Oil Market Report - November 2023

About this report

The IEA Oil Market Report (OMR) is one of the world's most authoritative and timely sources of data, forecasts and analysis on the global oil market – including detailed statistics and commentary on oil supply, demand, inventories, prices and refining activity, as well as oil trade for IEA and selected non-IEA countries.

Highlights

Chinese oil demand rose to another record high of 17.1 mb/d in September, underpinning global growth. China is set to account for 1.8 mb/d of the total 2.4 mb/d increase that lifts demand to 102 mb/d in 2023. Overall growth is expected to slow to 930 kb/d in 2024. In the OECD, economic headwinds are increasingly apparent, with this year’s slim demand gains giving way to a contraction in 2024.

World oil output increased by 320 kb/d in October to 102 mb/d. Growth in the United States and Brazil is outperforming forecasts, helping to propel global supply higher by 1.7 mb/d to a record 101.8 mb/d in 2023. Non-OPEC+ will again drive overall growth in 2024, projected at 1.6 mb/d. There has been no material impact on oil supply flows from the war between Israel and Hamas that started in early October.

Refinery margins collapsed in October from the near-record levels achieved during 3Q23. Weaker gasoline cracks drove much of the decline, but still-elevated middle distillate cracks ensured margins remain above the five-year average. Global crude runs are expected to rise by 1.9 mb/d in 2023 and 1 mb/d in 2024, to average 82.6 mb/d and 83.6 mb/d, respectively.

Russian oil exports eased by 70 kb/d in October, to 7.5 mb/d, as higher crude oil shipments failed to offset a decline in product flows. Estimated export revenues fell by $25 million to $18.34 billion as lower international oil prices more than offset a narrowing discount for Russian grades versus North Sea Dated. Russian crude and product prices, apart from gasoline and VGO, were above the G7 Price Cap.

Global observed inventories rose by 9.9 mb in September but remain near historical lows. Oil on water rebounded by 25.3 mb and OECD stocks inched up by 2.9 mb while non-OECD inventories declined by 18.3 mb. In 3Q23, crude oil stocks plunged by a massive 141.4 mb and oil product built by 112.7 mb as supply cuts by OPEC+ countries coincided with increased refinery activity.

ICE Brent futures slumped by $8/bbl during October, as the macroeconomic outlook deteriorated and supply fears following the Hamas attack on Israel subsided. Crude’s forward structure eased in tandem with flat prices, as contango returned to prompt WTI time spreads for the first time since July. The price rout continued into early November. At the time of writing, Brent was trading at $82/bbl.

Exceeding expectations

The market rally that pushed benchmark oil prices towards triple digits in September reversed sharply in October, despite continued tight crude supplies and an intensifying conflict in the Middle East. In early November, ICE Brent futures plunged to a four-month low around $80/bbl.

The abrupt sell-off came as market concerns shifted from supply risks to the global economy and oil demand. In addition, front month paper market trade has moved to 1Q24 when markets appear more or less in surplus, adding to the downward pressure on prices. While this more bearish mood may be justified, world oil demand continues to exceed expectations. In this Report, we have slightly revised up our 2023 growth forecast to 2.4 mb/d, as US deliveries proved more resilient than indicated by preliminary data and Chinese oil demand in September set another all-time high above 17 mb/d, fuelled by a booming petrochemical sector. Those gains have come to the detriment of petrochemical producers elsewhere, most notably in Europe and advanced economies in Asia and Oceania. Indeed, the two regions saw 3Q23 oil demand slump by a combined 560 kb/d year-on-year. This year’s surge will take world oil demand to 102 mb/d before growth eases to 930 kb/d in 2024 as the last phase of the pandemic economic rebound dissipates and as advancing energy efficiency gains, expanding electric vehicle fleets and structural factors reassert themselves. Despite growth that is almost two-thirds lower than this year’s increase, global oil demand is set to rise to a record annual high of 102.9 mb/d in 2024.

World oil supply growth is also exceeding expectations. Fears that the war between Israel and Hamas would escalate into a wider regional conflict, disrupting oil supply flows, have yet to materialise. Barring large unforeseen outages, world oil supply is firmly on an upward trajectory, with October output up 320 kb/d m-o-m. Record output from the United States, Brazil and Guyana underpin this year’s 1.7 mb/d increase in global oil supplies, to a record 101.8 mb/d. In 2024, non-OPEC+ producers will continue to lead global growth, projected at 1.6 mb/d, to an unprecedented 103.4 mb/d. A temporary easing of US sanctions on Venezuela in late October is expected to have only a marginal impact on supply, as production increases from the country’s battered oil sector will take time and investment.

Meanwhile, top oil exporters Saudi Arabia and Russia confirmed in early November they would continue with their additional voluntary output cuts until the end of the year. Those cuts look set to keep the oil market in a significant deficit through year-end, with the OPEC+ alliance pumping 900 kb/d below the demand for its crude. Global observed crude oil inventories fell by a massive 140 mb over the third quarter to a fresh low, according to the available data, as refineries boosted activity ahead of seasonal maintenance. With demand growth set to slow, the market could shift into surplus at the start of 2024. For now, with demand still exceeding available supplies heading into the Northern Hemisphere winter, market balances will remain vulnerable to heightened economic and geopolitical risks – and further volatility ahead.

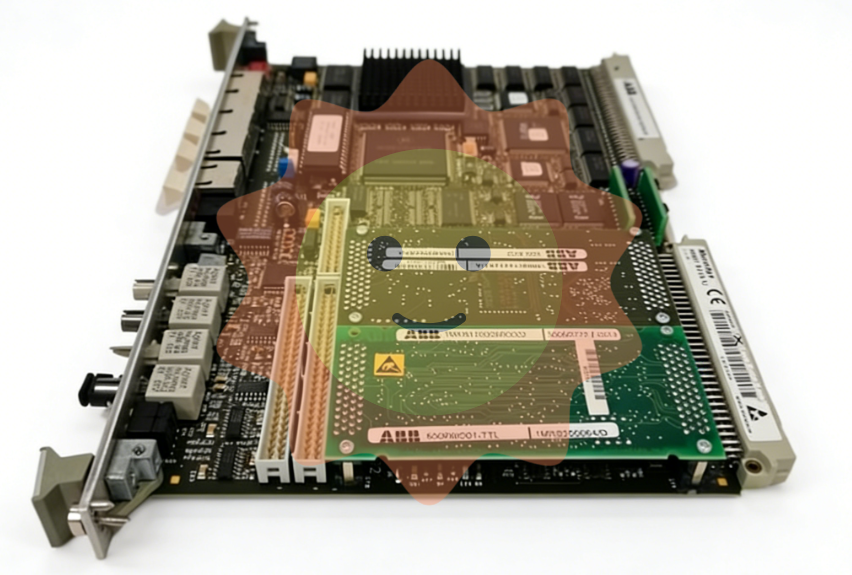

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

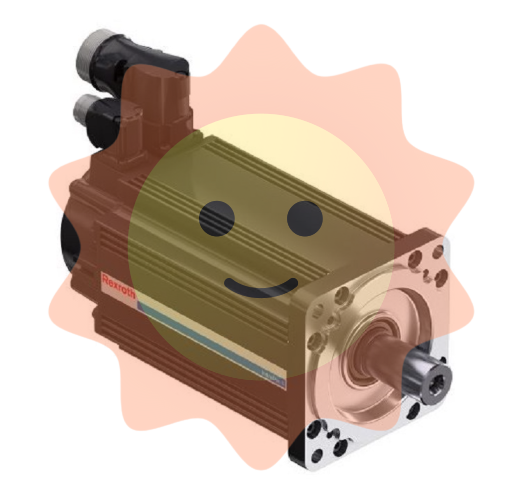

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA

- Other Brands