Chinese paper companies have accelerated overseas investment, targeting foreign waste paper and forest resources

Why Invest in Southeast Asia?

First of all, Chinese paper enterprises to invest in Southeast Asia, the primary purpose is still to solve the problem of raw material supply, and the United States and Europe's waste paper resources are the main target. At present, Southeast Asian countries do not restrict or prohibit the import of waste paper, and implement zero or low tariffs on imported waste paper (Laos's waste paper tariff is 5%). Set up factories in Southeast Asian countries, import waste paper from Europe and the United States after processing into pulp or pulp board, re-export to China, is the business model of most Chinese paper enterprises in Southeast Asia. For example, Jingxing Paper's Malaysia 1.4 million tons of pulp and paper project, Forest Packaging (605500) Thailand's 100,000 tons of waste pulp project, Jintian Paper's Thailand pulp and paper project are all in this situation. According to China Customs data, China's recycled pulp imports increased nearly 24 times in 2018, more than 208% in 2019, and more than 93% in 2020; The source of recycled pulp has also expanded from a few regions such as Vietnam and Taiwan to Laos, Malaysia, the United States, Thailand, Myanmar and many other countries and regions, which is echoing the above business model.

Secondly, Southeast Asian countries, except Singapore, labor costs, energy consumption requirements, environmental standards are relatively low, which is conducive to the expansion of production scale of paper enterprises. At present, the Chinese-funded paper projects in Southeast Asia, such as the Vietnam project of Lewen Paper, the Laos project of Sun Paper, and the Selangor project of Nine Dragons Paper in Malaysia, have almost all built their own power plants, which is difficult to achieve under China's current policy environment.

Third, the pulp is not suitable for long transportation, otherwise it is easy to deteriorate. Southeast Asian countries are close to China, and exporting pulp from these countries to China is not only conducive to ensuring quality, but also to saving transportation costs.

Finally, the governments of Southeast Asian countries are competing to introduce various investment preferential treatment to attract foreign industrial investment. For example, Malaysia encourages foreign investment in pulp products and grants income tax relief for 5 to 10 years for eligible projects. Laos encourages the development of forestry and the production of export commodities, exempts imported raw materials used in the production of export products from customs duties and value-added tax, and projects set up in areas where investment is encouraged can also enjoy the reduction and exemption of profit tax, value-added tax, lease fees, concession fees, etc. In Thailand, the production of aseptic pulp and paper products can be exempted from corporate income tax for up to 8 years.

03 M&A VS Greenfield Investment: Differences in the path of overseas investment

Chinese paper companies have invested in the US and Europe mainly through mergers and acquisitions of existing companies. In general, the cycle of mergers and acquisitions is shorter than that of new factories, helping investors acquire new capacity faster. The US paper industry has entered a mature period of decline, the US market research institution IBIS World data show that the scale of the US paper industry is shrinking at an average annual rate of more than 2%, the number of paper factories, enterprises continue to decrease, a large number of production facilities idle, which provides objective conditions for Chinese enterprises to carry out mergers and acquisitions.

After acquiring US and European companies, Chinese companies usually repair, transform or increase capital and capacity of the target company to adapt it to the business direction of the acquirer. The Old Town Paper Mill in the United States, formerly a plant with an annual output of 150,000 tons of bleached hardwood kraft pulp, has been idle since the fourth quarter of 2015. After being acquired by Nine Dragons Paper, the plant resumed production in August 2019 after nearly a year of refurbishment to produce unbleached softwood kraft pulp; In April 2021, the plant was transformed again with the commissioning of a new waste pulp production line capable of producing 200 tons of waste pulp per day.

The Verso Wickliffe plant acquired by Mountain Eagle International originally produced pulp and cultural paper, but due to the continuous decline in demand for local cultural paper in North America, the plant was discontinued in November 2015 and has been idle. After the acquisition, Mountain Eagle International invested $42 million to repair some equipment, so that it has an annual output of 360,000 tons of high-end cow paper/wood pulp capacity, and changed its name to "Phoenix Paper". On August 9, 2019, Mountain Eagle International announced an additional investment of $200 million to expand the new recycled paper business with an annual production capacity of 700,000 tons, and its pulp products will enter the Chinese market.

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

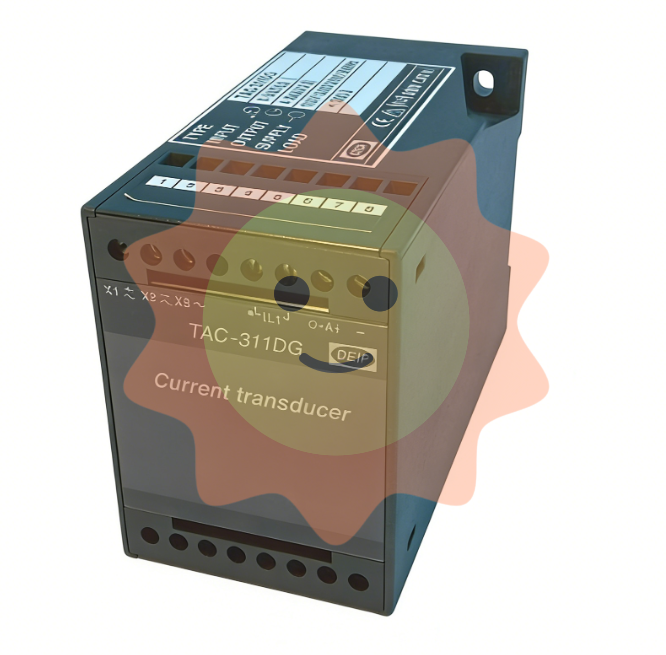

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA

- Other Brands