The development status of China's shipping industry in 2023, the shipping industry has been in a new cycle of recovery

I. Basic overview of the industry

Step 1 Define

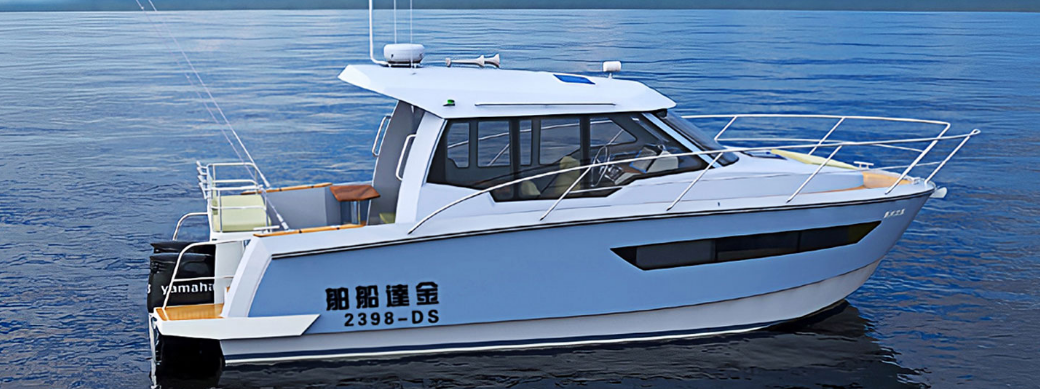

boats and ships is a general term for all kinds of ships. A ship is a means of transportation that can sail or berth in the water area for transportation or operation, and has different technical performance, equipment and structure types according to different use requirements.

A ship is a man-made vehicle operating mainly in geographical waters. In addition, civilian ships are generally called ships, military ships are called ships, and small ships are called boats or boats, which are collectively called ships or boats. The interior mainly consists of the housing space, support structure and drainage structure, with the use of external or internal energy propulsion system. The appearance is generally conducive to overcoming the fluid resistance of the flow linear envelope, materials with the progress of science and technology constantly updated, early for wood, bamboo, hemp and other natural materials, modern is mostly steel and aluminum, glass fiber, acrylic and various composite materials.

2. Development history

The modern shipbuilding industry began with the Jiangnan Manufacturing General Administration, which was established by the Qing government in 1865, and was affected by political factors and international environment until 2000, when the new century began, it returned to the throne of the world's largest shipbuilding country. At present, China's shipbuilding industry has entered a period of structural adjustment, and has gradually developed to the direction of intelligence, digitization and information.

Ii. Development of industry-related policies and regulations

1. Imo's new developments on carbon reduction

In 2022, the 78th and 79th sessions of MEPC discussed the revision of the preliminary strategy for greenhouse gas emission reduction in the maritime industry, and the final revision opinions have not yet been formed, but from the relevant proposals, IMO is likely to increase the carbon emission reduction requirements for ships. Some of the proposals propose that the IMO increase its existing carbon reduction targets for 2030 and 2050, and increase the carbon reduction requirements for 2040, ultimately achieving carbon neutrality in the shipping industry by 2050. According to IMO's next work plan, the 80th session of MEPC in July 2023 will issue a revised greenhouse gas emission reduction strategy for the Marine industry, which will have an important impact on the carbon emission reduction strategy of shipping companies, new ship ordering, and existing ship refit, as the strategy is the overall program of carbon emission reduction for the global shipping industry.

2. Changes in industrial policies related to the domestic shipping industry

In 2022, the CPC Central Committee, The State Council and relevant ministries and commissions issued a series of policies on development planning and green development. Shipbuilding industry is an important national defense and economic pillar industry in China, the state and relevant local governments have also listed the development of shipbuilding industry as a key development area in the "14th Five-Year Plan" period, and put forward specific planning measures, pointing out the direction for the high-quality development of shipbuilding industry in the "14th Five-Year Plan" period.

In terms of development planning, by 2022, The relevant departments of the state have successively promulgated the "Fourteenth Five-Year Plan" Development Plan for water transport, the "Fourteenth Five-Year Plan" Development Plan for Modern Comprehensive transportation System, the "Fourteenth Five-Year Plan" scientific and technological innovation Plan for transportation, the work Plan for the implementation of major transportation projects under the "Fourteenth Five-Year Plan", and the Implementation Opinions on Accelerating the development of cruise and yacht equipment and Industry The policy focuses on the transformation and upgrading needs of China's shipbuilding industry, comprehensively promotes the high-end, intelligent, and digital development of shipbuilding industry, improves the manufacturing capacity and quality level of major technical equipment, and steadily improves the influence of Chinese brands.

In terms of green development, 2022, The state has successively issued policy documents such as the "14th Five-Year Plan" Comprehensive Work Plan for Energy Conservation and Emission Reduction, the Implementation Plan for Accelerating the Comprehensive Utilization of Industrial Resources, the "14th Five-Year Plan" Renewable Energy Development Plan, the Implementation Plan for Pegging Carbon in the Industrial Sector, the "14th Five-Year Plan" Modern Energy System Plan, and the Implementation Opinions on Accelerating the Green and Intelligent Development of Inland waterway Vessels. It puts forward higher requirements for the clean, green and low-carbon development of China's shipbuilding industry, and also brings new opportunities for the development of China's shipbuilding industry. The policy requirements of ship clean energy alternative application, ship life cycle resource utilization, ship construction energy saving and emission reduction will promote the renewal demand of traditional fuel-powered ships. At the same time, the innovation and development of a number of advanced green manufacturing technologies can significantly reduce production energy consumption, accelerate the intelligent and green transformation of the Marine industry, and contribute to the strength of the Marine industry for the implementation of the "double carbon" action.

Iii. Industrial Chain

The upstream is mainly the preparatory link of ship manufacturing, including the supply of raw materials (mainly steel supply), the supply of ship supporting facilities, etc. In terms of Marine steel, China has 12 major shipbuilding and Marine engineering steel production enterprises and their 24 production lines, and the total output of these enterprises for shipbuilding and Marine engineering steel accounts for about 90% of the national total output. Among these 24 production lines, there are 7 well-equipped 5000mm and above wide and thick plate production lines, 7 4000mm and above wide and thick plate production lines, 5 3800/3500mm production lines, and 5 medium plate production lines below 3500mm, ranking in the world's leading level.

The middle reaches are mainly ship assembly manufacturing, among which dry bulk carriers, oil tankers and container ships are known as the world's three mainstream ship types. China's ship assembly and manufacturing is divided between north and south, "South ship" refers to China Shipbuilding Industry Group, "North ship" refers to China Shipbuilding Industry Group; The eight listed companies in the shipping industry under the two groups, together with non-listed companies such as Waigaoqiao, basically cover more than 90% of the market share of China's ship assembly manufacturing.

4. Development background

In recent years, the development of the world Marine economy has stepped into the fast lane of world economic development, and in many coastal countries and regions, the Marine economy has become a new growth point of development. China's Marine economy is developing rapidly, the total output value of the major Marine industries continued to grow before 2020, affected by the global epidemic in 2020, the development of the major Marine industries was hindered, and the overall output value of the industry declined. In 2021, the Marine industry resumed production activities, and the overall output value of the industry increased by 14.87%, achieving an added value of 3,405 billion yuan. Although uncertainties such as the impact of the epidemic and international geopolitical tensions continue, the trend of continued recovery and good development of the Marine economy will not change. In 2022, the total value of Marine production was 9,462.8 billion yuan, an increase of 1.9% over the previous year, with major economic indicators stabilizing and recovering, and China's total Marine economy achieving steady growth. The added value of 15 major Marine industries was 3,854.2 billion yuan.

Fifth, industry development status

In 2021, the recovery of the international shipping market superposition the ship batch replacement cycle, driving the global new shipbuilding market to rebound beyond expectations, China's shipping enterprises to seize the opportunity to undertake a large number of orders, the industry's overall GDP rapid growth reached 126.4 billion yuan, a growth rate of 10.20%. In 2022, the annual added value of the Marine shipbuilding industry reached 96.9 billion yuan, 23% lower than the previous year.

1. The international market share continues to lead, and the competitiveness of backbone enterprises is enhanced

In 2022, China's shipbuilding international market share has ranked first in the world for 13 consecutive years, and its position as a shipbuilding country has been further consolidated. China's shipbuilding completed volume, new orders received, and hand-held orders accounted for 47.3%, 55.2% and 49.0% of the world's total deadweight tons, respectively, an increase of 0.1, 1.4 and 1.4 percentage points over 2021, and accounted for 43.5%, 49.8% and 42.8% of the revised total tons, also maintaining the global lead.

2. New breakthroughs have been made in high-end equipment, and green-powered ships are growing rapidly

In 2022, China's shipping enterprises will continue to increase research and development efforts and make new breakthroughs in the field of high-tech ships and offshore engineering equipment. High-end ship types such as 24,000 TEU container ships and 174,000 cubic meters of large LNG were delivered in batches, the first domestically produced large cruise ship achieved a major node of main power generation vehicles, and the construction of the second large cruise ship began smoothly. The 300,000-ton LNG dual-fuel power very large oil carrier (VLCC), 209,000 tons Newcastle type LNG dual-fuel power bulk carrier, 49,900 tons methanol dual-fuel power chemical/product oil carrier and other green power vessels were completed and delivered.

In 2022, the proportion of new orders for green powered ships reached 49.1%, the highest level in history.

3. The application of domestic supporting products has accelerated, and the security level of the industrial chain has been enhanced

In 2022, the loading rate of domestic Marine main engine, Marine boiler, Marine crane, Marine gas supply system (FGSS) and other supporting equipment will continue to increase. The development capacity of Marine high-end steel has been continuously improved, all the crack plates of large container ships have been replaced by domestic products, the localization rate of two-way stainless steel on chemical ships has increased from less than 50% to more than 90%, the domestic high manganese steel tank project has started smoothly, and the special stainless steel for domestic thin-film LNG tanker has passed the patent company certification. The automatic welding equipment for all positions of corrugated plate of domestic LNG carrier has been developed successfully. The security level of industrial chain and supply chain has been significantly improved.

4. The demand for offshore oil and gas equipment has expanded, and the "destocking" has achieved remarkable results

In 2022, the high volatility of international oil prices, Brent international crude oil spot prices once climbed to 139 US dollars/barrel, a new high since the financial crisis, led to the expansion of global offshore oil and gas equipment market demand, domestic offshore engineering equipment enterprises to seize the opportunity, "destocking" achieved positive results.

5. Seize the favorable market opportunity, and the industry efficiency has improved

In 2022, the market environment factors of the shipbuilding industry have generally shown favorable changes. The Clarkson new ship price Composite Index was 162 points, up 4.5% for the year, and the average price of new ships such as large container ships, car carriers, and large LNG carriers rose by more than 10%. The price of 6mm and 20mm Marine steel plate is more than 1000 yuan/ton compared with the beginning of the year; The central parity rate of the RMB was devalued by 9.23% against the US dollar. At the same time, ship enterprises reduce costs and increase efficiency by strengthening the plan management of shipbuilding nodes, implementing intelligent transformation of production lines, and strengthening cost management.

6. New ship prices are rising at a slower pace and diverging trend

The price of this round of new ships began to rise in December 2020, and the increase rate and speed in 2021 were very fast, but the growth rate slowed down significantly and differentiated in 2022. From the Clarkson new ship price composite index, the increase in 2021 is 21%, and the increase in 2022 is only 5%, and the trend differentiation of subdivision ship types is obvious.

At present, the scale of China's shipbuilding industry continues to grow, and the three major indicators of China's shipbuilding completion, new orders and hand-held orders remain the world's leading. The capacity structure adjustment of China's shipbuilding industry has achieved results, and the shipbuilding industry is constantly expanding its industrial scale. With the trend of recovery of the international ship market, the industrial concentration of China's ship industry has maintained a high level, and the backbone ship repair enterprises have accelerated the development of high-end green products, green processes, and decarbonization technologies, and accelerated the practical application of information, digitalization and artificial intelligence technologies.

Affected by the Russia-Ukraine conflict and associated sanctions, regional trade growth and other geopolitical and macro environment changes, the world shipping market is also undergoing structural changes, for the use of Europe (Black Sea/Mediterranean Sea and other routes) and Russian ports more used Suez, Afra and other ship types hot demand; More flexible small and medium-sized container ships, refined oil tanker/chemical tanker and other ship types are also relatively considerable. The average age of the above ship type fleet is about 12 years, which is significantly higher than the large ships of similar ships. In the future, with the arrival of more capacity demand transformation and environmental protection replacement superposition, it will inject greater impetus into the new shipbuilding market. In 2022, the market size of China's shipping industry will be 344.356 billion yuan.

In the past two years, with the substantial growth of new ship orders, the demand for ship supporting equipment has significantly increased, and the capacity of ship distributing enterprises is difficult to rapidly improve in a short time, and the phenomenon of product price rise and supply delay is more common. In addition, due to the impact of the novel coronavirus epidemic, the production cycle of supporting equipment, logistics costs and transportation cycles have generally increased. The supply of some imported supporting equipment is more tight, the average arrival cycle of ship communication, navigation, automatic control system, electronic and electrical equipment is 1-3 months longer than normal, and the arrival cycle of ship chip, crankshaft, piston ring and control system is 3-6 months longer than normal.

In 2022, the number of ship orders in hand in China has once again exceeded 100 million deadweight tons after 6 years, and the average production guarantee coefficient of ship enterprises (the average number of orders in hand/the average amount of completion in the past three years) is about 2.7 years, and the shipping date of some enterprises has been scheduled to 2026. At present, the production tasks of ship enterprises are full, especially with the rapid growth of high-tech ship orders, the demand for skilled labor is greater. In recent years, due to the impact of the new coronavirus epidemic, there has been a large loss of migrant workers in shipping enterprises, and recently due to the increase in the number of infections, the staff attendance rate has decreased significantly, which has exacerbated the labor tension. The contradiction between full production tasks and insufficient labor supply of shipping enterprises has further expanded, and the problem of the stability of labor force has become more prominent.

From January to December 2022, China's shipbuilding completed 37.86 million DWT, down 4.6% year-on-year.

From the perspective of China's ship ownership, in recent years, China's ship ownership has declined, but the overall level is maintained at a high level, and in 2022, China's ship ownership is 125,400, which continues to maintain a downward trend. At present, the overall scale of China's shipbuilding industry has entered the ranks of the world's major powers. From the changes in the share of China's shipbuilding industry in the world shipbuilding market in recent years, it can be seen that the proportion of China's shipbuilding industry in the global market is rising significantly, and China has become one of the world's important shipbuilding centers.

The "2023-2028 China Shipbuilding Industry Market Status and Development Trend Research Report" released by Guanchi Domestic Information Network covers the latest industry data, market hot spots, policy planning, competitive intelligence, market prospect forecast, investment strategy and other contents; The report makes a detailed analysis of product classification, application, industry policy, industry chain, production mode, business model, favorable factors, unfavorable factors and barriers to entry in the shipbuilding industry.

6. Export situation

Among the export ship products, bulk carriers, oil tankers and container ships still dominated, with a combined export value of 13.82 billion US dollars, accounting for 55.9% of the total export value. Among them, the number of Chinese ships exported in 2021 will be 4,691; The export amount was 2,174,229 thousand dollars. The number of ships exported by China in 2022 was 5,692, an increase of 1001 ships compared with the same period in 2021, an increase of 20.6%. In 2022, China's ship exports amounted to US $21626144 million, a decrease of US $78.0885 million compared with the same period in 2021, a decrease of 0.4%.

Vii. Development Trend

Focusing on the decision-making requirements of the Party Central Committee and the work deployment of China State Shipbuilding Group, focusing on promoting high-quality development, the "Fujian Ship" aircraft carrier was successfully launched and named, large cruise ships fully entered the "two-wheel" construction era, and large LNG ships received the first order to face the international market.

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA

- Other Brands