H1 Global Food and Beverage Trends for 2023, analyzing 4 major innovation opportunities

After the impact of the epidemic for three years, for many industries and enterprises, 2023 is undoubtedly a restart year with numerous hopes. In the blink of an eye, more than half of 2023, in the past six months, macro policies have gradually repaired the economy, the offline doors that have been snubbed for three years are filled with familiar human fireworks, and the cultural travel around the country has also opened the long-lost "special forces" model.

However, looking at the entire consumer market, the market situation seems to be a little different from the "rabbit flying forward" that people have been looking forward to for a long time, and the consumption classification is a fact of sight. On the one hand, everyone's consumption demand is constantly upgrading, and the demand standard is also improving; On the other hand, consumers have also closed their wallets and returned to the rational, on-demand, and measured nature of consumption.

In the face of the increasingly mature consumer market and the increasingly segmented and crowded category track, how to better understand the needs of consumers, establish closer and effective communication with consumers, and make innovative products that consumers are willing to pay for and satisfied with is the common challenge faced by many food and beverage brands.

The market is still variable, and the brand still needs to be solved. In this context, FDL digital food proposes to launch the "2023H1 Global food and beverage Trend Analysis" report by analyzing more than 300 new food and beverage products at home and abroad, and summarizes four high-potential innovation tracks from it, hoping to help everyone get valuable product innovation inspiration and help the consumer market continue to grow.

Trend 1: Healthy ingredients

With the continuous awakening of national health awareness, people's demand for health is also accelerating into the daily diet scene. Eating and drinking have become the necessary self-cultivation in many people's minds.

In terms of healthy eating choices, more and more consumers tend to prefer a more flexible diet, taking the initiative to reduce sugar intake, increase the variety of food choices, and consider choosing low-carb water products. The survey data also shows that 82% of consumers worldwide say they have improved their health through diet changes, and 61% of consumers say they will increase the cost of diet changes in the future.

In order to meet the increasing pursuit of healthy and diversified dietary needs of consumers, FDL food advocate according to the 2023 H1 global food and beverage new product summary found that at present, not only the concept of "ingredient subtraction" has become the mainstream innovative way, but also the "nutrition enhancement" concept products represented by "high protein" and "high fiber" are increasing.

1, ingredients first, to create less and better diet optimal solution

With the continuous improvement of people's health knowledge and awareness, the understanding of sugar reduction and sugar control has become more and more in-depth, and more and more consumers have begun to reflect on and change the traditional high-carbon and high-fat diet. At the same time, after experiencing the COVID-19 pandemic, people are more willing to choose foods and beverages that can bring unique nutritional value in daily life, thereby improving their health.

In the pursuit of component subtraction, fat reduction, sugar reduction, and card reduction have become the TOP3 component subtraction methods that most meet consumer demand in the world, and these three "subtraction programs" are also developing toward the trend of zero fat, zero sugar, and zero card.

In addition, the low-carb diet is also becoming a new trend in global consumption. Research data show that the global low-carbon diet market size reached 27 billion US dollars in 2022, and is expected to grow to 42 billion US dollars by 2027, with a compound annual growth rate of 9.2%. Among them, the Asia-Pacific region is the largest market, accounting for more than 40%, mainly benefiting from the consumer demand of China, Japan, India and other countries and regions.

When it comes to the need for a "nutritionally enhanced" healthy diet, the data shows that 84% of consumers worldwide are willing to pay a higher premium for protein-rich products, while 60% of consumers say the quality and content of protein is their biggest motivation for buying. In addition, the concept of fiber reinforcement has also attracted the attention of consumers, and has become a highlight of differentiation for many domestic and foreign brands.

2023H1 Global food and beverage trends show that 28% of new products advertise low sugar, low fat, low calorie and low carbohydrate water; The number of new products boasting high-protein and high-fiber concepts accounted for 15 percent.

| Product Case

Swedish brand N! CK'S introduces Swedish-style ice cream, which includes 7 new flavors: Mint Choklad, Salta Karamell Swirl, Vanilj Choklad, Triple Choklad, Peanot Choklad Krunch, Strawar Swirl and Choklad Choklad. It is reported that the new product is not only rich in nutritional value, but also has no added sugar, low carbohydrate content and low calories, aiming to meet health-conscious consumers who seek sweet foods.

2, Functionalism, intestinal health, immune promotion, sports nutrition attention

In the face of the increasing pressure of life and work in the new era, sedentary, takeout, and staying up late have gradually become the normal life of people, and a variety of sub-health problems have come one after another, while the repeated three-year epidemic has also made people suffer from both physical and mental torture. In this context, health prevention methods such as diet health care and exercise health care have gradually changed from "supporting roles" to "leading roles".

Over the past two years, 70% of consumers worldwide have taken actions to improve their physical, mental and emotional health. While they are concerned about their own health, they are also concerned about the health of those around them, with 69 percent of consumers concerned about "the health of my family and friends", followed by 50 percent who are concerned about "their own health".

In terms of health issues, relevant surveys show that about a quarter of consumers in the world suffer from digestive health problems, while about 87.6% of people in China have intestinal health problems, and the number of domestic inquiries about intestinal health reached 26.568 million in 2022, an increase of 45.7% year-on-year in 2021.

On the consumer side, FDL Digital Food advocacy research data found that compared with before the epidemic, 85.28% of consumers in China said that they increased the frequency of buying health products, of which 75.86% of consumers regard "strengthening resistance" as the primary purpose of buying and using health products.

In addition to diet health, more and more consumers begin to pay attention to exercise and fitness, which also promotes the consumer group of sports nutrition is gradually expanding from athletes and fitness people to mass consumers, especially silver haired people, women, overweight people as the representative.

Global consumer demand for health diversification is undoubtedly promoting the development and innovation of relevant functional products and raw materials in the food and beverage market. According to H1 Global food and beverage trends in 2023, the proportion of new products with health function claims is 24%, of which intestinal health, exercise support, and immunity enhancement occupy the top three foods with health function claims, 36%, 20%, and 12% respectively. In addition, related products such as anti-fatigue, stress relief, anti-oxidation, and promoting nervous system health are also being launched one after another.

Product case

Rokit Health launches new line of Mind Boost, Immunity Boost and Energy uplift cold brew coffee. The coffee line is made from 100% Arabica beans. Among them, Mind Boost is rich in a variety of B vitamins to support nervous system health and promote mental performance; Immunity Boost is rich in vitamins B6, B12, D, iron, and zinc, which provide healthy support for the immune system. Energy uplift cold brew coffee is rich in natural guarana and taurine to reduce fatigue and provide energy.

3, clean label, natural, simple, healthy and transparent consumption of new requirements

With the continuous improvement of people's living standards and cognition, "clean label" has become a well-deserved new favorite in the food industry, and is favored by the public and businesses. The term "clean label" is translated from "clean label", and there is no clear legal definition of its meaning, which mainly refers to meeting consumers' new requirements for natural simplicity, healthy transparency and ingredient authenticity.

According to FDL, around 71% of consumers worldwide are willing to pay more for brands that have been reformulated to make them "cleaner," with more than 30% willing to pay a premium of more than 20%.

The research on the Asia-Pacific market also shows that consumers from China pay the most attention to food labels and ingredients, about 85% of Chinese consumers will pay attention to the ingredient list when buying food, and have a strong resistance to artificial additives and other "unclean" ingredients.

In order to meet the needs of more and more consumers for the simplicity, transparency and authenticity of food, "clean label" is gradually becoming a unique marketing point for food businesses at home and abroad. H1 Global Food and Beverage Trends in 2023 show that natural ingredients, no artificial additives, and gluten-free are the main innovation directions for clean labels, accounting for 18%, 15%, and 8%, respectively, in addition to the number of non-GMO, organic concept products is also gradually rising.

Product case

Mac Nut Kiki Milk (organic Macadamia Nut Milk) by PlantBaby is made with 100% organic ingredients, including macadamia nuts, cashews, Brazil nuts, germinated pumpkin seeds, oats, coconut sugar, coconut and Marine minerals, and is free of common allergens such as vegetable oils, edible gums, refined sugars, soy or gluten. It is a natural and clean labeled milk substitute.

Trend two: Environmentally sustainable

In addition to the pursuit of more nutritious, healthy, natural and simple ingredients in the diet, consumers have also begun to investigate whether the source of the purchased products, planting methods, and trading methods are in line with their own values. Especially under the global trend of promoting environmental protection and sustainability, people begin to expand their health concerns from human beings to the whole ecology when choosing food, and actively explore the sustainable dynamic balance between people and the earth.

The ADM survey found that 49% of consumers worldwide said they have changed many bad eating habits in the past two years in order to live more environmentally friendly lives.

At the same time, consumers are particularly focused on reducing their own food waste in their daily lives, so they have the same expectations for food companies to improve their environmental awareness. According to Innova, more than three out of five consumers worldwide say their trust in a brand increases when the brand is more honest about its environmental challenges and efforts.

So, in product innovation, how can food and beverage use sustainable trends to empower products?

According to H1 Global Food and beverage Trends in 2023, environmentally sustainable new products account for 20% of H1 new products, of which plant-based ingredients and sustainable packaging are the main innovation directions, and representative products include plant-based milk, plant-based meat, plant-based seafood, plant-based snacks, sustainable packaging, etc.

1, health and environmental protection, sustainable diet gradually "planted" into daily life

The biggest feature of plant-based is to replace animal protein in food with plant protein, from the name, it has a more natural connection with us; From the function point of view, it has great environmental protection significance to the environment and animals; At the same time, compared to animal protein products, plant-based products are more in line with the new generation of consumers' pursuit of healthy eating.

At the consumer end, the consumption heat and attention on plant-based products are rising. According to the data, 52% of consumers worldwide say they are flexitarians, and nearly two-thirds of them are willing to try adding plant-based foods.

In terms of product selection, Innova market Insights data shows that consumers' focus on plant-based products has fallen to sixth place in terms of "better simulated meat/dairy products", while the demand for "independent plant-based products, non-simulated meat/dairy products" has risen to third place.

Based on the continuous improvement of consumers' awareness of health, environmental protection and sustainability, coupled with more and more people starting to actively choose vegetarian food, the commercialization process of plant protein products has been further accelerated, and the plant-based food market has ushered in a golden period of development.

H1 Global Food and Beverage Trends in 2023 show that as many as 45% of products boast plant-based ingredients in environmentally sustainable trends, and the research and development focus of plant-based products has shifted from imitation of meat and dairy products to the optimization of the product itself and more independent market segments.

Product Case:

Schouten Europe has launched a new plant-based fillet designed to meet the growing consumer interest in fish alternatives and the resulting purchase demand. It is made from a mixture of wheat and rice and has a texture and taste similar to cod. In addition, the new product is crisp on the outside and soft on the inside, and can be used as an alternative to foods such as fish and chips or fish tacos.

2. Green packaging to create a renewable cycle with both responsibility and appearance level

In the process of purchasing food, packaging is often one of the most intuitive factors affecting consumers' decisions. Especially when sustainability becomes an important issue at the moment, how to create green packaging with both responsibility and appearance level is the top priority of this issue.

The so-called green packaging, also known as sustainable packaging, mainly includes two types of recyclable and biodegradable. Among them, recyclable packaging: usually marked with a "widely recycled" logo or plastic resin id, used to remind consumers whether it can be reused, such as plastic, glass, metal, etc.; Biodegradable packaging refers to the fast decomposition of packaging materials, which can be decomposed into environmentally friendly materials through composting, such as recycled cardboard and paper.

In 2022, more than 50% of consumers worldwide are willing to pay a premium for sustainable packaging. As consumers show a strong concern and emphasis on sustainability, more and more brands are also starting to work on packaging. According to the H1 Global Food and Beverage Trends Report 2023, the proportion of sustainable green packaging is as high as 23%.

Product Case:

Boxed Water has launched a new product, Boxed Water Watermelon Water, which is packed in a 92% plant-based carton with a plant-based lid. The packaging is made of FSC-certified sustainable tree waste. For pulp and bioenergy production. In addition, the product contains no artificial sweeteners and is pure natural fruit flavor.

Trend 3: New experiences for taste

Affected by the COVID-19 epidemic in the past three years, people not only have higher requirements for physical health, but also have increasing demands for mental and emotional health. Despite the current economic climate, consumers continue to crave pleasurable, indulgent experiences with food.

In fact, in addition to ingredients and packaging, flavor is also one of the important factors affecting consumers' choice of products, because food and beverages can not only provide consumers with health and other benefits, but also enhance their sensory experience. Especially under the influence of the epidemic, food has become an important choice for consumers to heal their body and mind, obtain a sense of pleasure, and soothe their emotions.

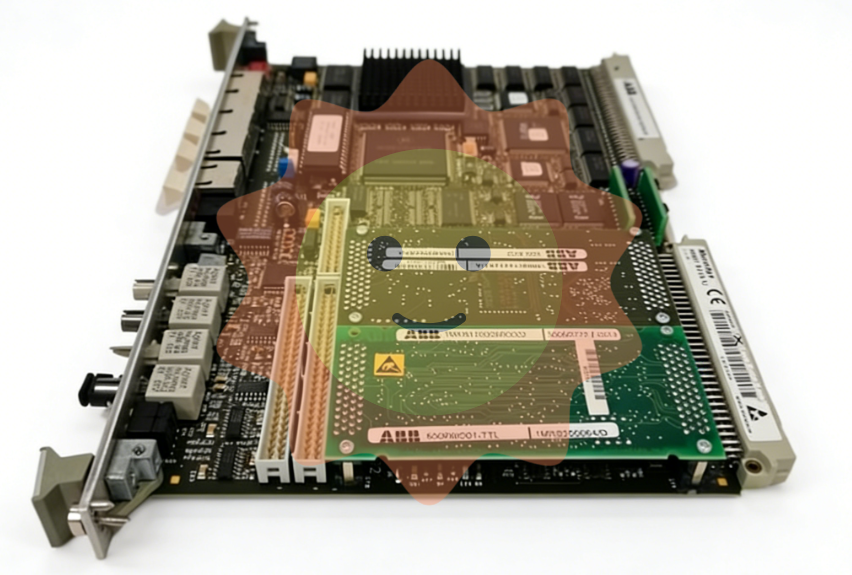

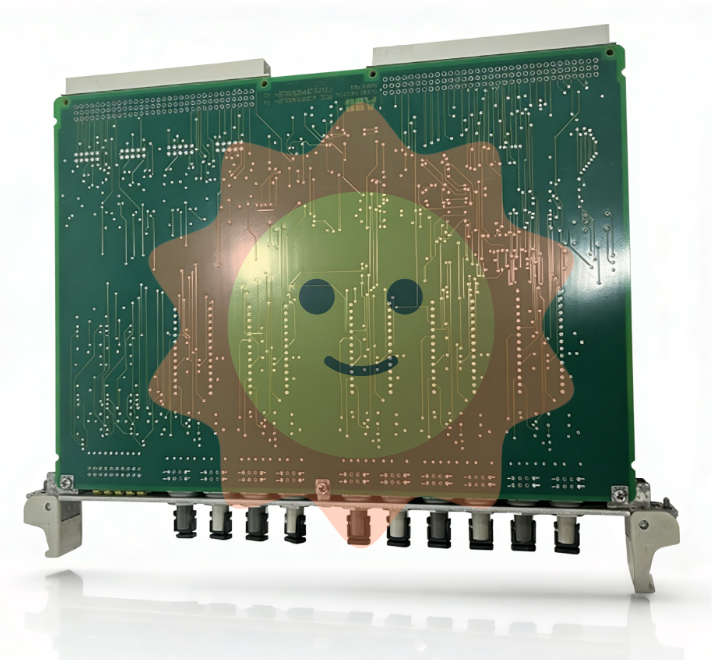

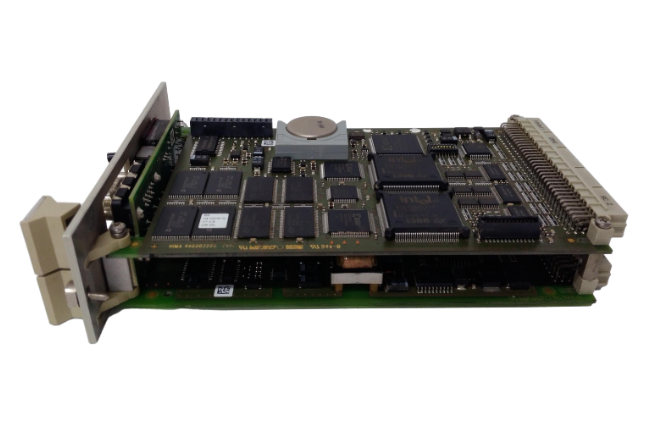

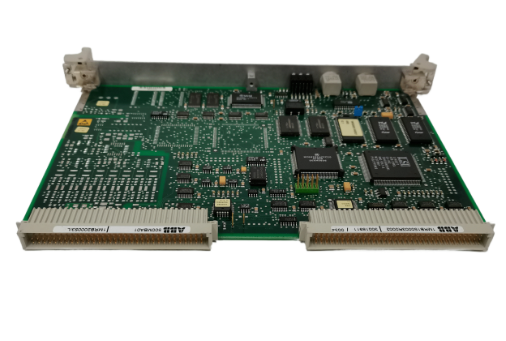

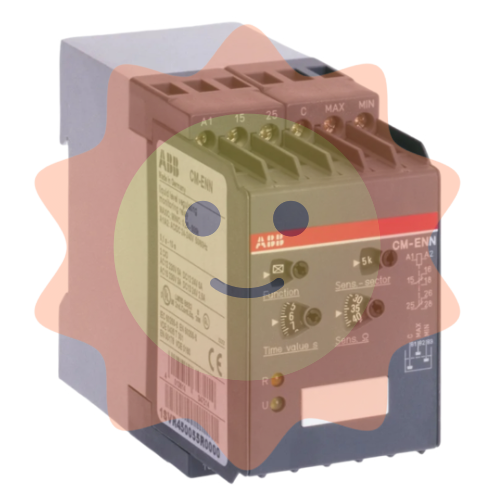

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

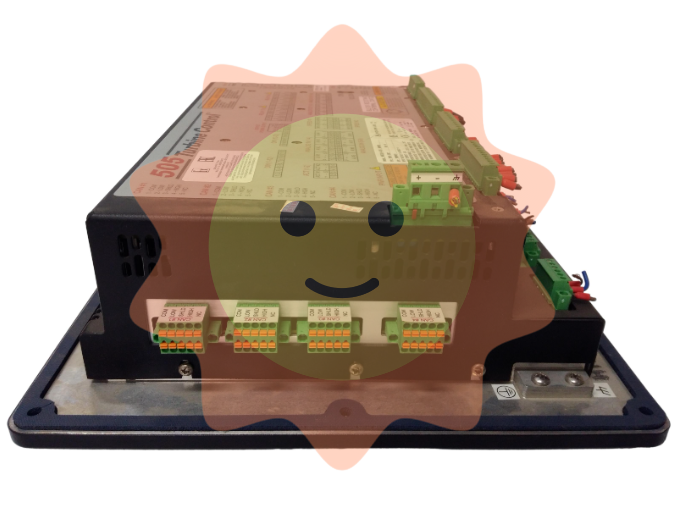

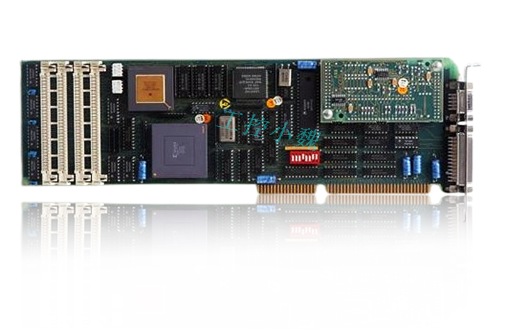

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA