Operation analysis of China's chemical fiber industry in 2022 and outlook in 2023

2022 is a very extraordinary year, and the internal and external development environment facing China's chemical fiber industry is becoming more complex and severe. Under the overlapping impact of multiple complex factors such as repeated epidemics, geopolitical conflicts, and high inflation, the global economic downturn is obvious, and the "triple pressure" of domestic demand contraction, supply shock, and weaker expectations has also increased, and the operation of China's chemical fiber industry has encountered unprecedented challenges. High crude oil prices fluctuate significantly, downstream demand continues to be depressed, resulting in a decline in the industry load, profitability pressure is more prominent. However, under the overall severe industry situation, the operation of the chemical fiber industry is still no shortage of bright spots. The domestic carbon fiber industry still maintains a high prosperity, and the market demand continues to increase; Under the guidance of the national new development concept and the "double carbon" goal, the scale of bio-based fiber industry has maintained rapid growth; The pace of research and development of differentiated and functional fibers is accelerating, and enterprises with good product development, good brand and high degree of internationalization are relatively less affected by market fluctuations; Exports still maintained a good growth trend, and the export volume of chemical fiber reached a new high.

First, the basic operation of the chemical fiber industry in 2022

(1) The production of chemical fiber slowed down and the output grew negatively

In 2022, the production and marketing pressure of the chemical fiber industry will increase, and the overall on-load will decrease significantly compared with 2021. In the first three quarters, there were two obvious load reduction periods in the industry from March to April and from July to August. The former was due to sporadic epidemics in many places, especially in Shanghai and the Yangtze River Delta, which had a greater impact on logistics transportation and internal circulation consumption demand. The latter is due to the traditional off-season, facing the pressure of high inventory and weak demand, superimposed in some areas of high temperature power rationing. During this period, product inventories continued to rise, basically reaching a high in mid-to-late July. Entering the "gold nine" traditional peak season, power rationing measures relaxed, cancelled, the industry chain has certain expectations for the peak season, so downstream demand has improved, the industry load has rebounded, but the second half of September returned to caution, in general, the peak season performance is not as good as in previous years. After mid-November, with the adjustment of the epidemic prevention and control policy, the infection of factory workers increased, resulting in a significant decline in the load of upstream and downstream industries in the industrial chain.

According to the statistics of the China Chemical Fiber Association, the production of chemical fiber in 2022 is 64.88 million tons, a slight decrease of 0.55% year-on-year (Table 1), which is the first negative growth of chemical fiber production in nearly 40 years. Among them, except for viscose filament and acrylic fiber production increased by 7.45% and 16.70%, respectively, the output of other main products showed negative growth. Chemical fiber production data of the National Bureau of Statistics was 66.9784 million tons, a decrease of 0.96% year-on-year. There are some differences between the two data, which may be caused by different statistical caliber, such as POY and DTY.

(2) Insufficient terminal demand and sluggish downstream performance

From the perspective of terminal demand, the domestic market demand for textiles and clothing is insufficient, and although exports have reached a new high, the export growth rate in the second half of the year has fallen month by month.

In terms of domestic demand, in 2022, affected by factors such as the slowdown in resident income growth and the slow recovery of consumption scenes, the domestic consumer market will be under pressure. Data from the National Bureau of Statistics show that in 2022, the retail sales of clothing, shoes and hats, and textile products above the quota in the country decreased by 6.5% year-on-year, and the growth rate has continued to be negative since March. Online retail sales of wear goods increased by 3.5% year-on-year, the growth rate slowed by 4.8 percentage points compared with 2021, but it has continued to grow positively since June, and the consumption of clothing such as sports, outdoor and health care still has good growth resilience.

In terms of external demand, China's textile and apparel exports reached a new high in 2022, remaining above $300 billion for the third consecutive year, and the increase in export prices played an important supporting role. Customs data show that in 2022, China's textile and apparel exports totaled 340.95 billion US dollars, an increase of 2.5%. Among the major export products, the export value of textiles reached 156.84 billion US dollars, an increase of 1.4% year-on-year. The export of textile fabrics, chemical fibers and other supporting products in the industrial chain was an important growth point. Garment exports amounted to $184.11 billion, up 3.4% year on year.

The lack of terminal demand has led to a decline in the operating rate of the main downstream industries of chemical fiber compared with the same period in 2021. Huarui information data show that the average operating rate of Jiangsu and Zhejiang looms in March was about 70%, down 16 percentage points from the same period in 2021; From April to August, the average monthly operating rate was below 60%, and in September and October, the average monthly operating rate rose to about 70%. Since late October, the operating rate has shown a downward trend, and there was a slight recovery in the first half of December, but it began to decline again in the second half of the month, and has fallen to about 25% by the end of December.

(3) Exports continued to grow and competitive advantages improved

Customs data show that the export volume of chemical fiber in 2022 is 5.654,500 tons, an increase of 8.76% (Table 2), which is 1.22 percentage points higher than the average annual growth rate (7.54%) since the "13th Five-Year Plan" (2015). The growth of chemical fiber exports reflects the increasing demand in the international market and the improvement of the competitiveness of China's chemical fiber products. Among them, acrylic fiber exports increased significantly. Analysis of the reasons: first, since the beginning of the year, the European Germanung 200,000 tons of factories shut down, resulting in a supply gap; Second, since the beginning of the year, the overall depreciation of the RMB has increased the price advantage of acrylic fiber exports; Third, compared with India and other countries and regions, the quality of domestic products also has certain advantages.

In addition, in the past two years, polyester bottle sheet exports have performed brilliantly, with a year-on-year increase of 36.03% in 2021 and a significant increase of 35.67% in 2022. The main reasons are: first, since the fourth quarter of 2021, some overseas devices have stopped unexpectedly, and failed to resume normal production in a short period of time, since 2022, the situation between Russia and Ukraine has affected the global energy shortage, overseas devices have low enthusiasm for construction due to high costs, and there is a large gap in overseas bottle flake supply; Second, with the easing of the epidemic, overseas market demand has gradually recovered; Third, although the export price of China's polyester bottle chips has also risen, compared with overseas products with high energy costs, China's polyester bottle chips are more cost-effective; Fourth, domestic bottle production capacity growth, and domestic demand growth is limited, so the factory actively expand the export market. Multiple factors superposition, so that China's polyester bottle sheet export to refresh the record high.

(4) The chemical fiber market is weak and the cost transmission is not smooth

Since 2022, the high price of crude oil has fluctuated greatly, which has seriously dragged down the chemical fiber market, and the combined demand is insufficient, and the overall performance of the chemical fiber market is weak.

In the first half of the year, crude oil prices rose by more than 60%, which significantly increased the cost of raw materials and energy costs in the chemical fiber industry, but in the reality of "weak demand", enterprises can not transfer the "high cost" smoothly, squeezing corporate profits and taking up a lot of working capital. In the second half of the year, crude oil prices fell rapidly, once falling back to the level at the beginning of the year, although the cost of raw materials for enterprises was greatly reduced, the chemical fiber market lost support, and the continuous decline in product prices caused sales to be more difficult.

(5) Revenue maintained growth, and profit decreased significantly

In 2022, the economic benefit indicators of the chemical fiber industry declined significantly. According to the data of the National Bureau of Statistics, the operating income of the chemical fiber industry remained at the trillion yuan level, reaching 1,0900,074 billion yuan, an increase of 5.32% year-on-year; The total profit was 24.129 billion yuan, a decrease of 62.22%, and the chemical fiber industry only contributed about 12% of the profit to the textile industry, which was 13 percentage points lower than that in 2021; The loss of the industry was 31.93%, an increase of 14.63 percentage points compared with 2021, and the loss of loss-making enterprises increased by 102.67% year-on-year (Table 3).

In terms of industry, polyester, nylon, acrylic and spandex industries contributed about 31%, 29%, 6% and 6% of the total profit of chemical fiber, respectively, of which the total profit of the acrylic industry increased significantly, and the spandex industry declined significantly due to the high base in 2021, but it was still higher than the pre-epidemic level. In addition, the carbon fiber industry still maintains a high prosperity, market demand continues to increase, the scale of production capacity is growing rapidly, and the entire industry continues to achieve profitability in 2022. It is worth noting that in the case of sluggish demand and severe industry situation, the larger the scale of enterprises, the greater the pressure on production and sales, some large enterprises take the initiative to limit production, resulting in higher operating costs per unit product, little improvement in profitability, but it gives more flexible small and medium-sized enterprises to vacate some space.

6. Investment in fixed assets increased and production capacity grew by inertia

Fixed asset investment in the chemical fiber industry declined from 2021, but still maintained stable growth. Data from the National Bureau of Statistics show that the investment in fixed assets of the chemical fiber industry in 2022 increased by 21.4% year-on-year, down 10.4 percentage points from 2021. However, this growth is largely inertial growth, and the new production capacity is still mainly concentrated in the head enterprises, with the weakening of inertia, superimposed on the high base in 2022, the growth rate of fixed asset investment in the chemical fiber industry in 2023 is likely to fall significantly.

Second, 2023 chemical fiber industry outlook

At present, the international situation is still complex and grim, and the foundation for economic recovery is still not solid. World economic recovery will face greater pressure in 2023, and China will continue to be the engine of global economic growth. When deploying the economic work in 2023, the Central Economic Work Conference stressed that "we must adhere to the word stability and seek progress while maintaining stability", and further clarified that we should grasp the "six better overall plans" to do economic work well, requiring "strengthening the coordination and cooperation of various policies and forming joint forces to promote high-quality development". The Second Plenary Session of the 20th CPC Central Committee further stressed that efforts should be made to expand domestic demand and effectively improve the resilience and safety of the industrial chain and supply chain. As the prevention and control of the epidemic in China enters a new stage and the implementation of various policies continues to decline, the order of production and life is expected to recover at a faster pace, the internal impetus for economic growth will continue to accumulate and strengthen, and the recovery of domestic consumption will have positive support.

After the Lantern Festival in 2023, the opening probability of downstream weaving and bomb enterprises continued to pick up, and the overall construction load of the chemical fiber industry rose at a low level, but the price transmission of the industrial chain was not smooth, and the economic benefits were not greatly improved. Looking forward to the whole year, the operation of the chemical fiber industry is still facing pressure from both ends of supply and demand, and whether the relationship between supply and demand can improve has become the key to whether the operation of the industry can stabilize and rebound. From the perspective of terminal demand, the domestic market has the basis for a stable recovery, and the improvement of residents' income and expectations provides an important support for the consumption growth of clothing, shoes and hats, but the transitional period of the epidemic may still cause periodic fluctuations in the domestic market. Textile and apparel export market pressure increases, developed economies clothing consumption growth space is limited, while emerging economies industrial chain supporting demand is facing downward pressure, China's yarn, fabric and other intermediate products export growth or slow down, chemical fiber exports are still expected to remain stable. From the supply side, chemical fiber production capacity is still likely to maintain inertial growth, before the effective growth of demand, industry enterprises should focus on controlling new capacity, to avoid further escalation of the contradiction between supply and demand, in order to maintain the sustainable and stable development of the chemical fiber industry. In addition, the trend of oil prices will continue to be one of the important factors affecting the operation of the chemical fiber market, the oil market in 2023 will be in the game between economic recession and geopolitics, Opec said that the economic factors affecting the oil price tilt downward. In the base case, oil prices in 2023 are expected to be less volatile than in 2022, and the operating center is expected to be lower than in 2022.

The year 2023 is the first year of fully implementing the spirit of the Party's 20 Congresses, and it is also a key year for the "14th Five-Year Plan". The "Guidance on the High-quality Development of chemical fiber Industry" jointly issued by the Ministry of Industry and Information Technology and the National Development and Reform Commission proposed that by 2025, a group of leading enterprises with strong competitiveness should be formed, a high-end, intelligent and green modern industrial system should be built, and a comprehensive chemical fiber power should be built. The 20th National Congress of the CPC drew a grand blueprint for comprehensively building a modern socialist country and comprehensively promoting the great rejuvenation of the Chinese nation with Chinese-style modernization, which further provided a fundamental guideline for the high-quality development of the textile and chemical fiber industry. In the face of new strategic opportunities and tasks, new strategic stages and requirements, the chemical fiber industry should face the forefront of science and technology, face the upgrading of consumption, face the major needs, and improve the innovation system; Adhere to the priority of energy conservation and carbon reduction, expand green fiber production, and build a clean, low-carbon, circular green manufacturing system; Increase the supply of high-quality products, cultivate well-known fiber brands, and expand the application field of fiber; We will accelerate digital and intelligent transformation, improve our operation and management capabilities, and modernize the industrial chain.

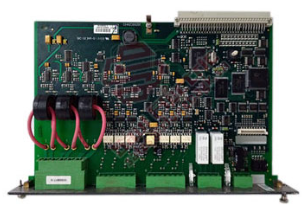

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

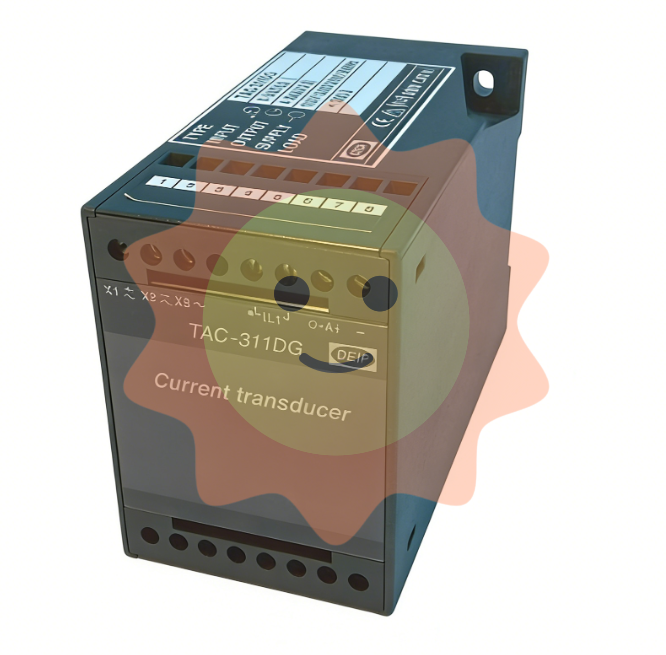

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

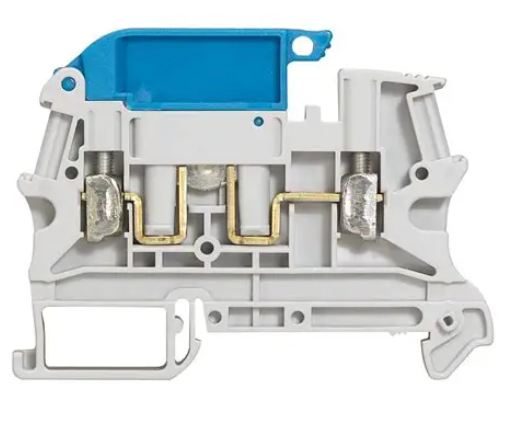

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA

- Other Brands