Cement industry: One hundred years of agitation, who master ups and downs

1. The cement industry relies on urbanization, and long-term demand is expected to level off

1.1. Worldwide: Cement demand is related to the degree of economic development

The development of human civilization begins with the transmission of wisdom, and the transmission of wisdom depends on organized social tribes. In today's society, materials, information and energy are the three pillars of human civilization, and materials are the cornerstone of building a city, where people live. Among them, cement is not only the most used material in human construction, but also the most consumed material in the world. According to the Portland Cement Association (PCA), cement is widely used in all aspects of our urban life and transportation, such as housing construction, roads and Bridges, and municipal facilities, and the scale of cement demand is closely related to urbanization.

According to the statistics of CRH, the world's largest building materials company, the proportion of cement, aggregate, concrete, asphalt and other building decoration materials in the field of new buildings and refurbished and repaired buildings has changed slightly in recent years (not considering the impact of the subprime mortgage crisis in 2007-10), and the market share of the maintenance field has slowly increased to 50%. Considering that Europe and the United States account for 49% of the company's sales, after the completion of regional urbanization (the urbanization rate in Europe and the United States exceeds 70%, including France and the United States, the urbanization rate exceeds 75%), the demand for housing, infrastructure and other market maintenance and renovation areas will increase or the main reason.

1.2. Focus on the United States: The overall demand for cement in the later stage of urbanization is flat

Since the Civil War, the American economy has been virtually untouched by the trauma of war. As the world's most developed economy, the complete development process of urbanization in the United States needs our in-depth study. We take the speed of urbanization rate in the United States as the basis for division, and based on this, the development of infrastructure investment and upstream cement industry is deeply discussed.

The process of urbanization is accompanied by the rapid development of fixed assets and real estate investment. Considering the economic inflation factors in 1930 and 1950's, this paper uses the physical index of fixed asset investment excluding price factors as the analysis base. Due to the US government's vigorous development of infrastructure investment during the Great Depression, we divided the US fixed asset investment into three stages. Before 1960, the average growth rate of US fixed asset investment reached a peak of 5.75%. On the one hand, the government led large-scale investment in infrastructure, and on the other hand, the rapid improvement of urbanization increased the demand for infrastructure and housing. Since 1960, the growth rate of infrastructure investment and real estate investment has narrowed under the condition of declining urbanization growth rate, and the periods of fast growth are mainly concentrated in 1965-1985 and 1993-2000, which are basically consistent with the two stages after urbanization.

From the perspective of citizens' clothing, food, housing and transportation, the growth of urban population and the expansion of urban scale have increased the scale of municipal facilities such as roads, hospitals, water supply and drainage. Taking the scale of government investment in highway and street construction in the United States as an example, large-scale investment in highway and street construction occurred during 1900-1930, 1946-1967 and 1985-2000 respectively, which coincided with the rapid growth of urbanization rate in the United States. The investment process is similar in other areas such as hospitals, water supply and drainage. In the process of urbanization, the increasing demand of new citizens for housing and public facilities has promoted the growth of the consumption of building materials such as cement and steel.

Cement demand is highly correlated with infrastructure and real estate investment, and weak demand in the post-urbanization phase is inevitable, but it will be stable in the long run. With the advancement of urbanization, the level of cement demand in the United States has risen; With the gradual completion of urbanization, the per capita cement demand scale began to fluctuate in a narrow range, which can be roughly maintained around the center of 330kg. Even after the subprime crisis of 2008, the recovery of the economy has revived demand for cement near this hub. We believe that the urbanization rate of the United States has been close to 80% in the 1990s, and the weak demand for cement after urbanization is inevitable; Considering that there is a large reconstruction and renovation demand in downstream markets such as infrastructure, real estate and municipal, the demand for cement is expected to be maintained at a relatively balanced level for a long time, which is more consistent with the per capita consumption of mainstream developed countries in the world.

2. Tracing the history of a hundred years of development, competitive price stability is the main theme

American market: A hundred years of industrial history records industrial changes

The American cement industry originated in the 19th century, and the introduction of rotary kilns in the early 20th century really accelerated the take-off of the American cement industry, and the American Cement Industry Association was also produced in this period. In 1916, the Portland Cement Manufacturers Association of the United States was renamed the Portland Cement Association, and the development of industry regulations accelerated the market competition. Relative to the UK, higher labor costs are the driving force for continued technological innovation in the US cement industry, including improvements in rotary kilns and fuel costs. The increase in the concentration of the US cement industry mainly experienced two periods from 1976-1983 and 1990-2007. The scale advantage brought by technological innovation accelerated the continuous integration of the leading companies in the industry in the 20 years after 1990, and the cement price was relatively stable and the overall supply and demand of the industry was relatively stable. Leading companies based on efficiency advantages, fuel cost advantages to start the journey of mergers and acquisitions, industry concentration enhancement into the fast lane.

The U.S. cement industry is monopolized by the global cement leaders, and the fully competitive market highlights the value of scale advantages, which is further conducive to technological progress and industry restructuring. According to incomplete statistics, in the past decade, the proportion of overseas cement leaders in the US cement market has further increased; As the third largest cement market in the world, leading enterprises rely on scale advantages to have large cost advantages, efficiency advantages and industrial chain advantages of small and medium-sized enterprises, and the highly market-oriented and highly concentrated cement industry has become the result of market selection, which is similar to the continuous improvement of the voice and development rights of domestic leaders. Through comparison, it is found that the world's leading cement LafargeHolcim, Heidelberg, CRH and Cemx have expanded rapidly from 1997 to 2007, and the accelerated pace of mergers and acquisitions during the stable period of industry demand is an important strategy for the sustainable development of leading enterprises.

After nearly 100 years of integrated development, the global cement market has been highly concentrated; Especially in the developed markets of Europe and the United States, the high concentration of the industry is especially obvious. In 2018, the top ten production capacity of the global cement industry accounted for 41.8%. China is the world's largest cement consumer, with domestic market leaders such as China National Building Materials, Conch Cement, China Resources Cement and Taiwan Cement accounting for as much as 22.4% of production capacity. Excluding 3.8 billion tons of production capacity in the Chinese market, the European and American cement leaders LafargeHolcim, Heidelberg, Cemex, UltraTech, CRH and Votorantim together account for 84.46% of the global cement production capacity (excluding China); Relatively speaking, the North American market is more globalized. In 2014, the sales of cement by the TOP5 cement companies in the United States reached 62% of the regional market share, and the global cement leader firmly occupied the industry position of the TOP4 cement market in the United States (among the TOP5, only Buzzi Unicem is a local cement company in the United States with an annual capacity of 8 million tons. Only 2.25% of Lafarge Holcim's capacity).

3. Cement ups and downs: century-old building materials giant

3.1. Industrial structure: Leading integration shows strong anti-cyclical characteristics

Looking at overseas mature markets, the increase in housing and infrastructure demand driven by urbanization promotes the boom cycle of the cement market; However, with the gradual completion of the pace of urbanization, the process of technological innovation relying on cost control, industry mergers and acquisitions and active capacity reduction in the process of cement demand has accelerated, and the oligopoly trend of the cement industry is more obvious. From the perspective of industry integration and concentration, in the past decade, the per capita cement consumption in mainstream developed countries has declined, and the cement revenue is still growing rapidly due to the continuous merger and acquisition expansion of leading companies. The further improvement of industry concentration is conducive to the price stability driven by the industry.

With the decline in cement demand, accelerating integration to the downstream has become a consistent choice for leading companies, which is consistent with the domestic leading companies mentioned in our last series of reports on the strengthening of pricing power and development rights to the downstream aggregate and concrete layout. Take CRH, the world's largest building materials company, as an example. Since 1985, the company has improved the building materials industry chain through continuous mergers and acquisitions. At present, it has formed a Heavyside business module covering cement, aggregate lime, concrete and asphalt, a Lightside business module covering decorative building materials such as blinds and awnings, and a distribution business covering various building materials.

The integrated business model continues to increase growth momentum while resisting the risk of large fluctuations in performance brought about by the economic cycle. Compared with the gross profit margin and net profit margin of leading building materials companies, the gross profit margin of CRH and Pacific Cement is relatively stable, which is closely related to their complete industrial chain and highly concentrated market. This trend can also be seen from the perspective of net profit margin. While the net profit margin of CRH remains relatively stable, in recent years, with the deep integration of various business modules, profitability has also been significantly improved.

Based on the development history and market performance of the overseas cement industry, we draw the following conclusions:

(1) Combined with our view in series 1, due to the constraints of new domestic production capacity, clinker shortage squeeches the downstream grinding station market space, and the upgrading of the pricing power and development right of leading clinker enterprises promotes the acceleration of the downstream aggregate and concrete business, and the relatively more complete industrial chain is conducive to providing the downstream with reliable quality and stable supply of construction and installation raw materials. This is similar to the layout of the whole industrial chain of foreign cement leaders;

(2) Compared with overseas markets such as Japan and Taiwan, after experiencing rapid urbanization in China, the demand for cement is likely to shrink significantly; With the downward demand, the industry merger and reorganization process is expected to accelerate, based on the leading companies to take the initiative to reduce capacity is expected to become the market's helpless choice; At the same time, the strengthening of the voice of leading companies is expected to lead the industry to rationally deploy production and exports according to market demand, and cement prices are expected to remain at a high level.

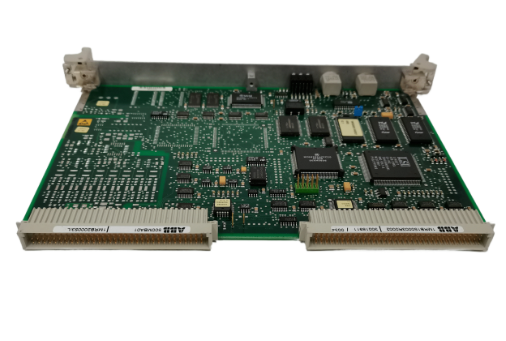

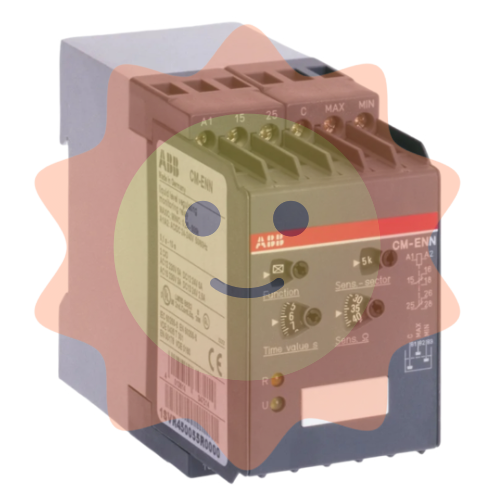

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA