By the east wind of the reform of central enterprises, the leading value of metallurgy is to be reassessed

The scale of overseas revenue of central enterprises is leading, and it is the leader of engineering going to sea. Large central enterprises have rich experience in foreign economic exchanges, and have strong international competitiveness in some industries such as infrastructure construction, high-speed rail, and nuclear power. In addition, the strategic positioning and main direction of attack are very clear, usually select key areas and countries or regions, and screen major projects, and the ability to resist risks is also high. From the perspective of overseas revenue volume, the scale of overseas business of large construction central enterprises is significantly ahead, as the main force of China's "Belt and Road", construction central enterprises have significant advantages in the traditional power, new energy, metallurgy, chemical and other professional engineering fields, is expected to benefit from the core overseas engineering demand, and is expected to bring valuation catalysis to the plate.

Metallurgical engineering is a traditional advantageous industry in China, and the demand potential of the "Belt and Road" region is great. As China's manufacturing advantage industry, the steel industry is a key area to expand international production capacity cooperation, and is also a basic industry to provide raw material guarantee for the "Belt and Road" infrastructure connectivity. In the global steel demand growth overall slowing down trend, participate in the "Belt and Road" Southeast Asia, South Asia, Central and Eastern Europe, West Asia and North Africa and other regions and countries of steel demand still has greater growth potential, some regions are in the accelerated development of industrialization, infrastructure and energy and other equipment manufacturing development to bring a large number of steel demand, metallurgical engineering construction demand is expected to rise. As the world's largest metallurgical construction contractor and operator of metallurgical enterprises, MCC has mastered the key technologies and processes in the fields of intelligent blast furnace smelting, mineral resources development, steelmaking equipment manufacturing, etc. The steel projects it has undertaken account for more than 63% of the world's steel market and has metallurgical construction projects in nearly 30 countries and regions around the world. Benefiting from the advancement of projects along the "Belt and Road", overseas orders are expected to resume rapid growth.

2.3. The company is rich in mineral resources and its business value needs to be reassessed

Mineral reserves are abundant, and the resources sector is expected to contribute to profit elasticity. The company's resource development business mainly involves the mining, beneficiation and smelting of nickel, cobalt, copper, zinc, lead and other metal mineral resources. According to the company's annual report, the company's mineral resources mainly have three mines in production, rich resource reserves, and the project mining period can reach 20 years. Papua New Guinea Rimu Nickel-Cobalt Project: It is the mine with the highest production rate and operation level among the laterite nickel mines that have been put into production in the world. The estimated resources of the project are 150 million tons, the average grade of nickel is 0.85%, the average grade of cobalt is 0.09%, equivalent to 1.29 million tons of nickel metal and 140,000 tons of cobalt metal. It can basically meet the needs of the project for 40 years of smooth operation and 20 years of doubled production capacity. Duda lead-zinc mine project in Pakistan: The estimated amount of zinc metal in the project is 850,000 tons, the amount of lead metal resources is 400,000 tons, the average grade of zinc is 7.81%, the average grade of lead is 3.61%, which can basically meet the stable operation of the project for nearly 20 years. Shandak copper-gold project in Pakistan: The estimated reserves of the east ore body of the project are 348 million tons, the average grade of copper is 0.36%, equivalent to 1.29 million tons of copper metal; The reserves of 75.49 million tons, the average grade of copper 0.375%, equivalent to 283,100 tons of copper metal, according to the reserves, can basically meet the stable operation of the project for 20 years.

- EMERSON

- Honeywell

- CTI

- Rolls-Royce

- General Electric

- Woodward

- Yaskawa

- xYCOM

- Motorola

- Siemens

- Rockwell

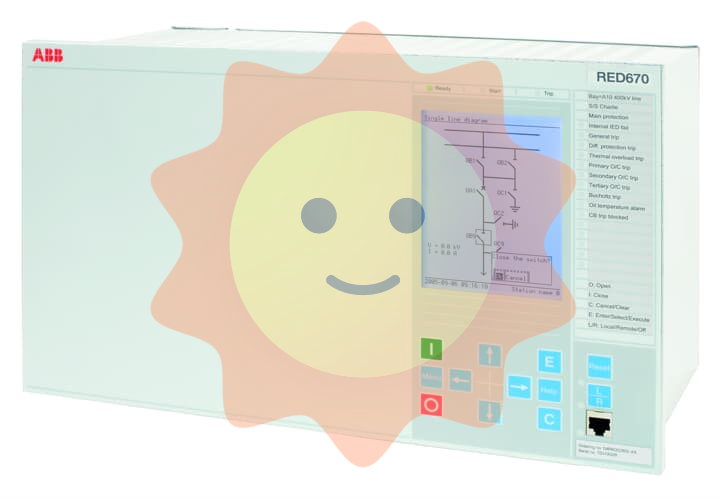

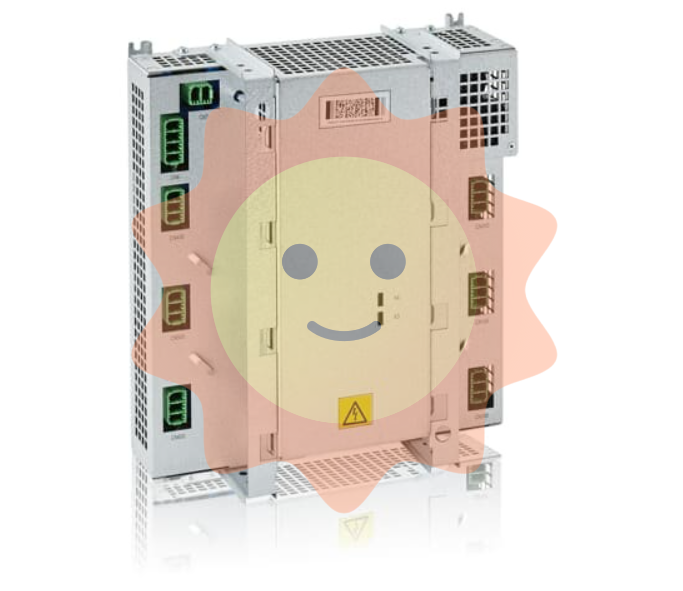

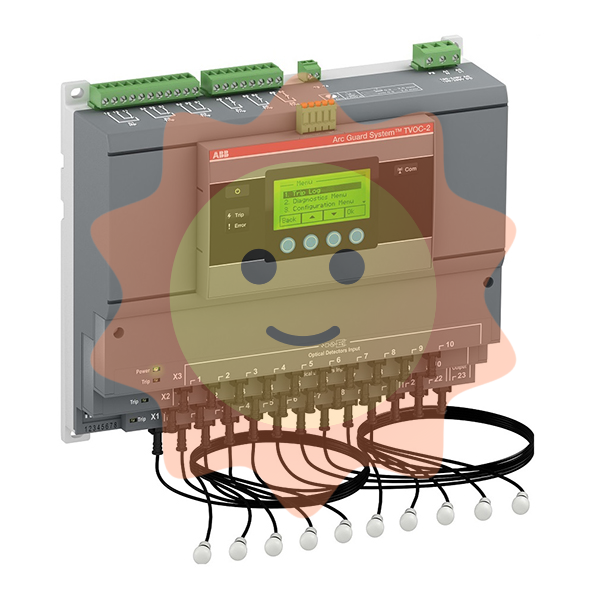

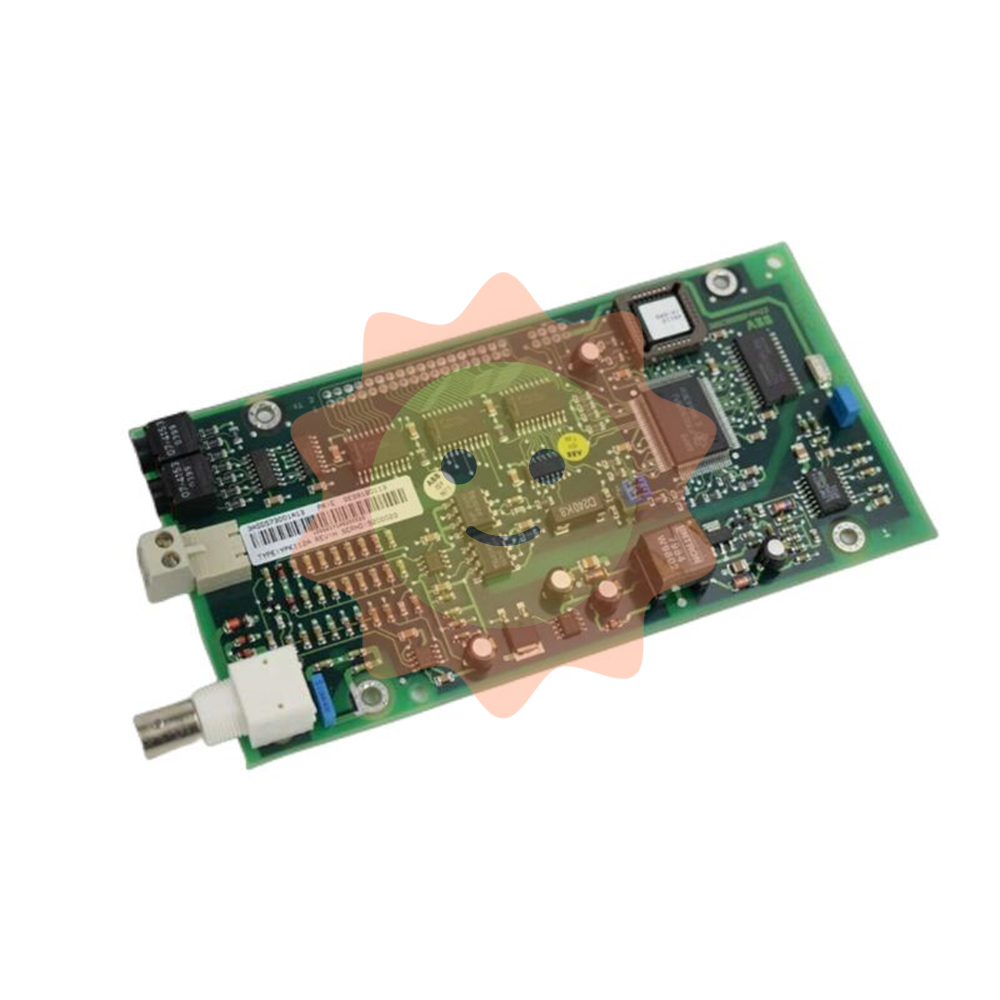

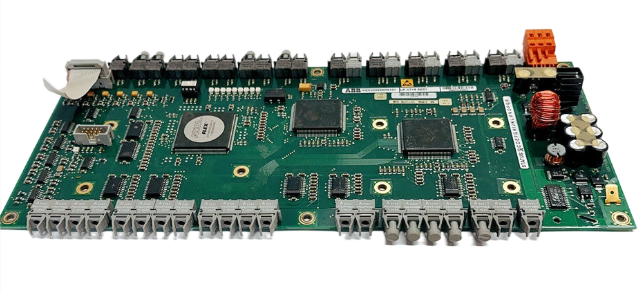

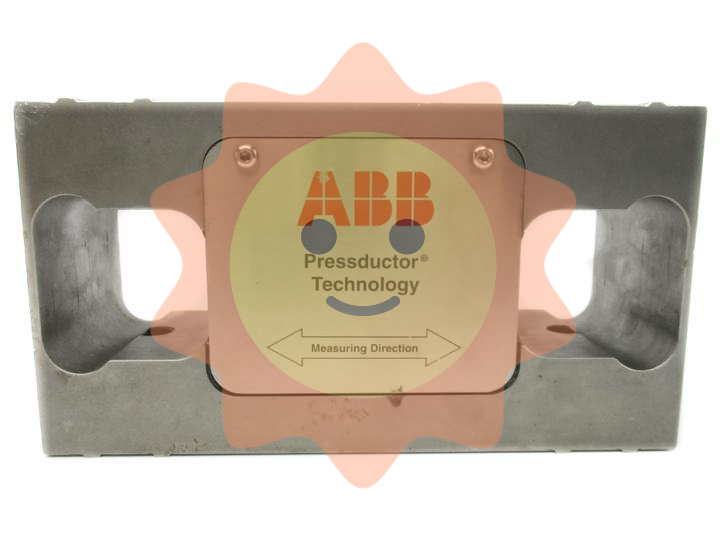

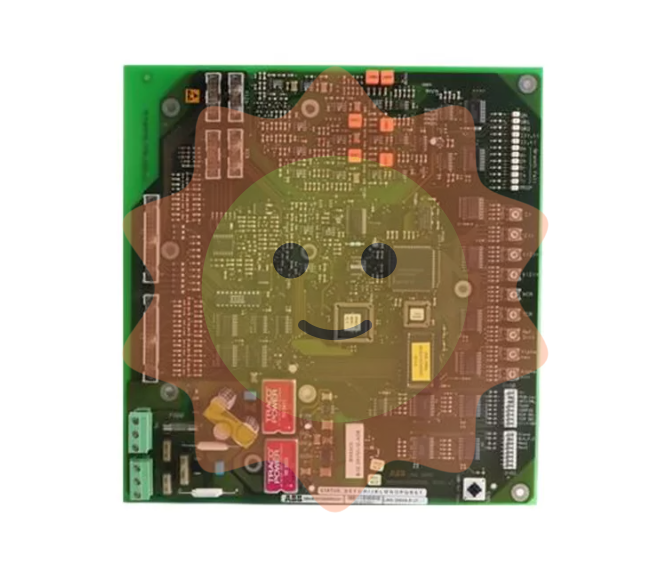

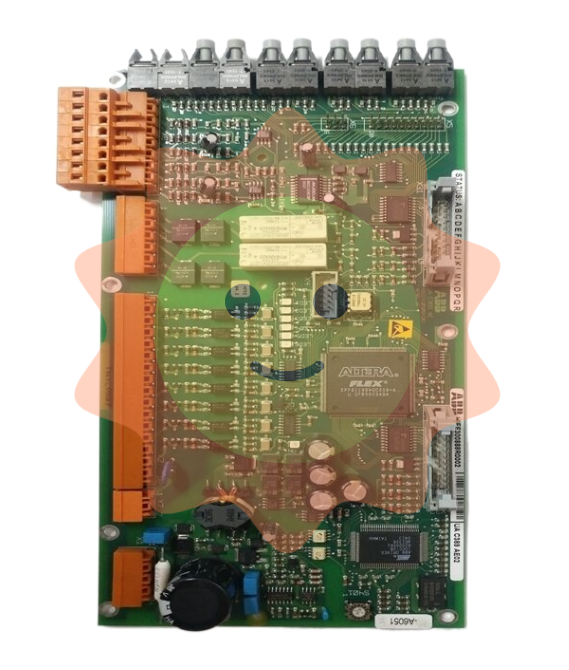

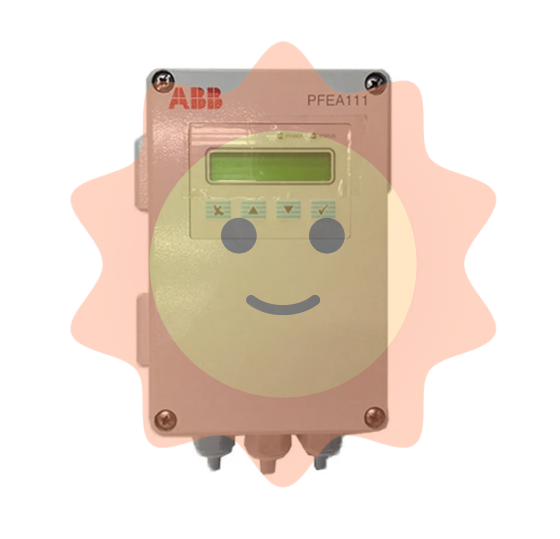

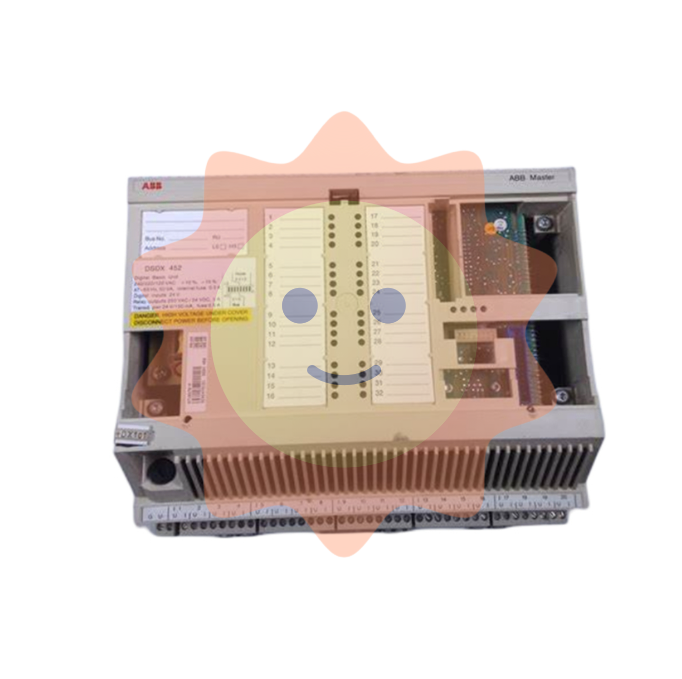

- ABB

- B&R

- HIMA

- Construction site

- electricity

- Automobile market

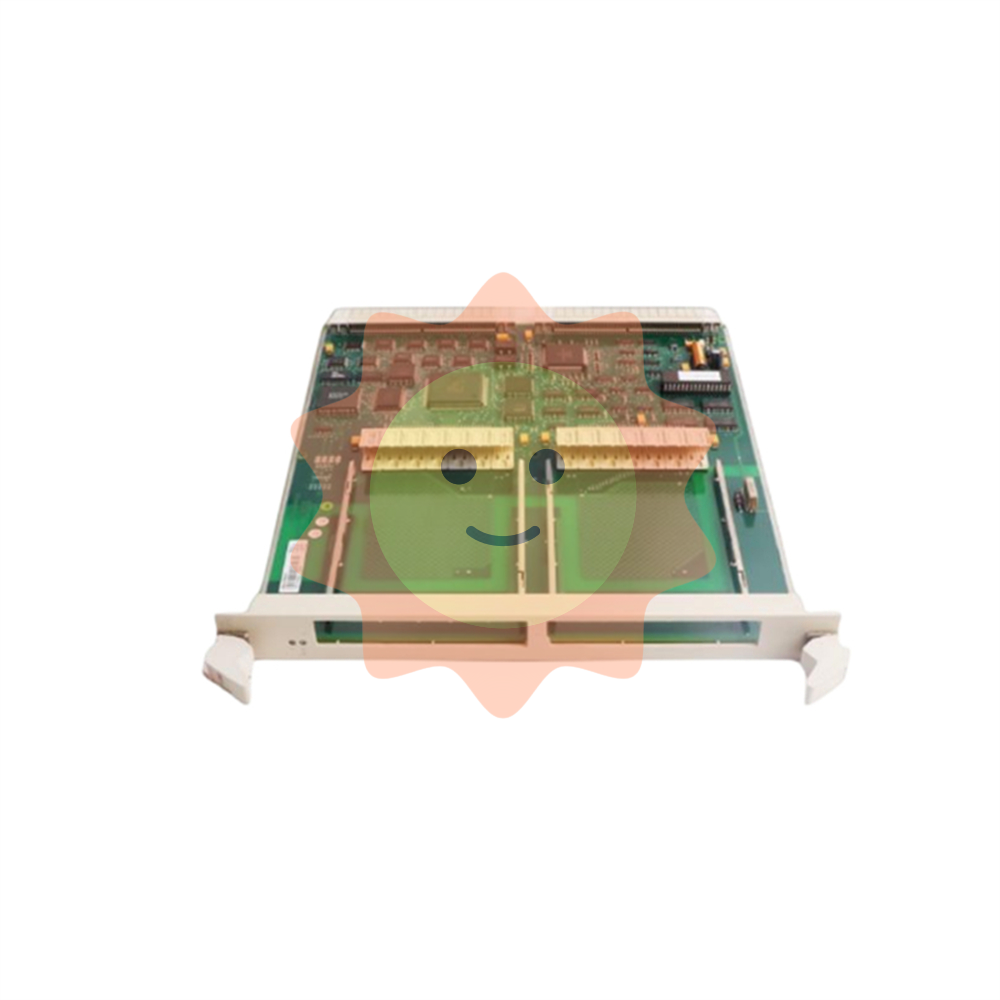

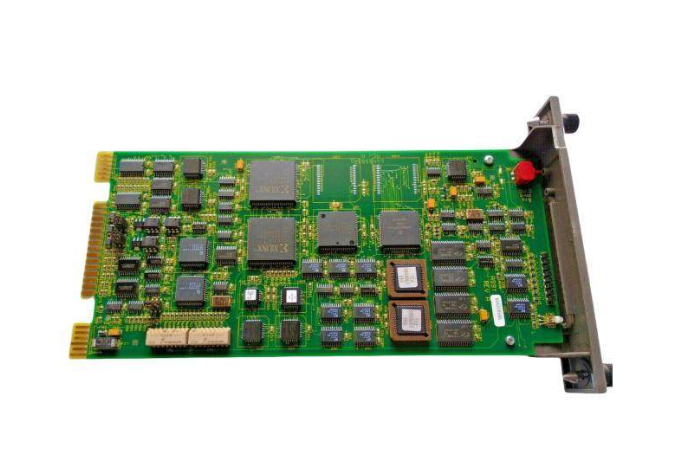

- PLC

- DCS

- Motor drivers

- VSD

- Implications

- cement

- CO2

- CEM

- methane

- Artificial intelligence

- Titanic

- Solar energy

- Hydrogen fuel cell

- Hydrogen and fuel cells

- Hydrogen and oxygen fuel cells

- tyre

- Chemical fiber

- dynamo

- corpuscle

- Pulp and paper

- printing

- fossil

- FANUC

- Food and beverage

- Life science

- Sewage treatment

- Personal care

- electricity

- boats

- infrastructure

- Automobile industry

- metallurgy

- Nuclear power generation

- Geothermal power generation

- Water and wastewater

- Infrastructure construction

- Mine hazard

- steel

- papermaking

- Natural gas industry

- Infrastructure construction

- Power and energy

- Rubber and plastic

- Renewable energy

- pharmacy

- mining

- Plastic industry

- Schneider

- Kongsberg

- NI

- Wind energy

- International petroleum

- International new energy network

- gas

- WATLOW

- ProSoft

- SEW

- wind

- ADVANCED

- Reliance

- YOKOGAWA

- TRICONEX

- FOXBORO

- METSO

- MAN

- Advantest

- ADVANCED

- ALSTOM

- Control Wave

- AB

- AMAT

- STUDER

- KONGSBERG

- MOTOROLA

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- Triconex

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- KOLLMORGEN

- Beijer

- Endress+Hauser

- MOOG

- KB

- Moxa

- Rexroth

Email:wang@kongjiangauto.com