Uncertain 2023, how should food and beverage firmly move forward?

(2) Hoarding under the one-person scenario

It has to be said that the impact of the epidemic on food and beverage and even the entire consumer industry is far more extensive and profound than imagined.

Life goes on, and China's fight against COVID-19 has entered a new phase, but the psychological impact of the last three years of COVID-19 and the projected consumer behavior are still lingering.

"The family has surplus food, the heart does not panic."

The older generation loves to stock up, because they have experienced a shortage of materials, and the subconscious has always been imprinted with the fear of hunger. Therefore, even if the economic level is improved later and the living conditions are comfortable, they still use stockpiling to obtain a sense of security.

In the era of material development and convenient logistics, the emerging generation has also deeply appreciated the taste of "one ration" because of the epidemic.

Many young people from the past disdain to hoard goods to today's habit of hoarding goods, as if the sense of security can only come from full refrigerators and lockers, and this psychological fear in the short term is difficult to be easily erased due to the relaxation of epidemic prevention and control.

Bain & Company and Kantar Consumer Index jointly released the "2022 China Shopper Report Series II" pointed out that the sales volume of China's fast-moving consumer goods market increased by 5.9% over the same period last year, becoming the main engine of sales growth, among which the consumer hoarding behavior spawned by the epidemic is one of the reasons for sales growth. Mintel data also show that the epidemic will lead to a significant increase in hoarding behavior.

Based on this hoarding heat, convenience food and prepared dishes take off and usher in a golden period of rapid development.

It is also worth noting that according to relevant data such as the China Statistical Yearbook, the number of people living alone in China will reach 92 million in 2021, resulting in a lonely economy with huge consumption potential.

When "hoarding" meets "lonely economy", the hoarding demand of a one-person scene may become an effective way for brands to seek differentiation.

Behind the one-person scene is the consumer's need to be independent and take better care of themselves, but also contains a huge emotional gap.

Therefore, the good goods built around this kind of people must have higher standards and requirements, not only to be convenient, but also need to be healthy, rich choices, and have a sense of ritual.

For example, compared with the traditional family clothing with large weight and single taste, the combination of small specifications for one person and a variety of flavors or a more balanced collocation of nutritional components is more friendly to the people living alone and more relevant to their real needs.

In addition, the brand can also skip the inherent limitations of thinking, starting from the consumer's use scenario, in the product form (liquid, solid, concentrated state...) Storage mode (frozen, refrigerated, room temperature...) Food program (ready-to-eat, pre-preparation, DIY...) Other dimensions of innovation consideration, to achieve the combined effect of 1+1>2.

(3) Sustainable "sustainability"

The hot word in the food industry in 2022 must be "sustainable".

Yili, Unilever, Danone, Gengenforest, Mengniu, Budweiser, Danone, Panpan and other enterprises have landed renewable energy carbon neutral factories.

At the same time, on June 5, 2022, Unilever and more than 20 global authorities and leading enterprises such as Vision Technology Group, China Energy Conservation Association, China Quality Certification Center, Shanghai Energy Efficiency Center jointly issued the "Zero carbon factory Evaluation Method" group standard, becoming the world's first complete and quantifiable "zero carbon factory" construction standards and evaluation rules.

With the operation of green factories, coffee, yogurt, ice cream, camellia oil, vegetable meat slices and other zero-carbon (low-carbon) foods have also entered the tables of consumers. In addition, such as Master Kong, Pepsi, Coca-Cola, Nestle, etc., have also launched non-bottle label low-carbon environmental protection packaging products.

If 21 years of the food circle, "sustainable" or just emerging branches of the new shoots, then 22 years is low-carbon products everywhere, "carbon neutral" in the food industry has been fully practiced in the year.

It is predictable that as climate and food crises become more severe, people will eventually begin to extend their health concerns to the whole ecology, exploring how to build a dynamic balance between people and the planet, and more and more people will intentionally apply sustainability to everyday life.

However, if food companies want to walk out of a sustainable road is not overnight, the process is bound to be full of challenges and difficulties, need to do a "protracted war" consciousness. Achieving "carbon neutrality" requires years of investment and accumulation for food and beverage companies, which is bound to require huge time and capital costs.

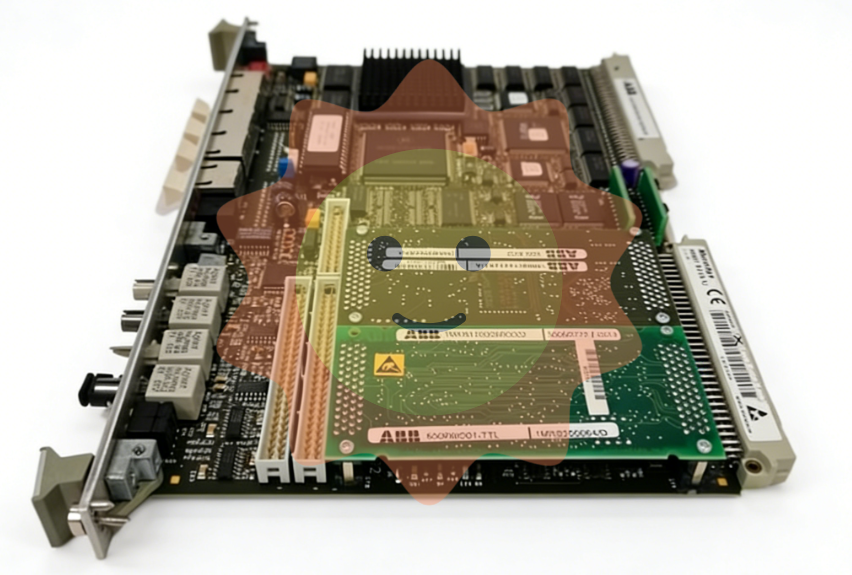

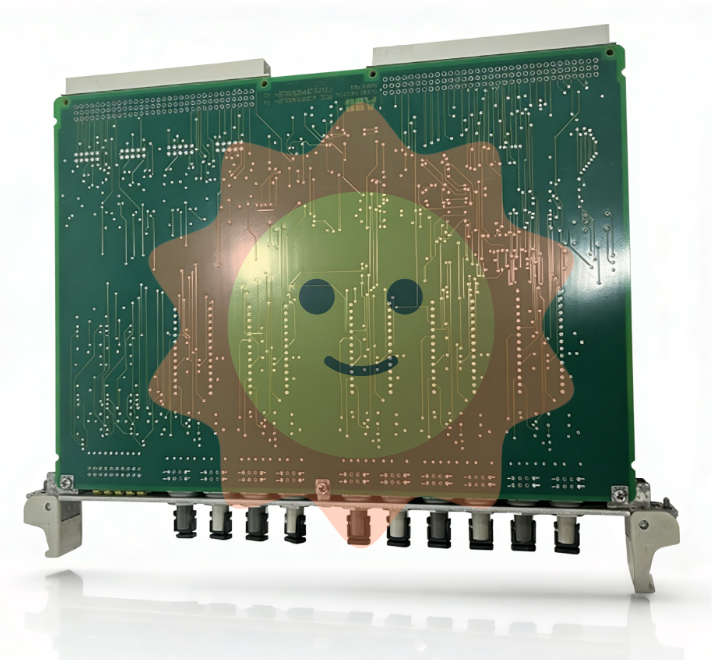

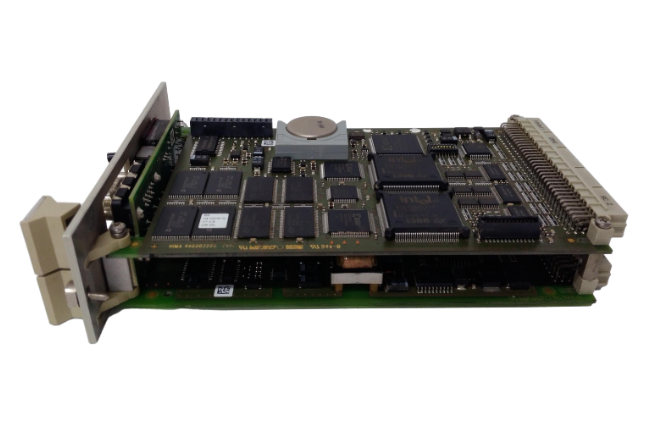

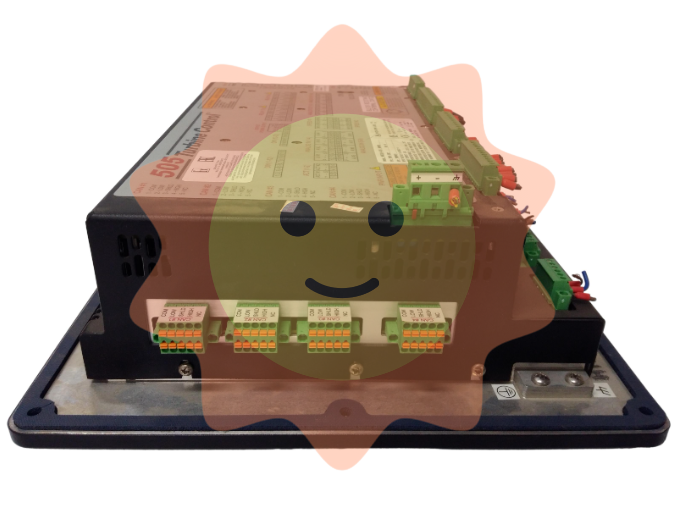

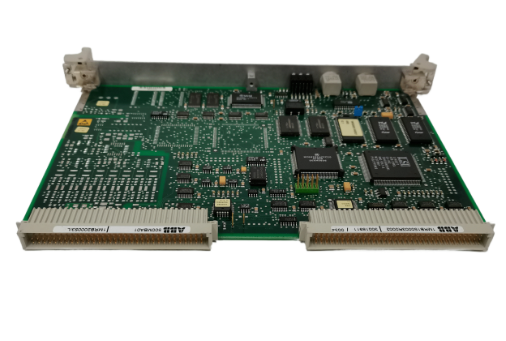

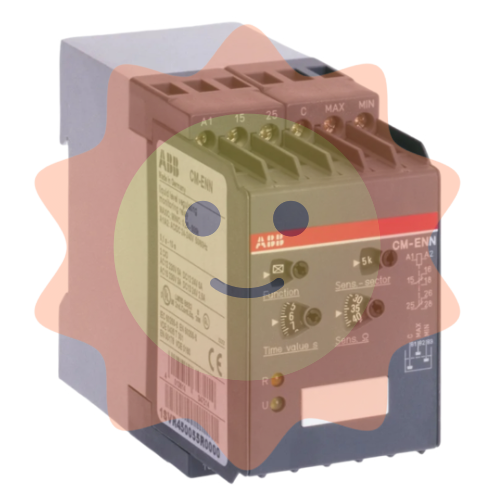

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA