What is the future of China's paper industry?

There is insufficient demand and big trouble on the supply side.

White cardboard, cultural paper and other major wood pulp paper face upstream cost pressure.

Finland, as the second largest source of pulp in China, broke out workers' strikes at the end of last year, and has extended the strike time seven times this year, directly affecting the production and supply of wood pulp. In the past, nearly 20% of China's wood pulp supply depended on Finland.

Another source of pulp imports is Russia, which exported about 6 million tons of pulp and paper products in 2021, 40% of which went to China. Affected by the war between Russia and Ukraine, the Russian Ilim Group suspended the supply of bleached needle pulp to China, and the recovery time is far from complete, which means that about 12% of the wood pulp sources of our production enterprises were cut off.

Other important international suppliers have not brought good news either. West Rock announced that it will permanently close its Panama City plant by June 6. As a result of the flooding, Canada's West Fraser Lumber Co. also announced that it would permanently reduce capacity at its Hinton pulp mill in Alberta.

The operating rate of double adhesive paper and double copper paper can only be maintained at 60%-65%.

At one time, the price of domestic pulp and paper was inverted, and the price of paper became a necessary option, but the imbalance between supply and demand led to the cost pressure could not be smoothly transmitted.

The terminal does not buy it, and the price increase of finished paper is very limited.

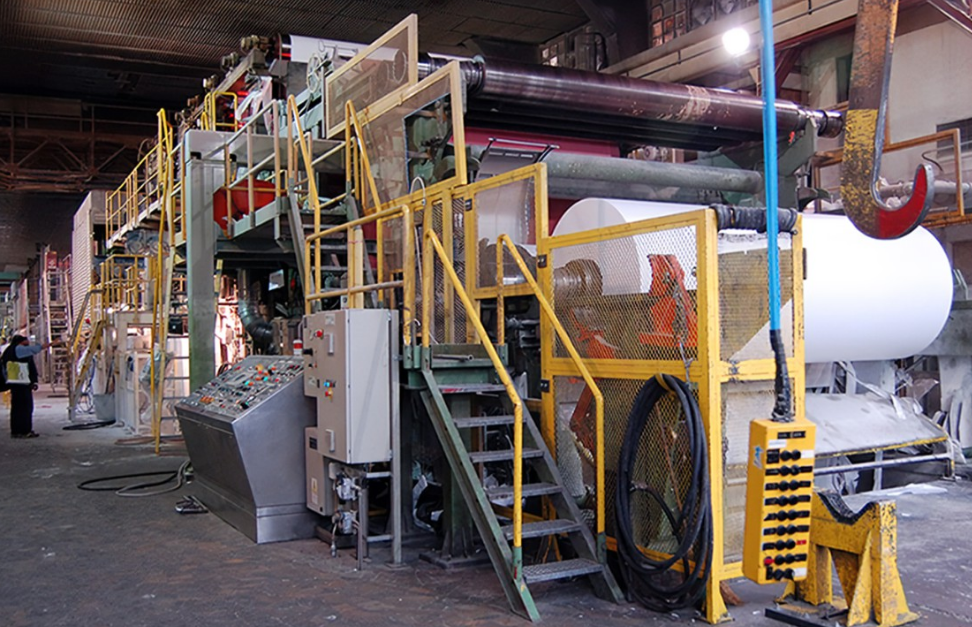

The paper industry saves itself

According to the National Bureau of Statistics, in the first quarter of this year, the overall revenue of the paper and paper products industry reached 357.1 billion yuan, an increase of 4.5%, but the total profit was only 12.56 billion yuan, down 49.3%.

▲ Producer purchase price

▲ The main financial data of the paper and paper products industry in the first quarter

At the moment, the profit halved paper companies are trying to save themselves.

Leading enterprises choose to take the lead in starting with raw materials.

Due to the large fluctuations in raw material prices, the vertical integration of the pulp and paper industry chain has become the most important measure to ensure production, and the layout of the integrated pulp and paper industry chain has accelerated.

From 2017 to 2021, the compound growth rate of China's pulp capacity and output demand is 14.34% and 10.37%, respectively. In 2021, China's total pulp production capacity reached 21.5 million tons, an increase of 11.57%.

Among them, Chenming Paper was the first group to promote the pulp and paper integration strategy. With the operation of Huanggang and Shouguang pulp plants, Chenming owns 3 of the 5 major pulp plants in China, with a production capacity of more than 4.3 million tons; It is also the first domestic wood pulp self-sufficiency, pulp and paper production capacity is basically balanced pulp and paper integration enterprise.

Another paper giant Sun Paper also attaches great importance to the pulp and paper integration strategy. Through the construction of self-produced "pulp line" in Beihai, Guangxi, the company increased the proportion of self-produced pulp, and began to expand the construction of overseas forest bases to ensure the supply of raw materials from the source of wood.

The rapid expansion of export scale is another major point of view of the paper industry.

The Ministry of Commerce and the General Administration of Customs on paper products processing trade policy adjustment, the effect of RCEP free trade zone, superimposed Russia and other major paper export countries of the current paper production capacity of the insufficiency, Europe, Asia and other regions of demand transferred to domestic enterprises, especially Bohui paper, Chenming paper and other white cardboard leading enterprises are benefiting from this.

Since the fourth quarter of 2021, China's paper industry exports have shown a rapid growth trend, with a year-on-year growth rate of more than 10% for three consecutive months. In the first quarter of this year, the paper industry exports were also strong, and the export delivery value in March was 5.54 billion yuan, an increase of 18.7%. The cumulative export delivery value in the quarter was 14.74 billion yuan, an increase of 18.3%. In the first quarter, the total export of pulp, paper and its products was 2.86 million tons, an increase of 33.4%.

▲ First quarter export data of pulp, paper and its products

In addition, many enterprises also ease the inventory pressure by proactively reducing production. At the same time, the industry is actively promoting small enterprises backward production capacity clearance, and enterprises without cost advantages face elimination.

In recent months, the news of small and medium-sized paper mills stopping production frequently appeared in the newspaper, environmental protection is not up to standard, the transformation of old and new momentum is slow, and the profit space is insufficient, so that many enterprises have suffered a survival crisis.

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA

- Other Brands