Downstream demand recovery, chemical fiber industry ushered in a cycle reversal

1, the downstream demand boom recovery, chemical fiber industry ushered in a cyclical boom reversal

After the supply-side reform in 2016, the effect of destocking was obvious, and the chemical fiber industry entered the stage of capital expenditure growth in the big cycle. At the end of 2019, the capital expenditure of the chemical fiber industry slowed down, the new production capacity was basically ended, and the industry supply bottomed out. Affected by the epidemic at home and abroad, at the beginning of 2020, the demand of the chemical fiber industry has dropped significantly, the inventory of chemical fiber finished products has accumulated, the profitability of main products has declined, and the valuation of the chemical fiber industry is at a historical low; In the second quarter, the domestic epidemic situation was gradually controlled, the epidemic situation abroad worsened, a large number of foreign orders were transferred into the country, the export demand of chemical fiber downstream textile and clothing increased significantly, the operating rate of domestic downstream enterprises increased, and the inventory continued to decline; 2020Q4 so far, with the gradual recovery of overseas demand, the demand of the chemical fiber industry continues to pick up, downstream enterprises take the initiative to replenish the stock, the profitability of the main products has rebounded, the market attention of the chemical fiber industry has increased, the valuation has entered the repair stage, and the cycle has continued to rise.

1.1, the production cycle of the chemical fiber industry is coming to an end, and the replenishment cycle is ushered in in 21 years

The cumulative fixed asset investment completed in the chemical industry is basically synchronized with the trend of the chemical product price index CCPI, and the prosperity of the chemical industry has gradually recovered since the second quarter of 20 years. Looking back at the trend of fixed capital investment and CCPI in the chemical industry in the past 8 years, it can be found that the capital expenditure of China's chemical industry is basically synchronized with the trend of CCPI. In July 2016, CCPI continued to decline and then rebounded. The cumulative amount of fixed asset investment completed in the chemical industry in August 2016 ushered in an upward inflection point. The sudden outbreak of COVID-19 in January 2020 dealt a major blow to the chemical industry, and the cumulative fixed investment completed in the chemical industry and CCPI fell to historic lows respectively. In the second quarter, the domestic economy entered a normal channel, the demand picked up significantly, and the fixed asset investment in the chemical industry and CCPI recovered steadily. The cumulative amount of fixed investment completed in the chemical industry in 2020 rebounded from -33% in February to -1.2% in December.

The production cycle of the chemical fiber industry is coming to an end, and the new production capacity has entered the market digestion stage. Compared with other chemical products, the chemical fiber industry shows the characteristics of early investment start and early investment end, and the investment cycle corresponds to the order of the business cycle start. From the historical data, the investment situation of the chemical industry and the investment cycle of the chemical fiber industry have obvious correlation. From 2006 to 2019, the chemical fiber industry and the chemical industry have experienced four investment growth periods, with a 4-25 month interval at the beginning of the cycle. In 2019, the new production capacity of chemical fiber varieties has come to an end, and the chemical fiber industry has bottomed out from the perspective of supply. In terms of chemical fiber production capacity, the cumulative fixed asset investment in the domestic chemical fiber industry showed an increasing trend from 2016 to 2018, but the new chemical fiber production capacity is still at a historically low level. In 2020, due to the impact of the production cycle of the chemical fiber industry and the new coronavirus epidemic, the total output of domestic chemical fiber is 61.68 million tons, an increase of only 3.6%. In the next few years, the production of domestic chemical fiber industry continues to slow down, and it is expected that the new supply of the industry is limited.

The change of chemical fiber inventory has a certain lag compared with the trend of CCPI, and it is expected that chemical fiber will usher in a replenishment cycle. Taking 2017-2018 as an example, the 2017Q2-2018Q3CCPI was in the rising cycle, and the chemical fiber inventory increased in 2017Q3-2018Q4, and the trend of chemical fiber inventory had a certain lag synchronization compared with the trend of CCPI, so the chemical fiber inventory as a lagging indicator had a certain predictability. Chemical fiber inventories fell significantly year-on-year from an all-time high of 40.7% in October 2018 to an all-time low of -10.5% in October 2019. Affected by the epidemic in early 2020, downstream demand was hit hard, and chemical fiber inventories increased significantly year-on-year, rising to 23.8% in March 2020. Since the second quarter, domestic chemical fiber production and sales have returned to normal, with the continuous recovery of overseas demand and the increase of export demand, and the inventory has entered the continuous decline channel after experiencing a brief rise in the second quarter. CCPI continues to rise after bottoming out in Q2 in 20 years, and the chemical fiber industry is expected to usher in a replenishment cycle.

The epidemic situation has become normal, and the prosperity of the chemical fiber industry has rebounded. At the end of 2019, the new production capacity of chemical fiber was basically completed, and the stock of chemical fiber was high due to the impact of the epidemic. The average inventory of chemical fiber in 2019-2020 has reached a historical high, and the industry's prosperity is depressed. At the beginning of 2020, due to the impact of the new coronavirus epidemic, domestic population migration was blocked, the operating rate of chemical fiber enterprises fell sharply, and the inventory of finished products was once high. 2020Q2 The domestic epidemic gradually stabilized, overseas textile and garment knitting demand picked up, textile and garment orders returned to domestic enterprises, chemical fiber enterprises significantly destocking, chemical fiber inventory at the end of 2020 has been at a low level, with downstream demand picking up, industry replenishment demand is strong.

1.2, downstream demand recovery, chemical fiber industry recovery

The export of downstream textile products increased significantly, which led to the recovery of the chemical fiber industry. In March 2020, the delivery value of chemical fiber outbound was 5.28 billion yuan, down 0.7% year-on-year. Since March 2020, the overseas epidemic has intensified, a large number of textile and knitting orders have been transferred to the domestic market, the downstream textile and clothing exports of the industry have increased significantly, and the delivery value of chemical fiber exports has continued to rebound since the second quarter of 20 years.

In the second quarter, the operating rate of domestic chemical fiber enterprises increased rapidly. Affected by the epidemic in the beginning of 20 years, domestic enterprises are generally in a state of shutdown and production, the capacity utilization rate of chemical fiber manufacturing industry hit a new low of nearly 5 years in March, and the inventory of finished products in the chemical fiber industry was high. Since the second quarter of 2020, domestic enterprises have generally resumed production, with the recovery of overseas demand, good orders, and the operating rate of the chemical fiber industry has climbed rapidly.

The export demand for textile products has increased significantly, becoming the main force for the recovery of the chemical fiber industry. The epidemic abroad has led to the transfer of a large number of textile and garment processing orders to China, and the export of chemical fiber has declined year-on-year. Affected by the epidemic, the demand for foreign epidemic prevention materials has increased sharply, and the export amount of textile and clothing in 2020 has reached a historic high of $31.29 billion, and the demand for textile and clothing continues to increase during Thanksgiving and Christmas. Among them, the cumulative equivalent ratio of textile yarns, textiles and products exports increased from -19.9% in February to 33.7% in September, and began to decline slightly in October, but still maintained a high level.

After the downstream demand picked up, the domestic loom operating rate increased significantly, and the textile and clothing trading volume continued to improve. In the first quarter of 2020, under the impact of the epidemic, domestic enterprises stopped production, and the downstream loom operating rate of polyester filament was only 7%, a record low, and the trading volume of the textile city fell to 1.16 million meters in the same period, a decrease of 65%. In the second quarter, the domestic epidemic prevention and control was effective, and enterprises gradually resumed work and production, while the deterioration of the foreign epidemic made the demand for protective materials break out, at the same time, affected by the supply limitation of the epidemic abroad, a large number of orders were transferred to the domestic, the domestic loom operating rate has increased rapidly since the second quarter, and the volume of textile city has rebounded significantly. Spinning and weaving enterprises are expected to resume work better than the same period in previous years, and the tight container problems that continued to restrict downstream and terminal exports in the early stage began to improve from the end of January 2021, providing a foundation for the execution of foreign trade orders in the later stage, and the sustained growth of the demand side has been strongly guaranteed.

Since the second quarter of 2020, retail sales of textile and clothing have rebounded rapidly year-on-year. In terms of domestic downstream textile and garment demand, the retail situation in the first quarter of 2020 was seriously affected by the epidemic, with a cumulative average decline of 30.7% year-on-year, downstream demand gradually recovered in the second and third quarters, and demand increased significantly in the fourth quarter. In 2020, the cumulative retail sales of domestic clothing, shoes, hats and needles, and textile products rebounded from -30.9% in February to -6.6% in December.

Industry prosperity recovery, chemical fiber industry valuation is expected to gradually repair. In the first quarter of 2020, the valuation of the chemical fiber industry is still at a historical low, with the gradual recovery of downstream demand for chemical fiber in the second quarter, the industry boom is picking up, the PPI of the chemical fiber manufacturing industry has improved significantly year-on-year and quarter-on-quarter, and the industrial added value of the chemical fiber manufacturing industry has shown a growth trend. Under the background of high certainty of performance growth in the past 21 years, the market attention of the chemical fiber industry has increased, and the industry valuation has entered the continuous repair channel.

2, polyester filament demand bottomed out and rebounded, and the industry ushered in a turning point

2.1. Basic introduction of polyester filament

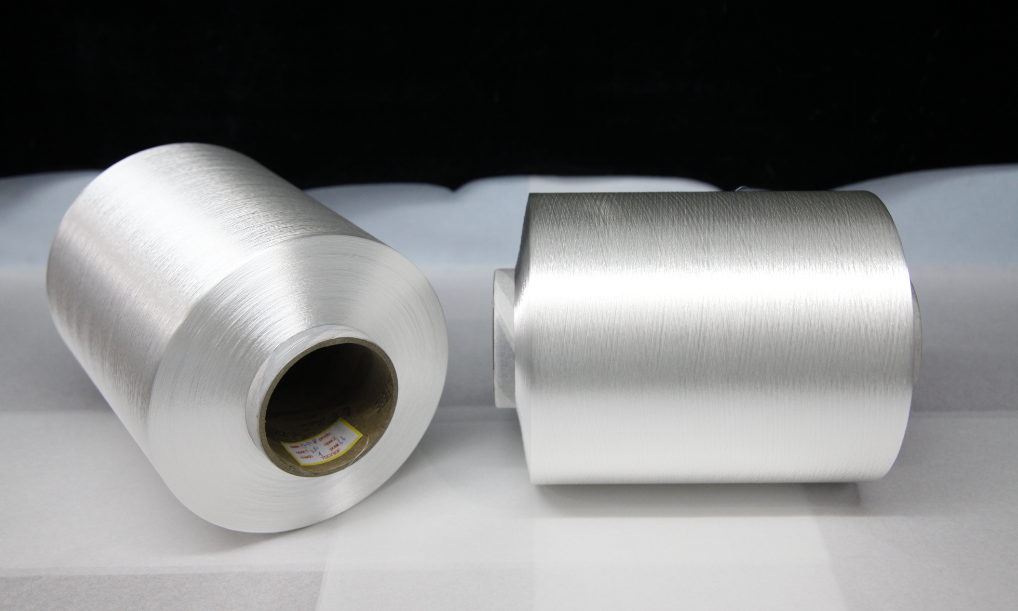

Polyester filament is made of polyester (namely polyethylene terephthalate, referred to as PET) by spinning and finishing the length of more than kilometers of fiber. Polyester, commonly known as "polyester", is made from refined terephthalic acid (PTA) or dimethyl terephthalate (DMT) and ethylene glycol (MEG) as raw materials by esterification or transesterification and polycondensation. Polyester filament has the advantages of high strength, good crease recovery, good wear resistance, and not easy to stain, and is widely used in various clothing and decorative materials.

Polyester filament is located in the middle and lower reaches of the entire industrial chain. Upstream for the petrochemical industry, the main production of PX, ethylene, naphtha and other chemical products; The middle reaches is the chemical fiber manufacturing industry, mainly producing PTA, MEG, PET, polyester film, polyester fiber, polyester chip, etc. Downstream mainly related to polyester filament and staple fiber and its spinning clothing, automotive applications. According to the difference of production process and performance, polyester filament can be divided into three categories: primary silk, stretched silk and deformed silk. Primary silk mainly includes POY (pre-oriented silk); The drawing filament mainly includes FDY (full drawing deformed filament); The textured silk mainly includes DTY (stretched textured silk) and other products, which are mainly used in the civil textile and textile garment industry.

The polyester filament industry has developed rapidly and has a variety of production processes. According to the spinning speed, polyester filament can be divided into conventional spinning process, medium-speed spinning process and high-speed spinning process. According to polyester raw materials can be divided into melt direct spinning and slice spinning; According to the process flow, it can be divided into three steps, two steps and one step. With the development of China's polyester filament industry, the small production capacity has been gradually eliminated, the production scale of the filament device has been upgraded, the leading enterprises in the industry have a significant advantage, and China's polyester filament has also achieved effective results in the production process development.

2.2, downstream demand gradually recovered, filament price spread continued to expand

The downstream application of polyester filament is mainly divided into three areas: industry, home textiles and textile and apparel, 2016-2020 polyester filament in the textile and apparel industry consumption of 53.95 million tons, accounting for 52% of the total downstream consumption, the textile and apparel industry demand changes have a significant impact on the demand pattern of polyester filament industry.

Domestic filament downstream recovery, overseas textile demand recovery. The demand terminal of China's textile and garment industry is mainly in the country, the epidemic attack in early 2020 led to a reduction in the demand for textile and garment and other daily necessities, a large number of textile and garment retail stores were closed, and the cumulative retail sales of daily necessities in February were negative for the first time in nearly seven years, and the cumulative export amount of textiles and kimono was reduced by 19% and 20% respectively. Affected by the textile and clothing industry, the average production and sales rate of polyester filament in January and February was only 19%. Since the second quarter, the domestic epidemic has been brought under control, and people's living consumption has gradually returned to normal. With the deterioration of the epidemic situation abroad, the demand for textile and clothing products, especially epidemic prevention materials, has increased sharply. Due to the shutdown of overseas factories due to the epidemic, a large number of foreign textile and clothing orders transferred to domestic enterprises, domestic downstream textile and clothing factories in strict observance of the epidemic prevention policy under the premise, the operating rate increased from 5% in early February to 65% in early March, and continued to maintain an upward trend, the average production and sales rate of polyester filament increased to 350% on November 10. Since the third quarter, the global epidemic has been under certain control, textile and clothing factories have resumed work and production, and China's polyester filament exports have continued to increase, gradually increasing from -32% in January to 1.6% in December. In 2020, the apparent consumption of polyester filament in China will be 30.47 million tons, an increase of 1.6%. Exports were 2.21 million tons, up 1.5% year-on-year. Although the new coronavirus vaccine has been successfully developed and gradually put into use, it still takes a long time for the vaccine to reach global coverage, and the world will enter a normal situation of epidemic prevention and control in the next few years, and the steady growth of textile demand will drive the polyester filament industry to continue to improve.

Polyester filament stock "tired - decrease - increase - decrease", replenishment cycle continues. In the first quarter of 2020, affected by the epidemic, the textile and clothing industry has a demand crisis, retail sales have fallen off a cliff, the terminal supply and demand imbalance is transmitted along the polyester industry chain to the polyester filament industry, and the polyester POY inventory reached 35 days in March 2020, an increase of 289%. In the second quarter, domestic demand for textile clothing gradually rebounded, foreign demand for epidemic prevention materials soared, and superimpose polyester filament enterprises took the initiative to clear inventory through promotional means. Downstream textile and clothing enterprises concentrated inventory, polyester filament inventory pressure has been eased, polyester POY inventory in April fell sharply to 7.5 days, down 31% from the previous month. During the same period, polyester filament enterprises entered the replenishment cycle, but the downstream loom resumed work relatively slowly, resulting in a gradual increase in polyester filament inventory from June to October. Since the fourth quarter, with the foreign epidemic has been further controlled, the global textile and clothing enterprises have taken the initiative to replenish the inventory, and the export volume of polyester filament in our country increased to 260,000 tons in December, and the polyester POY inventory fell to 16 days, a decrease of 40% from the previous quarter. As of April 2, 2021, the polyester POY inventory days are 16 days, the current polyester filament inventory is still at a historical low, and the future will continue to replenish the inventory cycle.

Downstream demand to improve the profitability of polyester significantly, polyester filament spread change trend to "gold nine silver ten" as the bottom rebound turning point. In the first half of 2020, the polyester filament price spread was generally affected by the lower demand for downstream spinning and clothing and the accumulation of stocks. From the second quarter, the demand for overseas epidemic prevention materials began to rise, leading to the increase of polyester filament exports and the decline in inventory, and the filament price spread ushered in a small rebound in the downward trend. In the second half of 2020, global textile and clothing enterprises have successively entered the replenishment cycle, polyester filament demand ushered in a new round of warming, polyester POY price differential continued to fall to 614 yuan/ton at the end of August, ushered in an upward cycle, as of April 2, 2021, Polyester POY spread continued to rise to 1706 yuan/ton. With the normalization of the global epidemic prevention and control in 2021, the demand of the textile and clothing industry is steadily increasing, and the current polyester filament inventory is at a low level, and enterprises continue to replenish the inventory cycle, it is predicted that the polyester filament price spread will continue to maintain an upward trend, profitability will continue to improve, and the industry prosperity will pick up.

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA

- Other Brands