Going faster and further – additional fuel switching options in the power sector

Faster deployment of rooftop solar PV systems can reduce consumer bills. A short-term grant programme covering 20% of installation costs could double the pace of investment (compared with the IEA’s base case forecast) at a cost of around EUR 3 billion. This would increase annual output from rooftop solar PV systems by up to 15 TWh.

Impact: An additional 35 TWh of generation from new renewable projects over the next year, over and above the already anticipated growth from these sources, bringing down gas use by 6 bcm.

5. Maximise generation from existing dispatchable low-emissions sources: bioenergy and nuclear

Nuclear power is the largest source of low emissions electricity in the EU, but several reactors were taken offline for maintenance and safety checks in 2021. Returning these reactors to safe operations in 2022, alongside the start of commercial operations for the completed reactor in Finland, can lead to EU nuclear power generation increasing by up to 20 TWh in 2022.

A new round of reactor closures, however, would dent this recovery in output: four nuclear reactors are scheduled to shut down by the end of 2022, and another one in 2023. A temporary delay of these closures, conducted in a way that assures the plants’ safe operation, could cut EU gas demand by almost 1 bcm per month.

The large fleet of bioenergy power plants in the EU operated at about 50% of its total capacity in 2021. These plants could generate up to 50 TWh more electricity in 2022 if appropriate incentives and sustainable supplies of bioenergy are put in place.

Impact: An additional 70 TWh of power generation from existing dispatchable low emissions sources, reducing gas use for electricity by 13 bcm.

6. Enact short-term measures to shelter vulnerable electricity consumers from high prices

With today’s market design, high gas prices in the EU feed through into high wholesale electricity prices in ways that can lead to windfall profits for companies. This has significant implications for the affordability of electricity, as well as for the economic incentives for the broader electrification of end-uses, which is a key element of clean energy transitions.

We estimate that spending by EU member states to cushion the impact of the energy price crisis on vulnerable consumers already amounts to a commitment of around EUR 55 billion.

Increases in electricity costs are unavoidable to a certain extent when gas (and CO2) prices are high. But current wholesale markets create the potential for profits for many electricity generators and their parent companies that are well in excess of the costs related to operations or capital recovery. Current market conditions could lead to excess profits of up to EUR 200 billion in the EU for gas, coal, nuclear, hydropower and other renewables in 2022.

Temporary tax measures to raise rates on electricity companies’ windfall profits could be considered. These tax receipts should then be redistributed to electricity consumers to partially offset higher energy bills. Measures to tax windfall profits have already been adopted in Italy and Romania in 2022.

Impact: Brings down energy bills for consumers even when natural gas prices remain high, making available up to EUR 200 billion to cushion impacts on vulnerable groups.

7. Speed up the replacement of gas boilers with heat pumps

Heat pumps offer a very efficient and cost-effective way to heat homes, replacing boilers that use gas or other fossil fuels. Speeding up anticipated deployment by doubling current EU installation rates of heat pumps would save an additional 2 bcm of gas use within the first year, requiring a total additional investment of EUR 15 billion.

Alongside existing policy frameworks, targeted support for investment can drive the scaling up of heat pump installations. Ideally, this is best combined with upgrades of the homes themselves to maximise energy efficiency gains and reduce overall costs.

Replacing gas boilers or furnaces with heat pumps is also an attractive option for industry, although deployment may take longer to scale up.

A shift from gas to electricity for heating buildings could have the corresponding effect of pushing up gas demand for power generation, depending on the situation. However, any increase would be much lower than the overall amount of gas saved. Such a shift would also transfer seasonal swings in demand from the gas market to the power market.

Impact: Reduces gas use for heating by an additional 2 bcm in one year.

8. Accelerate energy efficiency improvements in buildings and industry

Energy efficiency is a powerful instrument for secure clean energy transitions, but it often takes time to deliver major results. In this plan, we consider how to pick up the rate of progress, focusing on measures that can make a difference quickly.

At present, only about 1% of the EU’s building stock is renovated each year. A rapid extension to an additional 0.7%, targeting the least efficient homes and non-residential buildings, would be possible through standardised upgrades, mainly via improved insulation. This would save more than 1 bcm of gas use in the space of a year and would also bring benefits for employment, though it would require parallel efforts to improve supply chains for materials and workforce development.

- EMERSON

- Honeywell

- CTI

- Rolls-Royce

- General Electric

- Woodward

- Yaskawa

- xYCOM

- Motorola

- Siemens

- Rockwell

- ABB

- B&R

- HIMA

- Construction site

- electricity

- Automobile market

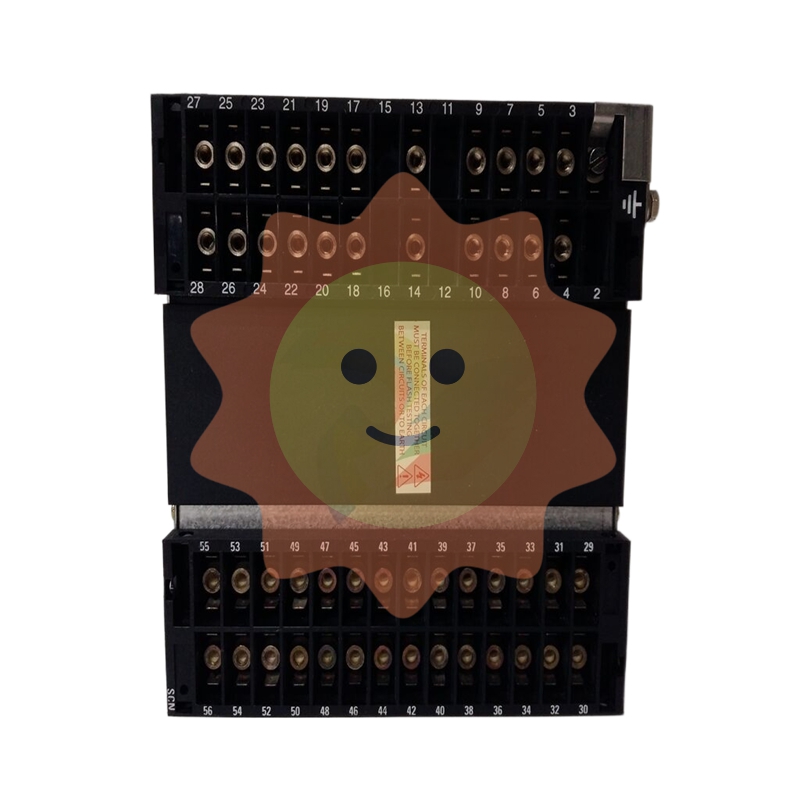

- PLC

- DCS

- Motor drivers

- VSD

- Implications

- cement

- CO2

- CEM

- methane

- Artificial intelligence

- Titanic

- Solar energy

- Hydrogen fuel cell

- Hydrogen and fuel cells

- Hydrogen and oxygen fuel cells

- tyre

- Chemical fiber

- dynamo

- corpuscle

- Pulp and paper

- printing

- fossil

- FANUC

- Food and beverage

- Life science

- Sewage treatment

- Personal care

- electricity

- boats

- infrastructure

- Automobile industry

- metallurgy

- Nuclear power generation

- Geothermal power generation

- Water and wastewater

- Infrastructure construction

- Mine hazard

- steel

- papermaking

- Natural gas industry

- Infrastructure construction

- Power and energy

- Rubber and plastic

- Renewable energy

- pharmacy

- mining

- Plastic industry

- Schneider

- Kongsberg

- NI

- Wind energy

- International petroleum

- International new energy network

- gas

- WATLOW

- ProSoft

- SEW

- wind

- ADVANCED

- Reliance

- YOKOGAWA

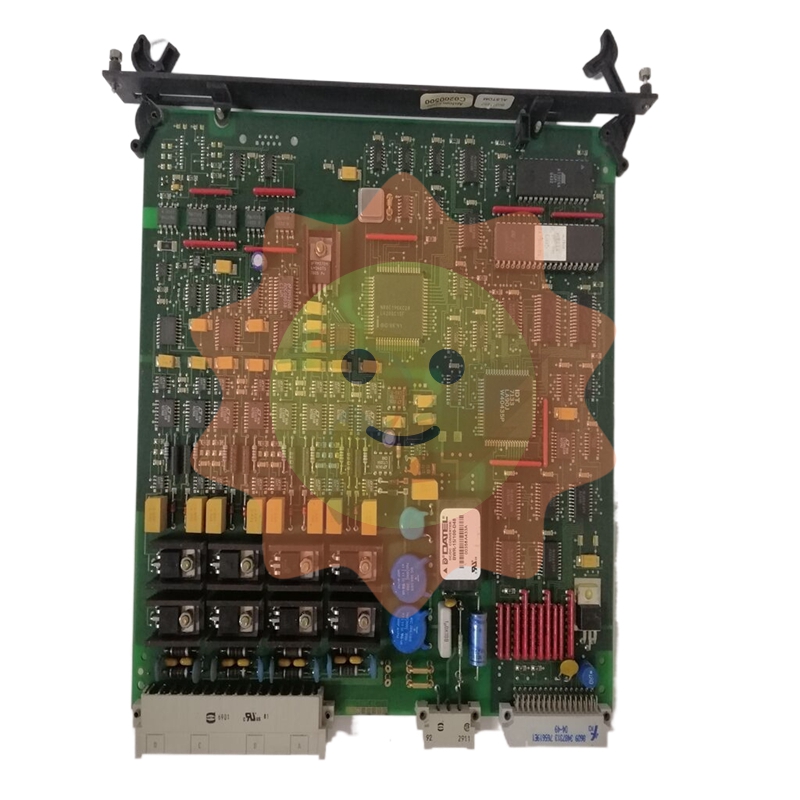

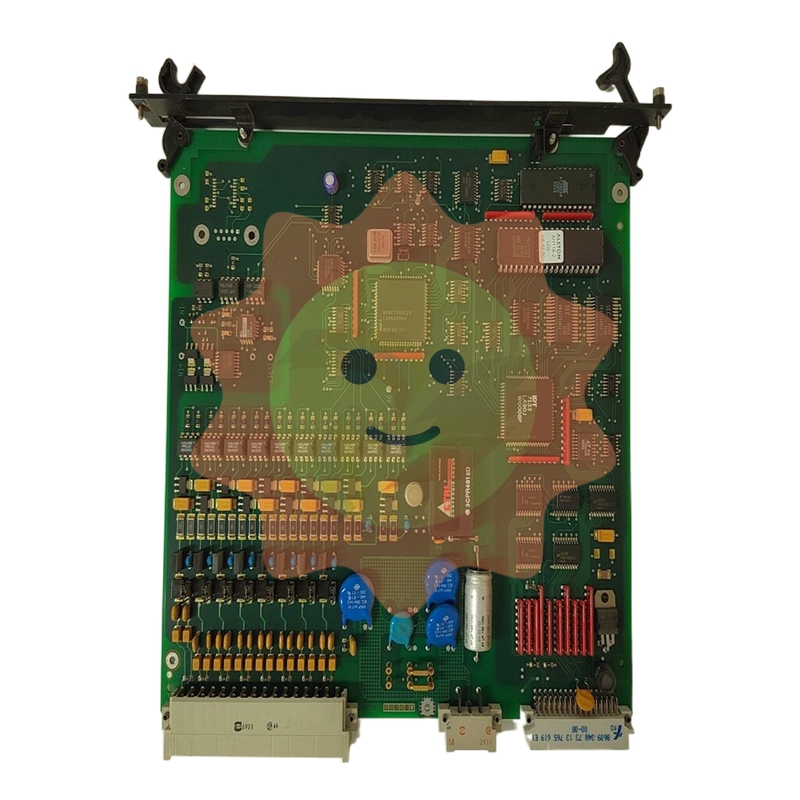

- TRICONEX

- FOXBORO

- METSO

- MAN

- Advantest

- ADVANCED

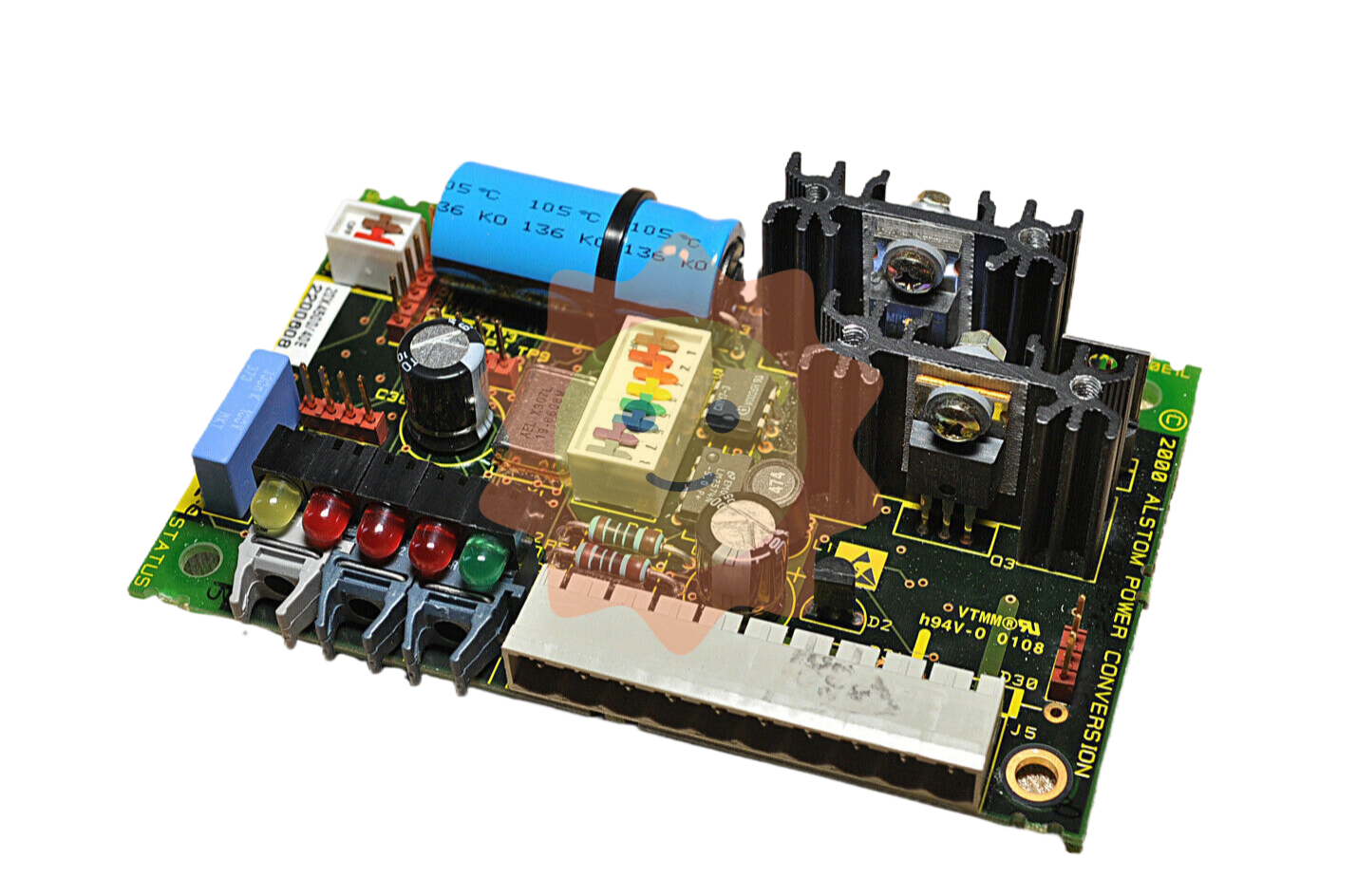

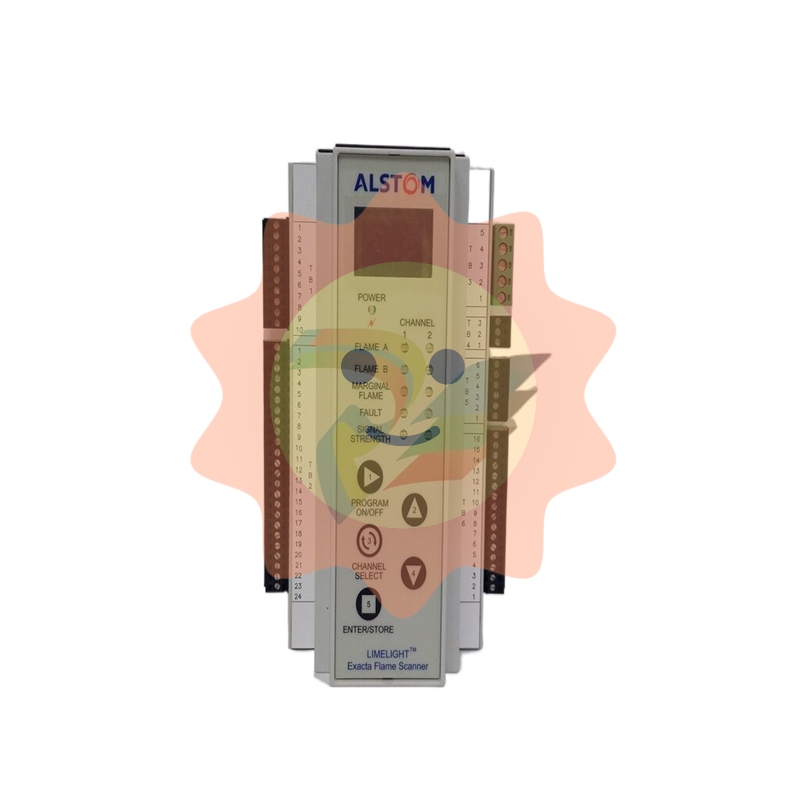

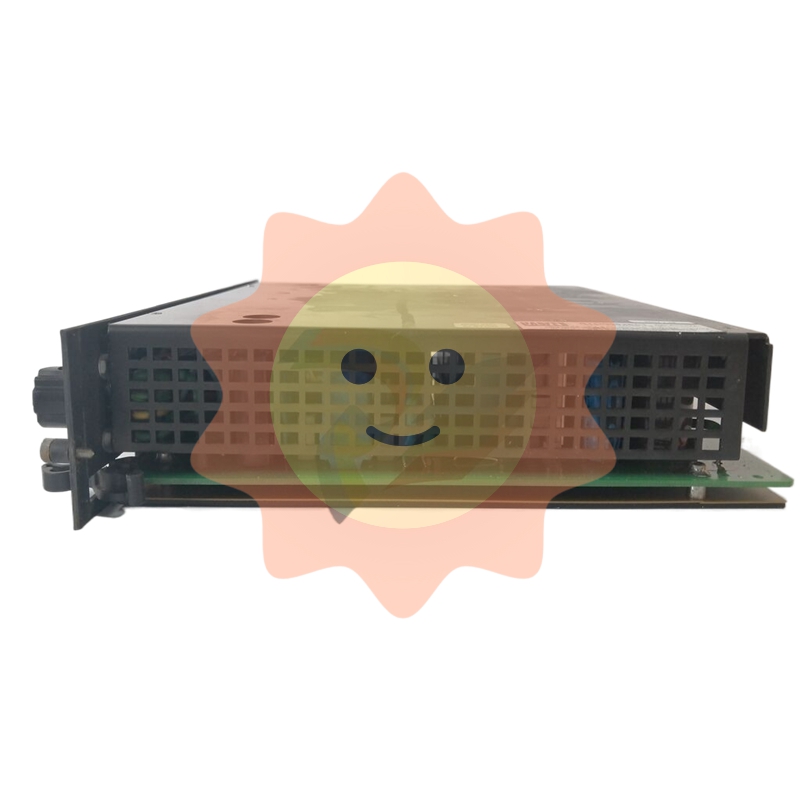

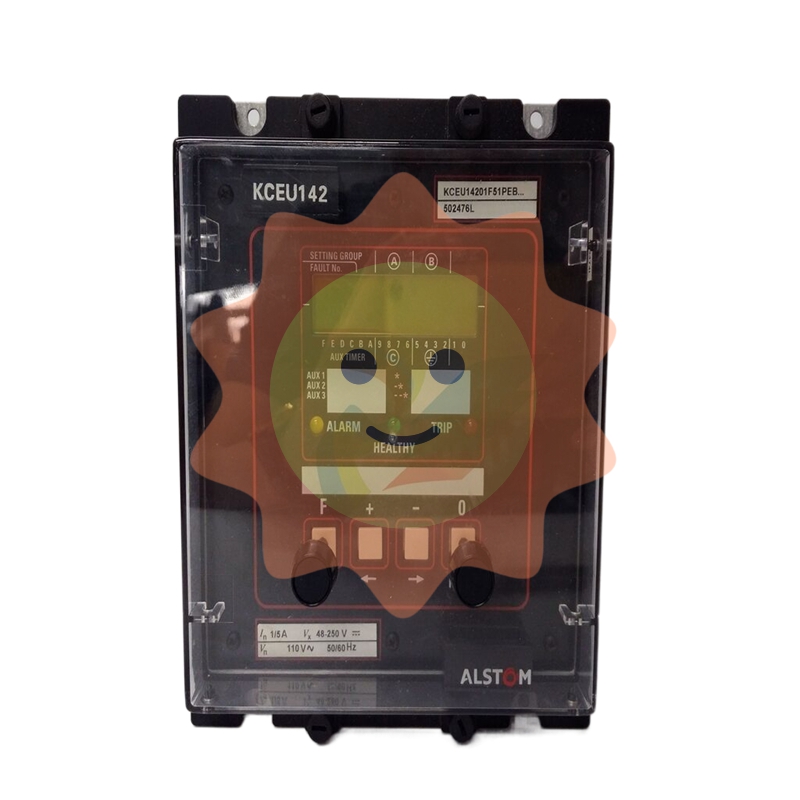

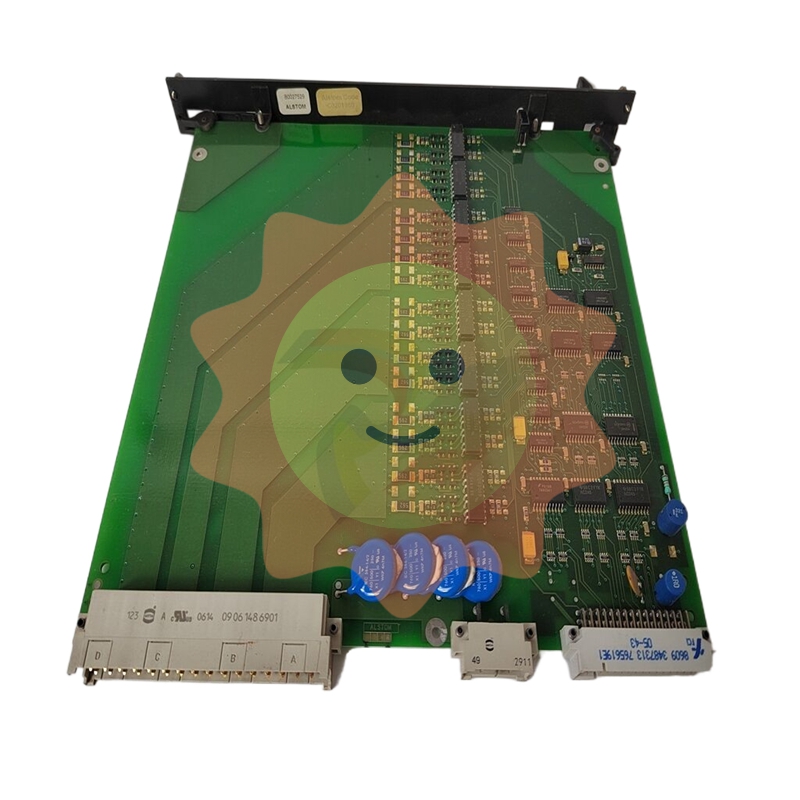

- ALSTOM

- Control Wave

- AB

- AMAT

- STUDER

- KONGSBERG

- MOTOROLA

- DANAHER MOTION

- Bentley

- Galil

- EATON

- MOLEX

- Triconex

- DEIF

- B&W

- ZYGO

- Aerotech

email:1583694102@qq.com

wang@kongjiangauto.com