Analysis of hot and difficult issues in infrastructure investment and financing

At this stage, China still needs to moderately advance infrastructure investment and construction, accurately make up for weaknesses and strong and weak points, in order to better promote high-quality development, and the resulting infrastructure investment and financing needs are very large. At present, China's infrastructure investment and financing still faces prominent institutional and structural problems, especially the challenges of local government debt risk prevention and financing platform company transformation are increasingly complex and severe, and it is urgent to seek new breakthroughs in infrastructure investment and financing.

Published by the People's Daily Press and written by Wu Youhong, director of the Investment System and Policy Research Office of the Investment Research Institute of the Chinese Academy of Macroeconomic Research, the book Infrastructure Investment and Financing Policies and Practices is like a timely rain. The book adheres to the combination of theory, policy and practice, focusing on hot and difficult issues such as infrastructure to make up for weaknesses, revitalizing existing assets, and innovating investment and financing models, and makes some very meaningful reflections.

First, the project capital level management. For a long time, project capital financing has always been one of the difficult problems in infrastructure investment and financing. Considering that the risk mitigation ability of different project capital instruments is quite different, it is necessary and feasible to carry out reasonable differentiation and fine management. At present, China mainly determines the project capital according to the equity attribute of funds, but this rule has not fully adapted to the situation of the financial market. Based on the perspective of the risk constraint function of project capital, this book innovatively proposes to appropriately expand the scope of qualified project capital, and divides project capital into first-level capital and second-level capital according to the power and responsibility relationship between different sources of capital, while supporting differentiated constraint measures. In view of the outstanding problems exposed in practice such as incomplete or even untrue disclosure of project capital information, the book proposes to further strengthen the obligation of project units to disclose capital information, which is also a key supporting system for hierarchical management of project capital.

Second, we need to integrate existing assets with new investment. After years of investment and construction, a large number of stock assets have been formed in the field of infrastructure in our country, and it is of great practical significance to effectively revitalize these stock assets. In recent years, the central government and relevant ministries have introduced a lot of support policies to revitalize stock assets, but some localities and market players have not fully understood the policies, for example, unilaterally regard revitalizing stock assets as a means of "unloading burdens" and government financing. This book makes a comprehensive analysis of the evolution and guidance of the policy of revitalizing stock assets, and proposes that revitalizing stock assets is not an isolated behavior, but should be organically combined with new investment, and the recovered funds should continue to be used for new infrastructure construction, forming a virtuous cycle of stock assets and new investment. The book also points out that the actual effect of the policy of revitalizing stock assets will be affected by multiple factors, such as the size of stock assets that have the conditions for revitalization, the size of recovered funds that can be used for new projects, and the constraint on the use of recovered funds for new investment. These insights have important guiding value for the understanding and practical operation of the policy of revitalizing the stock of assets.

Third, we will innovate the comprehensive development model. Under the background that land finance is not sustainable and the local debt rate has accumulated to a high level, infrastructure investment and financing urgently need to improve the hematopoietic capacity of the project and reduce the direction of financial investment. Integrated development modes such as public transport-oriented development (TOD) and ecological environment-oriented development (EOD) have changed the previous project implementation mode of scattered development and single-line promotion. By adopting innovative project organization and implementation methods such as industrial chain extension, joint management and combination development, a benign mechanism is formed in which industrial development and property operation feed back investment in infrastructure projects. Internalizing the economic value brought by infrastructure construction can help ease the pressure on government investment. In view of the institutional and institutional obstacles facing the current comprehensive development practice, this book explores and puts forward some "solutions", and provides useful reference for the current promotion of comprehensive development mode.

Fourth, objectively evaluate the contribution of government investment and financing platforms. Government investment and financing platform companies are the main force of local infrastructure investment and construction, and also the main body of infrastructure financing. Although there have been problems such as the rapid expansion of the scale of debt financing by government investment and financing platform companies, and the violation of rules by local governments or the provision of guarantees in disguise, the contribution of government investment and financing platform companies to urban construction and development cannot be denied. In the process of new urbanization in China, without the strong promotion of government investment and financing platform companies, there would be no high-quality infrastructure and vigorous development of modern urban system at this stage. In order to meet the still huge demand for infrastructure investment in the future, in a long period of time, government investment and financing platform companies play an irreplaceable role as the main force, and continue to promote the transformation and development of government investment and financing platform companies is an important part of improving the infrastructure investment and financing mechanism. This book proposes that the feasible path for the transformation of government investment and financing platform companies is to take market-oriented operation as the core, transform them from local government investment and financing subjects to government-authorized public resource utilization subjects and public project implementation subjects, and realize sustainable development by building appropriate business models. It is worth noting that it is neither necessary nor feasible to forcibly transform government investment and financing platform companies into market-oriented entities that have nothing to do with the government.

Fifth, government investment should be more appropriate. In the field of infrastructure investment and financing, government investment plays a very important role. In the situation of slowing down the growth of fiscal revenue, the government's investment capacity is facing great challenges, and the contradiction between limited government investment and huge infrastructure investment needs is becoming increasingly prominent. Government investment should "do something", focus on the focus, precise force, better perform the limited function of making up for market failure, more prominent public attributes of government investment, reduce investment in competitive fields, and make way for market players and even create investment opportunities. While clearly defining the scope of government investment, the book proposes to give full play to the constraining and guiding role of planning. One of the core measures is to work out investment and financing plans and medium - and long-term fiscal plans on a rolling basis, to find out the family's bottom line, to live within income, and to comply with financing regulations. Another measure is to strengthen the rigid constraints of the government's annual investment plan and annual fiscal plan, and improve the linkage mechanism between the investment plan and the fiscal budget. It is particularly worth mentioning that the book makes a clear distinction between government investment management and enterprise investment management, holding that the focus of the reform of enterprise investment management system is to loosen the management of enterprise investment projects and release the vitality of enterprise investment, while government investment management should continue to follow the basic principles of scientific decision-making, standardized management, emphasizing performance, openness and transparency put forward in the Regulations on Government Investment. It's not all about simplification and speed. It is instructive for us to correctly understand the course and direction of China's investment and financing system reform in the past 20 years and avoid confusing government investment management and enterprise investment management.

Infrastructure construction is a long-term undertaking, and the accompanying infrastructure investment and financing is a long-term and difficult task. This book cannot and does not need to cover everything, but its principles, ideas and methods provide useful reference for us to solve the problem of infrastructure investment and financing in the new era.

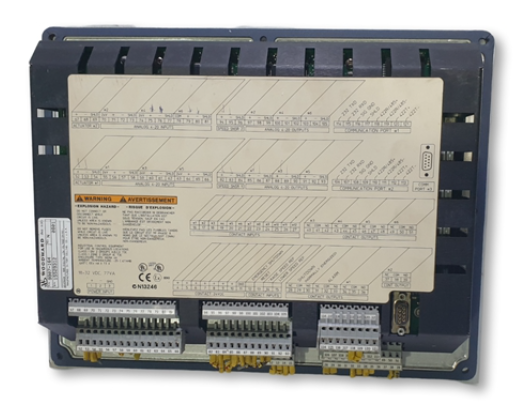

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

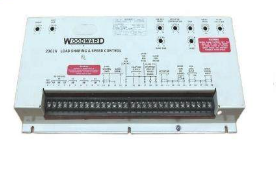

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

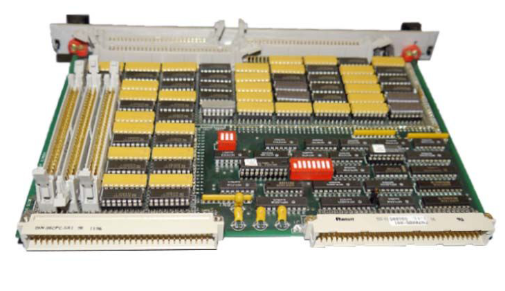

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- Triconex

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor