Grasp the industry trend, layout of new carbon fiber materials

1. Jilin Chemical fiber overview

Jilin Chemical Fiber, located in Jingkai District, Jilin City, Jilin Province, is a holding subsidiary of Jilin Chemical Fiber Group Co., LTD. The company was founded in 1960, in August 1964 was completed and put into operation, the initial production of viscose staple fiber. In 1993, Jilin Chemical Fiber Factory as the sole initiator, approved by the Jilin Province economic system Reform Committee, adopt the way of directional recruitment to set up a joint-stock enterprise. In August 1996, the company was listed in Shenzhen Stock Exchange. After listing, the company's business extends from viscose staple fiber to viscose filament. In December 2017, the company and Guoxing Materials signed the "Carbon Fiber Industry Cooperation Framework Agreement", officially involved in the field of carbon fiber carbonization.

1.1. Affiliated to Jilin Chemical Fiber Group, backed by Jilin City SASAC

According to the company's annual report for 2021, the actual controller is Jilin City SASAC, which actually controls 22.59% of the company's equity through its subsidiaries such as Jilin State-owned Capital Development Holding Group and Jilin Chemical Fiber Group, among which Jilin Chemical Fiber Group directly holds 14.67% of the company's equity.

1.2. Viscose filament faucet, focus to carbon fiber industry

Viscose filament is the company's characteristic product

The company's initial design capacity of viscose staple fiber is 100,000 tons/year, after process optimization and process reengineering, the current actual capacity has reached 120,000 tons/year. The company has about 80,000 tons/year of viscose filament production capacity, equivalent to one-third of the global production capacity, is the domestic viscose filament leading position.

The company shifted its focus to carbon fiber

Jilin is an important gathering area of China's carbon fiber industry, Jilin City brings together a number of enterprises involved in raw silk, carbonization and products. Jilin Chemical Fiber Group is the earliest enterprise involved in carbon fiber preparation in China. In recent years, with the breakthrough of equipment technology and polymer spinning technology, the civil carbon fiber industry of Jilin Chemical Fiber Group has begun to enter the fast lane. There is a process for the company to enter the carbon fiber industry. In December 2017, Jilin City Guoxing New Material Industry Investment Co., LTD., a wholly-owned subsidiary of Jilin SASAC, signed a framework cooperation agreement with Jilin Chemical Fiber, transferring its 18% equity of Jilin Jinggong Carbon Fiber Co., Ltd. to Jilin Chemical Fiber. And promised to fully support the development of Jilin Chemical fiber carbon fiber industry, will be based on the development of Jilin City carbon fiber industry, Jilin chemical fiber industry carbon fiber extension, will hold part of the equity of carbon fiber industry enterprises to Jilin Chemical fiber.

In October 2021, Jilin Chemical Fiber invested 137 million yuan and transferred 31.00% equity of Jilin Baojing held by Guoxing New Materials on the basis of the basic assets method. In February 2021, the company announced that its subsidiary Jilin Kemike planned to invest in the construction of 600 tons of carbonized production line, mainly engaged in the production of 1K and 3K small filament tow special carbon fiber, and the first production line was successfully started on October 28, 2021. In July 2021, the company announced that Jilin Chemical Fiber led and Three Gorges Group built carbon fiber project in Songyuan, Jilin, and there is no further information update. In November 2021, Jilin Chemical Fiber plans to increase by no more than 1.2 billion yuan, invest in the construction of 12,000 tons of carbon fiber composite projects, and further expand the layout in the field of carbon fiber. Due to historical reasons, the controlling shareholder of Jilin Chemical Fiber Group's Guoxing carbon fiber also has some carbonization assets, in March 2022, the company announced that Jilin Chemical Fiber Group is a competition in the industry, and intends to complete the injection of Guoxing carbon fiber within 3 years.

1.3. Achieved a turnaround and a significant year-on-year increase in revenue

The main revenue of the company currently comes from viscose filament and staple fiber. In 2021, the company's viscose filament business contributed 2.2 billion yuan in revenue, accounting for 62% of the company's total revenue; In 2021, the company's viscose staple fiber business revenue totaled about 1.2 billion yuan, accounting for 33% of the company's total revenue. The rest of the company accounts for less than 5%. The majority of the company's current revenue comes from the Chinese mainland market. In 2021, the revenue of the Chinese mainland market accounted for about 63%, and the revenue of the foreign market accounted for 33.25%.

From 2017 to 2019, the gross profit rate of the company's main products increased steadily, and the comprehensive gross profit rate of the company's business reached 20.01% in 2019, but the comprehensive gross profit rate fell to 7.29% under the impact of the epidemic in 2020, and the gross profit rate of the company recovered to 8.88% in 2021 as the epidemic situation improved but the impact was still there.

The increase of financial expense ratio leads to the increase of corporate period expense ratio. In order to ensure the smooth progress of the company's annual output of 15,000 tons of differentiated continuous spinning filament under construction projects, the expansion layout of the carbon fiber industry, and the company's abundant capital liquidity during the epidemic period, the company's bank loans increased significantly after 2018, resulting in a significant increase in the company's financial expense ratio. In 2020, the company's financial expense ratio reached 11.86%, and the comprehensive period expense ratio reached 17.51%. In 2021, with the substantial growth of total revenue, the financial expense ratio dropped significantly. The company's administrative expense ratio and sales expense ratio are basically stable at less than 4%. The company's current ROE of chemical fiber business is less than 5%. In 2018, the company's ROE reached a five-year high of 4.54% and ROIC was 6.09%. Under the impact of the epidemic in 2020, the company's loss ROE fell to -7.52%, and ROIC fell to 0.19%. In 2021, the operating condition of the company's chemical fiber business improved, and the ROE and ROIC recovered to -4.36% and 1.98%, respectively.

2. Jilin Chemical Fiber grasps the industry trend and lays out new carbon fiber materials

2.1. Carbon fiber is a special fiber with excellent properties

Carbon fiber is made of polyacrylonitrile, asphalt, viscose and other organic fibers cracked and carbonized under high temperature environment, carbon main chain structure inorganic fiber with carbon content of more than 90%, with excellent mechanical properties and chemical stability. With light weight, high strength, high modulus, electrical conductivity, thermal conductivity, corrosion resistance, fatigue resistance, high temperature resistance, low expansion coefficient and a series of other materials can not be replaced by the excellent performance.

Material determines performance, performance determines use, carbon fiber high strength, high mold, light characteristics determine that carbon fiber is a special material used in many fields, such as badminton rackets in daily life, golf clubs, high-end aircraft fuselage, wind power blades in the field of new energy, carbon heat field, pressure vessels and so on.

According to the different source of raw materials, carbon fiber can be divided into PAN and asphalt based carbon fiber, polyacrylonitrile (PAN) as the matrix of composite materials with excellent mechanical properties, a wide range of applications, the output of about 90% of all carbon fiber production in the world. According to the different size of the tow, the carbon fiber in the single tow is generally greater than 24K to become a large tow, and on the contrary, it becomes a small tow. The defense military field such as aircraft fuselage generally uses small tow carbon fiber, and the civilian field uses more large tow carbon fiber.

In the downstream application fields of carbon fiber, the demand and demand growth of wind power blades is the largest, and the aerospace market is the largest. According to Lin Gang's "2021 Global Carbon Fiber Composite Market Report" data show that the global demand for carbon fiber in 2021 is 118,000 tons, and the total market size is 3.4 billion US dollars. In terms of subdivision, the amount of wind power blades is 33,000 tons, accounting for 28%, which is the largest subdivision of the amount; The unit price of aerospace carbon fiber is as high as 72 US dollars/kg, and the market size is 1.188 billion US dollars, accounting for 35% of the market size, which is the largest market segment. From the perspective of the development trend of the industry, the wind power blade market is growing fastest, 2004-2020 demand compound growth rate of 26%, much higher than the aerospace market growth rate of 10%, according to the 15MW fan corresponding to the carbon fiber demand of 50,000 tons to calculate, sea breeze blade large-scale will further increase the demand for carbon fiber market.

China, the United States and Japan are the world's top three carbon fiber production countries. In 2021, the global carbon fiber operating capacity is about 207,600 tons. From a regional perspective, China surpassed the United States for the first time to become the world's largest production capacity, with an operating capacity of 63,400 tons, accounting for 30.5% of the global carbon fiber operating capacity in 2021; The operating capacity of the United States is 48,700 tons, accounting for 23.5%; Japan ranked third, with 25,000 tons of operating capacity, accounting for 12%. Due to the immature technology, China's carbon fiber construction is generally insufficient, and the operating rate in other countries and regions is maintained at a relatively high level. Specific to the carbon fiber large tow market, Japan's Torre acquisition of the United States ZOLTEK to become the global leader in large tow carbon fiber, Japan's Mitsubishi also began to increase the investment in large tow carbon fiber, Germany SGL company followed, the three are the global representative of large tow carbon fiber enterprises.

China's carbon fiber market operating rate is low, high dependence on foreign countries. From the data of 2021, China's total demand for carbon fiber is about 62,400 tons, and it has achieved a high growth of 27.7% under the impact of the new coronavirus epidemic. Because more domestic carbon fiber enterprises have not achieved a breakthrough in key technologies, the production line has the problem of operation and product quality instability, the nominal production capacity of 63,400 tons, the actual supply of 29,300 tons, the overall operating rate of 46.2%, showing a situation of production capacity without output. At the same time, China's carbon fiber has also maintained a high degree of foreign dependence, in 2020, China's carbon fiber imports of 33,000 tons, accounting for about 53% of the total demand, an increase of 9.2%.

Due to the wide application in the field of national defense and military industry, carbon fiber materials have become the material basis and technology guide for the development of high and new technology, national defense cutting-edge technology and transformation of traditional industries in the world, and are one of the most important development directions in China's strategic emerging industries. In the past more than half a century, China's main development of small wire bundles of carbon fibers used in the military field, breaking the key links of key military materials, with the increase in the penetration rate of carbon fiber in the civilian field, especially the emerging industries represented by new energy widely used carbon fiber materials, civil carbon fiber has become an opportunity for China's carbon fiber industry to achieve leap-forward development.

2.2. The global new energy is advancing rapidly, opening up the market space of large tow carbon fiber

With the landing of the "double carbon" policy, the development of the domestic carbon fiber industry ushered in a golden moment. Wind power, electric vehicles, hydrogen energy, photovoltaic and other fields are all industries in which China has comparative advantages and are also key industries supported by the state. The rapid growth of carbon fiber demand in related fields and the large market capacity can not only pull the demand for carbon fiber, but also better solve the serialization, differentiation and extension of the development of carbon fiber industry.

The installed capacity of wind power and the large size of fan blades drive the demand for carbon fiber

During the global "14th Five-Year Plan" period, the compound growth rate of wind power installed capacity exceeded 25%. After experiencing the rush to install in 2020, the wind power industry still maintains a high prosperity in 2021 under the background of the national carbon neutral policy, and the central subsidy will fully decline in 2022. According to the expectation of the new team of United Power, the large-scale offshore wind power installed capacity and the demand for onshore wind power after the cost reduction will continue to support the growth of new installed capacity. In 2025, the global installed capacity of wind power will reach 94GW, and China will reach 45GW, accounting for 47% of the global new installed capacity. Carbon fiber blades are cost-effective in large scale blades. When the fan becomes larger, the all-FRP blade can no longer meet the requirements of large and lightweight blades, and the carbon fiber material with better density and rigidity has become a more ideal choice. Under the premise of stiffness and strength, carbon fiber is more than 30% lighter than FRP blades. At present, the straight diameter of the wind wheel has exceeded 120m, and the blade weight has reached 18 tons. Carbon fiber blades improve power generation efficiency and reduce blade cost while reducing weight, especially with the continuous decline of the price tag in wind power, carbon fiber blades have prominent cost-effective advantages in large-size blades.

The Vestas blade carbon beam patent has expired, and the permeability of large tow carbon fiber in wind power blades is expected to be greatly improved. Vestas, a global wind power giant, has achieved the large-scale application of carbon fiber in fan blades, and other international giants, Siemens - Gamesa, GE-LM, Nordex, etc., have adopted carbon fiber pultrach plate manufacturing and testing prototypes in new models. Domestic wind power enterprises have not yet formed the large-scale mass production of carbon fiber blades, more in the prototype verification stage, July 19, 2022 Vestas blade carbon beam patent expired, is expected to bring step growth for the domestic leaf carbon fiber market.

According to Lin Gang's "2021 Global Carbon Fiber Industry Report" data, the global demand for wind power blade carbon fiber in 2021 is 33,000 tons, a year-on-year growth rate of 10%, and the proportion of demand has increased to 28%. In 2020, the demand for carbon fiber in the domestic wind power blade field is 22,500 tons, an increase of 10%, accounting for 36.1% of the total domestic demand. Carbon fiber for wind power blades are mainly T300 grade 24K, 48K, 50K and other products at home and abroad. Overseas are mainly Toray's Zortec (United States + Mexico + Hungary), Japan's Mitsubishi, Germany's Sigli and Formosa Plastics, Turkey Dowaksa, domestic Jilin Carbon Valley + Baojing products can basically meet the needs of downstream customers. We expect that by 2030, the global demand for carbon fiber in wind power blades will form a 100,000 ton market, three times the current wind power blade market, with a CAGR of about 13%.

Under the dual-carbon strategy, a number of new energy tracks continue to drive the growth of carbon fiber demand

Under the wave of energy change, the photovoltaic industry is developing rapidly, and hydrogen fuel cells are also preparing for development, and these emerging industries are also driving the substantial expansion of carbon fiber demand. Photovoltaic field: Carbon fiber is suitable for single crystal furnace thermal field with its heat resistance characteristics. As a consumable, carbon fiber crucible has the advantages of low energy consumption and long life compared with graphite crucible, and it is more suitable for carbon fiber crucible in large-size silicon wafers. In 2021, the global carbon fiber demand for carbon carbon thermal field is 0.85 million tons. With reference to the installed PV capacity of 133GW in 2021, according to the forecast of the new team of United Power, by 2030, the global PV installed capacity of 435GW corresponds to the carbon carbon thermal field carbon fiber demand of about 26,000 tons.

Hydrogen energy field: carbon fiber is the ideal material for high-pressure hydrogen cylinders, China gives strong support to the hydrogen energy industry, according to the planning of the first-line city cluster (Beijing, Shanghai and Guangzhou area) in 2025 hydrogen vehicles are expected to reach about 100,000. In 2021, the global sales volume of hydrogen vehicles is 16,300 units, and we calculate according to the White Paper on China's hydrogen energy and fuel cell Industry (2019 edition), assuming that 50,000 hydrogen vehicles will be shipped globally in 2025 and 1 million hydrogen vehicles will be shipped in 2030. If measured according to the heavy truck, the bicycle needs 10 hydrogen cylinders, and the mainstream hydrogen cylinder of 35KPa requires about 40 kg of carbon fiber. In 2021, the global pressure vessel carbon fiber market is 11,000 tons, according to our calculation, the demand for hydrogen vehicles is about 2,000 tons, and other traditional fields are 9,000 tons. We estimate that by 2030, the global shipment of 1 million hydrogen vehicles will correspond to 134,000 tons of pressure vessel carbon fiber market. It has become the first major carbon fiber application field after wind power blades. In summary, according to our calculation, benefiting from the growth of the new energy industry, the global market demand for carbon fiber will increase to 382,000 tons by 2030, compared with 2020, a 10-year increase of 2.5 times, CAGR=13.5%.

2.3. China's civil carbon fiber industry chain is initially opened, and it is expected to achieve corner overtaking in the future

From the perspective of development history, China's carbon fiber industry lags behind the United States and Japan. In terms of time line, among them, the United States is the original country, but carbon fiber from invention to application to the realization of economic value has gone through a bumpy process of 20 to 30 years; Due to the lifetime employment of employees in Japan, the short-term performance pressure of listed companies is relatively small, so even in the carbon fiber industry, the long research and development of losses to maturity has been accumulating, and finally ushered in the 1980s carbon fiber in the United States Boeing aircraft to achieve large-scale application. Look at the development of carbon fiber in China, the 1960s began to research and development, the beginning of the 21st century to achieve a breakthrough in the process, from the product application point of view is also from the lowest requirements of the sports equipment field, further to wind power blades, thermal fields, automobiles and other higher requirements of the field penetration, but the civil aviation field is still difficult to overtake, As military aviation carbon fiber materials are banned from export abroad, domestic manufacturers represented by Zhongjian Technology and Guangwei Composites are also constantly breaking through high-end military grades, and developing faster than civil aviation.

China has an industrial advantage in the new energy track. Compared with the traditional industry such as automobiles, aviation and other industries already behind the situation, our country in the field of energy transition of historical baggage light, as early as possible layout, and vigorously develop, in a certain sense can be considered to be standing in the same starting line or leading pattern with international counterparts. Especially in 2021, China clearly put forward the "double carbon" goal under the background, wind power, electric vehicles, hydrogen energy, photovoltaic and other fields in China is ushered in the development window period, China's industries are currently in the leading position of the global industrial chain, the future of China's manufacturing industry may rely on new energy industry to achieve the global industrial division of labor on the corner overtaking. At present, we believe that the domestic carbon fiber industry chain is basically complete, and we mainly consider three aspects: 1) the localization rate of equipment exceeds 90% (Jinggong technology large wire tow production line data); 2) T700 and below the large tow filament and carbon filament fully realize the domestic (performance is enough to meet industrial needs); 3) Both wet and dry spray wet spinning processes have been mastered, and the spinning speed has been continuously improved.

Civil large tow carbon fiber industry turning point has arrived: Wang Tiankai, former president of the carbon Fiber Branch of the China Chemical Fiber Association, announced at the 2021 annual meeting: The domestic carbon fiber industry in 2021 for the first time to achieve industry-wide profit, the market is currently showing a trend of short supply. The domestic carbon fiber industry has ushered in a new stage of development and entered the track of sound development. We believe that wind power blades drive the increase in demand for carbon fiber, and superimpose technological progress to bring about a decline in costs, and jointly promote the improvement of industry profitability. Looking to the future, we believe that China's civil carbon fiber industry has opportunities for overtaking corners. From the current global carbon fiber pattern, Japan's carbon fiber industry has the most significant advantages, but historically carbon fiber is not the first to develop and develop in Japan, and Japan then has advantages in technology and industry chain from two perspectives to achieve corner overtaking. First of all, at the technical level, in the 1960s and 1970s, the carbon fiber industry did not find large-scale commercial application scenarios, and the entire industry fell into losses. Japanese carbon fiber manufacturers digested and absorbed the carbon fiber industry chain technology during the industry downturn and re-innovated due to the lifelong employment of employees and the resistance to stage performance pressure. And the application of carbon fiber products was developed, and the basic conditions of industry were completed. In the 1980s, Boeing aircraft adopted carbon fiber materials on a large scale, opening up the market space for carbon fiber. Although Boeing aircraft is an American manufacturer, there are many Japanese companies in Boeing's suppliers, such as Kawasaki, Mitsubishi Heavy Industries, etc., and Japanese carbon fiber manufacturers indirectly enter the Boeing supply chain with the help of Boeing suppliers, seizing technology and industry chain opportunities to achieve curved overtaking.

2.4 Jilin's chemical fiber production capacity expanded rapidly

In 2019, large-scale production of large tow carbon fibers was successfully achieved. In July 2019, Jilin Jinggong (Baojing) 's large tow carbon fiber #2 line was successfully tested. The core equipment of the production line is independently developed, the device runs smoothly, and the product performance basically meets the needs of downstream users, marking the large-scale production of large tow carbon fiber in China. Jilin Chemical Fiber has the advantage of stable supply of carbon fiber precursors. Carbon fiber is the basis to achieve the qualified rate of carbonized products. At present, Jilin Carbon Valley is the main company with the ability to sell raw fiber abroad in China. Jilin Carbon Valley and Jilin Chemical Fiber belong to the State-owned Assets Supervision and Administration Commission of Jilin City, and are positioned as the carbon fiber raw fiber platform and carbonization platform under the State-owned Assets Supervision and Administration Commission of Jilin City respectively.

By 2024, the company will have an equity capacity of 40,000 tons/year. At present, Jilin Chemical Fiber's carbon fiber assets mainly include Baojing (49%) 8,000 tons of large tow production line, wholly-owned subsidiary Kemek two small tow production lines with a total of 600 tons, in addition, the company plans to build 12,000 tons of carbon fiber and composite production line. The company's brother unit Guoxing carbon fiber has 12,000 tons of large wire tow capacity by the end of 2021, and the large wire tow capacity under construction is gradually reaching production. 2022/3/20 The company has explained the competition in the industry for the fixed increase project in the non-public offering response letter: Jilin Chemical Fiber Group, the controlling shareholder, promised to inject Guoxing carbon fiber into the listed company within three years. If the project under construction is successfully implemented and the smooth injection of Guoxing carbon fiber, the company will have 40,000 tons of large tow carbon fiber equity capacity in the future, becoming the main domestic large tow carbon fiber supplier. In addition, on July 5, 2022, Jilin Chemical Fiber Group started the construction of an annual output of 60,000 tons of carbon fiber project with a total investment of 10.3 billion yuan. After the completion of the project, due to the listed company Jilin Chemical Fiber as the group's carbon wire business listing platform, and there are also problems of industry competition after the completion of the project, We believe that the Group has the possibility to further inject the project into the listed company.

3. Jilin Chemical Fiber is one of the largest viscose filament producers in China

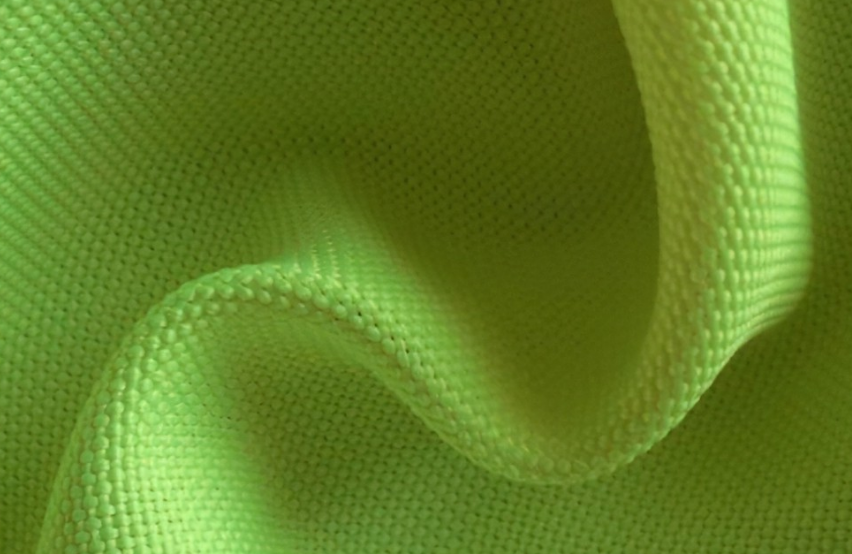

Viscose fiber is a kind of artificial fiber, natural plant fiber (cotton, wood, bamboo, etc.) as raw materials, through the process of alkalization, aging, sulfonation to make soluble cellulose xanthan ester, then dissolved in dilute lye to make viscose, made by wet spinning. This fiber is skin-friendly and non-irritating, has excellent moisture absorption and breathability, and is known as "breathable fabric". Viscose fiber can be subdivided into viscose filament and viscose staple fiber. The company started from viscose staple fiber and gradually extended to viscose filament business. In comparison, the company's staple fiber business advantages are not outstanding, 2022/7/15 the company issued an announcement, the original viscosi staple fiber series products by Hebei Jiguang commissioned the company to produce and process, so this report will not be discussed.

Viscose filament, also known as ice filament, has smooth and cool, breathable, antistatic, gorgeous dyeing and other characteristics, in the main textile fiber moisture content most in line with the physiological requirements of human skin, generally as a substitute for natural silk, used for high-end clothing and home textiles.

3.1. Viscose filament industry has a high concentration and an oligopoly pattern

Viscose industry belongs to high energy consumption and high pollution industry. Viscose industry is a typical labor-intensive industry, the production of environmental pollution, and there is a large amount of energy consumption. A single ton of viscose filament consumes 600 cubic meters of water and 10,000 KWH of electricity. At present, global viscose production is mainly concentrated in developing countries and regions. Viscose filament is a typical oligopoly supply pattern. At present, the global viscose filament supply is controlled by six enterprises in China and India. According to the "2021 viscose filament industry Project Business Plan" released by Xinsi Industry Research Center, as of 2021, the global total production capacity of viscose filament is about 281,000 tons, of which domestic enterprises account for 75%, and the total production capacity is 235,000 tons. Indian enterprises accounted for about 20.2%, and the production enterprises were mainly Century Rayon and Grasim. The domestic viscose filament industry is further clearing. In 2009, there are more than 10 domestic viscose filament production enterprises, to 2020 only 5, 2021, Jiujiang Shengjun silk 7,500 tons of viscose filament production capacity out of the market, the market concentration is further concentrated. CR3 in the viscose filament industry grew from 56% in 2009 to nearly 94% in 2021. Not only that, in September 2017, the Ministry of Industry and Information Technology began to implement the "viscose fiber Industry Standard Conditions (2017 version)", which prohibited the construction of new viscose filament projects.

3.2. Exports improved in the post-pandemic era

China is the world's most important exporter of viscose filament, and India is the world's largest consumer of viscose filament. According to the statistics of Baichuan Winfu, China's viscose filament exports account for about one-third of the total consumption. From 2017 to 2019, the export volume of viscose filament in China remained at more than 60,000 tons/year. In 2020, due to the impact of the global epidemic, the export volume of viscose filament fell to 55,400 tons. From January to November 2021, China's viscose filament production continued to decline, while the improvement of the epidemic situation in overseas markets prompted a significant increase in export demand. In the past five years, the overall price fluctuation range of viscose filament is 35,000-40,000 yuan/ton.

In 2016, the output of viscose filament was sharply reduced under the influence of supply-side reform, and viscose filament ushered in a boom period. Filament prices rose from 3.72 yuan/ton in early August to 40,100 yuan/ton at the end of March 17. Then the downstream Spring Festival production reduction, filament inventory accumulation, the price fell quickly. Since Q4 2020, the rapid increase in export demand has driven the price of viscose filament up, and the increase in energy prices has formed the cost support, and the price of viscose filament has continued to rise from 36,000 yuan/ton in October 2020 to 40,800 yuan/ton in December 2021, and the profitability has continued to improve.

3.3. The company's leading position in viscose filament business continues to strengthen

The company is one of the world's high-quality viscose filament suppliers, product quality reputation at home and abroad. In recent years, the company has seized the opportunity of industry capacity clearance, concentrated resources to further expand the production capacity of viscose filament, and filled the gap caused by the withdrawal of relevant enterprises. By 2021, the company has a viscose filament production capacity of 80,000 tons/year, with domestic production capacity accounting for 34.0% and global production capacity accounting for about 26.4%. In addition, the company currently has 15,000 tons of differential continuous spinning filament project (Phase II) is under construction, after the completion of the company's annual production capacity of viscose filament will increase by 10,000 tons to 90,000 tons, and the leading position in the industry will be further consolidated.

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA

- Other Brands