Under the background of stable coal supply and price, coal-fired power generation industry

1. Basic situation of coal-fired power generation industry

1.1 Thermal power is mainly coal-fired power generation

At present, China comprehensively uses a variety of different ways to generate electricity, including thermal power generation, hydroelectric power generation, wind power generation, solar power generation, nuclear power generation and so on. In terms of installed capacity, by the end of 2021, China's installed capacity of generating units was 2.377 billion kilowatts, of which thermal power, hydropower, wind power, solar power and nuclear power units were 12.97, 3.91, 3.28, 307 and 53 million kilowatts, respectively. The proportions were 54.56%, 16.45%, 13.82%, 12.90% and 2.24%, respectively. In terms of power generation, the power generation capacity of power plants above designated size in 2021 will be 8.11 trillion KWH, of which the power generation capacity of thermal power, hydropower, wind power, nuclear power and solar power will be 5.77, 1.18, 0.57, 0.41 and 0.18 trillion KWH. The proportion was 71.13%, 14.60%, 6.99%, 5.02% and 2.26%. Overall, China's thermal power unit installed capacity accounts for more than 50%, thermal power generation accounts for more than 70%, thermal power is an important source of power in China.

The principle of thermal power is to use the heat energy generated by burning coal and other combustible materials to heat water, thus producing steam. Steam drives the steam engine and produces mechanical energy. The steam engine runs the generator and produces electrical energy. Generally speaking, thermal power generally refers to coal-fired power generation, gas power generation, fuel power generation, biomass power generation and so on. By the end of 2021, the installed capacity of coal-fired power units in China will reach 1.109 billion kilowatts, accounting for 85.52% of the installed capacity of thermal power units. The installed capacity of gas units was 109 million kilowatts, accounting for 8.37%; The installed capacity of other units was 79 million kilowatts, accounting for 6.11%. The installed capacity of coal-fired units accounts for more than 80%, and thermal power is mainly coal-fired power generation.

1.2, coal power industry chain

In terms of the industrial chain of coal-fired power generation, the upstream is mainly composed of the thermal coal industry, and the representative enterprises are China Shenhua and Shaanxi Coal Industry. The coal-fired power generation industry is in the middle of the industrial chain, and the representative enterprises mainly include Huaneng International and Huadian International. The downstream is mainly composed of the power grid industry and power users, and the representative enterprises of the power grid industry are mainly the State Grid and the Southern Power Grid, etc. The power grid company transmits power to the terminal power users through the transmission and distribution network.

Located in the upstream of the thermal coal industry is a cyclical industry, we combed the data of 18 enterprises in the Shenwan thermal coal Index, 2017-2021 average gross margin and average net margin between 24% and 31% and 2% to 12%, respectively, profitability fluctuation is large. In addition, we combed the data of 27 enterprises in the Shenwan Thermal Power Index, and the average gross profit margin and average net profit margin in 2017-2021 were between 1% and 18% and between -9% and 8%, respectively, with large fluctuations. Generally speaking, when the price of thermal coal rises, the profitability of thermal coal enterprises will increase. As thermal coal is the main raw material of coal-fired power generation enterprises, with the price of thermal coal, the profitability of coal-fired power generation enterprises will decline. The same goes for thermal coal when prices fall. Therefore, the profitability of midstream coal-fired power generation enterprises and upstream thermal coal enterprises shows a reverse change relationship.

1.3. Market concentration is expected to increase

In terms of market competition, we have sorted out the data disclosed by the listed companies in the industry. By the end of 2021, the installed capacity of coal-fired units of Huaneng International, Guodian Power, Datang Power, Huadian International and Zheneng Power is 9211.82, 7739.96, 4795.40, 4236.00 and 2887.50 million kilowatts, respectively. The proportions were 8.31%, 6.98%, 4.32%, 3.82% and 2.60%, respectively. The total installed capacity of coal-fired power units of the five listed companies accounts for 26.03% of the country, and the market competition pattern is relatively dispersed, mainly because local governments usually hold and support local thermal power enterprises in order to ensure power generation and electricity consumption, such as Zhejiang Power Company listed in Zhejiang Province and Guangdong Power company listed in Guangdong Province.

We believe that China attaches more importance to the control of energy consumption of coal-fired power generation. In 2021, the National Development and Reform Commission issued the Notice on the transformation and Upgrading of National Coal power Units, requiring further reduction of energy consumption of coal power units, and in August 2022, the National Energy Administration issued the Standard on Further Improving energy Efficiency and Flexibility of coal power plants. It is required to promptly integrate and revise the binding standards related to the assessment of coal power efficiency and flexibility, such as the energy consumption quota of unit product of conventional coal-fired generating Units, and the future energy consumption standards may be further improved. Some thermal power plants with weak technical strength and financial strength are more difficult to promote the transformation of coal power units, will not be able to meet the stricter energy consumption standards, superimposed by high coal prices, such thermal power plants will lose market competitiveness. According to the data of the enterprise check, as of October 2020, there are 11,400 existing thermal power-related enterprises in China, but as of February 2022, there are only 4,276 existing thermal power-related enterprises in China. Taking Guangdong Electric Power A as an example, in 2021, the holding subsidiary of Guangdong Electric Power A acquired the capacity indicators of small thermal power units of Huangpu Power Plant and Yunfu Power Plant to improve its own strength. We believe that in the process of stricter energy consumption standards, large thermal power plants with strong comprehensive strength may merge and integrate some small and medium-sized thermal power plants, so the market concentration is expected to increase.

2, mainly coal-fired power generation thermal power will help ensure the demand for electricity

2.1. Electricity demand is expected to increase

From January to July 2022, the electricity consumption of the whole society was 4.93 trillion KWH, an increase of 3.40% year-on-year. By quarter, electricity consumption in the first quarter was 2.04 trillion KWH, an increase of 6.20%. Electricity consumption in the second quarter was 2.05 trillion KWH, up 2.04% year on year. Electricity consumption in July was 0.83 trillion KWH, up 7.30 percent year on year.

The growth rate of electricity consumption in the second quarter was slower, mainly because the epidemic spread in many places around April affected the start of production, resulting in the impact of electricity demand. In May, the cumulative growth rate of industrial added value and the cumulative growth rate of electricity consumption were the lowest values from January to July, and the two indicators gradually improved from June to July. In June, the epidemic situation eased, and the stable economic policy promoted the recovery of industrial production. At the same time, the continuous high temperature in many places led to increased demand for cooling electricity, and the year-on-year growth rate of electricity consumption rose in the month. The growth rate of electricity consumption accelerated further in July, mainly because industrial production continued to recover and China ushered in a prolonged hot weather. The national average temperature in July was 23.2 ° C, 1 ° C higher than the same period of the year, and the daily maximum temperature of 245 national meteorological stations exceeded the historical extreme value in July. At the same time, the average number of high temperature days in July was 5.6 days (daily maximum temperature ≥35℃), 2 days more than the same period of the year, and the second most in the same period since 1961 (second only to 2017).

As of August 30, the National Meteorological Center had issued a high temperature alert for 41 consecutive days, including 12 consecutive days of red alert, the highest level, from August 12 to 23. We believe that in the short term, higher temperatures will increase the frequency of use of appliances such as air conditioners, thereby increasing electricity demand. In the medium term, since June, the epidemic has been relatively controllable, the epidemic has been alleviated in areas to speed up the resumption of work and production, and the steady economic policies have continued to exert their strength, and the relevant policies and measures to promote consumption, promote employment, promote foreign trade, and expand effective investment are expected to gradually land. With the weakening of the impact of the epidemic and the continuous efforts of stable economic policies, industrial production is expected to continue to recover, and the demand for electricity is expected to increase. In July 2022, the China Electricity Union estimated that the electricity consumption of the whole society in 2022 would be 8.75 trillion-8.83 trillion KWH, with a year-on-year growth rate of between 5% and 6%. According to this estimate, the electricity consumption of the whole society in August to December this year is about 382-390 trillion KWH, with a year-on-year growth rate of about 6%-8%.

2.2. Thermal power, mainly coal-fired power generation, will help ensure power supply

From January to July 2022, the power generation of power plants above designated size in China reached 4.77 trillion KWH, an increase of 2.75% year-on-year. Among them, hydropower power generation reached 0.73 trillion KWH, an increase of 16.66% year-on-year, mainly because of the abundance of water from many important rivers in China in the first half of the year. According to the disclosure of key companies in the hydropower industry, Yangtze River Power said that in the first half of 2022, the total amount of incoming water from Xiluodu Reservoir in the upper reaches of the Yangtze River was about 50.97 billion cubic meters, 74.43% higher than the same period last year, and the total amount of incoming water from Three Gorges Reservoir was about 177.279 billion cubic meters, 27.47% higher than the same period last year; Huaneng Hydropower said that in the first half of 2022, the inflow of Xiaowan and Nuozhadu sections in the Lancang River basin exceeded 30% compared with the same period last year. In the second quarter, there was a surplus of water in the Yalong River basin, according to State Investment Power. At the same time, according to the data of key hydropower stations, the reservoir water level of the Three Gorges Hydropower Station and Panjiakou Hydropower Station in the second quarter was significantly higher than in previous years. The high water level of the hydropower station resulted from the abundant inflow of important rivers, and the abundant hydropower resources drove the power generation equipment to generate electricity. In the first half of the year, the average utilization of hydropower generation equipment was 1,691 hours, an increase of 13.03% year-on-year, thus promoting the substantial growth of hydropower generation.

In September 2020, China proposed at the 75th session of the United Nations General Assembly that it will strive to achieve the goal of peaking carbon emissions before 2030 and achieving carbon neutrality before 2060. In order to achieve the strategic goal of carbon peak and carbon neutrality, China has introduced a number of policies to continue to promote the development of new energy power generation industry with zero emission advantages, and the corresponding installed capacity has been rapidly increased. By the end of July 2022, China's installed capacity of wind turbines was 344 million kilowatts, an increase of 17.26%. The installed capacity of solar power generation units was 344 million kilowatts, an increase of 26.71%. The rapid increase in installed capacity has led to a rapid increase in power generation. From January to July 2022, the wind power generation of power plants above designated size in China was 0.39 trillion KWH, an increase of 18.55%. Solar power generation from power plants above designated size reached 0.13 trillion KWH, up 27.07% year on year.

From January to July 2022, the thermal power generation of power plants above designated size in China was 3.29 trillion KWH, down 2.04% year-on-year. We believe that on the one hand, the year-on-year decrease in thermal power generation is due to the year-on-year increase in power generation of other energy sources, including hydropower, which has more power generation in the first half of the year due to excessive water supply, and the rapid increase in installed capacity of wind power and solar power generating units, resulting in a faster growth in power generation. On the other hand, because the price of thermal coal is relatively high, the cost of thermal power generation is high, which restricts the willingness of thermal power enterprises to generate power

Since mid-September 2021, more than 10 provinces, including Zhejiang, Jiangsu, Guangdong, Shandong, Liaoning, Jilin and Hunan, have experienced power shortages, power rationing and production stoppage, affecting residents' quality of life and economic development. In this context, China attaches great importance to ensuring the supply of electricity. In December 2021, the Central Economic Work Conference stressed that the regulation of coal, electricity, oil and gas transportation should be strengthened in 2022 to promote adequate power supply. In May 2022, the National Regular Session pointed out that to ensure the normal supply of energy, and never allow power rationing. In July 2022, SASAC stressed that central enterprises should take strong measures to effectively enhance the ability of energy and resources supply security, jointly fight to win the battle of energy and power supply guarantee for the peak summer, and do a good job of preparing for energy and power supply guarantee this winter and next spring. In August, Sichuan, Chongqing and other places experienced extreme weather of high temperature and drought, which affected hydropower generation.

At the same time, hydropower has obvious seasonal characteristics, which is mainly manifested in the periodic change of hydropower generation due to the influence of the river's wet period and dry period. In general, there is more water flow in the rainy season, which drives hydropower plants to generate electricity, and hydropower generation usually peaks in July each year, and then gradually declines in each month. Therefore, in the next few months, China's hydropower generation will decline, and wind power, solar power and other new energy generation capacity is still small, temporarily unable to meet the larger electricity demand, so thermal power demand is expected to increase.

The National Energy Administration said that under the current technical conditions and installed structure, coal power is the most economically feasible, safe and reliable flexible power supply, and coal power will continue to play an important role in ensuring China's energy and power security for a long time. In the medium and long term, the development of new energy sources such as wind power and solar power generation in China started relatively late, and the power generation is restricted by natural conditions such as wind conditions and sunshine time, which is more unstable. The installed capacity of thermal power is relatively large, and thermal power generation is not restricted by external factors such as seasons and natural gas (high thermal power generation in winter and summer is mainly for thermal power plants to actively increase power generation to meet the needs of heating, cooling and other electricity needs of the whole society), and in the future, thermal power based on coal-fired power generation will remain as the main power source for a long time to help power supply.

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

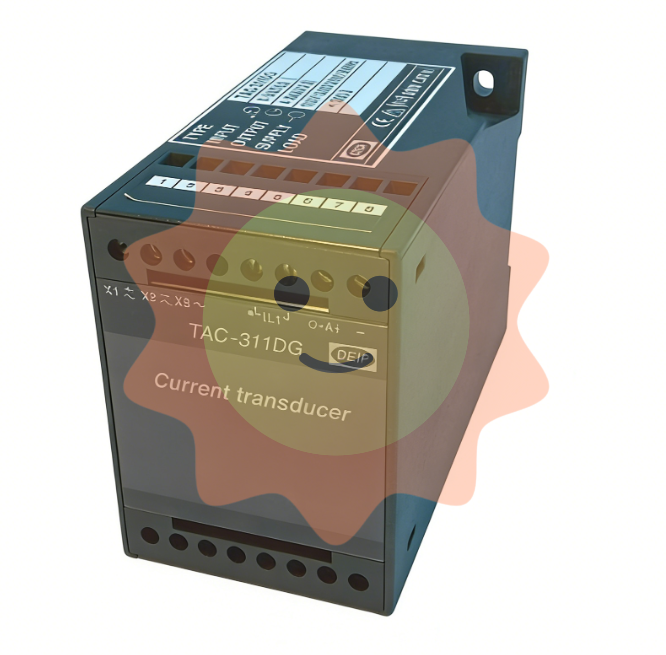

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA

- Other Brands