Cement market in 2023: Regain consensus and stabilize the overall situation

Affected by the decline in demand, the cement industry experienced a very difficult year in 2022. In 2023, the favorable policies continue, but the demand for cement is still difficult to return to the courage of the year. How should the cement industry respond to stabilize the market situation?

Zheng Jianhui, chief analyst of China Cement Network Cement Big Data Research Institute, believes that based on the current market situation, cement companies should "regain consensus", so that the industry can be stable and have progress, and companies can compete in combination and seek common ground while reserving differences.

First, the current cement industry should have five points of consensus

1. The situation of overcapacity has become more severe

In 2022, cement capacity utilization reached a record low. According to statistics, the cement capacity utilization rate in 2022 is 61%, while the actual clinker capacity is enlarged, and overcapacity is more serious.

The cement industry to capacity has been promoted for many years, why the capacity is still increasing?

Zheng Jianhui believes that one is because of technological upgrading, the maximum output of a single line is increased; Second, because of capacity replacement, low-efficiency capacity revitalized; Three is because of the relocation of the same amount; Fourth, the new production line lacks subversive revolution.

2. The upward pressure on costs has increased unprecedentedly

Especially in terms of coal costs, from 2020 to the present, coal price volatility has increased. The price of coal/cement once exceeded 3; At the same time, a large number of coal mines have been closed after 2016, and it is difficult to return to the "cheap era" of coal prices in the future.

In addition, unit energy consumption and carbon emissions control requirements continue to increase, with the promotion of the "double carbon target", cement companies not only need to invest a lot of transformation funds, but also face the possible cost increase brought by carbon trading.

3. The marginal utility of supply-side reform is diminishing

Taking off-peak production as an example, starting from the north, it has roughly experienced the following stages: November 2014 Northeast peak production - January 2015 pan-North China peak production - 2016 Northern 15 provinces and cities peak production - 2017 to 2021 southern provinces to join, at the same time when the northern summer peak began - 2022, the industry further extended peak production time, The off-peak production time in 21 provinces exceeded 100 days.

In recent years, the peak production time continues to increase, the scope continues to expand, especially in 2022, the peak production time around the increase is obvious, the implementation is more powerful than before, but ultimately affected by the decline in demand, the stability of the peak production on the market is weakened. In the future, under the background of weakening demand, the role of supply-side reform may further decrease.

4. The demand plateau is facing the contraction of the market size

Since the founding of the People's Republic of China, the development of the domestic cement market can be roughly divided into five periods, and today's industry is about to enter the downward period.

Cement planned Economy period (1949~1977)

Features: ① The total amount is low: a total of 500 million tons of cement is consumed (17 million tons per year); ② Low per capita: less than 60 kg per capita per year; ③ The number of enterprises is from a small to a maximum, and the number of cement enterprises is about 3,400.

Small cement development period (1978~1995)

Urbanization rate: 18%~30%

Features: ① The total amount is rising rapidly: a total consumption of 3.58 billion tons (200 million tons per year); ② Per capita to reach the global average: per capita consumption of 400 kg; (3) The number of enterprises increased rapidly: at the end of 1995, the number of cement enterprises was 8435.

Rapid development period (1996~2014)

Urbanization rate: 30%~55%

Features: ① The total amount has increased significantly: a total of 23.8 billion tons of cement (annual average of 1.2 billion tons); ② More than 1.8 tons per capita; ③ The scale of enterprises from large to small, the number of enterprises from more to less: at the end of 2014, the number of cement enterprises 3539.

Demand Plateau (2014-2025)

Characteristics: ① The total amount of high range fluctuation: 2.2 billion tons fluctuated by 10%; ② Production capacity remains stable; (3) The competition pattern remains stable; The number of enterprises is relatively stable.

Down period: 2025~ Bottom (before 2060)

Characteristics: ① The plateau period is broken, and the cement demand is in a long downward period: the trough of cement demand is expected to occur before 2060; (2) Per capita demand falls back; ③ The number of enterprises has decreased.

5, reasonable profit is the premise of transformation and upgrading

Data show that in the second half of 2022, the cement industry sales profit margin of 5.4%, 0.3 percentage points lower than the industrial average, is the first time lower than the industrial average since 2016.

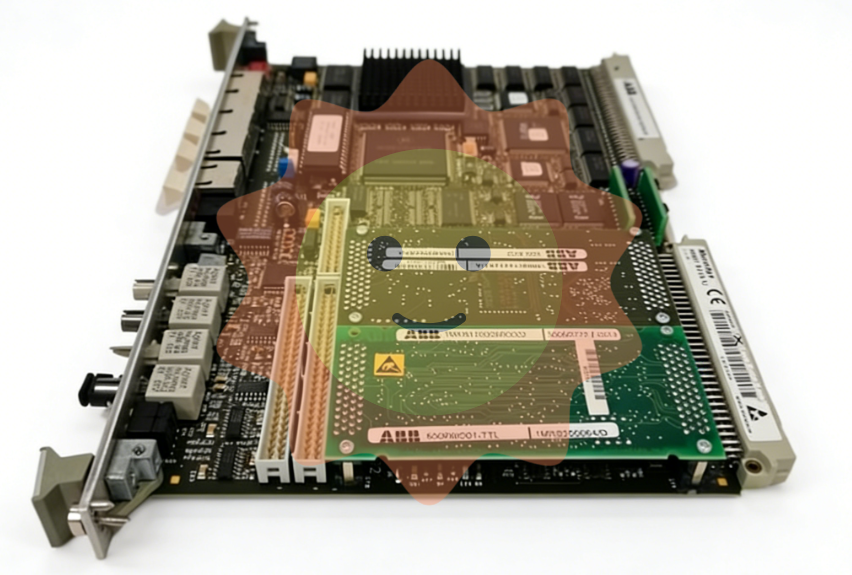

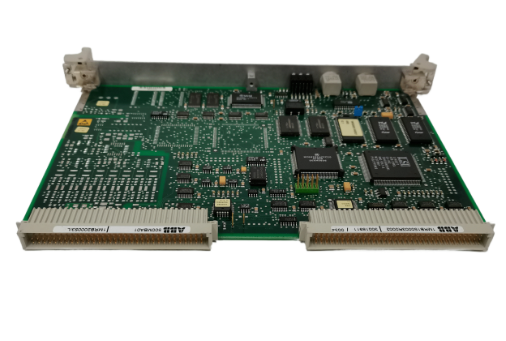

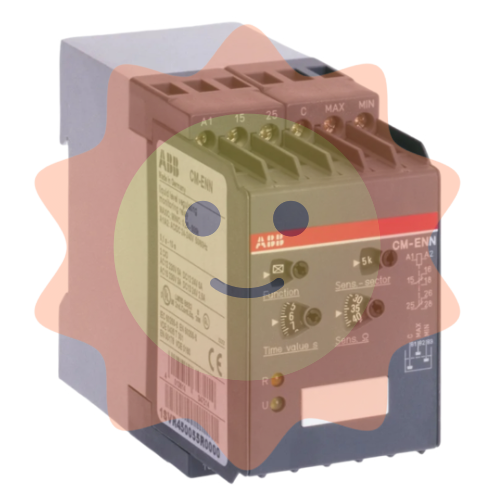

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

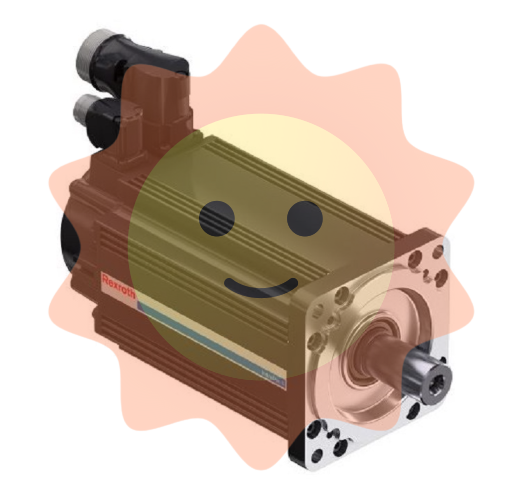

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA