Uncertain 2023, how should food and beverage firmly move forward?

The crude money-burning logic of the Internet and the obsession with digital myths have proved untenable in the consumer business.

With the departure of hot money and the dissipation of the capital bubble, new consumption will eventually return to the right track. Perhaps, when the fickleness and noise subside, the brand players can be more practical and more focused on the cultivation of internal skills.

On the other hand, only after a big reshuffle can the market enter a real virtuous circle.

What food and drink will we need in 2023?

In any case, in 2023, the food and beverage industry will eventually usher in the rotation of the old and the new, the subversion and reshaping of the rules and the establishment of a new order.

At the same time, as a always vibrant evergreen track, 2023 is bound to usher in more and more brands, and the game between various categories will become more subdivided and intense.

So, in this year of uncertainty, what kind of food and drink do we really need? How can brands find their own definite direction?

(1) The eternal theme of health

This year and even in the future for a long time, there is no doubt that "health" will become the main theme of food and beverage innovation.

With the continuous development of social economy and civilization, people's consciousness has been continuously improved and expanded, and new demands have also emerged, among which the demand for food and beverage has gradually derived from the bottom of the survival of food and clothing to the pursuit of physical and mental health.

Therefore, health is an inevitable choice in the process of continuous innovation and development of food and beverage, but the outbreak of the "new crown" black swan event has made consumers realize the rapid improvement of health awareness in a short period of time, thus greatly accelerating the pace of food and beverage innovation towards health.

The major consumer trend insights and analyses released in recent years also confirm that the current trend of food and beverage health is unstoppable.

However, under the major theme of "health", what kind of functional demands can make consumers willing to pay is largely affected by the environment and cognition.

I still remember that for a long time in the past, people's cognition that fat is the culprit that affects health and leads to obesity, so a variety of products under the banner of "low fat" have been popular among consumers.

Later, as the concept of sugar control gradually penetrated from the field of daily chemical to the food circle, in addition, a large number of studies have shown that excessive intake of added sugar can lead to obesity, diabetes, cancer and other diseases, the original beloved sugar instead of fat has become the target of public criticism, from the government, institutions to enterprises, individuals are competing to join the "anti-sugar" team.

In this context, products such as Genki Forest, which focus on zero sugar/low sugar, have become a new fashion that leads the trend.

It can be seen that the health of the product should be based on the trend, and it needs to be built on the premise of the broad cognition of consumers, and make deep insight based on consumer demand.

For example, in the past two years, many foreign authorities released the trend insight can always see the "enhance immunity" related trend prediction. However, returning to the Chinese market, both consumers and brands actually lack a sense of body in this direction.

This is largely due to the difference in epidemic prevention and control policies between China and foreign countries in the past, resulting in the vast majority of Chinese people have not had a personal health threat due to the epidemic.

However, with the opening of epidemic control at the end of 22 years, infection cases across the country continued to rise, and people began to have an urgent demand for enhancing their own immunity. In addition, products that protect or repair organs vulnerable to the attack of the new coronavirus, such as protecting the heart, clearing heat and resolving the lungs, were also sought after by consumers.

Now on January 12, due to rumors of helping to prevent "Yangkang myocarditis", Coenzyme Q10 climbed the Weibo hot search list with search volume skyrocketing 2500%, triggering 100 million + readings and 10,000 + discussions, and many well-known brands related products were out of stock several times.

All these will release a good signal for product innovation in China's health food market in 2023.

At the same time, as everyone said, "COVID-19 is like opening a blind box, but it is particularly unfriendly to the elderly."

On January 17, 2023, at the press conference on the Operation of the National Economy in 2022 held by The State Council Information Office, China's population decreased by 850,000 compared with the end of the previous year, which is the first negative growth in nearly 61 years.

It can be seen that after the baptism of the first wave of the epidemic, coupled with the worsening aging problem in China, healthy food focusing on the elderly in 2023 is also expected to enter a new stage of high-speed take-off.

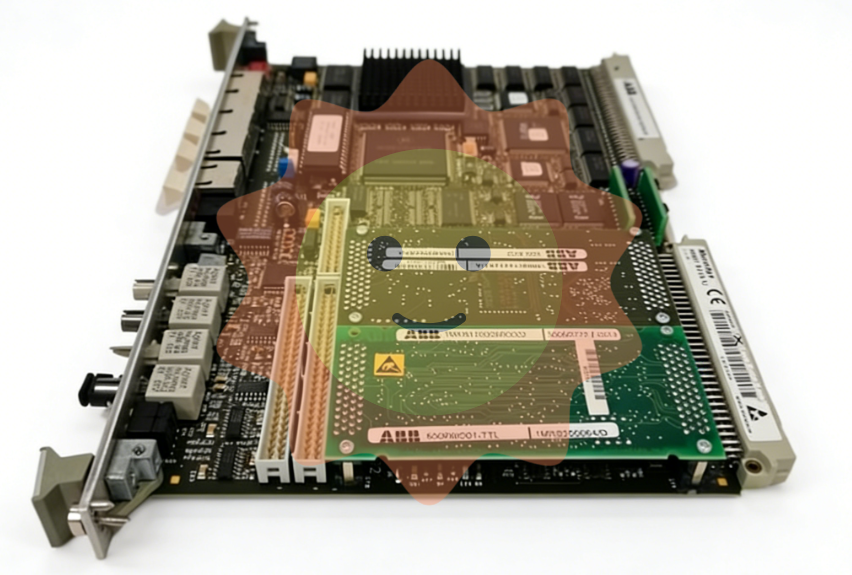

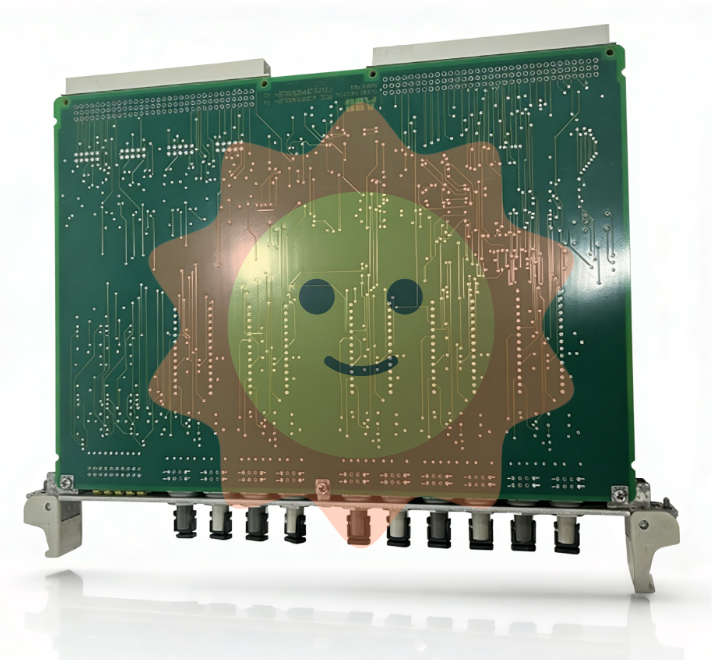

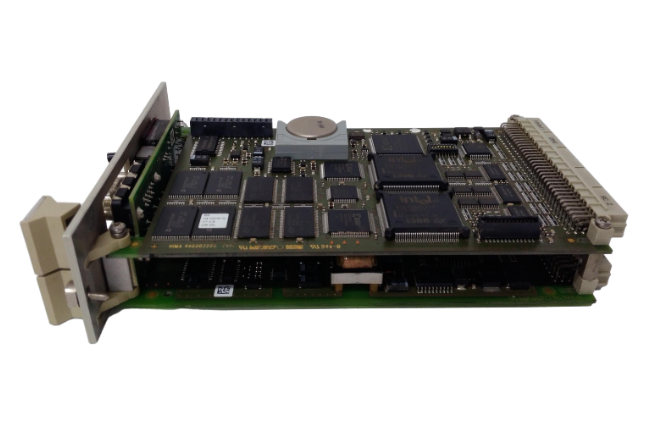

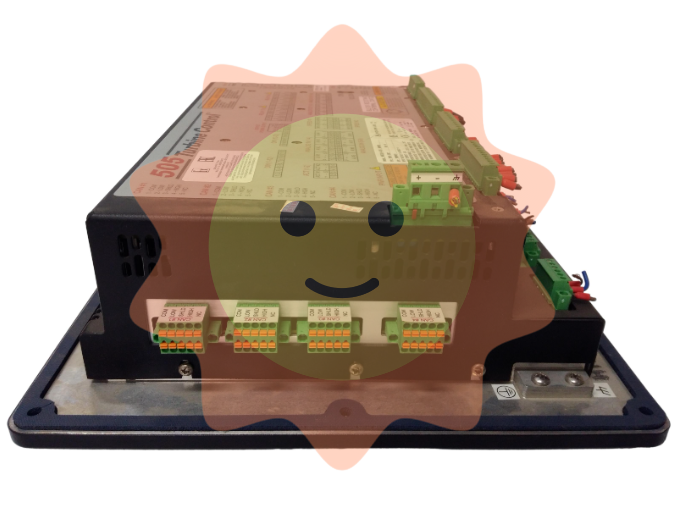

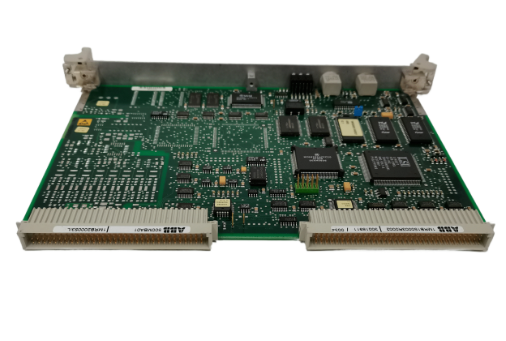

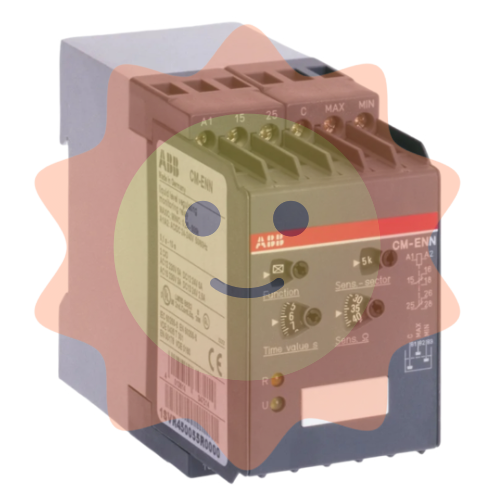

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA