China's Electric Vehicle Market Size and Share Analysis - Growth Trend and Forecast (2023-2028)

Analysis of electric vehicle market in China

China's electric vehicle market size is expected to grow from $26084 billion in 2023 to $575.56 billion in 2028, with a CAGR of 17.15% over the forecast period (2023-2028).

In the first half of 2020, the market was negatively impacted by COVID-19. Market growth has been disrupted due to the blockade and the declining income of the Chinese population. In the first half of 2020, manufacturing and sales activity slowed and supply chains were disrupted. The Chinese automotive industry saw significant growth in electric vehicle production last year and is expected to continue to grow during the forecast period.

In the medium term, the country has been paying attention and committed to developing sustainable transport as emissions increase and environmental concerns increase. This, in turn, has led to the electrification of its transport sector.

China is likely to witness growth in the adoption of electric buses during the forecast period, as more than 30 cities in China plan to achieve 100% electrified public transport in the short term, including Guangzhou, Zhuhai, Dongguan, Foshan, Zhongshan in the Pearl River Delta, as well as Nanjing, Hangzhou, Shaanxi and Shandong. Electric vehicle sales account for about 60% of the city's total, with no limit on vehicle additions. This suggests that there is still room for growth in electric vehicle sales in China in the coming years.

The adoption rate of hybrid and electric vehicles is high due to government regulations

With rising car sales and rapid urbanization, China is determined to reduce vehicle emissions. At the same time, the country plans to reduce its dependence on oil imports, boosting demand and sales of electric vehicles in the country. In addition, many major cities and provinces are implementing stricter restrictions. Beijing, for example, issues only 10,000 registration permits for internal combustion engine vehicles per month to promote its residents' switch to electric vehicles.

Increasing government regulations improving the adoption of electric vehicles and the strong expansion of adoption by Oems and suppliers in the region to adapt to the growing demand of China's automotive industry are expected to create a positive outlook for market growth over the forecast period. The Chinese government, for example, is encouraging the adoption of electric cars. The country has drawn up plans to phase out diesel fuel, which runs the current generation of tractors and construction equipment. The country plans to ban all diesel and petrol vehicles by 2040. In addition, in January 2021, BYD announced that it has received a cumulative order to supply 1,002 pure electric buses to Bogota, Colombia. The buses are scheduled to be delivered in 2021 and last until the first half of 2022. They will operate on 34 bus routes in five districts of the city.

The Chinese government has invested in building charging stations across the country to boost sales of electric vehicles. For example, in January 2022, the Chinese government announced plans to build enough charging stations for two electric vehicles by 2025.

For electric vehicles, the Chinese government has offered tax exemptions or reduced taxes. These government initiatives have attracted a large number of buyers to buy electric vehicles in the country. For example, in September 2022, China's Ministry of Finance (MOF), the State Administration of Taxation (STA), and the Ministry of Industry and Information Technology (MIIT) announced that new energy vehicles (NEVs) purchased between January 1, 2023 and December 31, 2023 will continue to be exempt from vehicle purchase tax. In addition, China's Ministry of Transport provides subsidies and other benefits for the development of low-emission bus fleets, thereby further impacting the market positively. For example, despite the epidemic, Chinese bus manufacturers sold another 61,000 new energy buses in 2020. These events have helped China set a firm and optimistic outlook for the development of electric vehicles in the country, which is expected to drive the market.

The passenger car segment is expected to dominate the market

The passenger car segment currently has more demand than commercial vehicles and is expected to continue to dominate during the forecast period. The growth is due to population growth, which provides conditions for the growth of electric vehicles. Strict government emission standards are expected to boost sales of electric vehicles. For example, the Chinese government implemented National VI pollution control regulations based on Euro 6 standards in the region in July 2020, thus boosting the demand for hybrid vehicles in the region.

Some competitors have been pushing the battery-electric car market in China, along with generous government support. China has extended incentives related to the purchase of new energy vehicles (NEV) until 2022.

Some non-auto companies, such as Alibaba, are entering the country's fast-growing electric vehicle market. For example.

In January 2021, Alibaba Group partnered with SAIC to release two electric models in China under the IM (Intelligent Sport) brand. The batteries for these vehicles are supplied by Ningde Times. Of the two models introduced, one is an electric sedan and the other is an electric SUV. The hatchback is expected to be launched first, with pre-orders beginning in April at the 2021 China International Auto Show, and the SUV will likely go on sale in 2022. The company informed that these vehicles may be offered with a 93 KWH battery, while a 115 KWH battery will be available as an option. Thereafter, the car can provide a range of up to 874 kilometers in the NEDC cycle.

In December 2020, Hyundai Motor Group announced plans to launch an all-electric platform in 2021, using its battery technology to cut production costs and time.

In September 2020, Tesla announced its commitment to reducing the cost of EV batteries and increasing production. The cheapest Tesla sells for $2,021 in 36,500 years.

Due to the large number of local electrical components and vehicles as well as the key national strategies and plans of the government, the market in the country is expected to achieve extraordinary growth in the coming years.

Overview of China's electric vehicle industry

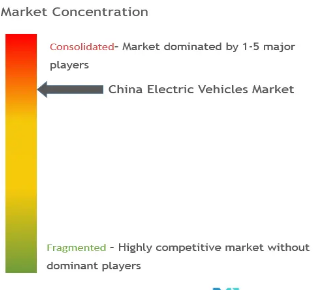

China's electric vehicle market is dominated by a few players such as Beijing Automotive, SAIC Motor Corp, Honda Motor Co, Geely Automobile Co and BYD Co, which is the leader in China's electric vehicle market as orders for its passenger cars and electric buses come from both domestic and international markets. Saic Motor is expected to become the second largest company, followed by Geely Automobile and BAIC Motor. In order to develop advanced products and technologies, the company has invested heavily in research and development.

In June 2022, BMW AG opened a new plant in Shenyang, China. An investment of 15 billion yuan (about $2.2 billion) focused on electric vehicles.

In February 2022, Danfoss announced that its Editron division has successfully started mass production of EM-PMI240-T180 motors designed for electric and hybrid drivetrains for buses at its Nanjing plant in eastern Jiangsu Province.

In June 2021, China Yuchai International Co., Ltd. announced a partnership with Guangxi Shenlong Automobile Manufacturing Co., LTD. (Xinlong) to develop four new energy powertrain systems, including e-CVT power Shunt hybrid Powertrain (YC e-CVT) and integrated electric transaxle powertrain (YC e-Axel) for new energy bus production in South China.

In February 2020, Honda announced the start of sales of the all-new Honda Fit Hybrid. It enhances Honda's 2-motor hybrid system, which drives the vehicle through an electric motor for smooth driving and greater fuel efficiency.

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA

- Other Brands