Chinese paper companies have accelerated overseas investment, targeting foreign waste paper and forest resources

Investing in Southeast Asia is a completely different path. In view of the low degree of modernization of the local paper industry and fewer large-scale manufacturers, most Chinese paper companies landing in Southeast Asia choose new projects, that is, the way of green field investment. Large-scale greenfield investment projects are also more likely to win preferential treatment from local governments, such as tax breaks and land supplies.

In September 2018, Sun Paper, through its wholly-owned Lao subsidiary, acquired the concession rights of 22,006 hectares of land, on which Sun Paper will build pulp board and wrapping paper production lines, thermal power plants, waste paper recycling paper shed, water supply plants, roads and other supporting projects, with a total investment of $636 million.

In addition to bringing a huge amount of capital, Chinese paper enterprises have also introduced modern production technology and management system to the site of the project to improve the operational efficiency of the landing project. For example, Nine Dragons Paper announced in March 2021 that it intends to invest in two new plants in Pahang and Selangor, which will introduce fully automated production lines in line with Industry 4.0 high-tech, and apply high-tech technologies such as the Internet of Things, big data analysis and cloud computing.

04 Three potential obstacles constrain overseas investment

The path for Chinese paper companies to invest abroad has not been straightforward. In addition to inherent constraints such as capital, talent, and management capabilities, three potential obstacles will have a huge impact on the success or failure of overseas projects.

The biggest destabilizing factor is the direction of US-China economic and trade relations. Although the US-China economic and trade conflict has stimulated the boom of Chinese paper enterprises to invest in the United States, the continued uncertainty about the policy direction of the two countries and the impact on trade and investment has intensified the concerns of enterprises, and even led to the abortion of projects in serious cases. On April 26, 2016, Sun Paper signed a memorandum of project investment cooperation with the state of Arkansas, intending to invest $1.36 billion to build the world's largest, most advanced and most efficient single-line fluff pulp production line locally. This was the largest manufacturing greenfield investment project by Chinese private enterprises in the United States at that time. However, less than five years later, in early March 2020, Sun Paper officially notified the United States that it would terminate the project due to the economic uncertainty brought about by the COVID-19 pandemic and the ongoing trade dispute.

This is not unique. According to the Report on the Development of China's Outbound Investment Cooperation 2020 released by the Ministry of Commerce of China on February 2, 2021, China's outbound direct investment flow in 2019 was US $136.91 billion, ranking second in the world for eight consecutive years and ranking top three in the world. However, in the same period, Chinese enterprises' direct investment in North America fell by 49.9% year-on-year, of which the investment flow to the United States fell by 49.1% year-on-year, and the investment flow to Canada fell by 69.7% year-on-year.

The public sentiment of the investment destination will also cause unexpected risks to the project. In mid-May 2014, there were serious violent incidents of beating, smashing, looting and burning targeting foreign investors and enterprises in Vietnam. Some Chinese enterprises and personnel, including those from Taiwan and Hong Kong of China, as well as those from Singapore and South Korea, were affected to varying degrees.

- ABB

- General Electric

- EMERSON

- Honeywell

- HIMA

- ALSTOM

- Rolls-Royce

- MOTOROLA

- Rockwell

- Siemens

- Woodward

- YOKOGAWA

- FOXBORO

- KOLLMORGEN

- MOOG

- KB

- YAMAHA

- BENDER

- TEKTRONIX

- Westinghouse

- AMAT

- AB

- XYCOM

- Yaskawa

- B&R

- Schneider

- Kongsberg

- NI

- WATLOW

- ProSoft

- SEW

- ADVANCED

- Reliance

- TRICONEX

- METSO

- MAN

- Advantest

- STUDER

- KONGSBERG

- DANAHER MOTION

- Bently

- Galil

- EATON

- MOLEX

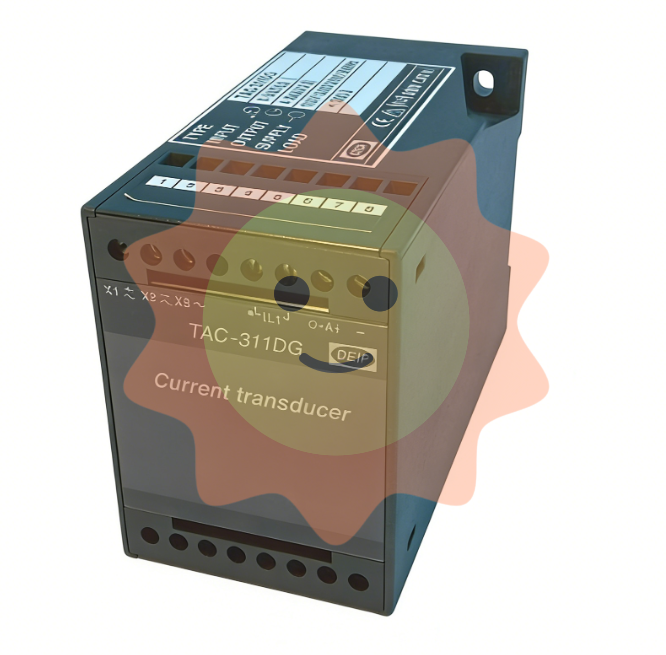

- DEIF

- B&W

- ZYGO

- Aerotech

- DANFOSS

- Beijer

- Moxa

- Rexroth

- Johnson

- WAGO

- TOSHIBA

- BMCM

- SMC

- HITACHI

- HIRSCHMANN

- Application field

- XP POWER

- CTI

- TRICON

- STOBER

- Thinklogical

- Horner Automation

- Meggitt

- Fanuc

- Baldor

- SHINKAWA

- Other Brands