effective products to improve the target customer group re-purchase rate and customer unit price level. From the perspective of major brands, Sam, Metro and Yonghui warehouse have more stores and more than 100 potential expansion store space, of which Sam, the most mature model, is expected to add 4-5 stores every year.

Taking Costco as an example, the proportion of groceries is relatively high, and the gross profit rate is lower than that of ordinary supermarkets through self-owned brands to achieve differentiated competition. Through SKU selection, self-owned properties, and supply chain optimization, the net profit rate is relatively stable. First of all, in the category selection, mainly "wide category narrow product", SKU selection to reduce the time cost of consumers, compared with more than tens of thousands of SKUs in traditional businesses, membership supermarkets control SKUs at about 1000-4000.

According to the statistics of the First Leopard Research Institute, Costco and other membership supermarkets in the food and grocery category accounted for about 40%, nearly half of which are private brands, followed by overseas brands, local brands accounted for relatively small, and different channels of the main own-brand category there are differences, such as Sam's main Member's Mark mainly drinks. Costco's Kirkland focuses on nuts, while Box Horse integrates local elements to form misplaced competition. Considering that the membership supermarket has strong bargaining power for upstream brands, low concentration of product selection, and emphasis on supply chain stability, it is expected that the single SKU in the channel has a low ceiling and the replacement rate of about 40% will test product quality and the ability to continue to promote new products. On the contrary, if selected as a supplier of this channel, the products under the brand endorsement are expected to accelerate the promotion to other high-end channels.

3.1.2 Case: Kam Yuen Foods -- Internet celebrity single product "Mustard flavor Macadamia fruit"

Revenue end: The rise of Sam, omni-channel diffusion, brand awareness. According to Baidu index statistics, the search frequency of Sam's Club store increased significantly in August 2021, which corresponds to the rise of the popularity of the "must-buy list" of grass platforms such as Xiaored Book, among which "mustard-flavor Macua" has become a new online celebrity product with its unique taste and better powder layer coating technology, and subsequently triggered the "leveling effect" of major platforms. From the packaging point of view to Sam's "Member's Mark" as the Logo, the supplier and manufacturer are respectively Beijing Wanjiali Food and California wilderness (Bazhou City) food, of which California wilderness is Wanjiali sub-brand, the actual production side is Gan Yuan Food.

According to the company announcement, as of the end of November 2021, the single product wasabi flavored macadamia fruit has a cumulative factory of about 40 million yuan, and many consumers seek affordable alternatives in the network red effect radiation and Sam's Club threshold constraints, and Kam uses the opportunity to launch wasabi flavored macadamia fruit with brand Logo in other channels such as e-commerce. The phenomenon of "out of stock" repeatedly occurred in the short term during the stacking season. According to the company's announcement, the 2021H1 comprehensive nut and bean series revenue was 110 million yuan, 2021H2 increased to 185 million yuan, 2022H1 was 156 million yuan, which was maintained at a high growth range of 40% year-on-year, and also became a new growth pole in the company's product portfolio from the perspective of the proportion.

1, Duplicate: forty years of channel changes, snack brands competing

Leisure snacks trillion market, rich categories, brands, in order to better understand the current status of the channel we will be 40 years of leisure food industry development is roughly divided into the following four stages. From the perspective of supply and demand, the rise of each round of new channel dividends will create new investment opportunities, and companies that can cross the cycle, maintain the lead, and form a brand are the only omni-channel cultivation and continuous iterative innovation.

Snack 1.0- The era of Great Circulation (1980-2000) : From the perspective of macro environment, this stage coincides with the dividend period of reform and opening up, with per capita GDP rising from less than 200 US dollars to 960 US dollars, CAGR reaching 8.3%, and foreign and Taiwanese brands with mature single products and distribution systems under the blank category of budding demand have entered the era of running the race. International snack giants such as Wrigley (1989), Dove (1993), Haojia (1993) and Heiliyou (1994) have set up factories in China, followed by Daliyuan (1989), Xizhilang (1992), Pan Pan (1996), Qiqiha Food (1999). With the "big single product + big production + big channel + big retail" model, win a place in the subdivision category and form the cognition of the finished product category and brand in the relatively concentrated period of traffic.

Snacks 2.0- The rise of brand chains (2000-2012) : From the perspective of macro environment, this stage was accompanied by the rapid increase of World Trade dividend and urbanization rate, and the rapid development of commercial real estate, including chain supermarkets and shopping centers. In 1992, the "Reply on the Utilization of Foreign Capital in the field of commercial retail" was released, and in 1995, it was opened to the field of food and chain operation. In 1995, Carrefour entered China and expanded rapidly at an average rate of 16 stores per year from 2003 to 2006.

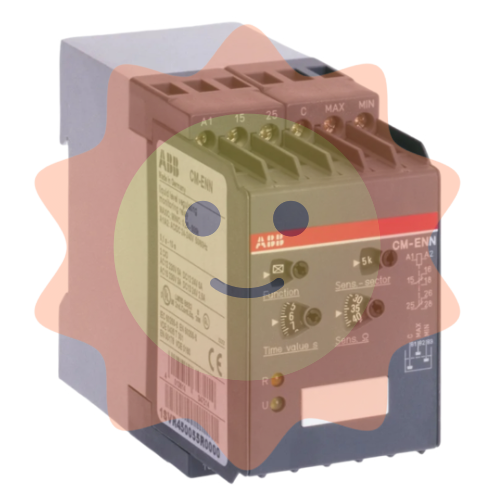

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

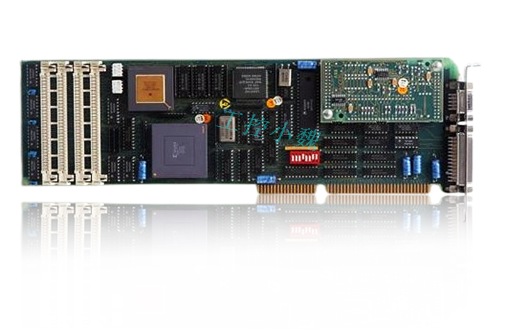

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA