From shipbuilding power to ship power, China still needs to do something

The shipbuilding industry, known as the "crown of comprehensive industry", is related to nearly 100 industries such as steel, chemical, machinery and electronics, and has a very strong driving role in the development of the national economy. At present, China has become the world's largest shipbuilding country, and has formed a number of large shipbuilding enterprise groups with strong international competitiveness. In 2018, China's shipbuilding industry's new orders, shipbuilding completions and hand-held orders reached 36.67 million DWT, 34.58 million DWT and 89.31 million DWT, accounting for 43.9%, 43.2% and 42.8% of the global total, respectively. At the same time of increasing scale, China's shipbuilding industry has made continuous breakthroughs in the fields of ultra-large container ships, large gas carriers, high-end ocean engineering equipment, independent design and construction of aircraft carriers, and deep-sea manned submarines. At present, China's shipping enterprises are moving towards the world's first-class large-scale shipping enterprise groups.

1. Comparison between Chinese shipbuilding enterprises and world-class large-scale shipbuilding enterprises

From the perspective of comprehensive index analysis, China State Shipbuilding Group (CSSC, CSIC), Yangzijiang Shipbuilding Industry has entered the ranks of the world's large ship enterprise groups, but there is still a gap with Japan and South Korea's first-class large enterprises in labor production efficiency.

(1) China's shipping enterprises have obvious advantages in scale

From the perspective of shipbuilding completion, Chinese shipping enterprises have comparative advantages. In 2018, China accounted for five of the top ten in the world, and CSSC and CSIC were second only to Hyundai Heavy Industries Group of Korea, which ranked first (see Table 1). From the perspective of industrial concentration, China's top five shipbuilding companies accounted for 80% of domestic shipbuilding completion, lower than South Korea. In October 2019, The State Council approved the joint restructuring of China Shipbuilding Group and China Shipbuilding Heavy Industry Group to establish China Shipbuilding Group, at the same time, South Korea's Hyundai Heavy Industry Group also announced the acquisition of Daewoo Shipbuilding and Marine Engineering, the production scale of the two new restructuring enterprises will be comparable, and Japanese shipping companies have recently announced business restructuring to reduce the scale disadvantage of Chinese and South Korean companies.

Table 1 Shipbuilding completions of the world's major shipbuilders in 2018.

In terms of revenues, Chinese shippers lead the way (see chart 2). China Shipbuilding Industry Group has grown rapidly in recent years, ranking first, and China Shipbuilding Group is in the leading position of the second tier. After the establishment of China State Shipbuilding Group, the scale of operating income will maintain about 60 billion US dollars, far ahead of Japanese and Korean ship companies.

Table 2 Business income of major shipping companies in the world

From the perspective of total assets, China's leading shipping enterprises have obvious advantages in asset scale (see Table 3). Before the merger, CSIC was 1.5 times the size of Japan's Mitsubishi Heavy Industries, and the combined China State Shipbuilding Group will have more than three times the assets of the Japanese and South Korean shipbuilders. But the assets of other Chinese shipbuilders are still much smaller than those of their Japanese and South Korean counterparts.

Table 3 Total assets of major shipping companies in the world

On the whole, the operating income and asset scale of China's state-owned large shipbuilding enterprises have surpassed those of Japan and South Korea, and China State Shipbuilding Group has become the world's largest ship enterprise. In terms of shipbuilding completion, if the merger of Hyundai Heavy Industries and Daewoo Shipbuilding and Marine Engineering is completed, the newly formed company's annual global shipbuilding completion share will be similar to or slightly exceed that of China State Shipbuilding Group.

(2) Profitability is comparable to that of world-class shipping enterprises

From the perspective of net profit margin, the profit level of Chinese enterprises is relatively high. Yangzijiang Shipbuilding, a privately owned company, has a five-year average net profit margin of more than 15%, and CSSC and CSIC rank high, and the earnings stability is better than that of South Korean companies.

From the perspective of asset-liability ratio, there are obvious differences between Chinese shipping enterprises, which are generally lower than Japanese and South Korean shipping enterprises (see Table 6). Among them, the asset liability ratio of the Yangtze River shipping industry is the lowest, which is lower than 50% for many consecutive years, and only 34.1% in 2018; Csic Group has been below 60% for two consecutive years, and CSIC Group has maintained an average of about 70% in the past five years.

(3) There is a significant gap in labor efficiency

In terms of per capita sales revenue, Chinese shipping companies lag far behind Japanese and South Korean companies. The first tier is Japanese shipping companies with per capita income of more than $400,000. The second tier is South Korean shipping companies, with per capita income of more than $260,000. Chinese shipping companies belong to the third tier, with per capita income between $150,000-260,000, and CSSC is only 34.6% of Mitsui Shipbuilding.

(4) Research and development investment intensity reached a relatively high level

Second, the reason why Chinese shipbuilding enterprises are big but not strong

China's large ship enterprises are large but not strong, and there is a certain gap between them and the world's first-class enterprises in high-quality development.

(1) The upgrading of product structure is limited by the weak industrial base and supporting capacity

The upgrading of China's ship product structure has made great progress, but in general, it is still dominated by middle and low-end ship types, and there is a significant gap with Japanese and Korean ship companies. South Korea is dominated by medium and high-end merchant ships such as oil tankers, LNG carriers (liquefied natural gas carriers) and very large container ships, and the global share of VLCC (very large crude oil carriers) and LNG carriers has reached 72.5% and 60.6% respectively. Japan is dominated by high-quality energy-saving and environmentally friendly bulk carriers, and the proportion of medium and high-end products such as very large container ships and VLCCS has also been increasing in recent years. Relatively speaking, the proportion of high-tech and high value-added vessels of Chinese enterprises is obviously low, and the profits of large shipbuilding and military enterprises mainly rely on military products, and the profits of civilian products are low.

The reasons for affecting the upgrading of product structure: First, the industrial base is not strong enough. China's shipbuilding industry has a short development time and insufficient technology accumulation, which is highlighted by the lack of independent large-scale industrial design software, small R&D reserves for new ship types, insufficient development and design capabilities for high-end ship types, and weak R&D capabilities for key components and basic materials. Second, the ship supporting industry is small in scale and not competitive. China's shipbuilding scale has ranked first in the world, but the competitiveness of the shipbuilding supporting industry is not strong, and it is difficult to meet the needs of structural adjustment. Data show that Japan, South Korea's ship supporting industry and shipbuilding industry scale ratio of 1:2.5 and 1:2.7, supporting domestic ratio of 90%-100%, 80%-90%, Europe's ship supporting industry is the most developed, the scale is more than 3 times that of the shipbuilding industry, supporting domestic ratio of 90%-100%. The ratio of China's shipbuilding supporting industry and shipbuilding industry is 1:6, the supporting domestic ratio of 60%-80%, and the supporting industry lacks international well-known brands, the technical level and the gap between Europe, Japan and South Korea is obvious, and some core supporting equipment is heavily dependent on imports from Europe and Japan.

(2) Low resource allocation efficiency affects operational efficiency

First, the level of fine management is not high. Compared with world-class enterprises, China's large ship enterprises have no obvious gap in shipbuilding facilities and equipment, and have basically established a modern final assembly shipbuilding model characterized by the organization and production of intermediate products. The main reason for the backward shipbuilding efficiency is that the production organization and management are not highly refined, so that the efficiency of people and money can not be fully utilized.

Second, overcapacity has caused a sharp decline in profitability. Since 2008, the global shipping market has been in a downturn. As of early August 2019, the global handheld-to-existing fleet (GT) ratio was about 10%, the lowest level in the past 20 years, and global handheld-to-order volume has declined by nearly 60% in 10 years. Market downturn and excess supply of production capacity have caused varying degrees of impact on shipbuilding enterprises in various countries. In addition to the continuous decline in the price of new ships, the sharp rise in raw material costs, and the frequent change of orders by shippers, Chinese enterprises have also had a negative impact on their operations due to the huge financial costs caused by the digestion of excess capacity, and the average profit margin of ship enterprises above scale has fallen from 9.4% in 2007 to 2.4% in 2018.

Third, the ability to optimize the allocation of global resources is insufficient. The international development of China's large shipping enterprises started early, but the progress is slow, and the export of products has been dominated for a long time. At present, with the promotion of the "Belt and Road" construction, some large Chinese shipping enterprises actively promote the international strategic layout, but overseas research and development, marketing, after-sales network layout and overseas investment and financing center construction is still in the initial stage, the scale of overseas mergers and acquisitions is relatively limited, and it is still unable to effectively optimize the allocation of resources in the global industrial chain and maximize benefits.

(3) The application of digital technology and green technology lags behind Japan and South Korea

China's digital shipbuilding is still in its infancy. At present, ship manufacturing is developing in the direction of intelligent design, intelligent product, refined management and information integration. Leading shipping companies such as Japan and South Korea have taken a leading position in the research and development and application of new technologies such as digital shipbuilding and smart shipyards. China's shipping enterprises are still in the initial stage of digital manufacturing, three-dimensional digital process equipment capacity is insufficient, the key process links are still mechanized, semi-automated equipment, lack of basic data accumulation, low level of information integration outstanding problems need to be solved.

There is a big gap in green manufacturing. China's large ship enterprises lag behind in technical indicators such as energy consumption per unit output, greenhouse gas emissions, VOCs emissions, waste generation and recovery rate. For example, a typical leading shipyard in China consumes 0.04 tons of standard coal per 10,000 yuan of revenue, while Hyundai Heavy Industries consumes 0.02 tons of standard coal and Mitsui Shipbuilding consumes only 0.01 tons of standard coal. In addition, the energy-saving and environmentally friendly new ship types built in Japan are in the world's leading position, and have environmental standards and norms that exceed the international general zero pollution and no dust spillover, which are favored by shipowners pursuing green shipping, and will bring greater competitive pressure on Chinese shipbuilding enterprises in the future.

Iii. Suggestions for building a world-class large ship enterprise group

At present, the global shipbuilding industry is becoming more and more competitive. In the context of the intensifying trade friction between China and the United States, Chinese shipbuilding companies may face greater challenges than Japanese and Korean shipping companies.

(1) Policy suggestions

1. Consolidate the foundation and accelerate the improvement of innovative research and development capabilities

First, focusing on international and domestic demand, the government will take the lead to guide the implementation of major innovation projects and projects in the industry, promote the collaborative innovation of the shipbuilding industry "government, industry, university and research", focus on improving the industrial technology foundation, basic and forward-looking technology research and development, new ship type development and design capabilities, and eliminate bottlenecks.

The second is to increase support for the independent innovation and industrialization of key core supporting equipment, and improve the shipping rate of domestic supporting equipment in China's shipbuilding industry.

The third is to strengthen the support for advanced manufacturing technology and process application, and promote the construction and demonstration application of smart shipyards

The fourth is to support the construction of major test verification and testing platforms in the industry, give play to the role of intermediary institutions such as industry associations and scientific and technological innovation incubation platforms, and accelerate the integration of scientific research resources, the transformation of results, and the efficient use of military-civilian integration.

2. Focus on domestic demand to cultivate new markets

First, in addition to accelerating the optimization and upgrading of the three major ship types of oil, bulk and container, we will pay close attention to the domestic LNG carrier market demand, and drive the domestic LNG carrier ordering demand by expanding the scale of China's own LNG carrier capacity and ensuring the import transportation of clean energy.

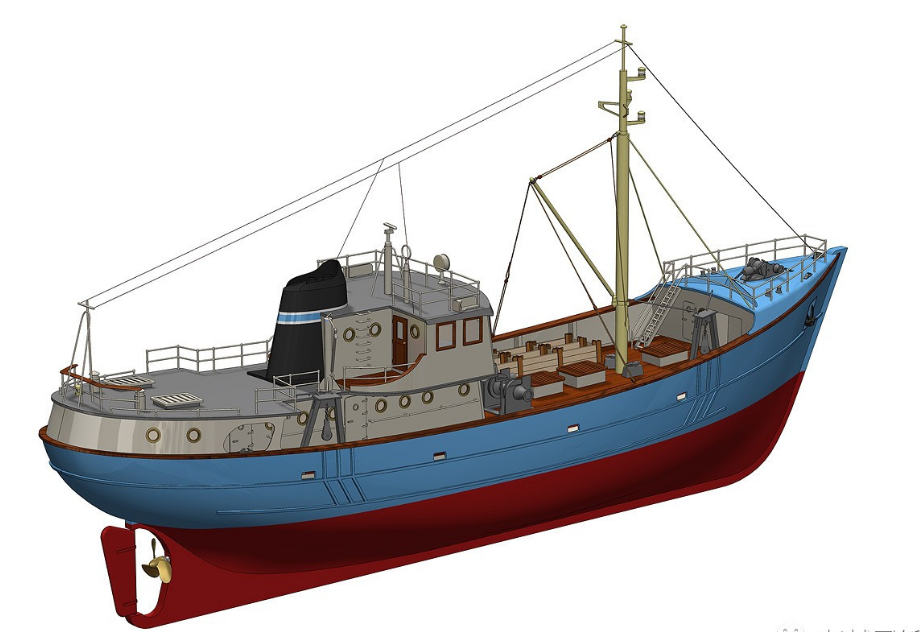

Second, we will accelerate the upgrading of old Chinese ocean-going fishing vessels, promote the development and application of technology and equipment such as floating platforms, deep-sea exploration, and exploration and development of Marine resources, and accelerate the cultivation and development of the cruise and yacht tourism market.

Third, in conjunction with the establishment of China's Emission Control Areas (ECA), we will promote the elimination and renewal of old inland and coastal vessels, improve the standards for energy conservation and emission reduction of inland vessels, encourage inland vessels to replace oil with gas, install shore power receiving facilities and waste gas treatment devices, and promote the use of clean energy.

3. Promote merger and reorganization to improve the efficiency of resource management

Support Chinese shipbuilding enterprises to carry out market-oriented mergers and reorganizations, reduce the restructuring and exit costs of shipbuilding enterprises, and jointly support the bottom of the government and enterprises; Support the internal resource integration of China State Shipbuilding Group, and when conditions are ripe, it can be used as a pilot reform of state-owned capital investment companies, accelerate the adjustment of strategic layout, and improve international competitiveness; Support enterprises to "go global" to carry out mergers and acquisitions, international production capacity cooperation and joint research and development, and improve the integration and utilization of global resources.

(2) Suggestions for enterprises

1, improve core technology research and development capabilities

First, intensify research and development efforts. Accelerate the optimization and replacement development of mainstream ship types, cultivate and form a number of brand new ship types, and expand the market share of mainstream ship types; Focusing on high-tech ship types with large market potential, strong driving force and certain foundation, Marine engineering equipment and ship types that are built but rely on foreign designs, we will carry out independent research and development, digestion, absorption and innovation of key technologies to form engineering capabilities.

Second, establish a new research and development system. Integrate internal R & D resources to form a multi-level R & D system such as technology R & D, application development and technology improvement; Through the establishment of joint laboratories, overseas mergers and acquisitions and other ways to build a global research and development network, to carry out collaborative innovation.

2. Develop advanced and efficient manufacturing mode

First, apply lean production theory, introduce value stream management technology, improve lean shipbuilding production design mode and engineering and cost management system, build modern and efficient shipbuilding system, and build lean shipbuilding enterprises.

The second is to comprehensively promote digital shipbuilding as the focus, promote the intelligent transformation of the existing shipbuilding production system and key industrial equipment, gradually realize the digital, networking and intelligent life cycle of ship design, construction, management and service, and promote the intelligent transformation of ship final assembly and construction.

Third, implement the green concept, actively promote ecological product design, clean production process, efficient energy utilization, recycling and renewable resources, increase the research efforts of energy conservation and environmental protection processes such as alternative energy, renewable energy, and waste energy utilization, and focus on breaking through the prevention and control technology of pollutants such as particulate matter, volatile organic compounds (VOCs), wastewater, and solid waste. Form green shipbuilding related technical plans and standards system.

3. Improve the ability to adapt to organizational change under the digital technology of the Internet of everything

First, build the core capabilities of platform enterprises and establish an open and win-win industrial ecology. Shipbuilding enterprises should strengthen the control of core products, promote coordinated development with industrial entities such as institutions, suppliers, shippers, intermediaries and capital through investment and equity participation, technical cooperation, personnel exchanges and business cooperation, and form an open and win-win industrial ecology with lower transaction costs, efficient information sharing and win-win results.

The second is to make use of the advantages of China's digital Internet technology, reconstruct the internal relations of enterprises, develop towards flat organizational structure and network management mode, and achieve efficient internal operation.

The third is to establish a talent team suitable for the development of new technologies. Focus on training intelligent manufacturing, big data, industrial Internet and other technology development and application and management personnel, and establish a cooperative and open international personnel training and exchange platform.

4. Enhance the ability to integrate global resources

First, actively docking the development needs of the "Belt and Road" countries, strengthening cooperation and joint efforts with domestic enterprises in other industries, and promoting the "going out" of China's shipbuilding equipment, services, technologies and standards.

The second is to combine their own business needs and internationalization status, accelerate the improvement of the global network layout, and form a global marketing after-sales service network.

Third, focus on weak areas such as research and development, brand design and human resources, increase overseas mergers and acquisitions and cooperation and exchanges, and strengthen the global allocation of capital, resources, technology, management and human resources.

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA

- Other Brands