Omni-channel deconstruction of snack food

Considering the complexity of retail channels, this paper disintegrates the characteristics of offline and online channels and combines the cases of snack companies to resume business, so as to better capture the investment opportunities of sub-sectors when the next round of new channel reform dividends rises.

3. Offline channels: member stores + discount stores, new highlights of structure

3.1, high-end member store: focus on the high line, brand endorsement

3.1.1 billion market scale, with its own brands to form differentiated competition

High-end member stores target middle and high income groups, select cost-effective products around the world, reduce costs through mass procurement, operating their own brands, and achieve profits through membership fee income and product price differences. Membership supermarket took shape in China in 1996, 2014-2018 due to the restriction of consumption concept development is relatively blocked, Sam and Metro have resilience, in 2019 Costco settled in Shanghai superimposed small red book and other content e-commerce grass, the local supermarket began to transform to membership supermarket under the network red effect. According to the statistics of the First Leopard Research Institute, from 2016 to 2021, the size of China's membership supermarket market increased from 1.3 billion to 2.7 billion US dollars, with a compound growth rate of nearly 16%.

From the perspective of target customer groups, according to business school research statistics, Sam's Club paying members are mainly in first and second-tier cities, accounting for nearly 60%, mainly 25-45 years old women, mostly white-collar occupations, from the educational distribution of university and postgraduate education accounts for a relatively high proportion. Considering the higher time cost of the middle and high income groups and the higher requirements for quality of life, the membership store selected by SKU becomes the better choice. According to the first leopard research statistics, more than 70% of consumers will go at least once in a month, "goods to find someone" mode channel through cost-effective products to improve the target customer group re-purchase rate and customer unit price level. From the perspective of major brands, Sam, Metro and Yonghui warehouse have more stores and more than 100 potential expansion store space, of which Sam, the most mature model, is expected to add 4-5 stores every year.

Taking Costco as an example, the proportion of groceries is relatively high, and the gross profit rate is lower than that of ordinary supermarkets through self-owned brands to achieve differentiated competition. Through SKU selection, self-owned properties, and supply chain optimization, the net profit rate is relatively stable. First of all, in the category selection, mainly "wide category narrow product", SKU selection to reduce the time cost of consumers, compared with more than tens of thousands of SKUs in traditional businesses, membership supermarkets control SKUs at about 1000-4000.

According to the statistics of the First Leopard Research Institute, Costco and other membership supermarkets in the food and grocery category accounted for about 40%, nearly half of which are private brands, followed by overseas brands, local brands accounted for relatively small, and different channels of the main own-brand category there are differences, such as Sam's main Member's Mark mainly drinks. Costco's Kirkland focuses on nuts, while Box Horse integrates local elements to form misplaced competition. Considering that the membership supermarket has strong bargaining power for upstream brands, low concentration of product selection, and emphasis on supply chain stability, it is expected that the single SKU in the channel has a low ceiling and the replacement rate of about 40% will test product quality and the ability to continue to promote new products. On the contrary, if selected as a supplier of this channel, the products under the brand endorsement are expected to accelerate the promotion to other high-end channels.

3.1.2 Case: Kam Yuen Foods -- Internet celebrity single product "Mustard flavor Macadamia fruit"

Revenue end: The rise of Sam, omni-channel diffusion, brand awareness. According to Baidu index statistics, the search frequency of Sam's Club store increased significantly in August 2021, which corresponds to the rise of the popularity of the "must-buy list" of grass platforms such as Xiaored Book, among which "mustard-flavor Macua" has become a new online celebrity product with its unique taste and better powder layer coating technology, and subsequently triggered the "leveling effect" of major platforms. From the packaging point of view to Sam's "Member's Mark" as the Logo, the supplier and manufacturer are respectively Beijing Wanjiali Food and California wilderness (Bazhou City) food, of which California wilderness is Wanjiali sub-brand, the actual production side is Gan Yuan Food.

According to the company announcement, as of the end of November 2021, the single product wasabi flavored macadamia fruit has a cumulative factory of about 40 million yuan, and many consumers seek affordable alternatives in the network red effect radiation and Sam's Club threshold constraints, and Kam uses the opportunity to launch wasabi flavored macadamia fruit with brand Logo in other channels such as e-commerce. The phenomenon of "out of stock" repeatedly occurred in the short term during the stacking season. According to the company's announcement, the 2021H1 comprehensive nut and bean series revenue was 110 million yuan, 2021H2 increased to 185 million yuan, 2022H1 was 156 million yuan, which was maintained at a high growth range of 40% year-on-year, and also became a new growth pole in the company's product portfolio from the perspective of the proportion.

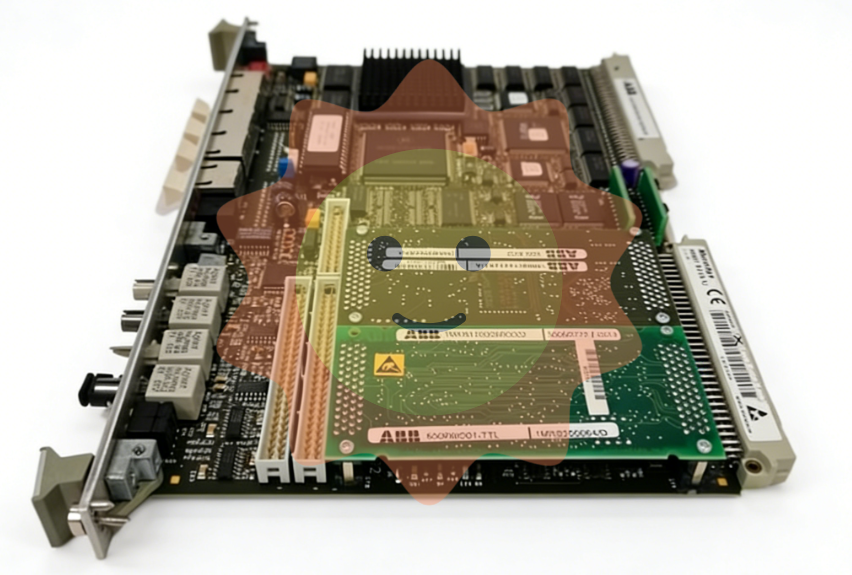

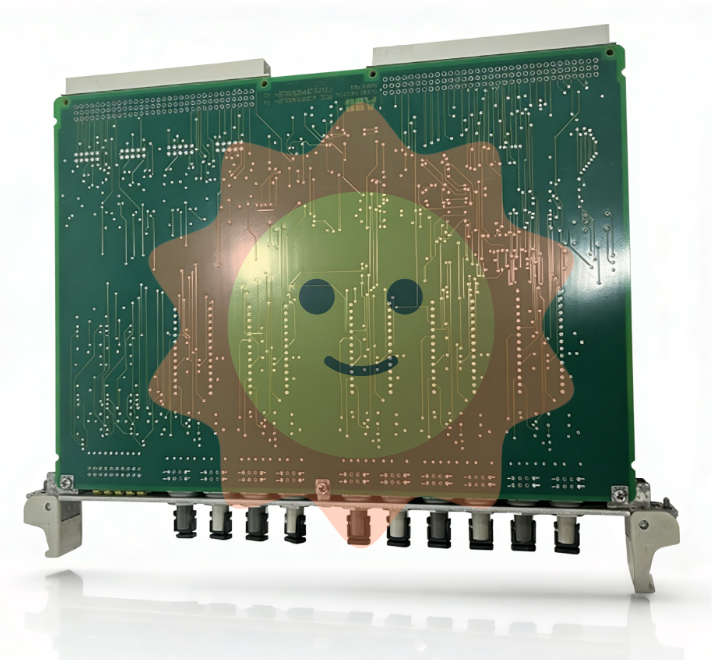

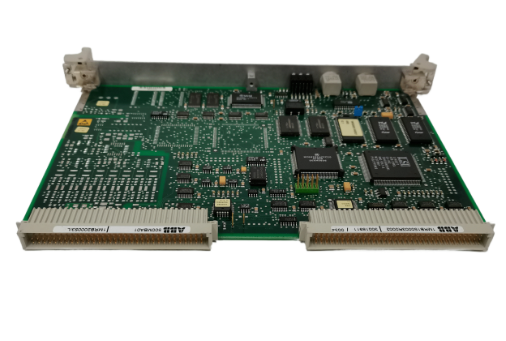

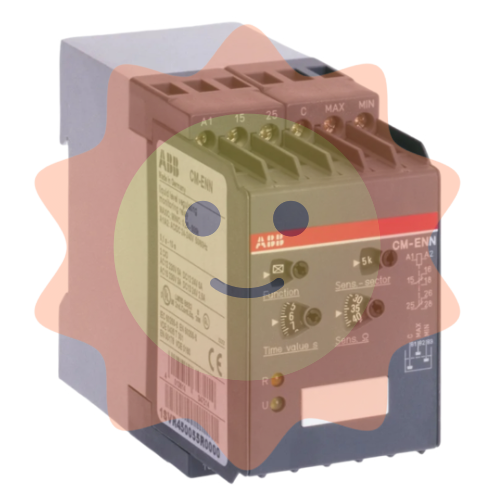

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA