The basic situation of ship finance leasing and its risk prevention

The shipowner should also exercise the shipowner's rights and take the initiative to bear the costs of unexpected risks and assume the responsibility of preventing the risks of the ship." Such a contract agreement clarifies the distribution of responsibilities, and can certainly regulate the process of ship leasing transactions and avoid the risks brought by ship defects to ship leasing transactions as far as possible.

3. Structural risks in the process of trading

First of all, the direct consequence of market risk is to cause debt repayment risk. The market risk in the shipbuilding industry mainly depends on its operating cycle. During the implementation of the project, if the market changes significantly and falls sharply, the default clause can effectively protect the lessor's income. However, when the default occurs, the lessee may have lost the ability to buy back and repay.

Through data analysis, the minimum average ship operating rate can be obtained, but in the actual situation, if there is a major change in the market and the market deteriorates, the average ship operating rate may be lower than this value. Moreover, the source of rent is not only the operation of the ship itself, but also the overall operating income of the group enterprise.

So the risk of debt repayment will be borne by the ultimate guarantor, while ensuring that the rent is paid. In the process of project construction, the rent payment does not only rely on the operation status and financial ability of a single lessee. The listed company will adjust all internal income, and the subsidiary company will pay rent to the lessor. Secondly, the direct factor that causes the final asset disposal risk is the residual value risk, because the residual value risk is uncontrollable.

Finally, whether the design structure of financial leasing projects is scientific and rigorous is mainly reflected in the possibility of resolving or sharing risks after the occurrence of default.

4. Risk prevention measures

No matter what kind of method is used, ship leasing generally has the following characteristics: the purpose of financing is to obtain all the financing and the right to use the ship at one time through this way of financing, and then pay the rent in installments. With this way of financing, the repayment pressure is small, and the company can have more cash. In addition, the rent payment is generally paid annually, which can generate sufficient cash flow in the early stage of the use of the ship and ease the repayment pressure for the loan construction of the ship. Make the enterprise's cash flow form a virtuous circle, conducive to the structure of assets and liabilities, financing risk is also smaller.

Compared with direct purchase, ship finance leasing is a very convenient way of leasing and financing, and ship lease financing is a long-term financing way of leasing transactions, which has certain advantages compared with other short-term financing.

For example, the main financing method in our country is bank loans, and ship leasing financing can provide greater convenience for enterprises. Ship leasing financing is characterized by a large capital base and a long time, generally buying a ship will cost hundreds of millions of yuan, but the overall scale of private enterprises is small, the cost of a ship exceeds the total value of the enterprise, the effective mortgage is insufficient, and the guarantee is difficult. Financial leasing pays more attention to the future development of enterprises. In the face of such a current situation, some emerging enterprises will have greater opportunities for competition.

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

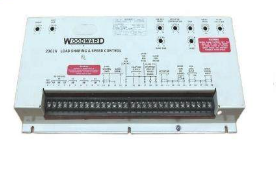

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- Triconex

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor