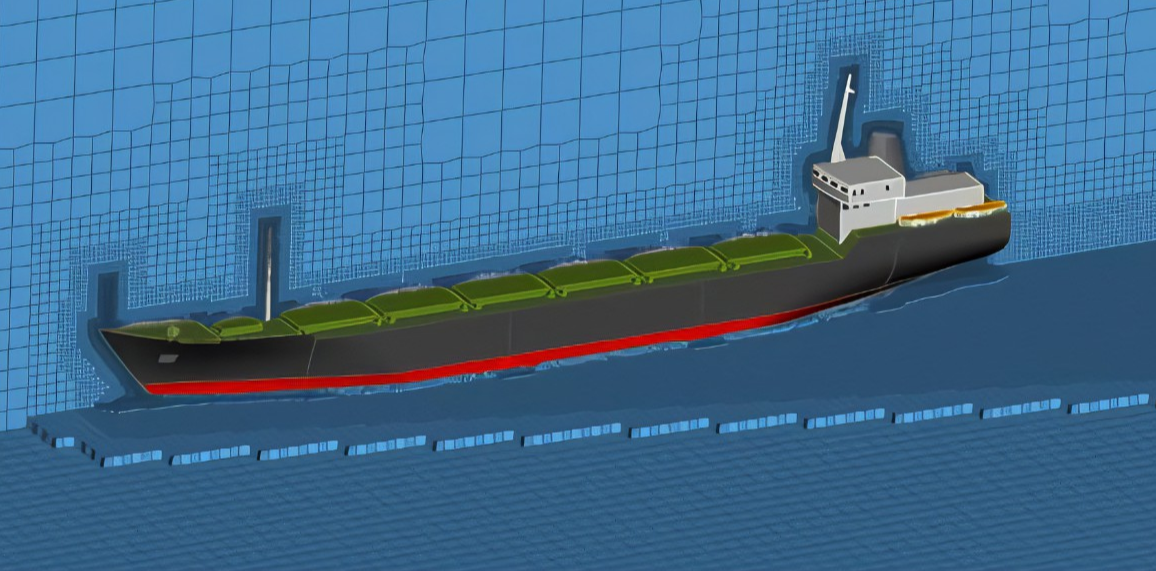

Overview of China's shipbuilding industry in 2021

Industry development status

1. The three major indicators of China's shipbuilding increased steadily

In 2020, the country completed 38.53 million deadweight tons of shipbuilding, an increase of 4.9 percent year-on-year. Orders for new ships were 28.93 million DWT, down 0.5% year-on-year. By the end of December 2020, orders for hand-held vessels were 71.11 million deadweight tons, down 12.9% year-on-year.

From January to July 2021, the country completed 24.18 million deadweight tons of shipbuilding, an increase of 20.7%. To undertake new ship orders of 45.22 million deadweight tons, an increase of 223.2%. As of the end of July 2021, the national hand-held ship orders of 89.67 million deadweight tons, an increase of 18.6% over the same period last year, and an increase of 26.1% over the hand-held orders at the end of 2020.

2. In 2020, the output value of key monitoring ship manufacturing enterprises will reach 153 billion yuan

From 2014 to 2021, the China Shipbuilding Industry Association focused on monitoring the fluctuations of the total industrial output value of enterprises. From January to November 2020, 75 key monitoring enterprises in the shipping industry completed the total industrial output value of 341.1 billion yuan, down 0.9% year-on-year. Among them, the output value of ship manufacturing was 153 billion yuan, down 2.3% year-on-year; The output value of supporting vessels was 25.1 billion yuan, down 4.6% year-on-year; The output value of ship repair was 14.7 billion yuan, up 12.2% year on year.

From January to July 2021, 75 key monitoring ship enterprises completed the total industrial output value of 214 billion yuan, an increase of 15.1%. Among them, the output value of ship manufacturing was 93.1 billion yuan, an increase of 16.2%; The output value of supporting vessels was 17.4 billion yuan, an increase of 20% year-on-year; The output value of ship repair was 8.1 billion yuan, down 10.9% year-on-year.

3. Ship manufacturing enterprises have been greatly affected by the epidemic

Different from the growth trend of other businesses in the shipbuilding industry, from 2013 to 2020, the sales revenue of China's shipbuilding enterprises above designated size showed a fluctuating downward trend, and the shipbuilding industry, as a traditional manufacturing industry, continued to be depressed.

In 2020, the national shipbuilding industry enterprises above designated size achieved sales revenue of 436.24 billion yuan, an increase of 0.6%. Among them, the sales revenue of ship manufacturing enterprises was 302.98 billion yuan, down 13% year-on-year; The sales revenue of ship supporting enterprises was 49.49 billion yuan, up 2.4% year on year; The sales revenue of ship repair enterprises was 29.93 billion yuan, up 13.5% year on year; The sales revenue of ship conversion enterprises was 3.93 billion yuan, down 2.7% year-on-year; The sales revenue of ship dismantling enterprises was 5.43 billion yuan, down 31.1% year on year; The sales revenue of offshore equipment manufacturing enterprises was 43.96 billion yuan, an increase of 19.3%; The sales revenue of manufacturers of navigation AIDS and other floating devices was 520 million yuan, down 17.2% year-on-year.

4, export ship orders accounted for 88% of the proportion of hand-held orders

In 2020, 34.25 million deadweight tons of export vessels will be completed nationwide, up 2.1% year on year; Received export ship orders of 24.45 million DWT, down 9.3% year-on-year; At the end of December, orders for hand-held export vessels were 65.21 million DWT, down 13.3% year-on-year. Export ships accounted for 88.9%, 84.5% and 91.7% of the country's shipbuilding completions, new orders and hand-held orders, respectively.

From January to July 2021, the country completed 22.653 million deadweight tons of export ships, an increase of 22.4%; To undertake export ship orders of 40.312 million deadweight tons, an increase of 219.4%; By the end of July 2021, orders for hand-held export vessels were 79.177 million deadweight tons, up 13.7% year-on-year. Export ships accounted for 93.7%, 89.1% and 88.3% of the country's shipbuilding completions, new orders and hand-held orders, respectively.

Industry competition pattern

1. Regional competition: East China has strong shipbuilding strength

From the number of enterprises, as of August 18, 2021, the number of domestic shipbuilding related enterprises as many as 82,449, Most of them are mainly concentrated in Jiangsu (20,340), Shandong (10,156), Shanghai (8,440), Zhejiang (8,417), Guangdong (7,642), Liaoning (4,513), Fujian (4,249), Hubei (2,709) and other provinces/cities. The industrial concentration of the top eight provinces reached 80.61%(according to the number of enterprises).

From the perspective of development, the current competition pattern of China's shipbuilding industry is a "three-legged" pattern of central enterprises, local shipbuilding enterprises and private shipbuilding enterprises. The central enterprise is China State Shipbuilding Group Co., LTD., while the local shipbuilding enterprises and private shipbuilding enterprises are mainly distributed in the Yangtze River Delta and Pearl River Delta, such as Jianglong Shipbuilding, Yangtze River Shipbuilding, New Era shipbuilding, Golden Bay shipbuilding and so on.

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA

- Other Brands