Omni-channel deconstruction of snack food

Different types of snack food companies, channel focus and investment return drivers vary. According to the different aspects of the industry chain, snack companies are divided into three categories: manufacturing, brand retail and chain. From the perspective of ROE disassembly, the manufacturing type is mainly driven by the net profit ratio, and there is a significant positive correlation with the scale effect. Such companies to product polishing as the core, in the creation of multiple growth curves at the same time, through the procurement bargaining power to improve, supply chain system optimization and brand premium increase to promote profit margins, channel side mostly offline as the basic plate, all-channel refined development. Brand retail is mainly driven by equity multiplier and turnover rate, efficiency is supreme and the rest is king, and it is necessary to rely on brand and supply chain to achieve profit margin improvement in the later period.

Such companies operate in multi-category, multi-SKUs and multi-channels, relying on OEM OEM in the upstream, optimizing operational efficiency in the midstream, and relying on their own channels or third-party channels for sales in the downstream, showing the overall characteristics of small profits and high sales, and the net interest rate is mostly in the low single digits due to the two-sided squeeze. The chain driving factors are relatively balanced, due to independent production + own channels, the theoretical profit margin space is higher, but due to the constraints of the management side path, the income ceiling is lower than the retail type. Because the channel of such companies is single-store model, management mechanism and category positioning, this report focuses more on the first two types of companies.

2. Current situation: Under the stratification of consumption, the channel customer base scene is differentiated

The proportion of middle income people increased, but the marginal consumption tendency was differentiated, and the offline market was a new engine for the growth of mass goods and K-shaped growth among categories. According to McKinsey's statistics, 45% of urban consumption in 2020 is mainly contributed by well-off families, and it is expected that by 2030, high-income consumers will drive nearly 60% of urban consumption, becoming the backbone of the future consumer market. From the perspective of consumer products, the marginal consumption tendency of the middle income group has a certain differentiation, the proportion and growth rate of mass consumer goods are weaker than the domestic overall level, and high-end consumption still continues to grow rapidly.

By city, according to Accenture's 2021 China Consumer research data, consumers in high-line markets are more inclined to increase investment in savings, education, healthcare and other fields, while consumers in low-line markets are more willing to spend on consumer entertainment. According to the study on the consumption trend of young and middle-aged people in the county market in 2022, the young and middle-aged people in the offline market have a longer disposable time and spend more than they need, spending an average of 879 yuan on food, tobacco and alcohol per month, which is the main expenditure on daily consumer goods. From the perspective of consumption decision-making, after clarifying the demand, 60% of the respondents surveyed by Accenture said that they would still verify the research through multiple channels and multiple information sources, and consume more rationally and restrained. According to the statistics of Kantar's China Shoppers Report in 2020, taking instant noodles, personal cleaning supplies, clothing washing and infant formula categories as examples, there is a clear phenomenon that the growth rate of low-end and high-end categories is as fast, and the performance of the mid-end category is lagging behind, which again reflects the K-type differentiation of consumption from the micro level.

The retail channel structure is scattered, offline channels are still the main market, and e-commerce and vertical chain maintain positive growth. Disassembling the existing retail channels can be divided into three categories: modern, traditional and online. With the stratification of consumption and the elaboration of the scene, various emerging formats such as member stores, discount stores, category franchises and O2O are derived. From the perspective of target customer groups, member stores, boutique supermarkets, etc. meet the needs of middle and high income groups, discount stores, community group buying and traditional channels meet the needs of customers who pay attention to cost performance. From the perspective of the scene, according to Nielsen survey statistics, member stores can cover an area of more than 5 kilometers; KA stores, BC supermarkets and discount stores improve the coverage radius of about 2 kilometers; convenience stores, CVS, franchise stores and mom-and-wife stores are mostly community stores, completing the last kilometer of contact. Online and O2O supplement the consumption scene from time and space. From the perspective of channel development, e-commerce and franchise stores have maintained positive growth in the past five years, and the remaining channels have been adjusted. Focusing on the casual snacks category, offline channels are still the core and due to the impulse consumption attributes of snacks, the online proportion is about 13% lower than the overall FMCG.

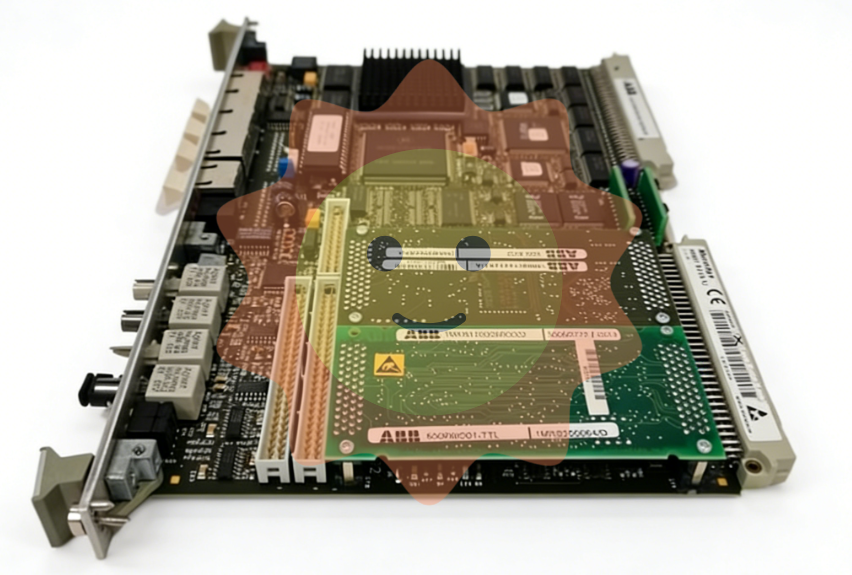

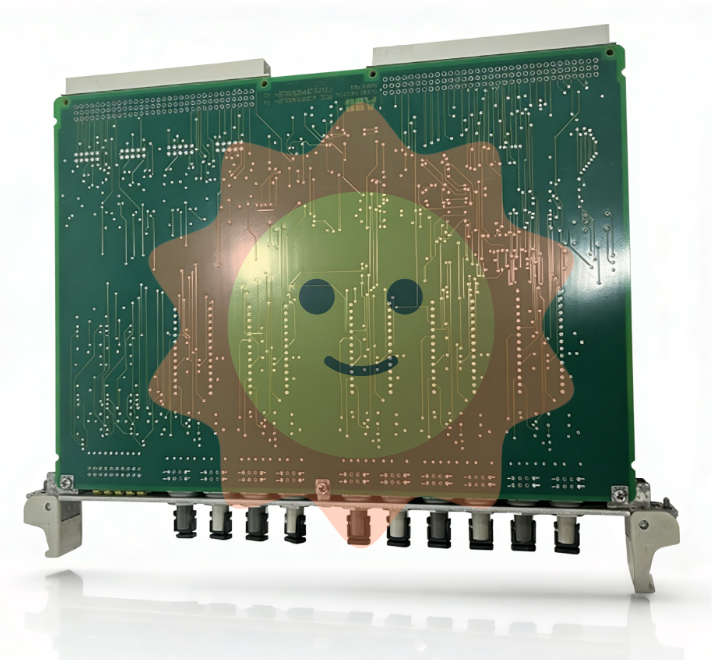

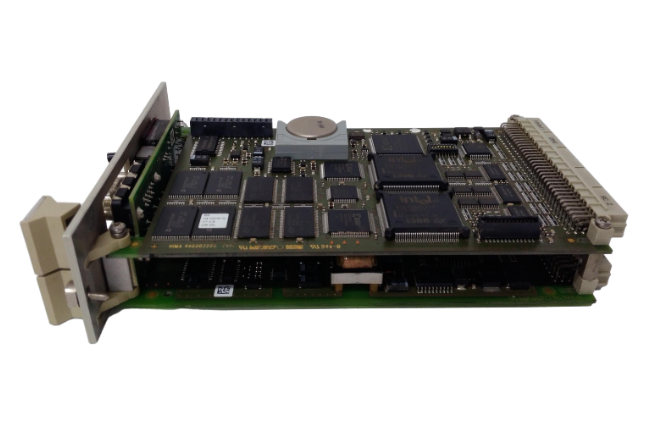

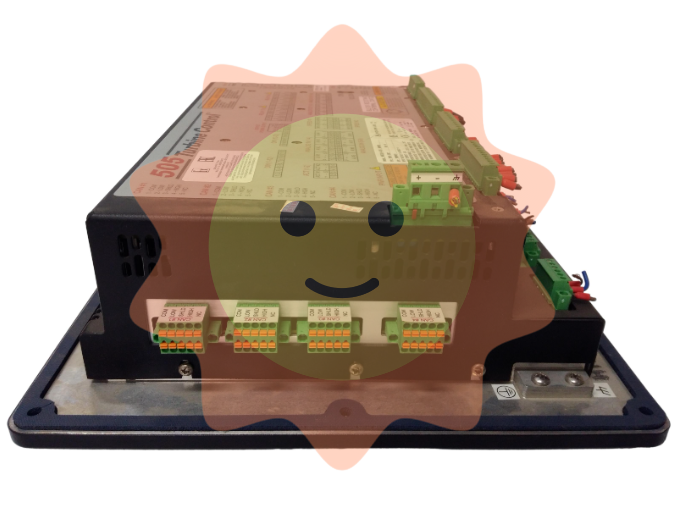

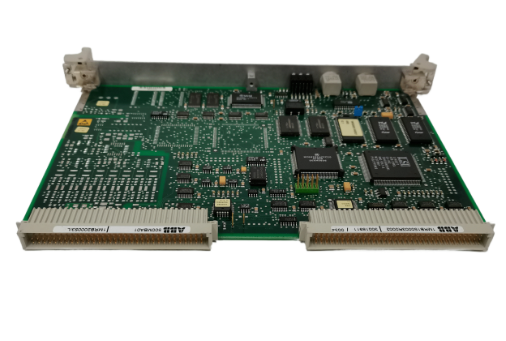

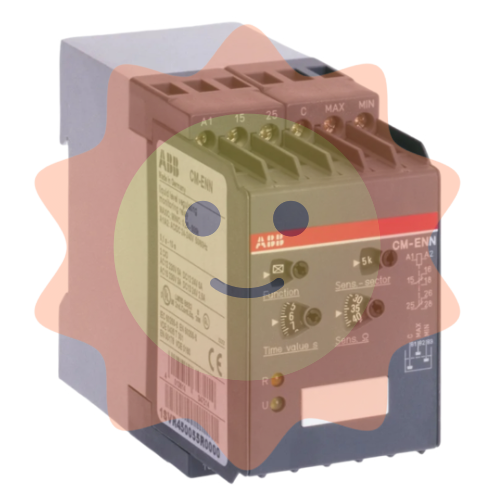

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA