India Energy Outlook 2021

About this report

India Energy Outlook 2021 explores the opportunities and challenges ahead for India as it seeks to ensure reliable, affordable and sustainable energy to a growing population. The report examines pathways out of the crisis that emerged from the Covid-19 pandemic, as well as longer-term trends, exploring how India’s energy sector might evolve to 2040 under a range of scenarios.

India’s future prosperity will hinge on affordable, clean and reliable energy…

India has seen extraordinary successes in its recent energy development, but many challenges remain, and the Covid-19 pandemic has been a major disruption.

In recent years, India has brought electricity connections to hundreds of millions of its citizens; promoted the adoption of highly-efficient LED lighting by most households; and prompted a massive expansion in renewable sources of energy, led by solar power. The gains for Indian citizens and their quality of life have been tangible. However, the Covid-19 crisis has complicated efforts to resolve other pressing problems. These include a lack of reliable electricity supply for many consumers; a continued reliance on solid biomass, mainly firewood, as a cooking fuel for some 660 million people; financially ailing electricity distribution companies, and air quality that has made Indian cities among the most polluted in the world.

India is the world’s third-largest energy consuming country, thanks to rising incomes and improving standards of living.

Energy use has doubled since 2000, with 80% of demand still being met by coal, oil and solid biomass. On a per capita basis, India’s energy use and emissions are less than half the world average, as are other key indicators such as vehicle ownership, steel and cement output. As India recovers from a Covid-induced slump in 2020, it is re-entering a very dynamic period in its energy development. Over the coming years, millions of Indian households are set to buy new appliances, air conditioning units and vehicles. India will soon become the world’s most populous country, adding the equivalent of a city the size of Los Angeles to its urban population each year. To meet growth in electricity demand over the next twenty years, India will need to add a power system the size of the European Union to what it has now.

This special report maps out possible energy futures for India, the levers and decisions that bring them about, and the interactions that arise across a complex energy system.

The increasing urgency driving the global response to climate change is a pivotal theme. India has so far contributed relatively little to the world’s cumulative greenhouse gas emissions, but the country is already feeling their effects. This report’s analysis is based on a detailed review of existing or announced energy reforms and targets. These include the aims of quadrupling renewable electricity capacity by 2030, more than doubling the share of natural gas in the energy mix, enhancing energy efficiency and transport infrastructure, increasing domestic coal output, and reducing reliance on imports. Progress towards these policy goals varies across our report’s different scenarios, none of which is a forecast. Our aim is rather to provide a coherent framework in which to consider India’s choices and their implications.

The Stated Policies Scenario (STEPS) provides a balanced assessment of the direction in which India’s energy system is heading, based on today’s policy settings and constraints and an assumption that the spread of Covid-19 is largely brought under control in 2021.

The India Vision Case is based on a rapid resolution of today’s public health crisis and a more complete realisation of India’s stated energy policy objectives, accompanied by a faster pace of economic growth than in the STEPS.

The Delayed Recovery Scenario analyses potential downside risks to India’s energy and economic development in the event that the pandemic is more prolonged.

The Sustainable Development Scenario explores how India could mobilise an additional surge in clean energy investment to produce an early peak and rapid subsequent decline in emissions, consistent with a longer-term drive to net zero, while accelerating progress towards a range of other sustainable development goals.

Prior to the global pandemic, India’s energy demand was projected to increase by almost 50% between 2019 and 2030, but growth over this period is now closer to 35% in the STEPS, and 25% in the Delayed Recovery Scenario.

The latter would put some of India’s hard-won gains in the fight against energy poverty at risk, as lower-income households are forced to fall back on more polluting and inefficient sources of energy. It would also extend the slump in energy investment, which we estimate to have fallen by some 15% in India in 2020. Even though the pandemic and its aftermath could temporarily suppress emissions, as coal and oil bear the brunt of the reduction in demand, it does not move India any closer to its long-term sustainable development goals.

India’s size and dynamism will keep it at the heart of the global energy system

An expanding economy, population, urbanisation and industrialisation mean that India sees the largest increase in energy demand of any country, across all of our scenarios to 2040. India’s economic growth has historically been driven mainly by the services sector rather than the more energy-intensive industrial sector, and the rate at which India has urbanised has also been slower than in other comparable countries. But even at a relatively modest assumed urbanisation rate, India’s sheer size means that 270 million people are still set to be added to India’s urban population over the next two decades. This leads to rapid growth in the building stock and other infrastructure. The resulting surge in demand for a range of construction materials, notably steel and cement, highlights the pivot in global manufacturing towards India. In the STEPS, as India develops and modernises, its rate of energy demand growth is three times the global average.

The Indian electricity sector is on the cusp of a solar-powered revolution…

Solar power is set for explosive growth in India, matching coal’s share in the Indian power generation mix within two decades in the STEPS – or even sooner in the Sustainable Development Scenario.

As things stand, solar accounts for less than 4% of India’s electricity generation, and coal close to 70%. By 2040, they converge in the low 30%s in the STEPS, and this switch is even more rapid in other scenarios. This dramatic turnaround is driven by India’s policy ambitions, notably the target to reach 450 GW of renewable capacity by 2030, and the extraordinary cost-competitiveness of solar, which out-competes existing coal-fired power by 2030 even when paired with battery storage. The rise of utility-scale renewable projects is underpinned by some innovative regulatory approaches that encourage pairing solar with other generation technologies, and with storage, to offer “round the clock” supply. Keeping up momentum behind investments in renewables also means tackling risks relating to delayed payments to generators, land acquisition, and regulatory and contract uncertainty. However, the projections in the STEPS do not come close to exhausting the scope for solar to meet India’s energy needs, especially for other applications such as rooftop solar, solar thermal heating, and water pumps.

India requires a massive increase in power system flexibility

The pace of change in the electricity sector puts a huge premium on robust grids and other sources of flexibility, with India becoming a global leader in battery storage. India has a higher requirement for flexibility in its power system operation than almost any other country in the world. In the near term, India’s large grid and its coal-fired power fleet meet the bulk of India’s flexibility needs, supported by hydropower and gas-fired capacity. Going forward, new power lines and demand-side options – such as improving the efficiency of air conditioners or shifting the operation of agricultural pumps to different parts of the day – will need to play a much greater role. But battery storage is particularly well suited to the short-run flexibility that India needs to align its solar-led generation peak in the middle of the day with the country’s early evening peak in demand. By 2040, India has 140 GW of battery capacity in the STEPS, the largest of any country, and close to 200 GW in the Sustainable Development Scenario.

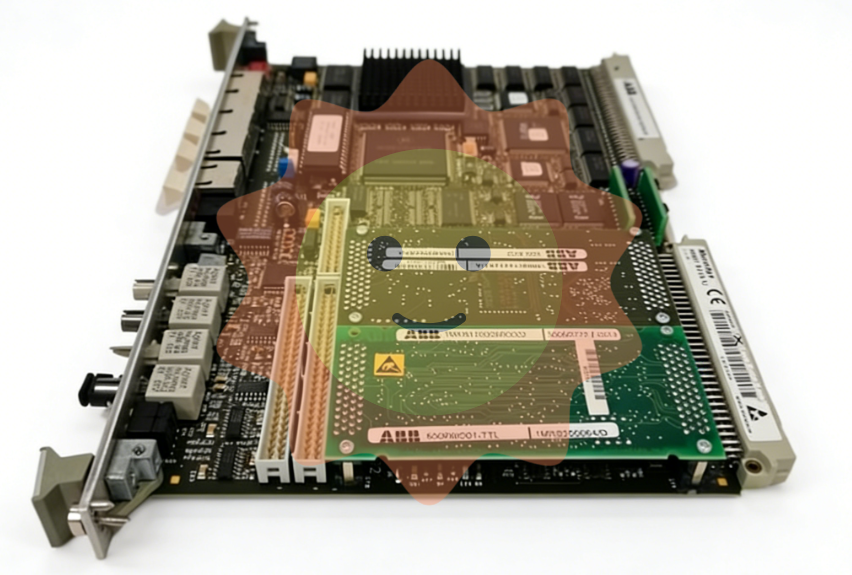

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

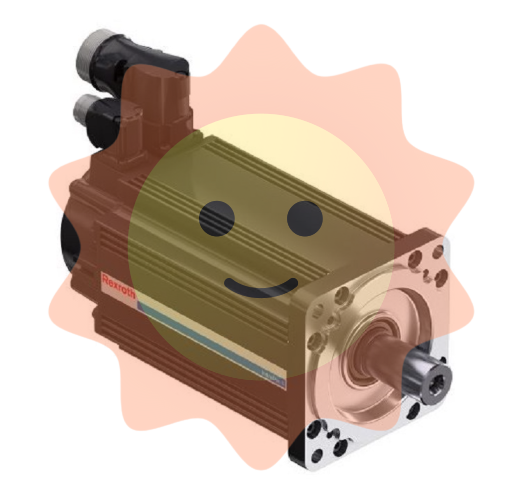

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA

- Other Brands