Marine engineering equipment and high-tech ships: big country shipbuilding is not afraid of rough seas

The situation facing

Marine engineering equipment and high-tech ships are the main carriers and means for human beings to develop, utilize and protect Marine mineral resources, Marine renewable energy, Marine chemical resources, Marine biological resources and Marine space resources as well as Marine transportation activities. Marine engineering equipment and high-tech shipbuilding industry is an important part of China's strategic emerging industries, and is a leading industry in the development of Marine economy.

The shipbuilding industry is a very cyclical industry. Throughout the development of the international shipping market, there is a large cyclical fluctuation at an interval of about 30 years, during which short - and medium-term fluctuations occur every 3-5 years. Of course, the length of the cycle will also be prolonged or shortened by multiple factors such as excessive prosperity or depression in the world economy, dramatic changes in international maritime rules, and large-scale wars. The destruction of ship assets in World War II led to a new shipbuilding market cycle of less than 15 years, and the International Maritime Organization (I-MO) adopted in 2003 the single-hull tanker phase-out convention and China's rapid economic development combined to extend the cycle of the last round of new shipbuilding market to more than 30 years.

In 2008, the international shipping market entered a new round of adjustment. In 2015, the global shipping capacity was close to 1.7 billion deadweight tons, and the contradiction between total capacity and structural excess was relatively serious. At the same time, the demand structure had obvious changes, and the demand for conventional ship types such as bulk carriers was weak, while the demand for Marine engineering equipment and high-tech ships was relatively strong. Energy-saving and environmentally friendly new bulk carriers, container ships, and oil tankers have become the main market demand, liquefied natural gas (LNG) vessels, liquefied petroleum gas (LPG) vessels are in strong demand, car carriers, luxury cruise liners, and ocean-going fishing vessels demand growth is relatively obvious, and technologically complex ship types have brought more market growth.

At present, the adjustment of the shipbuilding industry has come to an end, and the market recovery is in sight. From 2012 to 2016, the capacity adjustment of the shipbuilding industry was mainly based on shutdown, bankruptcy and liquidation, and gradually spread from small and medium-sized enterprises to large shipbuilding enterprises; From 2016 to 2020, the adjustment of the shipbuilding industry will shift to the merger and reorganization of large and medium-sized enterprises, including the acquisition of high-quality shipyard assets by advantageous enterprises and the merger and reorganization of large enterprise groups. After two rounds of capacity adjustment, the number of active individual shipyards with orders or delivery records of ships over 10,000 tons in the world decreased from 440 to about 180 in 2016, and remained basically stable; In 2020, affected by the epidemic and the market correction, the number of shipyards receiving orders or delivering ships fell to about 150. In the past three years, although the operation of shipbuilding enterprises is still difficult, the economic operation of major shipbuilding enterprises in China, Japan and South Korea is generally stable, and the production capacity clearance process has basically ended. At present, the global shipbuilding capacity has stabilized at about 120 million deadweight tons, the annual completion of about 90 million tons, and the capacity utilization rate has reached 75%, which is at the normal level of industrial development.

In the coming period, the competitive pattern of the global shipbuilding industry will be deeply adjusted, and the main force of the world shipbuilding industry will still be China, Japan and South Korea, and more mainly reflected in the field of high-tech ships and offshore engineering equipment. The European shipbuilding industry will further withdraw from the ship assembly and construction market, but in terms of design, supporting, maritime rule-making, etc., especially in the core design and key supporting fields of Marine engineering equipment, it still has advantages. Korea has proposed to turn the Marine engineering equipment manufacturing industry into a second shipbuilding industry. Singapore is committed to maintaining its competitive edge in offshore equipment. In the future, the competition between the major construction countries in the field of deepwater offshore equipment products will become more intense.

In the new industrial competition environment, the key to determining the success or failure of the competition is no longer the scale of facilities, labor costs and other factors, but technology, management and other soft power and shipbuilding, supporting the whole industry chain coordination, scientific and technological innovation ability to contribute more prominent competitiveness. Changes in competitive factors have directly led to the weakening of the original comparative advantages of China's shipbuilding industry, especially the increase in the cost of various factors such as labor and land, the RMB exchange rate is a two-way fluctuation trend, the traditional advantages of low-cost manufacturing are disappearing, and the focus of industrial development has shifted from the pursuit of speed to the pursuit of quality and efficiency. High-tech ships and Marine engineering equipment are at the high end of the value chain of the shipbuilding industry, and are the focus of the future development of China's shipbuilding industry.

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

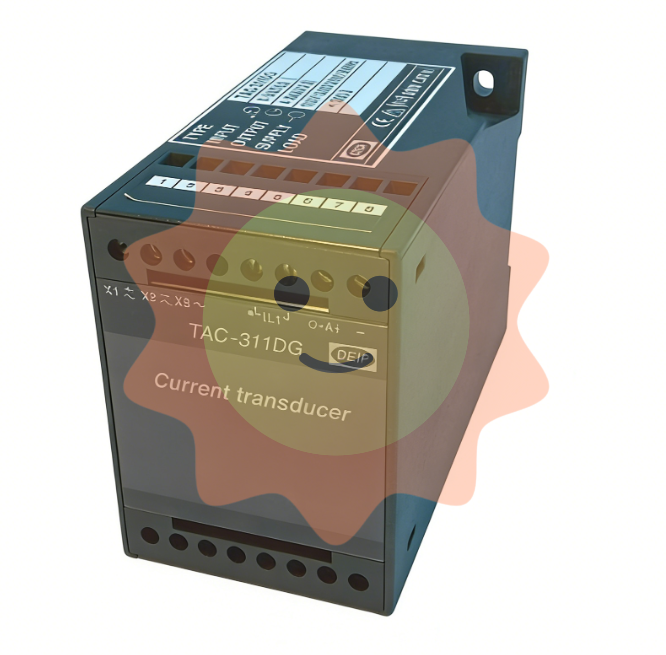

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA

- Other Brands