"2023 McKinsey China Automotive CEO Special Issue" released! Driving to 2030 - the auto industry race

1. Driving to 2030 - The Auto industry Race

What we are experiencing is another great change in the automotive industry. Since the invention of the automobile in the 1880s, whether it is epoch-making assembly line production, or the rapid development of small-displacement vehicles under the shadow of the "oil crisis", or the fundamental improvement of passive safety brought by the popularity of seat belts and air bags, these new technologies and new models have greatly promoted the popularization and sustainable development of automobiles. But these single local changes are difficult to compare with the current smart electric vehicle revolution. Driven by the rapid development of intelligent electric vehicles, China's auto market is undergoing a change that is far deeper and wider than expected:

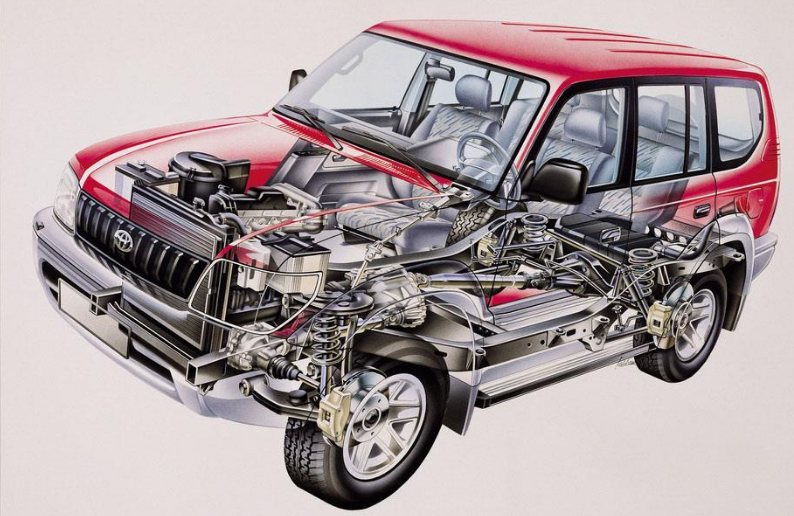

Power system change: electric drive is accelerating the replacement of internal combustion engine;

Core wins and losses change: The core wins and losses of "explosive" vehicles are gradually changing from hardware performance to software experience;

Profit model reform: The profit model of automobile enterprises has gradually evolved from the traditional "one hammer sale" of automobile sales to the value management of the whole life cycle of vehicles, as well as the identification of value realization opportunities at different stages of the cycle and the landing of the realization plan.

If before 2019, the development of intelligent electric vehicles is only a distant glimmer of light when the day will be bright and unknown, then since the explosion of electric vehicle sales in 2020, its vast trend has been like the brilliant sunrise in the East! In McKinsey's China Automotive CEO Quarterly 2019: In "Winning the Second Half of the Auto Industry", we have made ten prospects for China's auto industry in 2030, and six of them have become or are close to reality. Including the industry's high growth rate and high profit margin is difficult to reproduce, the demise of weak auto brands, the gradual disappearance of international brand premium rate, the importance of marketing services focused on customer journey experience, the decline and transformation of the traditional 4S model, and the dominance of independent brands on power batteries and low - and medium-price electric vehicle markets. Even if the changes are dramatic, these are the beginning, far from the climax, of great changes in the auto industry. And the real climax will be revealed one by one in the auto industry race to 2030:

Technology reshaping: Technology development in electric, network, intelligent and other fields will continue to profoundly shape the industry landscape and consumer demand;

Reshaping of brand positioning: Disruptive technological changes will create favorable conditions for new entrants to enter the market, thus rewriting the overall competitive landscape;

The transformation of value creation: new technologies and new entrants will continue to rewrite the business logic and value creation model of the industry;

Carbon reduction is imperative: As an industry responsible for nearly a quarter of global carbon emissions, carbon reduction efforts and progress in the automotive industry are critical to achieving the 1.5 ° C target on schedule.

Looking ahead to 2030, we believe that the development of smart electric vehicles will continue to penetrate into every corner of the Chinese automotive market. With established advantages in relevant areas and the desire to further consolidate their leading edge, we expect the competitiveness of Chinese car companies, especially some of the leaders, to be greatly strengthened. At the same time, the "volume king" that stands out in the fierce domestic market will also bring more "unheard of" cost-effective models to overseas consumers, and then profoundly change the competitive landscape of the international automobile industry. In an optimistic scenario, we expect 3 to 4 Chinese auto companies to be among the top 10 global auto companies, while 5 to 6 Chinese component suppliers will be among the top 20 global suppliers.

In the auto industry race to 2030, there will be one climax all the way. The next three years will be crucial for both established international giants and new domestic forces. If you can find the right feeling in the three years of competition and occupy a favorable position, you will have a great future! If we waste these three years of precious time and make little progress in the field of intelligent electric vehicles, the unbearable thing may not be far away!

Second, the road ahead is bumpy, do not slack off

The Chinese automotive industry's pursuit of the world's leading level and even catch-up is rooted in the leapfrog development of electric vehicles. After years of ups and downs, this "corner overtaking" strategy has finally revealed its edge in the auto industry race to 2030. Overtaking on corners is not a dream, but it is necessary to accurately control the steering wheel when overtaking on corners, so as not to run out of the track! At the same time, how to make full use of the advantages accumulated in the corner, maintain and expand the lead on the straight after the corner, will also be a subject that all Chinese car companies, especially the head companies, need to consider.

2030 can be expected, but the car industry race to 2030 is not a smooth road! As a person who has been working in China's automotive consulting industry for more than ten years and who has experienced and recorded countless twists and turns with many people in the industry, we sincerely hope that the people at the helm of the auto companies can clearly recognize the difficulties and challenges of transformation, keep vigilant at all times, avoid the recurrence of some chaos, and return to the source of value creation:

Say goodbye to "satellite release" : domestic car companies are never short of lofty ideals. If a simple summary of the 2025 and 2030 electric vehicle sales targets announced by many car companies, the sum is even close to the global total, can not help but wonder how feasible these ambitious goals. Looking up at the stars is important, but only down to earth, can be stable and far!

Balancing short-term profitability with long-term value creation: How to deal with the mismatch between short-term profitability and long-term value creation is a difficult problem for many auto companies. Enterprises can not be wishful thinking, immersed in the "profit for short-term sales" myth, do not talk about bicycle profit, do not calm down to cultivate internal skills; It should not be limited to the pressure of short-term financial assessment, and it is not enthusiastic and good at investing in long-term core technical capabilities. Similar "going to extremes" are not desirable, are not correct transition play!

Complete the evolution from the "2B gene" to the "2C gene" : "customer operation" or "customer-centric" is increasingly becoming the key word of automotive retail and service innovation. We have seen the pioneering and successful cases of some leading enterprises in this field, but at the same time, we have also witnessed a large number of later comers to follow suit and deliberately imitate. The imitation effect can be described as uneven, difficult to say, there is no lack of "imitation"; What is more, although the mouth is chanting "customer-centric", but the landing is some of the measures that make customers chill, called "draining the fish."

Do not seek new differences, ambitious: Chinese car companies seem to have achieved a "great leap forward" in technology overnight - full stack development, high-level electronic and electrical architecture, native electric vehicle platform, high-level autonomous driving, etc., and almost every car company's press conference has taken the time to emphasize that it has mastered these "black technologies." But the glitz goes hand in hand with lower-level basic features that consumers desperately need, such as AEB (automatic emergency braking), and occasional news of poor test results. Such a gap is impossible without causing suspicion among onlookers.

Bid farewell to the "military warrant" type of guarantee: due to the superposition of many factors, the guarantee is becoming a topic of concern in the whole industry. However, many enterprises do not conduct in-depth discussions on the development of the supply chain, lack of understanding of the depth pattern of their own upstream supply chain, and do not do research on new entrants in emerging fields, and all efforts to ensure supply are pressed on the "military warrant" type of "force guarantee XXX". Is it good for a time, but not for a lifetime? Notice that the key to guarantee is to broaden the "supply", rather than demanding "guarantee"!

Face the difficulty and challenge of going to sea: China's automobile exports have been hot recently, and the export scale has pushed Japan, Germany and other countries, and is even expected to surpass. But at the same time, the overall overseas business of Chinese car companies is still in its "infancy" : the combined sales of passenger cars by all Chinese car companies in overseas markets is less than 20% of the sales of a leading Japanese car company outside Japan. Systematically underestimating the difficulty of getting to sea is a more serious problem! In terms of overseas marketing system construction, brand reputation, after-sales support and other dimensions, international car companies have spent decades to accumulate relevant resources and channels, and it is difficult to catch up in the short term; At the same time, regardless of the specific national conditions of the target country, blindly copying the product design and marketing plans of the home country, etc., these old problems that have been repeatedly criticized by foreign car companies in China are also being repeated in the overseas business of quite a number of Chinese car companies! If this kind of intractable disease is not overcome, whether it can be "civil war expert" let alone, "foreign war amateurs" is almost the inevitable outcome!

"Carbon reduction" from slogan to implementation: in the context of "dual carbon", many car companies have expressed their willingness to reduce carbon on different occasions, and some even announced specific road maps. However, carbon reduction is a systematic project, which not only requires multidimensional optimization and even reshaping of its own operations, but also requires penetrating traceability of the upstream supply chain and collaboration with different echelons of business partners, which is not simply investing in a number of rooftop PV and paired with energy storage facilities.

Great expectations are under control

For a long time in the past, "trial and error" is the core magic weapon for Chinese car companies to achieve accelerated development. In the creation, promotion and iteration of new brands, new models and new technologies, Chinese car companies have felt the pulse of the market through rapid "trial and error", which has profoundly affected and even changed the trend of the industry. And investors' preference for "storytelling" also objectively provides endless ammunition for "trial and error." However, with the change of the overall environment and the change of the industry valuation logic, the living space of the "trial and error" strategy will be greatly compressed. The monetary loss is secondary; In the auto industry's race to 2030, the consequences of wasting precious time are even more serious. In a word, through the continuous "trial and error" to clear the direction of progress, and even poor quality decision-making caused by "mistakes" tolerance as "trial and error", will no longer have a place!

It is said that "the world can be acquired immediately, but it cannot be ruled immediately." Facing the upsurge of the new era of China's automotive industry, as the world's leading management consulting firm, McKinsey is willing to use its business thinking and industry insights accumulated over many years, its consulting tools have been tempered, and its strong strength in emerging fields such as artificial intelligence, big data, and carbon reduction. Share, create and win with many corporate partners in the transformation practice of China's automotive industry! This is why we are publishing the 2023 McKinsey China Automotive CEO Issue.

In this special issue, we will present the following:

1. Market Insights: What impact has the development of smart electric vehicles brought to the overall industrial landscape? How has consumer brand perception and car buying habits changed as a result? Riding on the east wind of intelligent electric vehicles, where will Chinese car companies go overseas? We will present them to you in the Market Insights section of this special issue.

2. Excellent products: Technical ability is the foundation of car companies. In the era of smart electric vehicles, the capture of emerging consumer demand for vehicles, technology development, feature release, and differentiated product experience will be critical. At the same time, the importance of an efficient research and development system for the profitability of electric vehicles is self-evident. In the Exceptional Products section of this special issue, we will discuss related topics.

Excellent marketing: The natural preference of the new generation of consumers for online channels, as well as the technical characteristics of intelligent electric vehicles themselves, make the traditional marketing model more difficult to establish itself in the era of intelligent electric vehicles; Therefore, car companies must accelerate the construction of a new omni-channel marketing model. We will explore this in detail in the Marketing Excellence section of this special issue.

3. Operational excellence: Affected by a variety of different factors, supply chain turbulence and uncertainty will continue for a long time to come. This will undoubtedly challenge the multi-dimensional operation capabilities of car companies such as procurement, production and financial management. The importance of building and strengthening supply chain resilience to maintain business sustainability will continue to increase. We will explain this in the Operational Excellence section of this special issue.

4. Low-carbon road: For the automobile industry, carbon reduction is not only a challenge, but also a responsibility and an opportunity. No matter how to choose the path of low-carbon development, car companies should accelerate the implementation of no-regret measures and strive to gain the lead in the creation of long-term low-carbon competitiveness. We present our views on this in the "Path to Low Carbon" section of this special issue.

"Insist on green mountains do not relax, standing root original in the broken rock." I sincerely look forward to working with ceos who are interested in stepping on the world stage to map out the future of China's automotive industry.

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA

- Other Brands