Cement market in 2023: Regain consensus and stabilize the overall situation

Zheng Jianhui believes that the reasonable profit rate of the cement industry should exceed the industrial average level, and it is better to maintain a fluctuation of 10%, and the reasonable profit of the industry should be 80 to 120 billion yuan. At present, the cement industry is in the stage of demand decline, should pay more attention to the quality of life, reasonable profit is the premise of transformation and upgrading.

Second, 2023 cement market outlook

1. Investment remains the main driving force for China's economic recovery

Zheng Jianhui believes that in 2023, with the release of the epidemic, China's economy will usher in a recovery. From the perspective of provinces, in 2022, no province has completed its GDP target. In 2023, all 31 provinces will increase their GDP targets by 1 (Shaanxi) ~9.3 (Hainan) percentage points compared with the GDP growth rate in 2022.

Based on the realization of economic growth in all provinces, it is predicted that: (1) China's economic growth rate will be 5.6% in 2023. (2) The contribution of Guangdong and Shanghai to the economy will increase, Guangdong (7%→9%), Shanghai (2%→4%).

In the process of achieving economic growth, investment remains the main driving force.

In recent years, the policy level has continuously promoted the investment of the whole society through government investment and policy incentives, accelerated the implementation of the "14th Five-Year Plan" major projects, and strengthened inter-regional infrastructure connectivity. At the same time, the amount of special bonds issued in advance increased: In November 2022, the Ministry of Finance issued 2.19 trillion yuan of new special bonds in 2023 in advance, an increase of 50% compared with 1.46 trillion yuan issued in advance at the end of 2021. The "Government Work Report" also pointed out that the new local special debt is planned to be 3.8 trillion yuan in 2023, a slight increase over the 3.65 trillion yuan planned for 2022.

2. The fluctuation of cement demand narrowed throughout the year: the weak recovery of real estate infrastructure is in advance

In terms of real estate, under the influence of the policy of ensuring the completion and delivery of buildings, the real estate industry has gradually completed the bottom, but is dragged down by land acquisition and new construction, and the probability of real estate investment continues to grow negatively, and the trend is low before and high after.

In terms of infrastructure, the China Cement Network construction project database shows that in 2022, the national construction project winning amount increased by 27% year-on-year. In 2023, infrastructure will obviously form a physical quantity, and the trend will be high and low.

Based on real estate and infrastructure investment trends, Cheng proposed two neutral and optimistic assumptions for cement demand in 2023. Neutral scenario: the decline in cement demand Narrows to less than 3%; Optimistic assumption: policy intervention beyond expectations, demand is stable or slightly positive;

3. Delayed ignition projects or concentrated production in the southern region exceeded 38 million tons

Affected by market trends in 2022, some domestic production lines choose to postpone production, and in 2023, with the large number of new lines put into production, domestic cement overcapacity pressure or further increase.

Zheng Jianhui expects that the country's new ignition clinker production capacity is expected to be 47 million tons in 2023, of which: more than 80% are located in the southern region; Southwest China (35%); East China (25%); Central and Southern China (24%); Yunnan, Anhui, Guizhou, Hunan ignition production lines are expected to be more than 3.

4, it is expected that cement prices in the fourth quarter are expected to turn positive

Zheng Jianhui believes that it takes time for investment to land, the project is slow to start, and the impact of the real estate industry, the demand for cement in the beginning of the year is sluggish, and the price of cement in the first quarter fell sharply compared with the same period last year. Starting from the second quarter, with the increase of project construction, cement demand is picking up, and the year-on-year decline in cement prices is expected to gradually narrow; In addition, it is expected that domestic cement prices in the fourth quarter are expected to turn positive. For the full year, average prices are likely to be below 2022 levels.

5, cement ton cost is expected to fall back industry-wide profits are expected to improve

Rising costs are an important reason for the sharp decline in cement industry profits in 2022, and the cost problem is expected to improve in 2023.

Zheng Jianhui said that in 2021-2022, the cost of cement tons rose by 60 yuan/ton, an average increase of more than 30%, and the cost increase far exceeded the price increase, resulting in a decline in gross profit.

In 2023, the cost is expected to decline: (1) The impact of fuel price fluctuations on cost fluctuations is weakened, and fuel prices are also expected to decline slightly in a stable way; (2) The use of alternative raw materials/alternative fuels has further increased, and the proportion of cement kiln collaborative disposal lines has increased to more than 25%. (3) Profit reduction Enterprises reduce expenses to reduce costs.

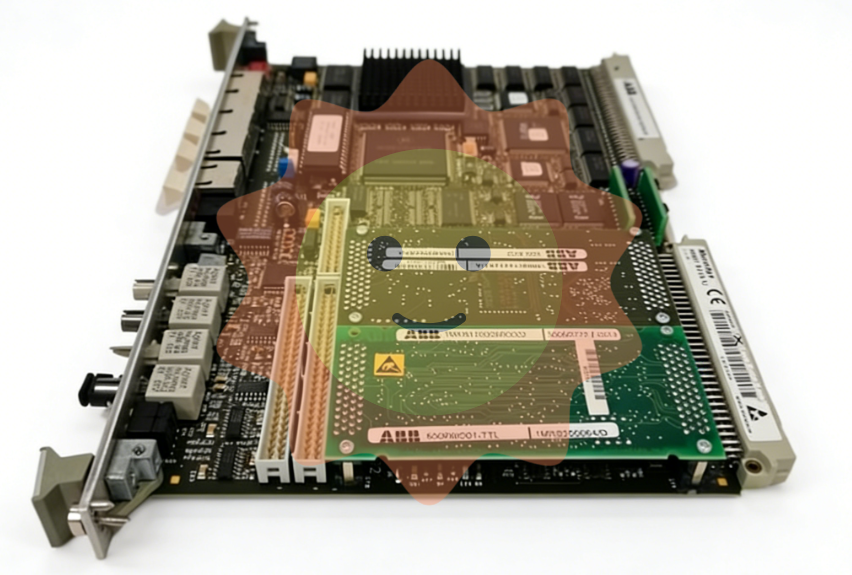

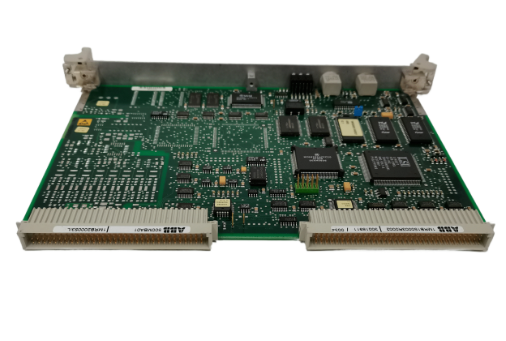

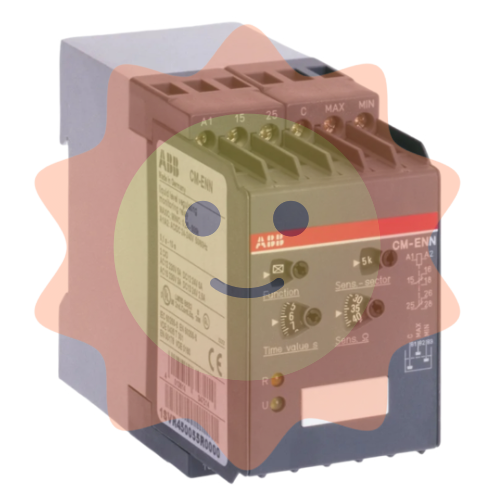

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

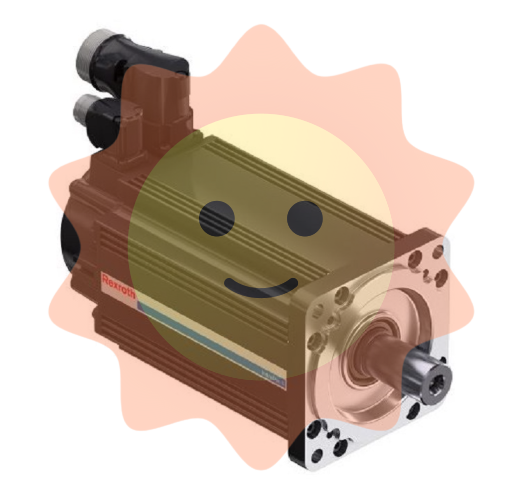

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA