PX ushered in the production capacity cycle, and the external dependence continued to decline

PX production capacity continued to be put into operation, and the self-sufficiency rate gradually increased. Due to the high technical barriers and production process of PX plants, PX supply in China has been mainly dependent on imports from South Korea, Japan, Brunei and other countries for a long time, PX prices are greatly affected by foreign pricing, and product premiums are high. Before 2019, with the increase of apparent consumption of PX, PX imports increased year by year, and PX external dependence was as high as 61% in 2018. The high price difference combined with high import substitution space attracts enterprises with both process technology and financial capacity to start the process of domestic PX production capacity. In 2019, the private PX refinery project was completed and put into operation. Hengli Petrochemical opened the whole PX process to add 4.5 million tons of capacity, taking the lead in opening the domestic PX production capacity expansion pattern. The PX production capacity of Hainan Refining and Chemical and Fujian Fuhaichuang simultaneously increased to 1.6 million tons, and the PX production capacity increased by 59% year-on-year in 2019, and the import volume fell for the first time, and the PX supply pattern in China began to develop toward self-sufficiency. With the decline of domestic PX dependence on foreign countries, PX prices gradually returned to normal market pricing, the PX-naphtha price spread continued to fall, and the PX and naphtha price spread was repaired to a certain extent before the Spring Festival in 2021. As of April 2, 2021, the PX price spread has increased to 1463 yuan/ton, but it is still at a low level. It is expected that in the next two years, more domestic PX production capacity will be added, PX external dependence will be significantly reduced, and in the background of PX slight destocking and rising oil prices, PX price trend after the holiday will obtain strong cost support, PX valuation is optimistic.

PTA re-ushered in the capacity expansion cycle, price spreads are expected to remain at a low level

The production capacity of leading enterprises is accelerating, and PTA is facing oversupply. PTA relative to PX technical barriers are low, as early as 2015 with the end of the enterprise PTA capacity expansion cycle, China fully realized PTA self-sufficiency, and in this round of expansion cycle in 2014, capacity growth is 28 percentage points higher than apparent consumption growth. It indicates that at the end of production in 2015, China's PTA industry will face overcapacity supply, 2015 PTA total production capacity of 48.99 million tons, apparent consumption of 28.12 million tons. From 2016 to 2019, the growth rate of PTA investment and production slowed down, the apparent consumption steadily increased and the domestic PX price spread fell back on track, and the PTA price spread gradually increased to 1640 yuan/ton on August 17, 2019. In early 2020, affected by the epidemic, the PTA price spread once dropped to 311 yuan/ton, a year-on-year decrease of 36%, in the same year, Hengli Petrochemical added 5 million tons of capacity, and Dushan Energy 4.4 million tons of PTA capacity was put into operation. The new generation of PTA technology represented by Invista P8 technology and BP has brought about a cost reduction of 100-200 yuan/ton, and the leading enterprises have updated their production capacity, and PTA has re-entered the capacity expansion cycle. As of April 2, 2021, the PTA price spread is 309 yuan/ton, which is at a historical low. In the next two years (2021-22), PTA is expected to add 39.4 million tons of total production capacity, the industry supply continues to oversupply, superimposed polyester filament demand is expected to increase steadily and the cost of oil is expected to rise, it is expected that after the Spring Festival PTA has no obvious downside space, but the rise in costs will pull PTA up.

MEG external dependence is expected to continue to decrease, the price rises steadily

Ethylene glycol, also known as ethylene glycol, 1, 2-ethylene glycol, referred to as EG, chemical formula (CH2OH)2, mainly used in the production of polyester, polyester, polyester resin and other products, 2016-2021 ethylene glycol consumption in the polyester field accounted for 90%. In 2020, with the improvement of the demand for polyester filament, the apparent consumption of MEG in China increased to 18.7 million tons, a year-on-year growth rate of 11%, and the growth rate reached the highest value in nearly seven years. In terms of production capacity, MEG production capacity increased significantly in 2020, with a year-on-year growth rate of 45%, production increased by 18%, and MEG external dependence decreased from 67% in 2013 to 56% in 2020. In 2020, the MEG price showed a steady upward trend, and by April 2, 2021, the MEG price rose to 5200 yuan/ton. In the context of the post-holiday polyester demand exceeding expectations, with the maintenance of foreign equipment, there is no significant increase in imports in February-March 2021, and the port inventory of ethylene glycol is reduced after the Spring Festival, and the trend of ethylene glycol is more optimistic. It is expected that in the next two years, with the continued release of MEG production capacity, the self-sufficiency rate will be greatly increased, and the demand pattern of polyester filament will drive the apparent consumption of MEG to continue to rise, and the price will rise steadily. The upstream supply is loose, and the profits of the industrial chain are expected to transfer to the polyester end. From 2016 to 2018, PX and MEG raw materials in the upstream of the polyester industry chain mainly rely on foreign imports, with high product price premiums and rich profits relative to the downstream. Since the second half of 2019, a large number of domestic PX and MEG production capacity has been completed, the external dependence of raw materials has decreased, the profit of polyester has shrunk, and the profit differentiation of various varieties has been obvious. In 2020, MEG (coal) profit dropped to -693 yuan/ton, PTA has fallen into a serious loss state, and small and medium-sized enterprises' cash flow is worrying. In the next two years, the supply of PTA and PX will increase significantly, and the profits of the industrial chain are expected to transfer to the polyester end.

Supply pattern ushered in improvement, the industry continues to boom

Polyester filament production capacity growth slowed down, the supply pattern ushered in improvement

2015-2016, after the end of the last round of production cycle, polyester filament faced overcapacity, production capacity slowed down, the industry continued to decline, and the supply side reform was implemented in the industry during the same period, and a large number of small and medium-sized enterprises' production capacity was cleared. 2017-2020 Leading enterprises with cost advantages and scale advantages quickly put capacity to occupy the market share of clearing enterprises. In three years, Tongkun Group put in 2.9 million tons of production capacity, and New Fengming added 2.12 million tons of production capacity, and the production capacity was concentrated in leading enterprises, and the industry concentration increased significantly. In 2020, the production capacity of Shenghong, Hengli and Hengyi will increase by 250,000 tons, 700,000 tons and 750,000 tons respectively, and the total production capacity in 2020 will be 42.18 million tons, an increase of 24% compared with 2017. The total output was 36.62 million tons, an increase of 25% compared with 2017.

Polyester filament industry expansion in the next two years orderly. In 2021, it is expected to add 2.62 million tons of new production capacity, an increase of 6%, and in 2022, Tongkun Rudong two phase plants are planned to be put into operation, and it is expected to increase production capacity by 2.4 million tons. It is expected that the growth rate of polyester filament production capacity in the next 2-3 years is expected to maintain a stable trend, but most of the new production capacity comes from leading enterprises. According to Longzhonginformation forecast, the next two years of new production capacity of more than 6 million tons, the annual growth rate of more than 9%, lower than the apparent consumption forecast growth rate of 9.7%, the demand growth rate is greater than the supply growth rate, polyester filament will greatly improve the supply and demand pattern, the industry cycle boom continues.

The concentration of polyester filament industry continues to increase

The advantages of leading enterprises continue to expand, and the industry concentration continues to improve. With the continuous expansion of polyester filament production, supply and demand imbalance caused by industry profits compression, a large number of small and medium-sized enterprises limited capacity, high production costs, low market share, unable to support technology upgrades and other expenditures, have stopped production exit the market, leading enterprises with scale advantages, cost advantages and capital advantages quickly seize market share. In 2020, the market share of CR10 in the polyester filament industry is about 57%, and the concentration of the top four in the industry has reached about 40%. In the future, leading enterprises will continue to expand production, and the survival space of small and medium-sized production capacity in the industry is limited. It is expected that the concentration of the polyester filament industry will be further improved. According to the production plan of the past two years, it is expected that the industry concentration of CR10 can reach more than 80% in 2023. In recent years, the new production capacity of leading enterprises led by Tongkun, Hengyi, New Fengming and Shenghong has reached more than 6.6 million tons, leading enterprises have constantly adjusted the industrial chain, optimized the industrial structure, improved the overall competitiveness, widened the gap between leading enterprises and small and medium-sized enterprises in the industry, and the industry concentration has been continuously improved.

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

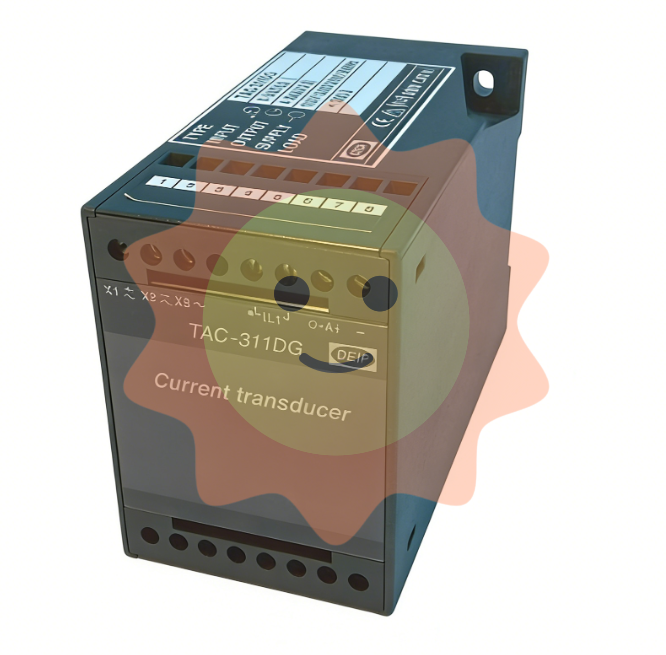

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA

- Other Brands