What is the future of China's paper industry?

More than ten leading paper companies, including Chenming Paper, Sun Paper and Bohui Paper, have recently issued price hike letters. Following the gray bottom white, special paper, and household paper, cultural paper also ushered in a price increase of 200 yuan/ton, and China's paper industry "rose".

Since the second half of 2021, pulp prices, shipping costs, and energy costs have been rising, geopolitics, and the epidemic situation are fickle, and China's paper industry, which is under pressure from both sides of supply and demand, has had to seek self-rescue in one round after another of price increases.

This is an industrial re-arrangement and optimization, and some leading enterprises have seen the dawn of recovery.

Have to rise

From toilet paper to copy paper, from kraft paper to corrugated paper, since 2022, the paper industry has received one letter after another.

According to the main source of raw materials, paper can be divided into waste paper and pulp paper two categories, one with waste paper pulping, one with wood pulping.

Look at the wood pulp first.

Starting from the second half of 2021, under the interaction of a series of factors such as the epidemic, supply chain problems, international logistics, and policy news, wood pulp prices have risen sharply.

In 2021, the price of coniferous wood pulp increased by about 10%, and the price of hardleaf wood pulp increased by nearly 20%.

▲ Hardwood pulp price trend

Under the epidemic, the factory operating rate is difficult to guarantee, the "dual carbon" policy for paper pollution emissions, coupled with large fluctuations in domestic coal prices, but also make many small enterprises can not continue to supply raw materials for downstream enterprises. The contradiction between coordinating "double carbon" and production capacity supply has already formed. In 2021, the number of pulp manufacturing enterprises in the paper industry chain is 11,522, a reduction of 25.9% from 2020, and the domestic pulp gap is nearly 30 million tons.

Not only is the capacity of domestic factories difficult and expected, but the difficulty of wood pulp imports is also increasing.

Since 2022, multiple overseas events such as the Russia-Ukraine war, the Finnish general strike, and the Canadian floods have jointly brought supply chain tensions, and the price spike and efficiency reduction of ports and shipping on an international scale are also worrying. Shipping schedules have been extended sharply, and shipping costs are rising, nearly tripling from a year earlier.

As a large importer of wood pulp, China's external dependence on wood pulp is close to 65%, several major import sources of black swan events, mixed with the skyrocketing prices of international commodities, so that imported wood pulp has become an expensive business.

In the first quarter, the price of outer plate coniferous pulp rose from $710 / ton to about $900 / ton; The price of broadleaf pulp has gradually risen from about 560 US dollars/ton to 700 US dollars/ton.

In addition to wood pulp, waste paper is another main raw material for paper making.

In the past, a quarter of the waste paper raw materials used in papermaking in China relied on imports. However, the "ban on waste" issued in 2017 will be fully implemented by 2021, and the import of waste paper will be completely halted. The raw material gap can not be completely filled by domestic waste paper, for paper enterprises, the higher price of waste pulp or imported pulp has become the only alternative.

▲ Price trend of waste paper

However, the sluggish global economic performance in the past two years has caused a sharp decline in the amount of waste paper recycling and exports in Asia, Europe and North America.

According to data from the Shanghai Futures Exchange, the highest price of pulp futures market in March this year is 7462 yuan/ton, from the average monthly price in the first quarter, an increase of nearly 12%, although pulp prices have fallen in April, the monthly settlement reference price is still as high as 7049 yuan/ton.

▲ Price trend of pulp ending value

The high price of raw materials has made the price of downstream paper enterprises frequent, which in turn has further supported the pulp and wood pulp market.

A market that doesn't follow

In general, in the face of rising raw material costs, companies can pass some of the pressure on to consumers by raising terminal prices. However, despite a wave of price increases in the paper industry, paper enterprises soon found that the consumption downturn under the epidemic, the chain reaction of the policy, together with the increasingly fierce competition in the industry, so that the entire Chinese paper industry had to face the dual dilemma of demand and supply.

An obvious example is that in mid-2021, the "double reduction" policy in the education industry was formally implemented, and the demand for teaching aid workbooks dropped sharply, making the corresponding cultural paper products coated paper and double-tape paper sell poorly.

At the same time, since the second quarter of 2021, a large influx of imported finished paper has impacted the domestic market, and the price of cultural paper has dropped sharply, and the gap once reached 2000 yuan/ton.

There is insufficient demand and big trouble on the supply side.

White cardboard, cultural paper and other major wood pulp paper face upstream cost pressure.

Finland, as the second largest source of pulp in China, broke out workers' strikes at the end of last year, and has extended the strike time seven times this year, directly affecting the production and supply of wood pulp. In the past, nearly 20% of China's wood pulp supply depended on Finland.

Another source of pulp imports is Russia, which exported about 6 million tons of pulp and paper products in 2021, 40% of which went to China. Affected by the war between Russia and Ukraine, the Russian Ilim Group suspended the supply of bleached needle pulp to China, and the recovery time is far from complete, which means that about 12% of the wood pulp sources of our production enterprises were cut off.

Other important international suppliers have not brought good news either. West Rock announced that it will permanently close its Panama City plant by June 6. As a result of the flooding, Canada's West Fraser Lumber Co. also announced that it would permanently reduce capacity at its Hinton pulp mill in Alberta.

The operating rate of double adhesive paper and double copper paper can only be maintained at 60%-65%.

At one time, the price of domestic pulp and paper was inverted, and the price of paper became a necessary option, but the imbalance between supply and demand led to the cost pressure could not be smoothly transmitted.

The terminal does not buy it, and the price increase of finished paper is very limited.

The paper industry saves itself

According to the National Bureau of Statistics, in the first quarter of this year, the overall revenue of the paper and paper products industry reached 357.1 billion yuan, an increase of 4.5%, but the total profit was only 12.56 billion yuan, down 49.3%.

▲ Producer purchase price

▲ The main financial data of the paper and paper products industry in the first quarter

At the moment, the profit halved paper companies are trying to save themselves.

Leading enterprises choose to take the lead in starting with raw materials.

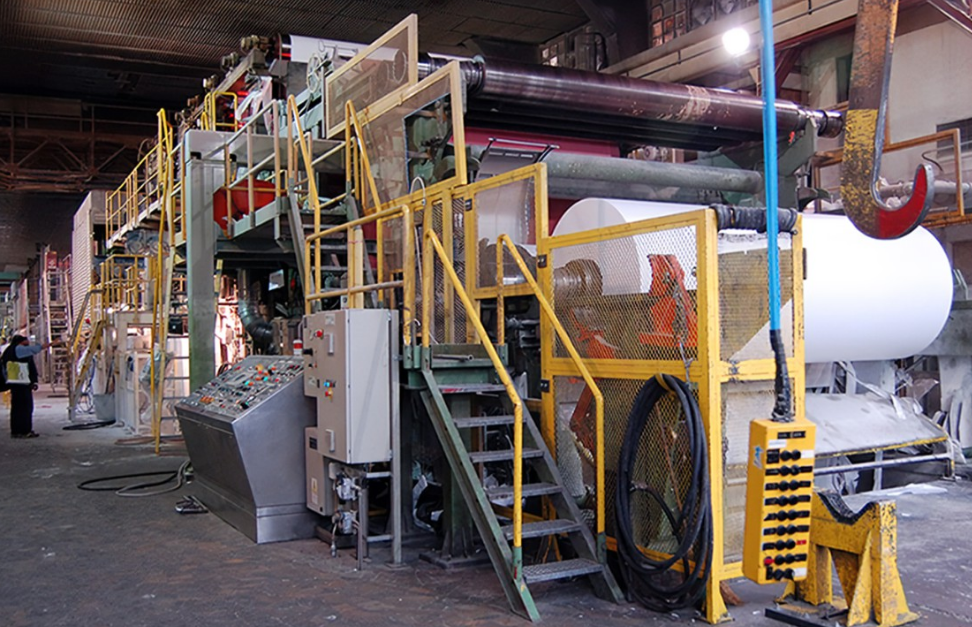

Due to the large fluctuations in raw material prices, the vertical integration of the pulp and paper industry chain has become the most important measure to ensure production, and the layout of the integrated pulp and paper industry chain has accelerated.

From 2017 to 2021, the compound growth rate of China's pulp capacity and output demand is 14.34% and 10.37%, respectively. In 2021, China's total pulp production capacity reached 21.5 million tons, an increase of 11.57%.

Among them, Chenming Paper was the first group to promote the pulp and paper integration strategy. With the operation of Huanggang and Shouguang pulp plants, Chenming owns 3 of the 5 major pulp plants in China, with a production capacity of more than 4.3 million tons; It is also the first domestic wood pulp self-sufficiency, pulp and paper production capacity is basically balanced pulp and paper integration enterprise.

Another paper giant Sun Paper also attaches great importance to the pulp and paper integration strategy. Through the construction of self-produced "pulp line" in Beihai, Guangxi, the company increased the proportion of self-produced pulp, and began to expand the construction of overseas forest bases to ensure the supply of raw materials from the source of wood.

The rapid expansion of export scale is another major point of view of the paper industry.

The Ministry of Commerce and the General Administration of Customs on paper products processing trade policy adjustment, the effect of RCEP free trade zone, superimposed Russia and other major paper export countries of the current paper production capacity of the insufficiency, Europe, Asia and other regions of demand transferred to domestic enterprises, especially Bohui paper, Chenming paper and other white cardboard leading enterprises are benefiting from this.

Since the fourth quarter of 2021, China's paper industry exports have shown a rapid growth trend, with a year-on-year growth rate of more than 10% for three consecutive months. In the first quarter of this year, the paper industry exports were also strong, and the export delivery value in March was 5.54 billion yuan, an increase of 18.7%. The cumulative export delivery value in the quarter was 14.74 billion yuan, an increase of 18.3%. In the first quarter, the total export of pulp, paper and its products was 2.86 million tons, an increase of 33.4%.

▲ First quarter export data of pulp, paper and its products

In addition, many enterprises also ease the inventory pressure by proactively reducing production. At the same time, the industry is actively promoting small enterprises backward production capacity clearance, and enterprises without cost advantages face elimination.

In recent months, the news of small and medium-sized paper mills stopping production frequently appeared in the newspaper, environmental protection is not up to standard, the transformation of old and new momentum is slow, and the profit space is insufficient, so that many enterprises have suffered a survival crisis.

In addition, the entry threshold for new and expanded production capacity is also constantly improving, and the overall operating costs of the industry are high, which also makes many paper enterprises gasp for breath.

Correspondingly, the improvement of the threshold of operation makes the industry concentration continue to improve, and the industry pattern continues to optimize.

The performance of leading enterprises has begun to build a bottom climb, and the fall of raw material prices and the partial landing of price increases have made many enterprises see the hope of performance improvement. Sun Paper achieved a net profit of 675 million yuan in the first quarter, down 39.08% year-on-year, but the operating income increased 26.48% year-on-year; Chenming Paper achieved a net profit of 132 million yuan, down 90.34% year-on-year, but the chain also showed an upward trend.

The second quarter is the traditional peak season of the paper industry, paper enterprises are trying to find ways to promote the integration of pulp and paper, expand exports, and improve operational efficiency. Although in the context of the epidemic, Chinese paper enterprises also face the test of raw materials, logistics, operating costs and emergencies, but have survived the darkest moment of price increases, supply cuts, and outages, the paper industry has obviously seen the dawn of recovery.

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA

- Other Brands